You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

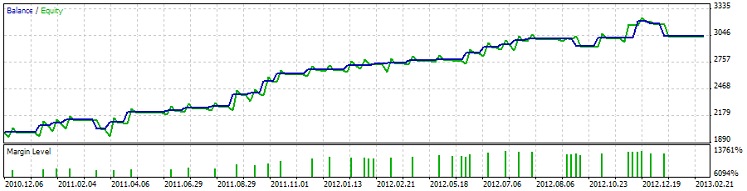

This is classical approach with 2 Moving Averages indicators but using some levels on the chart, and it seems to be profitable during the long run:

2MA_4Level - expert for MetaTrader 5

2 SMA — fast and slow. The averaging period of the fast SMA is always less than that of the slow one.

Also uses the following levels:

The articles on adding alerts to indicators:

Sound Alerts in Indicators

Alert and Comment for External Indicators

Alert and Comment for External Indicators (Part Two)

Alert and Comment for External Indicators. Multi-Currency Analysis Through External Scanning

MACD Histogram, multi-timeframe, multi-color [v03] - indicator for MetaTrader 5

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video March 2017

Sergey Golubev, 2017.03.10 07:42

All About MACD

"MACD (Moving Average Convergence Divergence) is an Index that tracks market momentum using a series of EMA’s. As these averages converge and diverge, MACD either gains strength or weakens. The Idea is that traders can easily read MACD to interpret the markets direction as well as gauge its current momentum."

"Traders can elect to use other components of the MACD indicator to time their market entries. This includes the zero line, signal line and histogram. One example, a simple MACD crossover: traders may elect to wait for the MACD line to cross above the signal line in an uptrend to enter into the market. Of course even the strongest trends can turn, so traders should always be prepared to manage their risk! "

Forum on trading, automated trading systems and testing trading strategies

Indicators: MACD - Any higher timeframe

Sergey Golubev, 2014.03.05 07:36

MACD as an Entry Trigger (based on dailyfx article)

Having a strong trigger in a trading strategy can be a very important component. After all, to have a bias and to blindly buy or sell to trade on that bias can be categorized as haphazard; and in some cases that may be a bit of an understatement.

Having a trigger helps with timing the entry into a position. It won’t be perfect, but this is trading an perfection is impossible in the first place. Rather, a strong trigger is a way that traders can look to increase the probabilities of success by allowing the market to begin showing the trader what is wanted before any position is ever entered.

Let’s look at a few examples below to illustrate in more detail.

Using MACD with a Fundamental Approach

Many fundamental traders eschew technical analysis for one reason or the other. This isn’t to say that technical analysis is better or vice versa; these are just two differing ways of analyzing a market. But, the best way is often to try to include them both, and something like a MACD entry trigger can be a best friend to a fundamental trader.

Let’s say that a trader has a bias on the market. This can be any bias: Perhaps the trader expects the S&P to begin tumbling lower… or maybe the trader is expecting the Aussie to shoot to the moon on the back of a cheap dollar and stronger than expected Chinese data. Whatever the case and whatever the bias, the trader can wait to enter the position until the market appears more primed for their idea to come to fruition.

The trader can simply watch the 4-hour chart to get a MACD entry signal in the direction that they are looking to trade

The trader can even look to manage the position via MACD after the first trade is placed.

If a contrarian MACD signal shows up (MACD crosses down and under the signal line while in a long position or vice versa); the trader can look to close the long position until another bullish trigger takes place.

Using this type of approach can allow the fundamentals trader to get potentially higher probabilities of success since they’re waiting for the technical environment to agree with their fundamental bias before triggering into the position.

Using MACD as a Scalper/Day-Trader

Just as the Fundamental-based trader can use MACD to trigger trades in the direction of their bias, scalpers and day-traders can look to do the same on very short-term charts.

Shorter-term traders can use the hourly or four-hour chart to look for trends or biases in the marketplace that may be operable for their purposes; and then can look to enter position with MACD crossovers in price movements in that direction.

Scalpers can use longer-term trend analysis and shorter term MACD entries in direction of trend

The MACD trigger can be investigated on the five or fifteen minute charts to look for quick entries in the direction of slightly longer-term swings.

MACD Triggers as Part of a Broader-based Technical Strategy

Traders can also look to implement a MACD trigger in conjunction of additional technical methods of analysis.

In the 4-hour trader, we looked specifically at that type of strategy.

Traders can use a longer time frame chart, such as the daily chart, to investigate trends and determine any relevant biases that may exist in the marketplace.

Once the trader has determined the direction that they want to trade in a market given the trend found on the longer-term charts, they can then go down to the shorter time frame chart to wait for a MACD signal in the direction of that trend.

Multiple time frame analysis can bring enormous benefit to the trader.

The longer time frame provides the ‘bigger picture’ view of any biases or trends that may exist in the marketplace; and the MACD trigger on the shorter time frame can allow the trader to focus on high-probability setups in which the longer-term bias may be coming back into the market.

Forum on trading, automated trading systems and testing trading strategies

BRAINWASHING SYSTEM

Sergey Golubev, 2013.05.12 16:25

This is the thread about Brainwashing system. We will start with original version of this system and will improve it later.

==========

Just something about the history. There are 3 famous signals system (manual trading systems based on signal indicators): Asctrend, BrainTrend and Brainwashing. First two system were already explained and developed by indicators and EAs. So, we are going to discuss the last signal system: Brainwashing.

==========

Just for information:

ASCTREND SYSTEM

The Theory.

Manual Trading statements

Second version of this manual trading system and for now - asctrend indicator together with NRTR indicator

First version of AsctrendND EA.

Next version of AsctrendND EA (verion 1.02) with TrendStrength filter added.

BRAINTRADING SYSTEM

How To Create Your Own Mmanual Trading Signal System Based On Indicators From MT5 CodeBase - Instruction For Non-Programmers

Forum on trading, automated trading systems and testing trading strategies

Signal Systems

Sergey Golubev, 2017.03.20 16:53

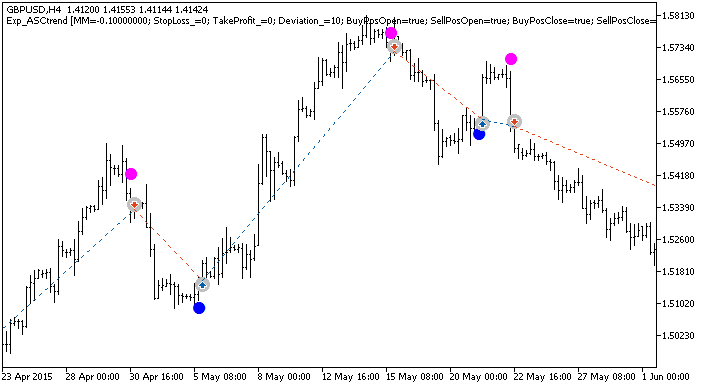

AscTrend Expert Advisor - expert for MetaTrader 5

ASCtrend - indicator for MetaTrader 5ASCtrend_HTF - indicator for MetaTrader 5

Exp_ASCtrend - expert for MetaTrader 5

ASCtrend_HTF_Signal - indicator for MetaTrader 5ASCtrendAlert - indicator for MetaTrader 5

IchimokuAlert - indicator for MetaTrader 5

This is a simple indicator from the standard МetaТrader 5 delivery package, with an additional Alert function.

more:

Forum on trading, automated trading systems and testing trading strategies

The secret of the Ichimoku

Sergey Golubev, 2016.12.29 11:18

Ichimoku Trading for Beginners

Just one good wiki thread (with the links to download good indicators/tools for MT4 and MT5):

Advanced links/threads/toolsColor Zerolag RSI for Metatrader 5 (attached).

This indicator may be good one to filter false signals for example.

Something interesting

The beginning

After