- History - MetaTrader 5 for Android

- Executing Trades - Trading Operations

- Instant Execution - Opening and Closing Positions - Trade - MetaTrader 5 for iPhone

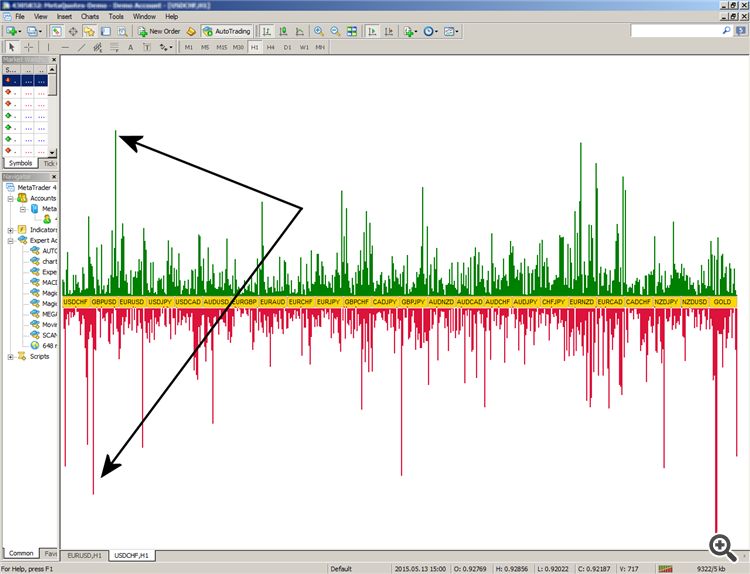

Did anyone get burnt by this morning's GBP crash. I was caught totally unawares. Only been live for about 2 weeks. Had formed the destructive habit of trading without a. It happened in a matter of seconds. Lost 80% of my capital. I had been up 50% on my initial investment till then. Very painful lesson. I now know for sure to set a stop loss level and avoid trading till after data releases. Anyone got some advice for me? Want to jump right back in. But after this morning am very wary. Still bullish on my chances though.

Hi,

these are my advice:

1) Always use stop loss (personally i use 2% stop loss, so in order to burn 80% i need to be wrong 40 times in a row....)

2) you need to adopt a good strategy of money managment, with at least 1:2 risk/reward ratio (so if your stop is = 2% of account, your take profit should be at least = 4%)

3) try to learn a good trading strategy

4) do not do "revenge trade"

Money managment is the key to survive in trading.

Regards

I just loss my profit not whole investment. What is different in our trading strategies. I was testing a logic but I thing, We should thing together. here is my Skype: ashfaq.techx

You can discuss, May we found some better system.

Hi,

these are my advice:

1) Always use stop loss (personally i use 2% stop loss, so in order to burn 80% i need to be wrong 40 times in a row....)

2) you need to adopt a good strategy of money managment, with at least 1:2 risk/reward ratio (so if your stop is = 2% of account, your take profit should be at least = 4%)

3) try to learn a good trading strategy

4) do not do "revenge trade"

Money managment is the key to survive in trading.

Regards

I he had done a revenge trade, he would have gained back most of his losses.

Things like "what goes up, must come down" , and "as above, so below" , or how about, "Action, Reaction" come to mind.

Likewise if someone got on board after it happened, he doubled up.

Or if someone got on board on multiple GBP pairs after it happened, tripled up or even more.

But then the term revenge trade would not apply simply because there was no losing trade to start with.

I he had done a revenge trade, he would have gained back most of his losses.

Things like "what goes up, must come down" , and "as above, so below" , or how about, "Action, Reaction" come to mind.

Likewise if someone got on board after it happened, he doubled up.

Or if someone got on board on multiple GBP pairs after it happened, tripled up or even more.

But then the term revenge trade would not apply simply because there was no losing trade to start with.

dear Marco vd Heijden, I'm sorry I think I have misunderstood what was written by SasukeUchicha.

I thought he had closed a trade in loss.

the idea that I wanted to express with "revenge trade" was more tied to psychology that the execution of the trade itself.

Of course what goes up must come down, easy to understand, but difficult to trade without experience (and he is trading real money only by 2 weeks)

The market has been here for 100 years and will be for much longer. No hurry to recover losses.

in any case it was the last point in order of importance in my suggestions.

if he has lost 80% of the account in a movement of 100 pips, that it is normal on gbpusd, he is overleveraged and it is only a matter of time, he will burn the account.

this is just my personal idea.

regards

I believe you are right Stefano.

My example was simply to show that if one currency pair, makes a rather large move, usually two things happen,

1. It drops back to a previous value shortly after or,

2. All other economy's must move toward the new value too which is unlikely, but most of the time the re-balancing flux can be seen in other pairs too, so it will actually be a combination of both.

Expecting something to happen is not the same as predicting it because prediction is impossible.

Maybe it was indeed the price of taking too high a risk i hope SasukeUchicha will recover and that this actual trade will improve his skills.

I believe you are right Stefano.

My example was simply to show that if one currency pair, makes a rather large move, usually two things happen,

1. It drops back to a previous value shortly after or,

2. All other economy's must move toward the new value too which is unlikely, but most of the time the re-balancing flux can be seen in other pairs too, so it will actually be a combination of both.

Expecting something to happen is not the same as predicting it because prediction is impossible.

Maybe it was indeed the price of taking too high a risk i hope SasukeUchicha will recover and that this actual trade will improve his skills.

You are right too Marco :)

Thanks for your intresting consideration!

I hope our comments helps SasukeUchicha

have a nice day!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use