Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.28 21:25

COT report by Scotiabank: Takeaways On USD, EUR, AUD, & Other Majors (based on efxnews article)

EUR sentiment deteriorated for the first week in four, the net short widening $1.3bn to $13.9bn. Its w/w shift was the result of a paring back in both long and short positions, highlighting a broader trend of withdrawal in traders’ participation as a result of elevated uncertainty and the binary nature of Greek risk.

Investors pared back JPY risk in a manner similar to that observed in EUR, albeit to a greater degree with a $2.7bn decline in gross longs and $2.0bn decline in gross shorts. The pattern suggests that traders await a greater degree of certainty in the face of binary Greek risk.

CAD sentiment has deteriorated for the third week in four,

the net short widening $0.4bn to $1.4bn on the back of a decline in

gross longs—falling to their lowest levels since June 2013.

AUD sentiment is also bearish, albeit modestly so

with a net short at $0.7bn. Investors in appear cautious in adding to

risk in either CAD or AUD, waiting for a breakout of their relatively

narrow ranges.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.29 07:17

Forex technical analysis: EURUSD gaps. What is the trading strategy? (based on forexlive article)

'Looking at the daily chart below, the price has been able to extend

below the 50% of the move up from the March low at 1.04617 to the high

from May at 1.14658. That level comes in at 1.09638. This remains a key

level to get below - and satay below if the bears are to extend the

range further.'

'Above, there a slew of old swing lows and highs at 1.1032 to 1.1065. The 100 day MA is at 1.1049 (key level). I would expect that sellers will lean against the 1.1032-49 area as a risk defining level in trading today. It would seem to me that the 100 day MA should be a key "line in the sand" for the pair from a technical perspective. We should not trade above this level.'

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.29 13:46

Credit Agricole - 'A Referendum On EUR': What's Next For Greece? (based on efxnews article)

"The upcoming referendum is in fact a referendum on the Greek membership in the Eurozone.

Indeed, if the people of Greece turn down the reform proposal, the

country will end up with no creditor funding (and no ECB support for its

banks). A default should follow and, with Greece still cut off from the

global capital markets and with no sovereign default resolution

mechanism in place in the Eurozone, the government will be forced to

raid domestic deposits or issue IOUs. The latter will be in violation of

the EZ treaties and mean Greece should ultimately leave the EUR."

"Needless to say, social tensions should escalate and political uncertainty soar, pushing the economy closer to the precipice."

"Given

the gravity of the decision, we still think the people of Greece will

choose to stay in the EUR and agree to the creditors' reform proposal on

July 5."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.29 20:45

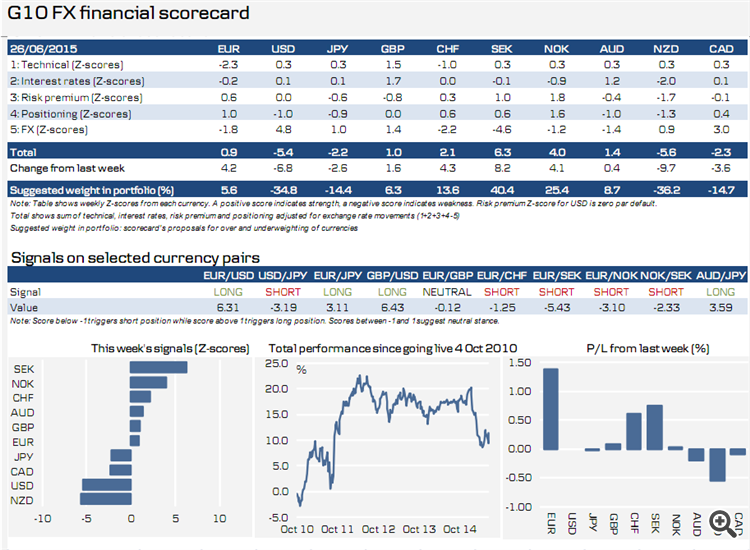

Danske Bank 'Buy SEK, NOK, CHF And Sell NZD, USD, CAD for this week' (based on efxnews article)

- This week the scorecard recommends buying SEK, NOK and CHF, and selling NZD, USD and CAD (see suggested weights in portfolio in table below).

- The recommendation to buy the Scandies and the Swissie derives largely from last week’s dire performance (i.e. a mean reversion argument) and fits neatly with the likelihood that risk-off sentiment will dominate markets at the start of what looks set to be a chaotic week for Greece. NOK is also favoured due to positioning and the risk premium component.

- While the scorecard suggests selling USD this week due to technicals, last week’s price action and still stretched positioning, we note in relation to the latter component that IMM data actually suggests that there should be room to add to longs in USD as we are still some way off the highs for the year, see IMM Positioning: Still decent room for USD longs to be added.

- Last week’s signals resulted in a close to 2% gain. The short EUR position in particular performed well due to the sell-off in EUR crosses this morning as Grexit risk has intensified.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.30 07:32

Bank of America Merrill Lynch for EURUSD: Monetary Policies Vs Greece (based on efxnews article)

FED, ECB, Greece:

"The Greek Referendum will drive headlines for the near-term. We believe that divergence of monetary policies is a more powerful EUR driver than Greek risks. In this context, the timing of the first Fed rate hike (September is our call) and the ECB’s tone (the market misread the ECB’s message to get used to volatility) are more important for the euro than Greek headlines. Whilst Greek headlines and deadlines are clearly urgent, and the market implications in our view both important and not priced in the short-run, ultimately the evolution of monetary policy is in our mind more important," BofA argues.

"We remain bearish EUR/USD, but the uncertainty around the Fed is not bolstering our conviction levels. The euro’s reaction to Greek headlines has been puzzling, sometimes weakening in response to positive headlines for a deal. In part, this is because the USD is oversold. It can also be that the market does not believe that a deal will fully address Grexit risks, which in turn suggests that the ECB is likely to keep QE to be able to address periphery risks and push against a rates sell-off. This could explain the negative correlation between European equities and the Euro recently. Our view remains that tail risks in Greece are negative for the Euro," BofA adds.

Forecasts:

"We have marked-to market our Q3 EUR/USD projection, but keep our end-year projection to 1.00. This assumes that US data will improve in H2, the Fed will start hiking rates in September, the ECB will push against the recent sell-off in rates, inflation will remain below the ECB’s target path, and the market will start expecting the ECB to continue with QE after September 2016," BofA projects.

"At the same time, we expect the Fed to push against any strengthening of the USD that goes beyond what data would justify. We do not expect Grexit in our baseline, but believe that Greek risks will continue weighing on the Euro, with Grexit risks increasing as long as Greece remains in a grey zone," BofA adds.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.30 12:44

Euro area annual inflation down to 0.2% (based on official report)

Euro area annual inflation is expected to be 0.2% in June 2015, down from 0.3% in May 2015, according to a flash estimate from Eurostat, the statistical office of the European Union.

EURUSD M5: 35 pips price movement by EUR - CPI Flash Estimate news event:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.30 19:30

Bank of America Merrill Lynch about Non-Farm Payrolls on Thursday (based on efxnews article)

-

"The employment report is likely to show another solid month of

job creation in June. We look for job growth of 220,000, a slowdown from

the 280,000 pace in May but consistent with the recent trend.

As a result, the unemployment rate will likely lower to 5.4% from 5.5%. With the continued tightening in the labor market, we think average hourly earnings (AHE) will increase a “strong” 0.2%, allowing the yoy rate to hold at 2.3%." - "Within the components of the establishment survey, we expect private payrolls of 215,000 with the government only adding 5,000. Similar to last month, we expect the goods side of the economy to reveal weaker job creation, consistent with the softer trajectory of industrial production and capital expenditures. Moreover, we have yet to see the end of job cuts in the energy-related sectors. That said, there should be some support from greater construction hiring given the improvement in homebuilding. On the services side, we look for broad-based expansion in jobs with particular gains in leisure and hospitality and overall business services."

- "The household survey, which provides the data on the unemployment rate, should also show solid job growth. The three-month average has been a bit softer than nonfarm payrolls, with growth of only 166,000, but the six-month average has been consistent at 244,000. A wildcard is the change in labor force participation. After a sharp gain of 0.11% in May, we look for little change in June, given the volatile nature of the series. Smoothing through, the labor force participation rate has been essentially moving sideways since last fall, suggesting that a cyclical gain has managed to offset the secular downward pull."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.01 11:43

Skandinaviska Enskilda Banken - intraday outlook for EURUSD, USDJPY and USDCAD (based on efxnews article)

EURUSD. 'One day older and none the wiser. The market fell back to mid-body levels and stayed there. Outside 1.1110-1.1245 is needed to end a micro-term stalemate, but we guess this could come with the next headline about Greece.'

USDJPY. 'A key ref at

122.04 was yesterday violated, but bears could ask more of dubious price

action around the 122-handle. Dynamic support in the bullish "Cloud"

("Kumo") could inspire some buyers to step back in, but resistance at

123.23 & near the 124-mark should temper any attempt to rally the

market back towards key resistance at 124.38\47. Extension below 121.85

would target 121.16/07 next.'

USDCAD. 'The market used the high end of the short-term {Fibo adjusted) "Cloud" as support and a spring for extension higher. The 1.2563 "Double-top" is one step closer now and none of our short-term indicators indicate a stretch in the displayed timeframe perspective. Prior 1.2423 resistance is thought to act supportive now. Current intraday stretches are located at 1.2375 & 1.2560. A protective sell-stop on short-term longs could be lifted to breakeven (@1.2360).'

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.01 18:26

Credit Suisse - A “Yes” victory at the 5 July referendum would allow markets to refocus on policy divergence, with negative implications for EUR (based on efxnews article)

"The breakdown in negotiations between the Greek government and its international creditors over the weekend has suddenly cast the possibility of an imminent Greek default in the spotlight, and in the hands of the people of Greece, as they prepare to vote on the extension of the (now expired) bailout program on Sunday 5 July.

Several days into this new chapter of the Euro peripheral saga, and following a missed IMF payment by Greece, markets appear to believe that the likelihood of a systemic outcome is low.

While we do not necessarily disagree with this view, we favor a cautious approach to positioning. Specifically, we see a distinct possibility that conditions of broad uncertainty might persist in the event of a victory of the “yes” vote on Sunday.

A “Yes” victory at the 5 July referendum would allow markets to refocus on policy divergence, with negative implications for EUR. In the meanwhile, both the likelihood of a potentially systemic event and overall market uncertainty have increased.

A victory of the “Yes” camp would cause the former to subside, but could have a less than proportionate impact on the latter, in our view. The prospect of lingering uncertainty would keep demand for "safe haven" currencies supported, especially USD and GBP."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price was on ranging bullish movement with secondary correction: the price was stopped above 1.1134 key support level near 'reversal' Sinkou Span A line which the border between primary bullish and the primary bearish on the chart. The price formed descending triangle with 1.1134 key strong support level located to be above Ichimoku cloud and very near Sinkou Span A line. Chinkou Span line is estimating the future possible breakdown of the price movement from the primary bullish to the bearish area of the chart. If the price breaks Descending Triangle with 1.1134 so the price will be inside Ichimoku cloud and we may see the reversal to the bearish with secondary ranging market condition.

D1 price - secondary correction within the primary bullish - ready to reversal:

W1 price is on bearish market condition with secondary ranging between 1.0818 (W1) support level and 1.1466 (W1) resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.1134 support level on close D1 bar so the price will be fully reversed to the primary bearish market condition.

If D1 price will break 1.1436 resistance level so the bullish trend will be continuing with possible good breakout.

If not so the price will be on ranging between 1.1134 and 1.1436 levels.

SUMMARY : correction

TREND : possible reversal to ranging bearish