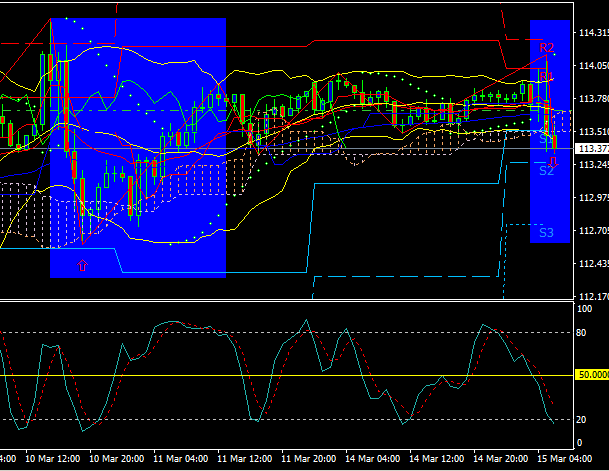

Agreed, more bearish than bullish unless we see a significant move up. Would like to see a drop below 113 for continued downside, 116 as a break higher

Stuart Browne:

On the Daily chart, the pair is breathing, then going up to 115 and aboveAgreed, more bearish than bullish unless we see a significant move up. Would like to see a drop below 113 for continued downside, 116 as a break higher

lets wait for the Fed to announce the rate then we make our call.

owhh

predictions will form the same pattern

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Overall technical outlook for this pair still looks bearish. To change the price situation should rise above 115.00. The next resistance is located at 116.25 (55-day MA). Another bearish factor was the purchase yen from Japanese exporters ahead of the end of the Japanese fiscal year this month. More narrow range consolidation.

Support is at 112.50, 111.00 and 110.00.