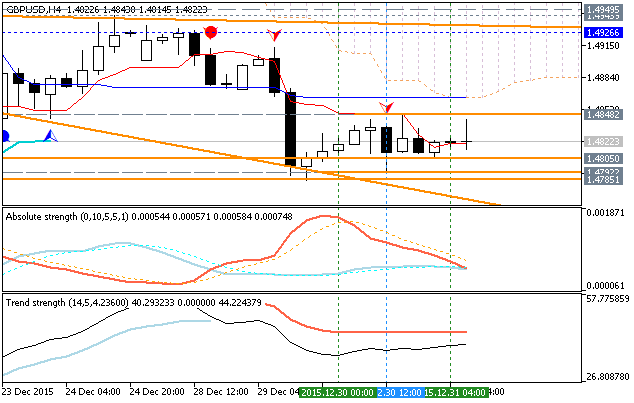

GBPUSD Intra-DayTechnical Analysis: ranging bearish

The price is located below Ichimoku cloud on bearish market condition with the secondary ranging:

- The

price is near and below Senkou Span line

(which is the virtual border between the primary bullish and the

primary

bearish on the chart) which makes the reversal of the price movement from the primary bearish to the ranging bullish to be possible in the near future.

- Tenkan-sen line is below Kijun-sen line of Ichimoku indicator for the bearish trend to be continuing.

- Chinkou Span line is located near and below the price to be ready to cross it for possible breakout or to be ready to continue with the recent bearish condition.

- Bullish key resistance level is 1.4926, and if the price breaks this level to above so the bullish reversal of the price movement will be started with good breakout possibility.

- Bearish key support level is 1.4785, and if the price breaks this level to below so the bearish trend will be continuing.

If the price will break 1.4785

support level on close bar so the bearish trend will be continuing.

If the price will break 1.4926 resistance level so the bullish reversal will be started with the secondary ranging: price will be located inside Ichimoku cloud.

If the price will break 1.4949 resistance level so the price will be fully reversed to the bullish market condition.

If not so the price will be ranging within the levels.

- Recommendation for long: watch close price to break 1.4926 for possible buy trade

- Recommendation

to go short: watch closeprice to break 1.4785 support level for possible sell trade

- Trading Summary: ranging

| Resistance | Support |

|---|---|

| 1.4926 | 1.4785 |

| 1.4949 | N/A |

SUMMARY : ranging

TREND : bearish

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.01.03 13:30

Forex Weekly Outlook January 4-8 (based on the article)

2016 begins with a busy calendar: Canadian employment data, US PMIs, Trade Balance, FOMC Meeting Minutes and employment data culminating with the Non-Farm Payrolls. In addition, liquidity is set to return after the holiday season. These are the highlights opening 2016. Join us as we explore these market-movers.

U.S. consumer confidence edged up to 96.5 from 92.6 in November, beating market forecasts. Current conditions improved from 110.9 to 115.3 and the Expectations Index improved to 83.9 from 80.4 in November. Overall, consumers’ assessment of the current state of the economy remains positive. Meanwhile Jobless claims increased 20,000 during the holiday week due to temporary holiday factors. Economists expected a rise of 270,000. Analysts expect a slower pace of job market improvement in 2016 despite the low unemployment rate.

- Chinese Caixin Manufacturing PMI: Monday, 1:45. This independent report for the Chinese economy has worried investors during 2015, but did recover from the lows. After hitting 48.6 points in November, a rise to 48.9 is on the cards for December, still below the 50 point mark separating growth and contraction.

- US ISM Manufacturing PMI: Monday, 15:00. The U.S. manufacturing activity plunged in November to its worst levels since June 2009, when the index of national factory activity declined to 48.6 crossing the 50 point line for the first time since November 2012. The previous reading was 50.5. Economists expected the index to rise to 50.6. The employment section rose to 51.3 from 47.6 in October, new orders fell to 48.9, lowest since August 2012 and the prices paid index fell to 35.5 from 39. A score of 49.1 points is expected now.

- US ADP Non-Farm Employment Change: Wednesday, 13:15. Private sector employment increased by 217,000 jobs in November according to ADP Report. The reading topped market forecast and followed a 196,000 reading in the previous month. This was the strongest gains in the service sector since June. The increase was mainly driven by a rebound in professional/business service jobs. Job growth remains strong and the pace of job creation is twice that needed to absorb growth in the working age population. 193K is expected now.

- US Trade Balance: Wednesday, 13:30. The U.S. trade deficit widened unexpectedly in October amid a fall in exports. The trade gap increased 3.4% to $43.9 billion, resulting from a stronger dollar. September’s trade deficit was revised up to $42.5 billion from the previously reported $40.8 billion. Economists had expected an improvement to $40.6 billion. Exports fell 1.4% to $184.1 billion, the lowest level since October 2012. Imports slipped 0.6% to $228.0 billion in October. A deficit of 44 billion is expected.

- US ISM Non-Manufacturing PMI: Wednesday, 15:00. The U.S. service sector reflected slower business activity in November. The Institute for Supply Management’s non manufacturing purchasing-managers index fell to 55.9 from 59.1 in October. Economists expected the index to fall to 58.1. However, despite this decline, November’s reading shows the resilience of the domestic services sector. Business activity, new orders and employment components fell by more than 4 points, but still posted readings above 55.

- US FOMC Meeting Minutes: Wednesday, 19:00. These are the minutes from the historic rate hike decision. The statement showed a unanimous vote, but perhaps the wider array of members wasn’t in full agreement. It will be important to note the sentiment towards further rate hikes in 2016. Currently, 4 hikes are foreseen according to the dot plot, while markets expect far less activity. The Fed decided to put an emphasis on inflation, and we will also learn how worried they were at the time.

- US Unemployment Claims: Thursday, 13:30. Initial jobless claims in the U.S. increased by 20,000 last week to a seasonally adjusted 287,000. The increase was larger than the 274,000 initially expected. Meanwhile, the four-week moving average increased by 4,500 claims to 272,500. Continuing jobless claims edged up by 3,000 to a seasonally adjusted 2,198,000. A drop to 271K is predicted now.

- Canadian employment data: Friday, 13:30. The Canadian economy shed nearly 36,000 jobs in November after a massive part-time workers hired for the October federal election were dismissed. The job losses, were four times larger than the 10,000 expected raising the unemployment rate to 7.1%, from 7% in October. While the economy lost 72,000 part time workers, it also gained 36,000 full-time employees, suggesting the picture is not as bad as it looks. A gain of 10.4K jobs and steady unemployment rate at 7.1% are predicted now.

- US Non-Farm Employment Payrolls: Friday, 13:30. The last NFP report showed a 211,000 jobs gain in November, beating forecasts for a 201,000 increase, keeping the unemployment rate steady at 5%. The solid job gain was exactly what the Fed needed to make the call to raise rates on their December meeting. Wages increased 2.3% year-over-year in November a bit lower than the 2.5% rise posted in October showing a growth trend. A gain of 202K jobs is predicted with a steady unemployment rate of 5%. Wages are expected to rise 0.2% m/m once again. While no hike is expected in the January meeting, this feeds into the March decision.

Forum on trading, automated trading systems and testing trading strategies

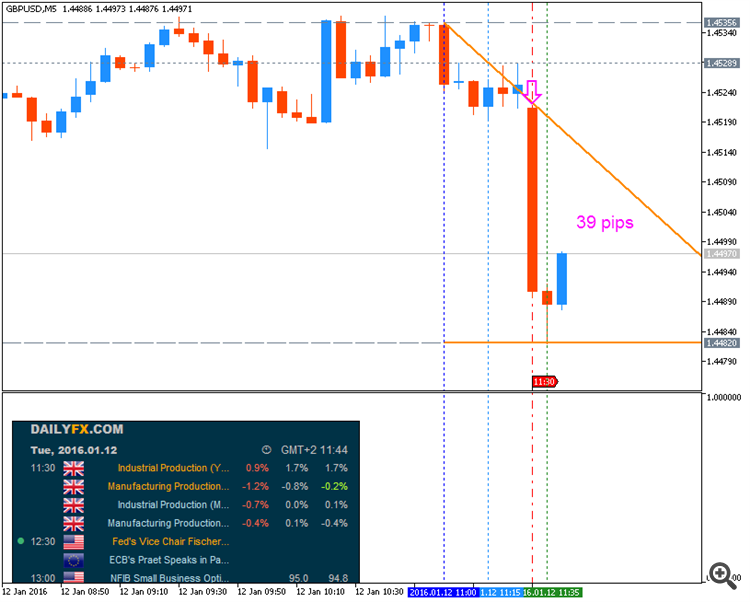

Sergey Golubev, 2016.01.12 10:45

GBP/USD Intra-Day Fundamentals - Manufacturing Production and 39 pips price movement

2016-01-12 09:30 GMT | [GBP - Manufacturing Production]

- past data is -0.4%

- forecast data is 0.1%

- actual data is -0.4% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Manufacturing Production] = Change in the total inflation-adjusted value of output produced by manufacturers.

==========

- "Total production output is estimated to have increased by 0.9% in November 2015 compared with the same month a year ago. There were increases in 3 of its 4 main sectors, with the largest contribution coming from mining & quarrying, which increased by 10.5%."

- "Manufacturing output decreased by 1.2% in November 2015 compared with November 2014. The largest contribution to the decrease came from the manufacture of machinery & equipment not elsewhere classified, which decreased by 13.7%."

- "Total production output is estimated to have decreased by 0.7% between October 2015 and November 2015. There were decreases in all of the main sectors, with manufacturing, mining & quarrying and electricity & gas having the largest contributions to the decrease."

- "Manufacturing output decreased by 0.4% in November 2015 compared with October 2015. The largest contribution to the decrease came from the manufacture of basic pharmaceutical products & pharmaceutical preparations, which decreased by 4.9%."

- "In the 3 months to November 2015, total production and manufacturing output increased by 0.2% and 0.5% respectively on the previous 3 months."

- "In the 3 months to November 2015, production and manufacturing were 9.1% and 6.1% respectively below their values reached in the pre-downturn GDP peak in Quarter 1 (Jan to Mar) 2008."

==========

GBPUSD M5: 39 pips price movement by GBP - Manufacturing Production news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.01.12 15:48

GBP/USD Intra-Day Fundamentals - BOE Governor Mark Carney speaks and 25 pips price movement

2016-01-12 14:15 GMT | [GBP - BOE Governor Mark Carney speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[GBP - BOE Governor Mark Carney speaks] = Discussion titled "Legacy for Business Models and Financial Stability" at the Farewell Symposium for Christian Noyer, in Paris. As head of the central bank, which controls short term interest rates, he has more influence over the nation's currency value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

==========

GBPUSD M5: 25 pips price movement by GBP - BOE Governor Mark Carney speaks :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.01.13 14:58

Intra-Day Fundamentals - China CGAC Trade Balance and 67 pips price movement for majors

2016-01-13 02:00 GMT | [CNY - CGAC Trade Balance]

- past data is 343B

- forecast data is 339B

- actual data is 382B according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CGAC Trade Balance] = Difference in value between imported and exported goods during the previous month. Export demand/currency demand are directly linked with each other: foreigners buy the domestic currency to pay for the exports.

==========

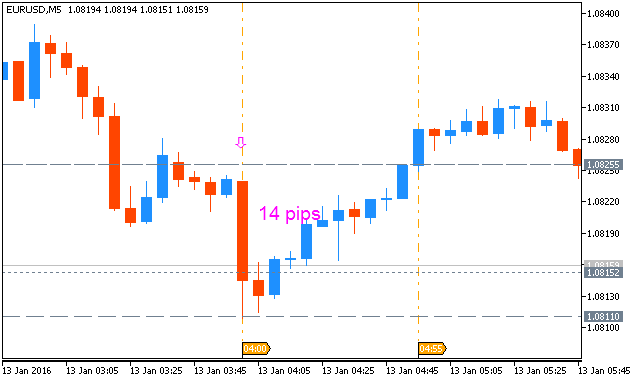

EURUSD M5: 14 pips price movement by CNY - CGAC Trade Balance news event :

==========

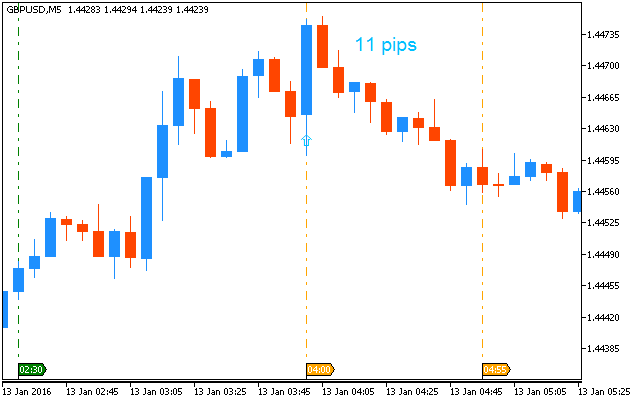

GBPUSD M5: 11 pips price movement by CNY - CGAC Trade Balance news event :

==========

USDJPY M5: 31 pips price movement by CNY - CGAC Trade Balance news event :

==========

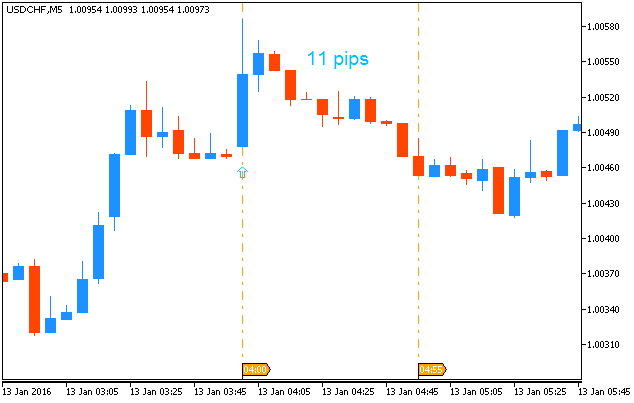

USDCHF M5: 11 pips price movement by CNY - CGAC Trade Balance news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.01.14 14:30

GBP/USD Intra-Day Fundamentals - Official Bank Rate and 54 pips price movement

2016-01-14 12:00 GMT | [GBP - Official Bank Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BOE lends to financial institutions overnight.

==========

"The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy in order to meet the 2% inflation target and in a way that helps to sustain growth and employment. At its meeting ending on 13 January 2016, the MPC voted by a majority of 8-1 to maintain Bank Rate at 0.5%. The Committee voted unanimously to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion, and so to re-invest the £8.4 billion of cash flows associated with the redemption of the January 2016 gilt held in the Asset Purchase Facility."==========

GBPUSD M5: 54 pips price movement by GBP - Official Bank Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.01.16 09:22

What we’re watching (based on the article)

- USD - "Evidence of accelerating core inflation could help the USD but mainly against risk-correlated and commodity currencies."

- EUR - "ECB President Draghi may consider a more dovish rhetoric as part of next week’s press conference. This should keep the EUR a sell."

- GBP - "Next week’s labour and retail sales data

should confirm constructive domestic conditions to the benefit of rate

expectations, and the currency."

- CAD - "Even if the BoC were to refrain from easing monetary policy further as soon as next week, they should consider a dovish rhetoric. This should prove sufficient in keeping the CAD a sell on rallies."

- NZD - "Any better than expected inflation data is likely to prove an opportunity to sell the NZD anew."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.01.19 08:43

GBP/USD Intra-Day Fundamentals: China Gross Domestic Product and 16 pips price movement

2016-01-19 02:00 GMT | [CNY - GDP]

- past data is 6.9%

- forecast data is 6.9%

- actual data is 6.8% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

GBPUSD M5: 16 pips price movement by CNY - GDP news event :

Forum on trading, automated trading systems and testing trading strategies

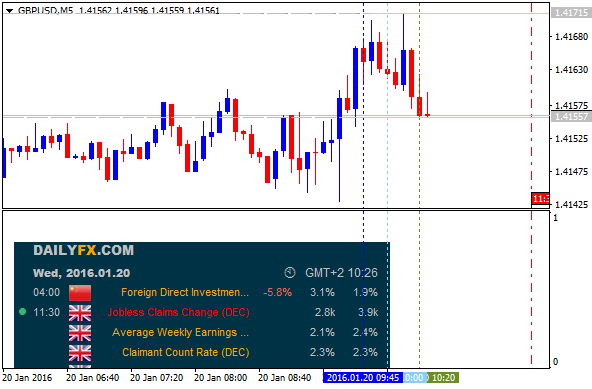

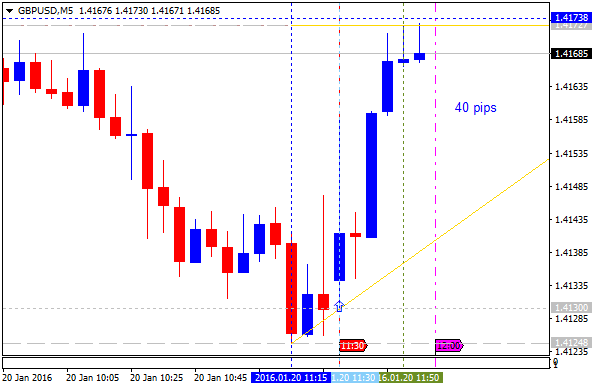

Sergey Golubev, 2016.01.20 09:41

Trading News Events: GBP Jobless Claims Change (based from the article)

What’s Expected:

Why Is This Event Important:

The recent comments from BoE Governor Mark Carney suggests that the

Monetary Policy Committee (MPC) is in no rush to lift the benchmark

interest rate off of the record-low, and the board may continue to

endorse a wait-and-see approach at the next policy meeting on February 4

as the central bank head looks for signs of stronger inflation.

Nevertheless, the pickup in private-sector lending along with the rise

in household spending may encourage U.K. firms to expand their labor

force, and a positive development may spur a greater dissent within the

BoE as central bank officials see a ‘solid’ recovery in the region.

How To Trade This Event Risk

Bearish GBP Trade: Jobless Claims Increase, Household Earnings Slide

- Need red, five-minute candle following the print to consider a short GBP/USD trade.

- If market reaction favors selling sterling, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

GBPUSD Daily

- Longer-term outlook for GBP/USD remains tilted to the downside as price & the Relative Strength Index (RSI) retain the bearish formations carried over from the previous year; will continue to watch the downside especially as the oscillator pushes deeper into oversold territory and approaches the lowest level since September 2009.

- Interim Resistance: 1.4860 (78.6% retracement) to 1.4910 (61.8% retracement)

- Interim Support: 1.3870 (78.6% expansion) and 1.4000 pivot

GBPUSD M5: 40 pips price movement by GBP Jobless Claims Change news event:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.01.22 12:10

GBP/USD Intra-Day Fundamentals: Retail Sales and 56 pips range price movement

2016-01-22 09:30 GMT | [GBP - Retail Sales]

- past data is 1.3%

- forecast data is -0.1%

- actual data is -1.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

- "Year-on-year estimates of the quantity bought in the retail industry

showed growth for the 32nd consecutive month in December 2015,

increasing by 2.6% compared with December 2014.

- The underlying pattern in the data, as suggested by the 3 month on 3

month movement in the quantity bought, showed growth for the 24th

consecutive month, increasing by 1.1%.

- Compared with November 2015, the quantity bought in the retail industry is estimated to have decreased by 1.0%.

- When comparing the 2015 annual data with 2014, the quantity bought in

the retail industry was estimated to have increased by 4.5%.

- Average store prices (including petrol stations) fell by 3.2% in

December 2015 compared with December 2014, the 18th consecutive month of

year-on-year price falls.

- The amount spent in the retail industry decreased by 1.0% in December

2015 compared with December 2014 and decreased by 1.4% compared with

November 2015.

- The value of online sales increased by 8.2% in December 2015 compared

with December 2014 and decreased by 5.2% compared with November 2015.

- Revisions to this release were caused by the incorporation of late data. The earliest revisions point for current price, non-seasonally adjusted data was December 2014. More information on revisions can be found in the background notes."

==========

GBPUSD M5: 56 pips range price movement by GBP - Retail Sales news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on ranging bearish condition located below 100 period SMA (100 SMA) and 200 period SMA (200 SMA). The price is ranging within the following key support/resistance levels:

The price was bounced from 1.4805 support level for the ranging condition to be started, but RSI indicator is estimating the ranging bearish trend to be continuing anyway so I foresee this breakdown to have a second try with this level for example.

Weekly price is on ranging bearish breakdown to be below 100 period SMA (100 SMA) and 200 period SMA (200 SMA). The price is ranging within the following key support/resistance levels:

The key reversal resistance level for the weekly price is Fibo resistance at 1.5929, and if the price breaks this level to above so the reversal to the primary bullish trend will be started. But as we see from the chart - the descending triangle pattern was formed with 1.4864 support to be broken for the bearish, and RSI indicator is estimating the bearish trend to be continuing in the future as well so the more likely scenario for weekly timeframe is the bearish market condition with the secondary ranging.

Monthly price is on bearish condition for the ranging within the following key support/resistance levels:

The key reversal resistance level for monthly price is 50.0% Fibo resistance at 1.5929: if the price breaks this level to above so the bullish reversal will be started with the secondary ranging and with 1.7228 level as a long-term bullish target. But symmetric triangle pattern was already broken by the price to below for the bearish trend to be continuing and with 1.4565 as the next bearish target to re-enter so the bullish reversal scenario is very unlikely with this situation for example.