Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.04 18:33

EUR: Outlooks For The Coming Week - Morgan Stanley (based on efxnews article)

"EUR: EUR Still Driven by Risk. Neutral.

As risk sees some relief, we would expect EUR to see some pressure,

given the inverse relationship between EUR and equities. We like

tactically trading short EUR/EM crosses, though we would be selective on

EM currencies. EURUSD could also weaken in this environment. Over the

medium term, we also expect EUR to head lower, on the back of divergence

in monetary policy between Europe and the rest of the world."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.05 09:02

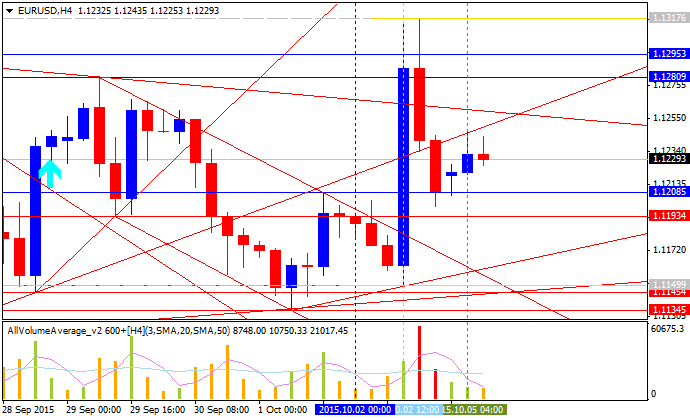

EUR/USD: Levels & Targets by UOB (based on efxnews article)

UOB expects for EUR/USD the ranging within 1.1160 and 1.1275.

-

"It is likely that a temporary top is in place but the down-move from the high is viewed as part of a consolidation and not the start of a sustained downmove."

-

"From here, only a clear break above 1.1330 will shift the current

neutral outlook to bearish. In the meanwhile, this pair is expected to

trade in choppy manner, likely within 1.1115 and 1.1330 for another week

or so."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.06 13:39

Intraday Outlooks for EUR/USD by SEB (based on efxnews article)

EUR/USD: "Sellers keep responding. Thinned dynamic

resistance keeps attracting responsive selling, but bears' initiative

below 1.1150/05 is needed to confirm the ongoing bearish "Flag". Current

intraday stretches are located at 1.1115 & 1.1285."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.07 09:32

EUR and the global risk picture - Morgan Stanley (based on efxnews article)

Morgan Stanley is expecting for EUR/USd to be in breakdown below 1.1120/1.1100 level with 1.0850 as a next target with the possibility to break resistance levels in spike way in short-term situation for example:

-

"A more risk positive environment appears to be

developing for currencies markets which should continue to provide some

short-term relief for commodity-related currencies and selective EM

currencies."

-

"However, the reaction in currency markets, so far, has been more muted than

may have been expected. This may cause some questioning of the

relationship between currencies and the risk environment."

- "We think it does, although it has been challenged on occasions recently. Indeed, monetary policy expectations are also having a strong influence on the EUR. Our FX drivers analysis suggests that front-end rates are having an equally strong positive relationship with the EUR as the negative risk relationship."

- "Hence, while we believe that the relationship between the EUR and the global risk picture remains intact, it has loosened and is now more prone to challenges and shift in policy expectations."

-

"Overall, in the current environment we expect the EUR to put

pressure on the lower end of the range, with a break below 1.1120/00

opening the way for a EURUSD decline towards 1.0850. But risk-off events

should still generate EUR spikes higher."

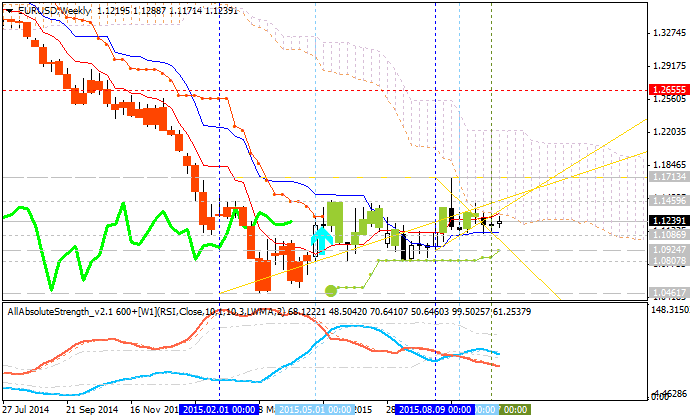

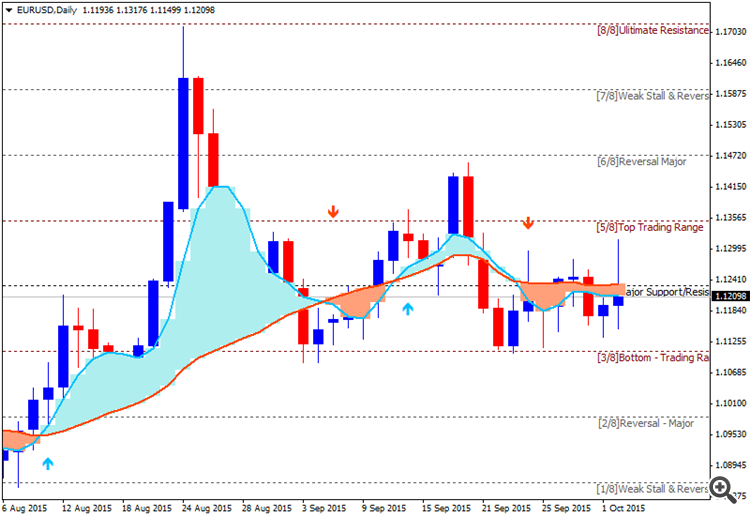

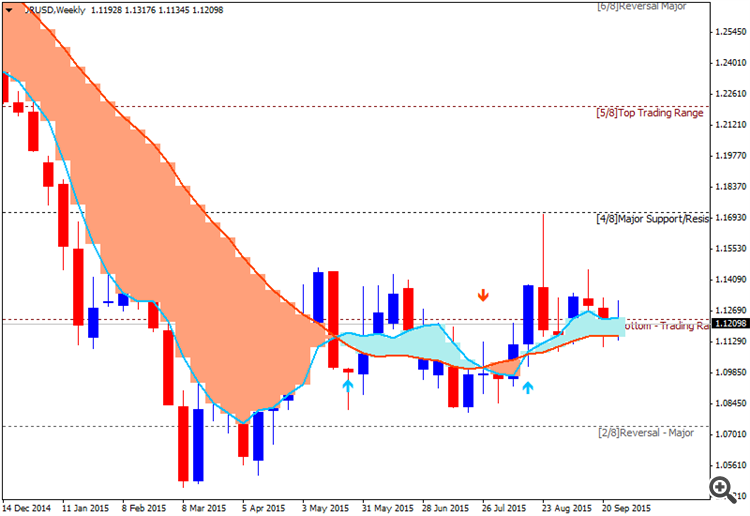

As we see from the chart above - the price is on bearish with the ranging within the following support/resistance levels:

- 1.1459 resistance level located inside Ichimoku cloud in the ranging area of the chart, the next target in this case is 1.2655 'reversal' resistance level located in the primary bullish area of the chart, and

- 1.0924 support level located in the bearish area with 1.0807 as a next bearish target.

Thus, the most expected scenario is the following: the price will go down for breaking 1.0924 with 1.0807 as the next bearish target. As we are talking about the ranging market condition for this pair so we should expect some local downtrend as a bear market rally up to 1.1459 resistance in short-term basis for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.08 09:16

FOMC Minutes expectations by Barclays Capital (based on efxnews article)

Barclays Capital made some expectation and forecasting concerning upcoming Federal Open Market Committee Minutes:

- "Since the September FOMC meeting, a number of FOMC participants have declared that the decision not to raise rates was “close”. We look to the minutes to provide some insight into this statement."

- "We also look to the minutes for context on the new sentence inserted into the September statement acknowledging risks from global economic and financial developments."

- "The minutes are likely to reveal the balance of sentiment between those members who preferred to look through these risks and those members who pushed to postpone any rate hike in an abundance of caution."

- "In addition, the minutes should reveal the number of members who are focused on economic activity abroad rather than just the financial market spillovers to the US."

Just to remind one trading rules for high impacted news event such as FOMC Minutes: more hawkish than expected = good for currency (for USD in our case).

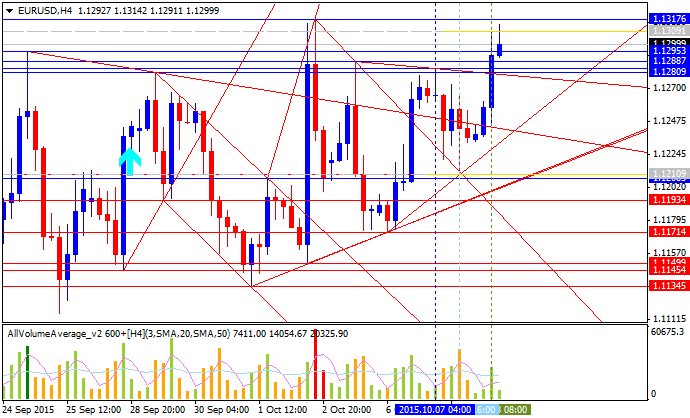

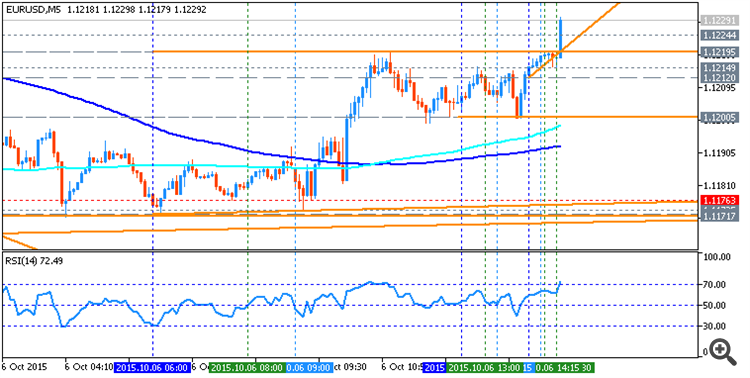

From the technical points of view, the EUR/USD is moved on the border between the primary bearish and the primary bullish in intra-day H4 chart and on daily chart, and any good high impacted news event can move the price to any direction for example. Key support/resistance levels for EUR/USD H4 are the following: 1.1317 bullish resistance and 1.1134 bearish support. On the daily chart we may see 1.1579 key resistance and 1.0878 key support levels.

Once the price breaks key support/resistance levels at least in intra-day basis so it may be the good sign for the direction to be chosen by the price for the next week for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.08 12:08

Intraday Outlooks for EUR/USD and Gold - SEB (based on efxnews article)

EUR/USD: "Another 1.13+test underway. Even though most factors speaks in favor of a bear flag being under construction since Sept 22 the short term charts speaks of more near term upside risk. The move above 1.1273 triggers an hourly buy signal calling for a test of the flag’s upper boundary, 1.1340-ish (and then turning for a downside test). To avoid the above scenario prices must fall back below 1.1211."

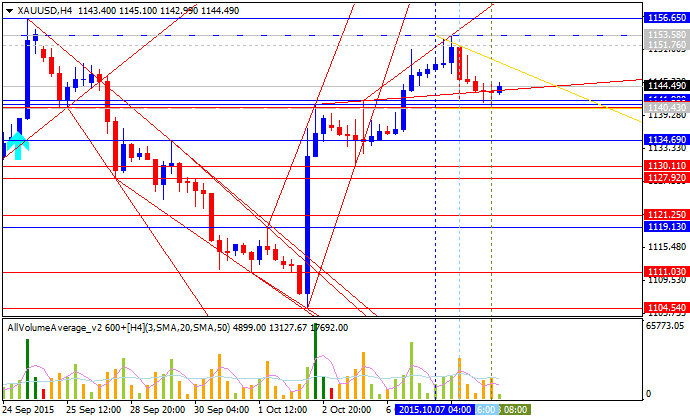

Gold: "Small setback likely before sharply up. Trendline sellers mark a "Triangle" wave point “D” and it should ideally be followed by a short & shallow “E-wave low, somewhere around 1,131/26 before moving up for the BIGbreak out of the formation to challenge resistance at 1169\70, 1,184 to reach the extension objective at 1,192."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.09 11:45

Intraday Outlooks for EUR/USD by SEB (based on efxnews article)

EUR/USD: "Flag ceiling basically met. The pair did the

anticipated up and down move. The rejection from the upper boundary does

now indicate that a new attempt to exit the flag to the downside should

be seen next week."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bearish market condition for ranging between the following key support/resistance levels:

Intermediate s/r levels for this pair on the way to the key s/r are the following:

D1 price - ranging:

If D1 price will break 1.1086 support level on close D1 bar so the bearish market condition may be started.

If D1 price will break 1.0847 support level on close D1 bar so we may see the bearish breakdown.

If D1 price will break 1.1295 resistance level on close D1 bar so the bullish reversal may be started for this pair.

If D1 price will break 1.1713 resistance level on close D1 bar so we may see the bullish breakout on this timeframe.

If not so the price will be on ranging within the levels.

SUMMARY : ranging

TREND : waiting for direction