Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.10.15 06:20

A Basic Breakout Strategy For Forex

Talking Points:

- Forex tips for finding support and resistance levels.

- Learn to enter Forex breakouts using Donchian Channels.

- Complete a breakout trading plan with stop orders.

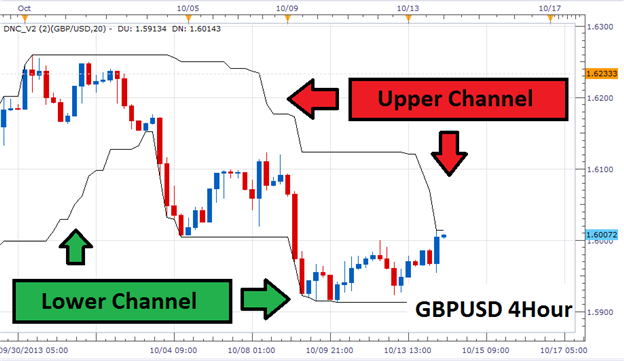

The Forex market is known for its strong trends, which can make trading a breakout strategy an effective approach to the markets. Normally the first step of any breakout strategy is to identify the key levels of support and resistance for a currency pair. Today we are going to review using Donchian Channels for just that purpose, while complete a trading setup on the GBPUSD.

Let’s get started!

Trading Donchian Channels

Donchian Channels can be applied to any chart to extrapolate current

levels of support and resistance. They do this by clearly identify the

high and low on a graph created during the selected number of periods.

Above we can see the Donchian Channels applied to a GBPUSD 4Hour chart,

using a 20 period setting. The channel lines highlight the current 20

periods high and low values, which can be used as support and resistance

when trading breakouts. Breakout traders in a downtrend will look for

price to break below the lower channel prior to creating new entries in

the direction of the trend. The same is true in an uptrend, where

traders will identify the upper channel as a potential area to enter the

market.

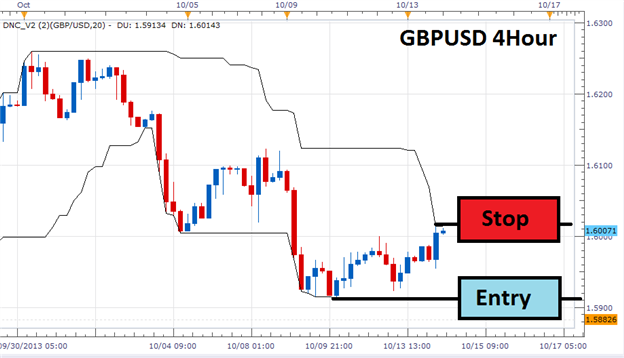

Since the price of the GBPUSD has declined as much as 346 pips for the month of October, many traders will want to identify new entries to sell the pair on a breakout towards lower lows. With our current low already identified by the Donchian Channels at 1.5913, traders can begin preparing for a breakout below this value. As pictured below, you can find a sample breakout setup. Entry orders to sell the GBPUSD can be placed at a minimum of one pip below support, so traders enter the market on a breakout to lower lows.

Setting Risk

As with any strategy, breakout traders should incorporate stops into

their trading. When using Donchian Channels, this process can be made

very easy. Remember how the top pricing channel (representing the 20

period high), acts as an area of resistance? In a downtrend price is

expected to make lower lows and stay below this value. If a new high is

created, with a breach of the upper channel, traders will want to exit

their positions. Traders may also want to manually tail and move their

stop order to lock in profit as the trend continues. On trading tip

breakout traders can employ is moving this preset stop along with the

decreasing pricing channel as the trade moves in their favor.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

XMA Ichimoku Channel:

In this indicator the moving averages are calculated the same way as the ones of Ichimoku Kinko Hyo (see XMA_Ichimoku), the envelopes are built afterwards.

Author: Nikolay Kositsin