You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.22 20:11

EUR/USD Intra-Day Fundamentals: ECB Sabine Lautenschläger Speech and 19 pips price movement

2016-02-22 18:00 GMT | [EUR - ECB Sabine Lautenschläger Speech]

[EUR - ECB Sabine Lautenschläger Speech] = Sabine Lautenschläger is a member of the European Central Bank's Executive Board since January 2014.

==========

"Rede von Sabine Lautenschläger, Mitglied des Direktoriums der EZB und stellvertretende Vorsitzende des Aufsichtsgremiums des einheitlichen Aufsichtsmechanismus, Bankenabend der Hauptverwaltung in Baden-Württemberg der Deutschen Bundesbank, Stuttgart, 22. Februar 2016."

==========

EURUSD M5: 19 pips price movement by ECB Sabine Lautenschläger Speech news event :

EUR/USD Intra-Day Technical Analysis - ranging within key reversal levels

M5 price is located above 200 period SMA (200 SMA) and near 100 period SMA (100 SMA) for the primary bullish market condition with the secondary ranging. The price is rabnging within the following key reversal support/resistance levels: 1.1049 bullish reversal resistance and 1.1020 bearish reversal support levels.

SUMMARY : ranging

TREND : bullishForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.23 10:35

EUR/USD Intra-Day Fundamentals: German Ifo Business Climate and 38 pips price movement

2016-02-23 09:00 GMT | [EUR - German Ifo Business Climate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Ifo Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers.

==========

"Sentiment among German businesses continued to weaken in February. The Ifo Business Climate Index for German industry and trade fell to 105.7 points this month from 107.3 points in January, marking its third consecutive decrease. The majority of companies were pessimistic about their business outlook for the first time in over six months. Assessments of the current business situation, by contrast, were slightly better than last month. German businesses expressed growing concern, especially in manufacturing."

==========

EURUSD M5: 38 pips price movement by German Ifo Business Climate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.23 16:16

EUR/USD Intra-Day Fundamentals: CB Consumer Confidence and 20 pips price movement

2016-02-23 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

"The Conference Board Consumer Confidence Index®, which had increased moderately in January, declined in February. The Index now stands at 92.2 (1985=100), down from 97.8 in January. The Present Situation Index declined from 116.6 to 112.1, while the Expectations Index decreased from 85.3 to 78.9 in February.

The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was February 11."

“Consumer confidence decreased in February, after posting a modest gain in January,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions weakened, primarily due to a less favorable assessment of business conditions. Consumers’ short-term outlook grew more pessimistic, with consumers expressing greater apprehension about business conditions, their personal financial situation, and to a lesser degree, labor market prospects. Continued turmoil in the financial markets may be rattling consumers, but their assessment of current conditions suggests the economy will continue to expand at a moderate pace in the near-term.”

==========

EURUSD M5: 20 pips price movement by CB Consumer Confidence news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.24 10:39

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

EUR/USD: Ranging - Daily closing below 1.0989 would shift to bearish.

"EUR edged below 1.0990 (low of 1.0987) but closed higher at 1.1015. Only a daily closing below 1.0990 would indicate further EUR weakness towards the next support at 1.0850. Overall, this pair is expected to remain under pressure unless it can reclaim 1.1130 in the next few days."

As we see from the chart above - the daily price broke 200-day SMA for the primary bearish market condition with the ranging around 100-day SMA area. If the price breaks 1.0989 key support level on close daily bar so the primary bearish trend will be continuing, otherwise - the price will be ranging within 200-SMA/100-SMA levels waiting for direction.

EUR/USD Intra-Day Technical Analysis - ranging near 200-SMA reversal area

H4 price is located near and above SMA with period 200 (200-SMA) with the ranging on reversal area waiting for the bullish trend to be continuing or for the bearish reversal.

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.25 14:46

EUR/USD Intra-Day Fundamentals: Durable Goods Orders and 22 pips price movement

2016-02-25 13:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

EURUSD M5: 22 pips price movement by Durable Goods Orders news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.26 10:58

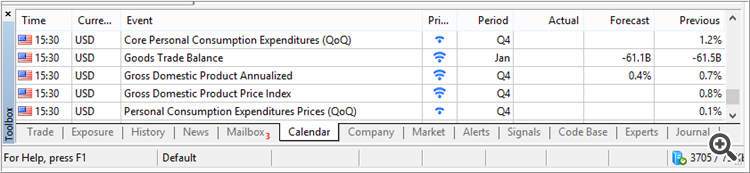

Trading News Events: USD Gross Domestic Product (based on the article)

The preliminary U.S. 4Q Gross Domestic Product (GDP) report may produce headwinds for the greenback and spark a near-term a rebound in EUR/USD should the report highlight a slowing recovery in the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Even though the U.S. approaches ‘full-employment,’ a marked downward revision in the growth rate may undermine Fed expectations for a ‘consumer-led’ recovery, and the central bank may largely endorse a wait-and-see approach throughout 2016 in an effort to mitigate the downside risks surrounding the region.

Nevertheless, the pickup in private-sector consumption may generate a better-than-expected GDP print as it remains one of the leading drivers of growth, and signs of a more meaningful recovery may boost the appeal of the greenback as it puts increased pressure on the Fed to implement higher borrowing-costs over the coming months.

How To Trade This Event Risk

Bearish USD Trade: 4Q GDP Slows to Annualized 0.4% or Lower

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD.

- If market reaction favors a short dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: Growth, Inflation Top Market Expectations- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.26 14:47

EURUSD M5: 39 pips range price movement by U.S. Gross Domestic Product news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.27 11:29

Next Week's February NFP by BofA Merrill (based on the article)

EURUSD M5: 133 pips range price movement by Non-Farm Employment Change news event :