New article Time Series Forecasting Using Exponential Smoothing (continued) is published:

Author: Victor

I have tried many times to search for this modified new indicator in the Code base section of the MT5 but I couldn't found it.

Can you please add it into the code base of MT5 so I can download it easy and test it? Or please provide me the modified indicator and how to download it into my MT5?

Do you have the same for MT4?

Any on can help please/

Thank you

Forum on trading, automated trading systems and testing trading strategies

Discussion of article "Time Series Forecasting Using Exponential Smoothing"

newdigital, 2014.06.06 21:48

Becoming a Fearless Forex Trader

- Must You Know What Will Happen Next?

- Is There a Better Way?

- Strategies When You Know That You Don’t Know

-Michael Steinhardt

"95% of the trading errors you are likely to make will stem from your attitudes about being wrong, losing money, missing out, and leaving money on the table – the four trading fears"

-Mark Douglas, Trading In the Zone

Many traders become enamored with the idea of forecasting. The need for forecasting seems to be inherent to successful trading. After all, you reason, I must know what will happen next in order to make money, right? Thankfully, that’s not right and this article will break down how you can trade well without knowing what will happen next.

Must You Know What Will Happen Next?

While knowing what would happen next would be helpful, no one can know for sure. The reason that insider trading is a crime that is often tested in equity markets can help you see that some traders are so desperate to know the future that their willing to cheat and pay a stiff fine when caught. In short, it’s dangerous to think in terms of a certain future when your money is on the line and best to think of edges over certainties when taking a trade.

The problem with thinking that you must know what the future holds for your trade, is that when something adverse happens to your trade from your expectations, fear sets in. Fear in and of itself isn’t bad. However, most traders with their money on the line, will often freeze and fail to close out the trade.

If you don’t need to know what will happen next, what do you need? The list is surprisingly short and simple but what’s more important is that you don’t think you know what will happen because if you do, you’ll likely overleverage and downplay the risks which are ever-present in the world of trading.

- A Clean Edge That You’re Comfortable Entering A Trade On

- A Well Defined Invalidation Point Where Your Trade Set-Up No Longer

- A Potential Reversal Entry Point

- An Appropriate Trade Size / Money Management

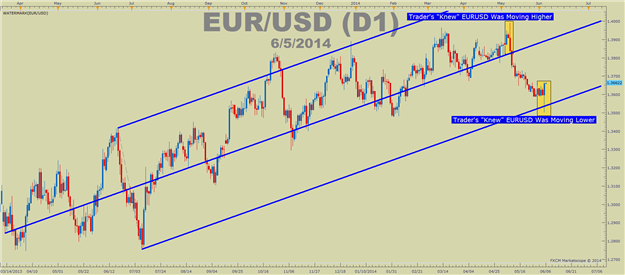

Yesterday, the European Central Bank decided to cut their refi rate and deposit rate. Many traders went into this meeting short, yet EURUSD covered ~250% of its daily ATR range and closed near the highs, indicating EURUSD strength. Simply put, the outcome was outside of most trader’s realm of possibility and if you went short and were struck by fear, you likely did not close out that short and were another “victim of the market”, which is another way of saying a victim of your own fears of losing.

So what is the better way? Believe it or not, it’s to approach the market, understanding how emotional markets can be and that it is best not to get tied up in the direction the market “has to go”. Many traders will hold on to a losing trade, not to the benefit of their account, but rather to protect their ego. Of course, the better path to trading is to focus on protecting your account equity and leaving your ego at the door of your trading room so that it does not affect your trading negatively.

Strategies When You Know That You Don’t Know

There is one commonality with traders who can trade without fear. They build losing trades into their approach. It’s similar to a gambit in chess and it takes away the edge and strong-hold that fear has on many traders. For those non-chess players, a gambit is a play in which you sacrifice a low-value piece, like a pawn, for the sake of gaining an advantage. In trading, the gambit could be your first trade that allows you to get a better taste of the edge you’re sensing at the moment the trade is entered.

James Stanley’s USD Hedge is a great example of a strategy that works

under the assumption that one trade will be a loser. What’s the

significance of this? It pre-assumes the loss and will allow you to

trade without the fear that plagues so many traders. Another tool that

you can use to help you define if the trend is staying in your favor or

going against you is a fractal.

If you look outside of the world of trading and chess, there are other

businesses that presume a loss and therefore are able to act with a

clear head when a loss comes. Those businesses are casinos and insurance

companies. Both of these businesses presume a loss and work only in

line with a calculated risk, they operate free of fear and you can as

well if you presume small losses as part of your strategy.

Another great Mark Douglas quote:

“The less I cared about whether or not I was wrong, the clearer things

became, making it much easier to move in and out of positions, cutting

my losses short to make myself mentally available to take the next

opportunity.” -Mark Douglas

Happy Trading!

The source

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Time Series Forecasting Using Exponential Smoothing (continued) is published:

Author: Victor