Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.02 16:47

Weekly Fundamentals by Morgan Stanley: USD, EUR, JPY, GBP, CAD (based on efxnews article)

USD: Bullish

"We expect USD

strength to be focused against EM and commodity currencies."

EUR: Bearish

"Many

investors have hedged equity positions in Europe with short EUR. This suggests that in an environment

where commodity currencies and EM may sell off, risk generally could

take a hit, adding some support to EUR in the near term. Over the medium

to longer term, however, we retain our bearish view on EUR."

JPY: Neutral

"We believe the BoJ is likely to refrain from further easing barring an

unforeseeable shock to inflation, which should offer support to JPY.

The central bank is likely focused on its new core CPI measure which

does not include energy, and has grown steadily over recent months."

GBP: Bullish

"GBP performance will unfold in three phases going

forward. First, broad-based GBP strength heading into the August 6 MPC

meeting, where we expect the first vote for a rate hike. Second, a more

selective approach after the August meeting. Finally, given the

longer-term headwinds to UK growth from fiscal tightening and political

uncertainty, the currency may lose steam after the first hike."

CAD: Bearish

"We like

buying USDCAD on this dip, believing that as oil price uncertainty

continues to mount, USDCAD will continue to head higher, testing the

levels reached at the end of last week. On top of this, the second round

impact of the lower oil price on the economy is likely to continue to

be seen, possibly in upcoming employment data."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.03 11:19

Skandinaviska Enskilda Banken: Outlooks For EUR/USD, USD/JPY, AUD/USD, SP500 (based on efxnews article)

EURUSD: rejection from the 55-day MA

'The up and

down move on Friday became the third consecutive rejection from the 55d

ma band (since the return below it a month ago). The behavior is showing

that bearish forces are at play and increasingly so given the return to

a negative slope. We are thus looking for additional selling.'

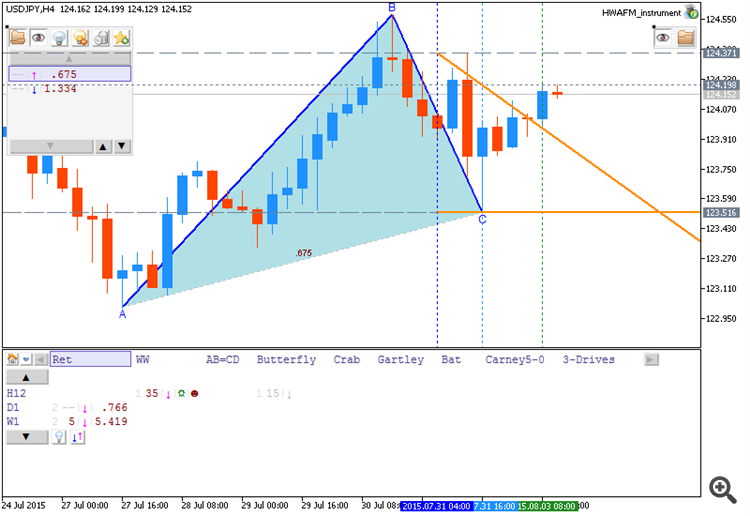

USDJPY: new attempt to be above the key level

'Given the

violation of the B-wave high (and a three wave setback from Thursday’s

peak) there’s a high probability of a soon more successful break higher

(targeting a new trend high). For today we see 124.37 as the trigger

point for the next step higher.'

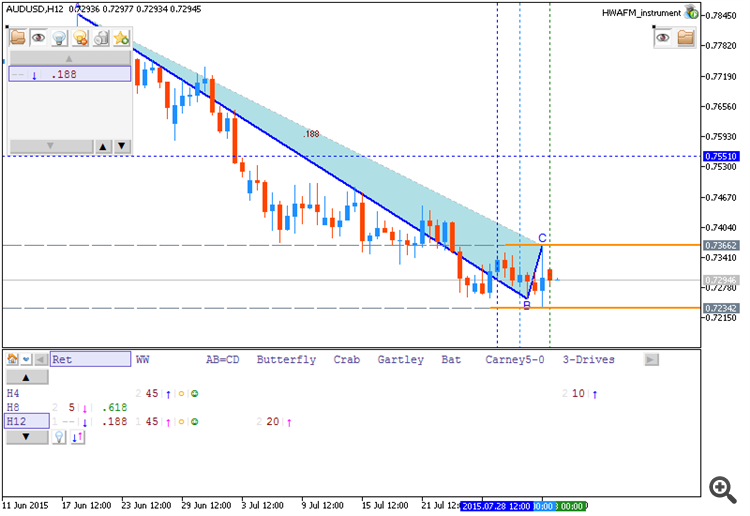

AUDUSD: Signs for sellers

'The spinning

candle (small net move and big spikes to both sides) and the spring

bottom are both signs of exhaustive sellers. There’s clearly a potential

for the pair to bounce back to retest the 2001 trend line (or even back

up to the 0.75- area) during the coming week.'

S&P 500: Higher again

'As long as the recent

correction low remains unbroken a positive view should be kept in place

(the July candle also developed into a mildly bullish piercing pattern).

The entire structure since May can also be seen as an inverted head and

shoulders formation, here seen as an upside continuation pattern.'

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.03 12:30

Societe Generale: EURUSD and Non-Farm Payrolls (based on efxnews article)

Societe Generale made some review for Non-Farm Employment Change report (Change in the number of employed people during the previous month, excluding the farming industry) which will be on Friday:

- "There’s a risk that we see edgy markets in the meantime...At the risk of sounding like a broken record, the case for raising rates to less unusually low levels does not rest on wage growth or inflation returning in earnest first. Rates are too low, and capital is misallocated as a result."

-

"More than the wage data however, we’d focus on the unemployment rate. We

look for a solid 240k increase in non-farm payrolls, a 2.2% increase in

hourly earnings and a drop to 5.2% from 5.3% in the unemployment rate."

-

"Anything that gets the front end of the curve higher in the US should

be negative for EUR/USD. A meander back above 1.10 is possible in the

early part of the week, but we’d like to sell against 1.11 and look for a

break lower in August."

Thus, I think - it may be good bearish breakdown during this high impacted news event.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.03 19:39

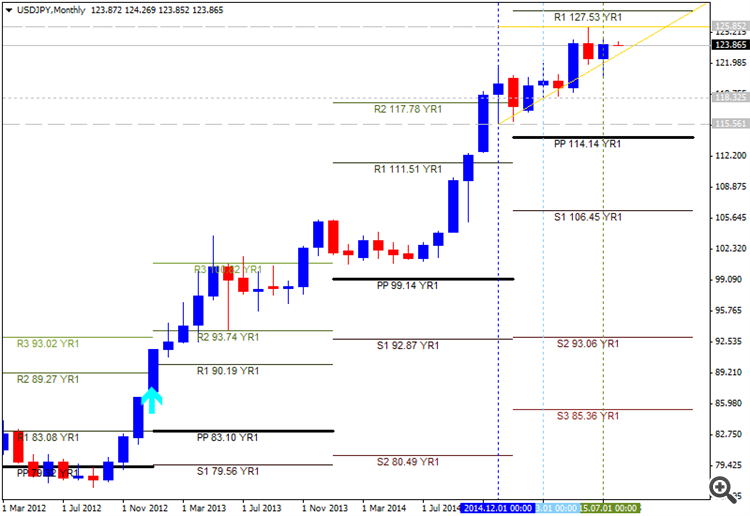

Deutsche Bank - Get Ready For An August-October 'Jump' In USD/JPY (based on efxnews article)

Deutsche Bank made a forecast for USDJPY for August-October 2015 and for 2016:

- August-October 2015

"We believe the USD/JPY could jump to a ¥125-128 level over the next few months in reflection of robust US economic indicators." - 2016

"We expect the USD/JPY to strengthen in August-October and edge upward to only around ¥130 throughout 2016."

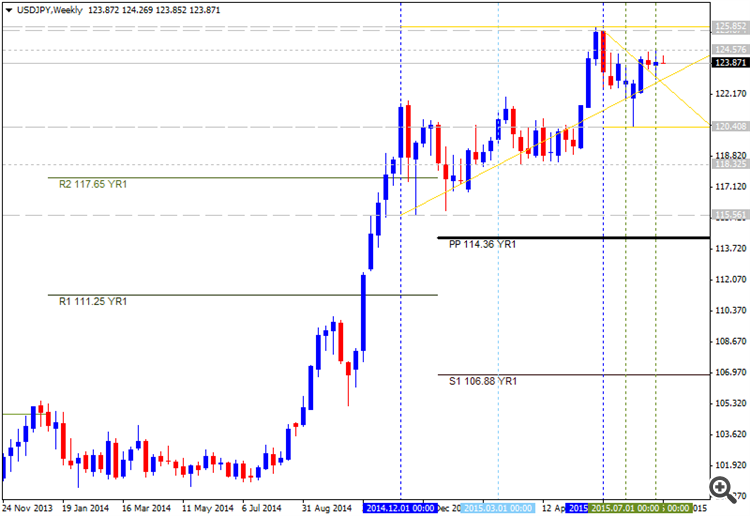

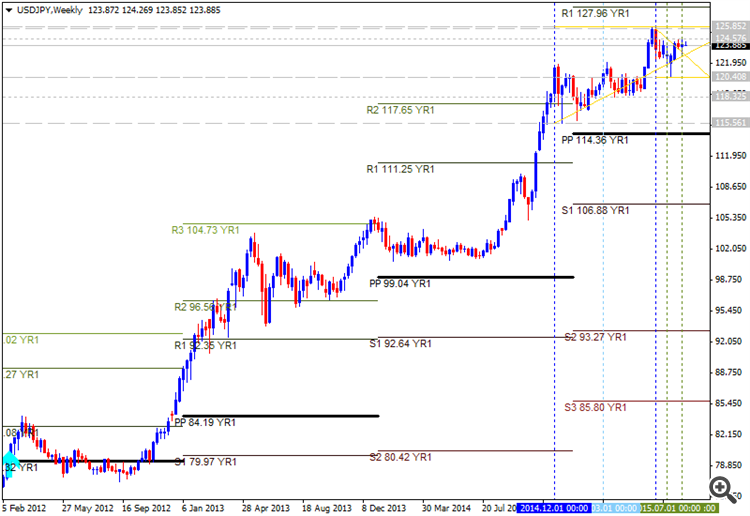

Let's evaluate this situation using Pivot Points and s/r levels.

- S/R levels

If we look at USDJPY W1 timeframe so we see the price broke symmetric pattern from below to above with 125.85 as the nearest resistance level, and it is located for now between 120.40 support and 125.85 resistance. - Pivot Points

The price is located to be above yearly Central Pivot at 114.36 and below R1 Pivot at 127.96. It means the bullish market condition with secondary ranging.

| Instrument | S1 Pivot | Yearly PP | R1 Pivot | R2 Pivot |

|---|---|---|---|---|

| USD/JPY | 106.88 | 114.36 | 127.96 | 135.22 |

If we summarize above mentioned data so we can understand the following: the price is on primary bullish condition with the nearest target as 125.85. The next target is R1 Pivot at 127.96, and we may expect for this next target to be broken by the end of this year for example.

As to 2016 so it may be much easier - R2 Pivot level is located at 135.22, and it will be the next target in 2016 if the price will break 127.96 by the end of this year.

Thus, the forecast of Deutsche Bank was confirmed: ¥125-128 during August-October 2015, and around ¥130 in 2016.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.04 07:40

Bank of Tokyo-Mitsubishi - 'we target EUR/USD at parity by year-end and at 0.96 by Q1'16-end' (based on efxnews article)

Bank of Tokyo-Mitsubishi (BTMU) made their fundamental forecasts for EURUSD based on some fundamental factors:

- "The euro weakened in July with the focus in the foreign exchange market shifting away from the uncertainty related to ‘Grexit’ and back to the monetary policy divergence between the euro-zone and the US. That should mean that the euro reverts to being the funding currency of choice."

-

"We suspect there’s a lot more potential selling to come."

- "However, falling oil prices, if extended, will complicate the ECB’s achievement of its inflation target that could mean the ECB needs to extend QE while China weakness that keeps capital flowing out of China means reduced FX reserves that removes reverse recycling support for the euro as well."

-

"Despite the resolution to the crisis in Greece, at least for now, we maintain that the fundamentals point to renewed EUR weakness and a decline in EUR/USD toward parity."

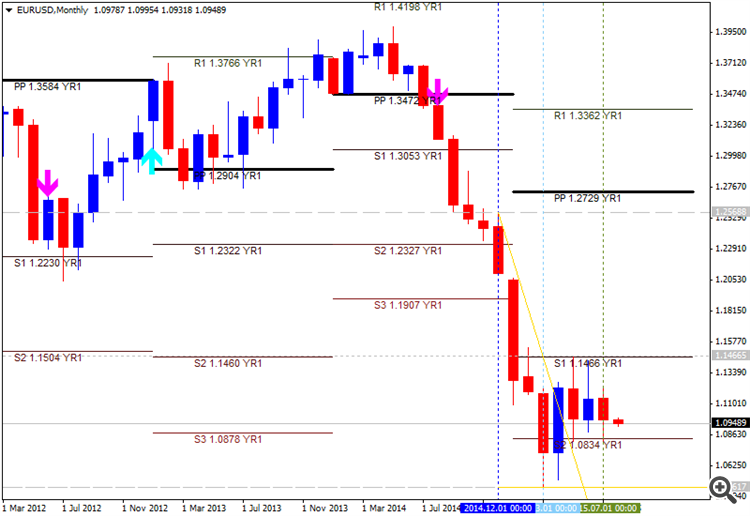

Bank of Tokyo-Mitsubishi (BTMU) forecasts for EURUSD to be at parity by year-end and at 0.96 by Q1'16-end.

By the way, the price is located to be below yearly Central Pivot at 1.2729 for the primary ranguing between S1 Pivot at 1.1466 and S2 Pivot at 1.0834, and the next target in the case the bearish trend will be continuing is S3 Pivot at 0.9571. So, the Bank of Tokyo-Mitsubishi (BTMU) is right with their forecast.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.04 17:13

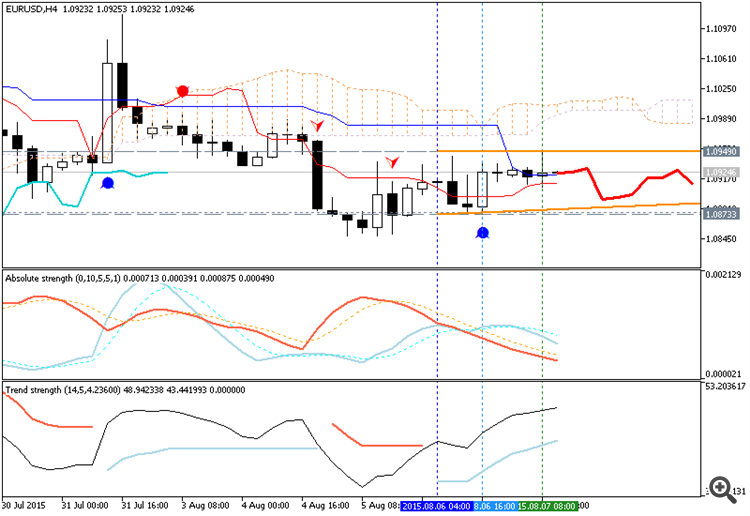

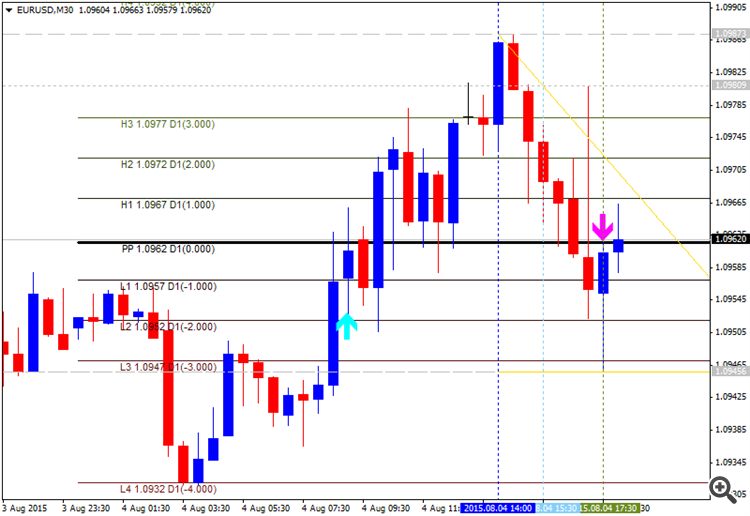

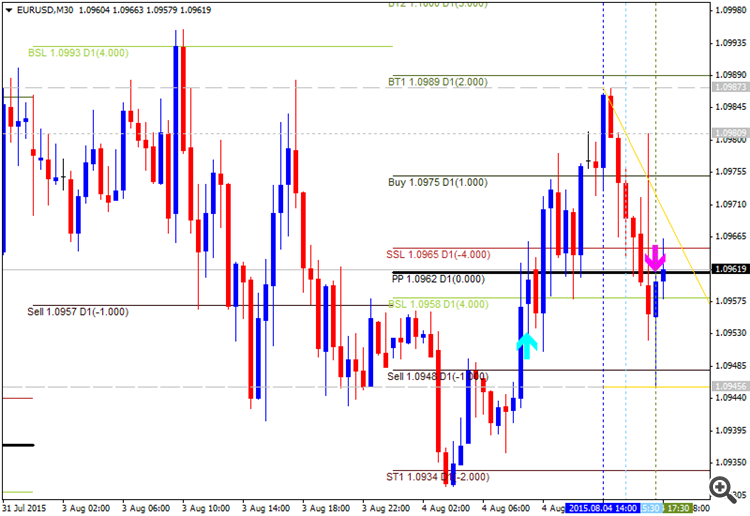

EURUSD Breakout Fails (based on dailyfx article)

- An Initial bullish breakout fails for the EURUSD

- Range reversals begin at 1.0964

- Range support starts at 1.0934

After traversing its daily 30 pip range, the EURUSD has opened the US trading session with a false breakout. Prices attempted a move above today’s R4 Camarilla pivot at 1.0979, but this bullish breakout quickly reversed. Prices are currently tradingback inside of today’s pivot range. As seen below, the EURUSD’s trading range begins at resistance found at the R3 pivot, at a price of 1.0964. If price continues to decline through values of support, traders will begin to look for price to target the S3 pivot found at a price of 1.0934.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.05 15:23

SEB - Outlooks For EUR/USD, EUR/JPY, AUD/USD, NZD/USD (based on efxnews article)

EUR/USD: "Continued losses yesterday brought the prices down through the 1.0921 support an event that adds additional bearishness to our outlook. The next and stronger support is located in the 1.0819-1.0808 range (May and July lows) and should be thoroughly tested within shortly."

EUR/JPY: "Repeatedly rejected from the combined 55/233d ma bands the pair again seems to be making way for a test of the utterly important 133.30/10 support. So remaining below 136.17 should keep us in the bear camp looking for additional losses near term."

AUD/USD: "The primary correction target, the rechecking of the previously broken trend-line, was fulfilled yesterday with the pair moving up to 0.7428 before stalling and rolling over to the downside. A move below yesterdays mid body point, 0.7322, will further enhance downside forces and below 0.7260 new trend lows will be confirmed."

NZD/USD: "Underpinned by another poor dairy auction yesterday (index down -9.3%) the Kiwi continued its decline. A completed three wave pattern (a-b-c) correction does also weigh on prices making a new trend low look like a done deal."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.06 12:35

UBS - Trade Ideas For EUR/USD, USD/CHF, AUD/USD (based on efxnews article)

EUR/USD: "Stay flexible ahead of the US payrolls with a slight bias to sell rallies. Watch support at 1.0880/1.0820 and resistance at 1.0940-50/1.0990."

USD/CHF: "Only a shocking US NFP tomorrow can change

this dollar bullish tone. We still like buying on dips to 0.9740-60 as

long as USDCHF trades above 0.9720."

AUD/USD: "had a rollercoaster ride during trading in

Asia on Australian jobs data. Stick to playing the pair from the short

side, adding on rallies with a stop above 0.7430 and targeting an

eventual move towards 0.7000."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.07 09:19

The Royal Bank of Scotland - USD Into Payrolls (based on efxnews article)

The Royal Bank of Scotland (RBS) made forecast concerning the following coming high impacted news events:

- Non-Farm Payrolls (or Non-Farm Employment Change) - they made a forecast for non-farm payroll growth of 250K in July, above the listed consensus of 225K.

Just to remind that previous NFP data was 223K,

and forecasting for now is 225K for example, so if RBS is looking for

250K as an actual data - it

means to be more bearish for EURUSD. Because in case of NPF: actual >

forecast = good for currency (for US Dollar in our case). So, it means:

more bearish for EURUSD with some key support levels to be broken.

- "After 2Q growth in the Employment Cost Index (ECI, a broad measure of compensation) underwhelmed sharply, we think the monthly average hourly earnings growth could look more positive, as even a trend like gain would boost the y/y rate. (RBSe 2.2% y/y vs. consensus 2.3%). While we think the employment report will be broadly positive, our economists think a pickup in the labour force could push the unemployment rate up from 5.3% to 5.4%."

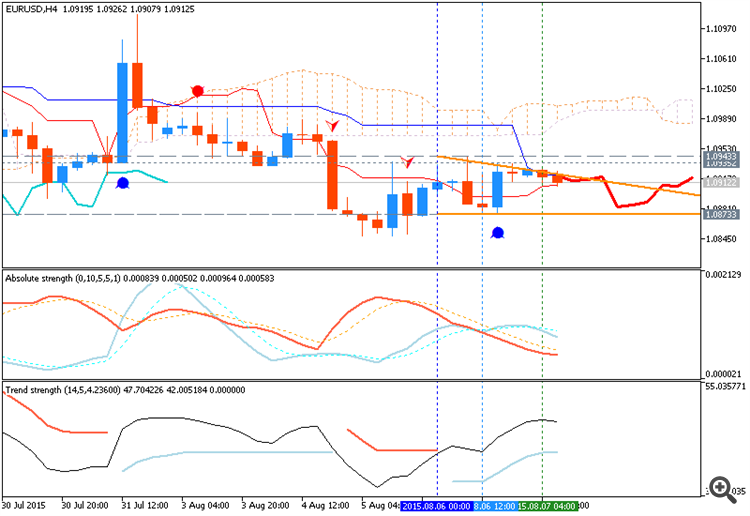

- "We think strong payroll gain should support the USD, particularly after FOMC officials have placed a much greater focus on the cumulative recovery in the labour market than on concerns emanating from abroad."

And just about the levels:

- if we look at H4 Ichimoku chart so we see that the price is on ranging bearish with 1.0873 support level;

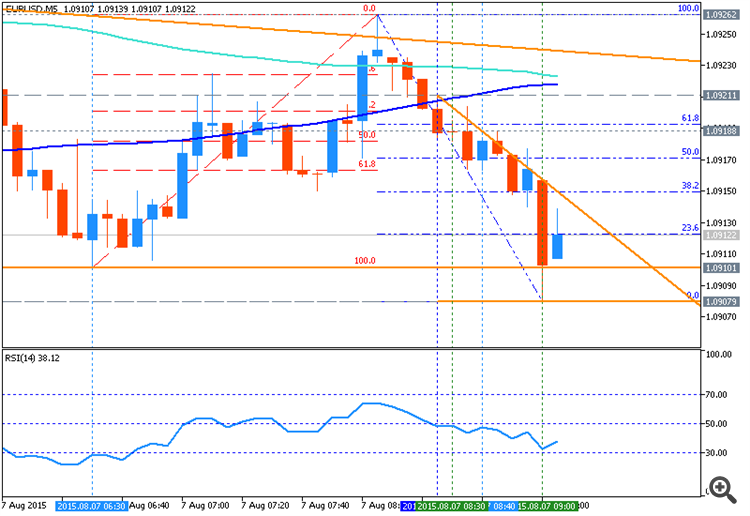

- if we look at M5 price action chart - the support level to be brokeb by price will be 1.0910.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.07 11:00

Trading News Events: U.S. Non-Farm Payrolls (based on dailyfx article)

Another 225K expansion in U.S. Non-Farm Payrolls (NFP) may spur greater demand for the greenback and spark a near-term sell-off in EUR/USD should the fresh batch of data heighten speculation for a Fed rate hike at the September 17 meeting.

What’s Expected:

Why Is This Event Important:

Despite the unanimous vote to retain the zero-interest rate policy (ZIRP) at the July 29 meeting, signs of a stronger recovery may generate a greater dissent within the Federal Open Market Committee (FOMC), and we may see a growing number of central bank officials talk up bets for a September liftoff should the employment report boost the outlook for growth and inflation.

However, waning business sentiment along with the ongoing weakness in

private-sector spending may drag on job growth, and a dismal employment

report may encourage the Fed to further delay its normalization cycle

especially as Chair Janet Yellen looks for a further improvement in

labor dynamics.

How To Trade This Event Risk

Bullish USD Trade: U.S. Employment Increases 225K or Greater

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

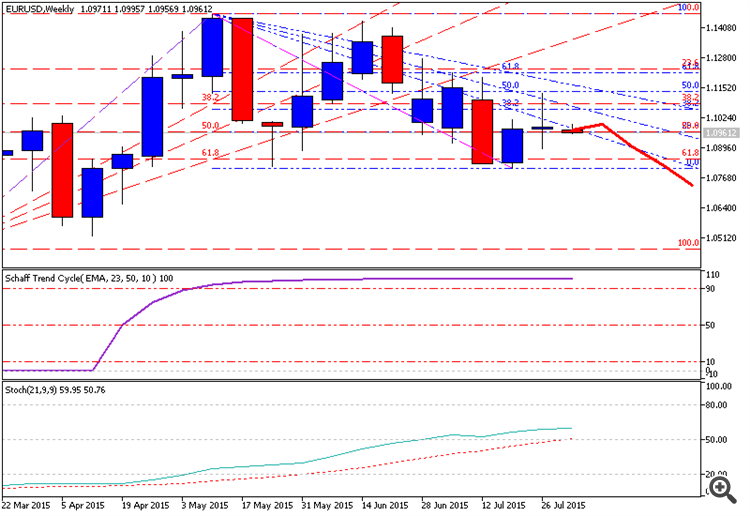

EURUSD

- Long-term outlook for EUR/USD remains bearish amid the divergence in the policy outlook, but the pair may continue to consolidate over the near-term as it remains stuck in the wedge/triangle formation from earlier this year.

- Interim Resistance: 1.1180 (23.6% expansion) to 1.1210 (61.8% retracement)

- Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

June 2015 U.S. Non-Farm Payrolls

EURUSD M5: 66 pips price movement by USD - Non-Farm Payrolls news event:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located inside Ichimoku cloud and below Sinkou Span A line on the bearish area of the chart for ranging between 133.29 support level and 140.62 resistance level with 134.46/137.09 as the intermediate levels. Chinkou Span line is located below the price indicating the ranging market condition by direction.

D1 price - ranging:

W1 price is on bearish ranging between 133.29 (W1) support level and 141.04 (W1) resistance level.

MN price is on ranging bullish with 126.08 support level.

If D1 price will break 134.46 support level on close D1 bar so the bearish trend to be continuing with secondary ranging market condition.

If D1 price will break 133.29 support level so the price will be away from the ranging zone with primary bearish.

If D1 price will break 137.09 resistance level so the price will be reversed to the primary bullish with the secondary ranging.

If D1 price will break 140.62 resistance level so the primary bullish will be continuing without ranging possibilities.

If not so the price will be on ranging between the levels.

SUMMARY : bearish

TREND : ranging bearish