You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.03 10:52

GBP/USD Intra-Day Fundamentals: UK Services PMI and 38 pips price movement

2016-02-03 09:30 GMT | [GBP - Services PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

GBPUSD M5: 38 pips price movement by UK Services PMI news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.04 09:55

Trading the News: Bank of England (BoE) Interest Rate Decision (based on the article)The Bank of England (BoE) interest rate decision is likely to reveal another 8 to 1 split as the central bank remains in no rush to normalize monetary policy, but the updated forecasts may heighten the appeal of the sterling and fuel a larger recovery in GBP/USD should the central bank highlight a greater risk of overshooting the 2% inflation target over the policy horizon.

What’s Expected:

Why Is This Event Important:

Even though Governor Mark Carney largely endorses a wait-and-see approach, an upward revision in the BoE’s economic projections may boost interest rate expectations as central bank officials remain upbeat on the U.K. economy and prepare households/businesses for higher borrowing-costs.

Nevertheless, signs of sticky price growth paired with the pickup in private-sector lending may push the BoE to drop its dovish tone, and the fresh updated coming out of the central bank may spur a larger recovery in the British Pound should the central bank show a greater willingness to implement a rate-hike in 2016.

How To Trade This Event Risk

Bearish GBP Trade: MPC Continues to Endorse Wait-and-See Approach

- Need red, five-minute candle following the rate decision to consider a short GBP/USD trade.

- If market reaction favors selling Cable, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: BoE Highlights Greater Risk of Overshooting Long-Term Inflation Target- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish sterling trade, just in reverse.

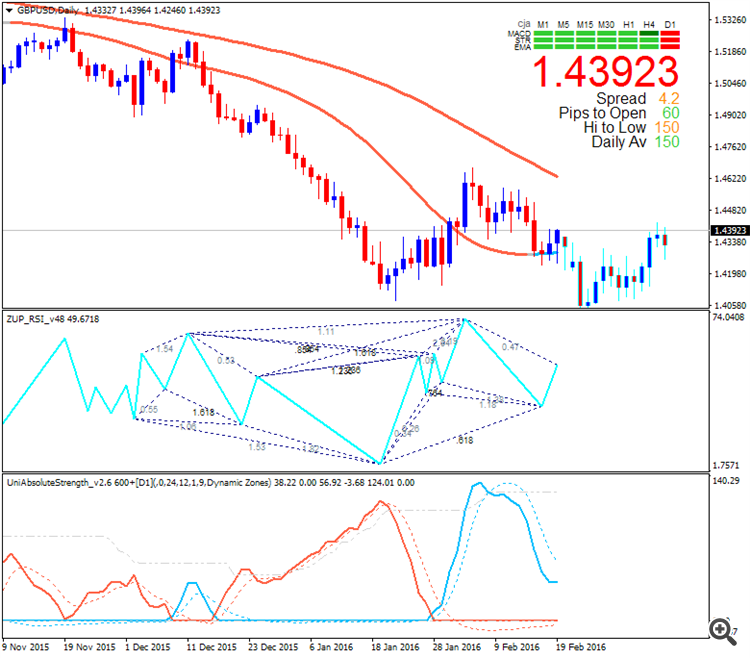

Potential Price Targets For The ReleaseGBP/USD Daily

GBPUSD M5: 63 pips range price movement by BOE Official Bank Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.05 09:25

Technical Targets: EUR/USD, GBP/USD, AUD/USD, NZD/USD (based on the article)

EUR/USD: Bullish. Major resistance at 1.1238, waiting for breakout or correction.

GBP/USD: Neutral: Closing above 1.4667 would indicate the bullish phase to be started.

AUD/USD: Bullish: Target a move to 0.7242 to continuing with bullish trend.

NZD/USD: Bullish: Target a move to 0.6746 for bullish to be continuing.

GBP/USD Intra-Day Technical Analysis - waiting to break the levels for direction

H4 price is located between SMA with period 100 (100 SMA) and SMA with the period 200 (200 SMA) waiting for the direction for the possible breakout or breakdown. The key support/resistance levels for this pair are thefollowing : 1.4514 as the resistance and 1.4350 as support level.

SUMMARY : ranging

TREND : waiting for directionForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.10 10:42

GBP/USD Intra-Day Fundamentals: UK Manufacturing Production and 56 pips price movement

2016-02-10 09:30 GMT | [GBP - Manufacturing Production]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Manufacturing Production] = Change in the total inflation-adjusted value of output produced by manufacturers.

==========

"Total production output is estimated to have decreased by 0.5% between Quarter 3 (July to Sep) 2015 and Quarter 4 (Oct to Dec) 2015. This decrease was larger than the forecasted decrease of 0.2% contained within the Gross Domestic Product: Preliminary Estimate, Quarter 4 (Oct to Dec) 2015."

"The largest contribution to the total production quarterly decrease came from mining & quarrying, which decreased by 2.3%, while manufacturing output remained unchanged during the same period."

"Total production output is estimated to have increased by 1.0% between 2014 and 2015. Of the 4 main sectors, manufacturing output was the only one to fall, decreasing by 0.2%."

==========

GBPUSD M5: 56 pips price movement by UK Manufacturing Production news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.14 18:18

Weekly Outlook for GBP/USD by Morgan Stanley (based on the article)

GBP/USD: Ranging bearish with symmetric triangle pattern to be broken to below with 1.4325 target.

"Any risk rally in equities or oil is likely to provide GBP with a boost. We don’t expect this to last long though, so continue to promote selling on rallies. The BoE remains dovish and the Brexit debate is in full swing in the press. The UK’s current account deficit makes the currency prone to weakness when inflows are reduced due to high market volatility. EURGBP this week broke previous highs, supporting the upside momentum in this pair."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.17 08:05

Trading the News: Claimant Count Change (based on the article)Despite forecasts for another 3.0K decline in U.K. Jobless Claims, a further slowdown in Average Weekly Earnings may weigh on the sterling and spark a bearish reaction in GBP/USD as it provides the Bank of England (BoE) with greater scope to retain its current policy throughout 2016.

What’s Expected:

Why Is This Event Important:

Following the unanimous vote to retain the current policy, signs of slower wage growth may encourage the BoE to endorse a wait-and-see approach at the next meeting on March 17 as Governor Mark Carney & Co. reduce their economic projections and turn increasing cautious towards the U.K. economy.

Nevertheless, improved confidence paired with the ongoing expansion in private-sector lending may generate a stronger-than-expected job/wage report, and a positive development may foster a near-term rebound in GBP/USD as it puts increase pressure on the BoE to remove the record-low interest rate in 2016.

How To Trade This Event Risk

Bearish GBP Trade: Jobless Claims, Average Hourly Earnings Disappoint

- Need red, five-minute candle following the print to consider a short GBP/USD trade.

- If market reaction favors selling sterling, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: U.K. Job/Wage Growth Exceed Market Forecast- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

GBPUSD M5: 32 pips price movement by Claimant Count Change news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.19 11:18

GBP/USD Intra-Day Fundamentals: UK Retail Sales and 58 pips price movement

2016-02-19 09:30 GMT | [GBP - Retail Sales]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

Year-on-year estimates of the quantity bought in the retail industry showed growth for the 33rd consecutive month in January 2016, increasing by 5.2% compared with January 2015.

The underlying pattern in the data, as suggested by the 3 month on 3 month movement in the quantity bought, showed growth for the 26th consecutive month, increasing by 1.4%.

Compared with December 2015, the quantity bought in the retail industry is estimated to have increased by 2.3%.

Average store prices (including petrol stations) fell by 2.6% in January 2016 compared with January 2015, the 19th consecutive month of year-on-year price falls.

The amount spent in the retail industry increased by 2.4% in January 2016 compared with January 2015 and increased by 2.3% compared with December 2015.

The value of online sales increased by 10.4% in January 2016 compared with January 2015 and increased by 2.7% compared with December 2015

==========

GBPUSD M5: 58 pips price movement by UK Retail Sales news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.20 09:30

Week Ahead: High Volatility, limited GBP downside risk from the current levels - Crédit Agricole (based on the article)

What to watch:

USD - "Next week’s PCE data will be key. Only a considerably weaker than expected outcome may lower rate expectations further."

GBP - "Growth data should become a more important currency driver anew. Hence next week’s GDP data will be closely watched. We see limited GBP downside risk from the current levels."

JPY - "It remains to be seen if weaker inflation data will drive the JPY lower. This is due to increased uncertainty about the BoJ’s policy stance being efficient in bringing inflation back to target."Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.20 15:48

Fundamental Analysis: Weekly Trading Forecast for GBP/USD (based on the article)

GBPUSD

"In the near-term, this could be GBP positive as fears of a Brexit on the back of stalled negotiations had driven the Sterling lower. Longer-term will depend on British voters. For now, we take a bullish forecast on GBP moving into next week, and will review as more information on negotiations and a potential Brexit become available."