USDJPY Technical Analysis 2015, 03.05 - 10.05: Daily Breakout Reversal to Primary Bullish Trend with 120.28 Resistance and 122.02 Key Resistance Levels

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.03 08:39

Monthly Forex Forecast: May 2015 (based on dailyforex article)

The USD has fallen meaningfully in value over the past 1 month and 3 month periods. This is a significant quantitative change in the market and is suggestive of continuing USD weakness over the coming month. Next, it should be noted that both the GBP and the JPY have been enjoying steady movement overall for many months, with the GBP rising and the JPY falling. Over the past 3 months, we are also seeing strong turnarounds from bearish to bullish in CAD and NZD, and in AUD to a lesser extent. This suggests that the current month will see rises in GBP, CAD, NZD and AUD, and falls in USD and JPY – in these orders of preference.

Many traders believe fundamental factors should either be ignored completely, or taken as the primary factor to consider in entering or exiting a trade. Fundamental analysis is best used as a final filter in deciding whether to take a trade that already looks good from a technical perspective.

Therefore let’s consider the aforementioned currencies from a fundamental perspective. Both the GBP and the CAD have higher base rates than the USD. Of the three currencies, the market probably sees the next rate rise as most likely to come in the GBP, closely followed by the USD. The USD is seen as having the strongest economy, but that perception is arguably under threat now. The CAD may be impacted by the price of oil with a positive correlation, and the price of oil is bouncing back and rising strongly. Overall it seems that the fundamental factors are mixed and questionable enough to probably not be a block in the direction of the trades discussed.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.02 12:56

Forex Weekly Outlook May 4-8 (based on forexcrunch article)

The US dollar experienced a very turbulent week, tumbling down and recovering, but not against the euro. Close elections in the UK, an important rate decision in Australia, employment data from New Zealand, Australia, Canada and the all- important US non-Farm Payrolls release are key events. These are the highlight events on Forex calendar for this week. Here is an outlook on the top events coming our way.

The Federal Reserve downgraded its economic outlook amid soft growth data. The Fed admitted recent weakness in the first quarter relating it to temporary factors. Inflation will have to climb back to 2% and the job market needs to improve further before a rate hike is announced. However, the Fed believes the US economy will rebound in the second quarter. Meanwhile, jobless claims released last Thursday, surprised markets with a 34,000 fall in the number of claims nut not all data points impressed. The biggest winner was the euro, that broke critical resistance and seems unstoppable. Poor data weighs on the pound towards the elections and central banks weigh on the kiwi and the Aussie.

- Australian rate decision: Tuesday, 4:30. The Reserve Bank of Australia kept its cash rate at 2.25% for the second consecutive month in April, as the majority of policy makers decided against another rate cut. The last rate cut in February was designed to boost growth in non-mining sectors. RBA governor Glenn Stevens notes in his rate statement that further easing measures will be announced in the next few months. No change in rate is expected this time, but there is no 100% consensus. This means that a rate cut will hit the Aussie, and another “no cut” is set to boost it.

- US Trade Balance: Tuesday, 12:30. The U.S. trade deficit narrowed in February to the lowest level since 2009, reaching $35.4 billion. Economists expected deficit will rise to $41.3 billion. However, the strong dollar, weak global demand and lower crude oil prices probably impacted trade balance in February. Despite the low deficit, economic growth slowed considerably in the first quarter. Exports declined 1.6% to $186.2 billion, the smallest since October 2012, while imports from China fell 18.1%, pushing the politically sensitive U.S.-China trade deficit down 21.2 percent to $22.5 billion. Trade deficit is expected to grow to 39.7 billion in March.

- US ISM Non-Manufacturing PMI: Tuesday, 14:00. The U.S. non-manufacturing sector continued to expand at a slower pace in March, as service companies increased their export orders. Economists expected Non-Manufacturing PMI to reach 56.6. The majority of respondents’ were positive about business conditions and the overall economy. The ISM’s new orders index increased to 57.8 in March from 56.7 in February. The export index jumped to 59.0 from 53.0. The ISM business activity index declined to 57.5 from 59.4 in February and 61.5 in January. Non-manufacturing PMI is expected to reach 56.2 in April.

- NZ employment data: Tuesday, 22:45. New Zealand’s employment market expanded 1.2% in the fourth quarter of 2014, compared to 0.8% growth in the previous quarter. Economists expected a 0.8% rise in the number of new positions. Despite the bigger than expected job gain, the unemployment rate increased to 5.7% from 5.4% in the third quarter, posting the highest unemployment rate since Q1 2014. Analysts estimate an average of 5.2% in 2015. New Zealand’s employment is expected to grow by 0.7% in the first quarter, while the unemployment rate is forecasted to decline to 5.5%.

- US ADP Non-Farm Payrolls: Wednesday, 12:15. The U.S. private sector registered the smallest job gain in more than a year, adding 189,000 positions in March. The reading was below market forecast of 227,000 jobs and weaker than the 212,000 increase in posted the previous month. Harsh winter, a strong dollar and weaker global demand were partial causes for the disappointing jobs release. ADP private sector employment is expected to grow by 185,000 in April.

- Janet Yellen speaks: Wednesday, 13:15. Federal Reserve Chair Janet Yellen will speak in Washington DC. She may speak about the recent FOMC rate decision the state of the job market. Market volatility is expected.

- Australian employment data: Thursday, 2:30. Australia’s labor market expanded by 37,000 new jobs in March, pulling the unemployment rate down to 6.1%. The majority of jobs asses were full time positions. Economists expected a lower gain of 14900 positions and forecasted unemployment of 6.3%. Productivity has climbed increasing employers’ demand for workers. Improved job prospects expected to lift household incomes and boost the economy. Australian labor market is forecasted to expand by 3,100 jobs, while the unemployment rate is expected to reach 6.2%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing new claims for unemployment fell last week to the lowest level since 2000, indicating the weakness in the labor market during March was only temporary. The number of initial claims plunged 34,000 a seasonally adjusted 262,000, beating forecasts for 290,000 new claims. The four-week moving average declined l 1,250 to 283,750.

- UK elections: Thursday, initial results expected late in the US session. After 5 years of a Conservative-LibDem coalition, incumbent David Cameron boasts an recovering economy while Labour leader Ed Miliband points to deteriorating standards of living. The markets would prefer a Conservative government, the current coalition or at least an outright majority for Labour. However, things look much more complicated, with both leading parties expected to fall short of a majority and a hung parliament also on the cards – an uncertain situation with negative ramifications for the pound. Polls are too close to call, making it an interesting event indeed.

- Canadian employment data: Friday, 12:30. The Canadian economy unexpectedly added 28,700 jobs in March, beating forecasts of jobs contraction. The majority of jobs were part-time positions, but employers also cut 28,200 full-time jobs. The main gain was detected in the service sector. RBA Governor Stephen Poloz stated that first quarter growth will be badly affected by the recent oil price collapse. The labor participation rate edged up to 65.9% from 65.7%. The unemployment rate remained at 6.8% while expected to tick up to 6.9%.

- US Non-Farm Payrolls: Friday, 12:30. US non-farm payrolls disappointed in March showing job growth of 126,000 positions, far below the 246,000 gain expected by analysts and following 295,000 job addition in February. Meanwhile the unemployment rate remained stable at 5.5% in line with market forecast. The employment-population ratio remained at 59.3%, while the participation rate edged down to 62.7% in March from 62.8% in the prior month. US private sector is expected to gain 231,000 jobs, lowering the unemployment rate to 5.4%.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.04 18:46

USDJPY: "Golden" Breakout Could Target 7.5-Year High

The technical perspective is relatively clear. USDJPY broke out of its near-term triangle pattern on Friday and is maintaining that move thus far this week, but more broadly, rates are in a sideways range with support in the 118.30-50 zone up to resistance at the 7.5-year high around 122.00. With the RSI also breaking out of its own triangle pattern, more technical strength is favored this week, though the pair may struggle to break strong resistance near 122.00 without a major fundamental catalyst.

In that vein, there are a few major fundamental storylines to watch this week. Logistically, it's worth noting that Japanese Banks are closed today and tomorrow for the end of the Golden Week celebration, so liquidity (and volatility) could be limited in the early part of this week. Later in the week, traders will gain insight into the US economy's performance in April, highlighted by the release of the ISM Non-Manufacturing PMI report (Tuesday), the ADP Non-Farm Employment report (Wednesday), a panel discussion from Fed Chair Yellen (Wednesday), and the marquee US Non-Farm Payroll report (Friday). Traders will be looking to see if the world's largest economy is accelerating after yet another disappointing first quarter of the year and a strong NFP report would go a long way toward alleviating fears of continued economic malaise.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.03 20:05

Forex Forecast – Quant vs Chart Reading (based on dailyforex article)

Quantitative Forecast- If the price is higher, the statistical edge is in trading that pair long.

- If the price is lower, the statistical edge is in trading that pair short.

On this basis, the quantitative momentum forecast for the edge during the coming week is as follows:

![]()

On this basis, my technical analysis forecast for the edge during the coming week is as follows:

![]()

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.04 11:50

Markets Prepare for US Employment Reports (based on primepair article)

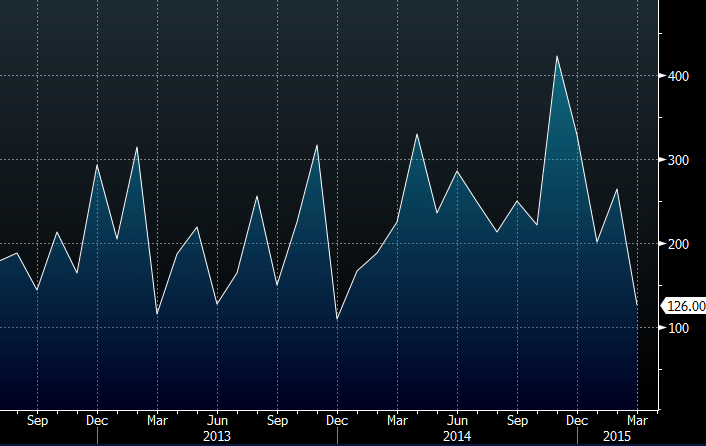

The Labor Department’s official figures are due on Friday and forecasters are expecting to see 231k jobs added across both public and private sectors. We will see a significant readjustment in the dollar if the data falls wide of the mark on either side. Markets have already sharply lowered their expectations for growth in the US economy and consequently the expectations for future interest rate hikes.

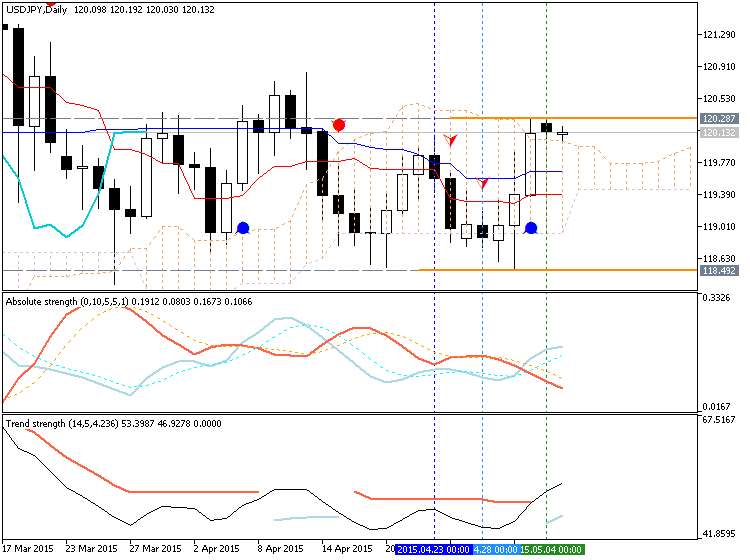

D1 price is on reversal from the primary bearish to primary bullish condition:

- The price crossed Ichimoku cloud/kumo and Sinkou Span A line (which is the virtual border between the primary bullish and the primary bearish on the chart) on open D1 bar for possible reversal of the price movement from the primary bearish to the primary bullish on D1 timeframe.

- Tenkan-sen line is below Kijun-sen line of Ichimoku indicator and both lines are moved in fully horizontal way which is indicating that the reversal to the primary bullish may be going on for now.

- Chinkou Span line broke the price from below to above for breakout to be started on close bar.

- Nearest support level is 118.49 (D1)

- Nearest resistance level is 120.28 (D1)

W1 price is on bullish market condition with secondary ranging between 118.32 (W1) support level and 122.02 (W1) resistance level

MN price is stopped by 122.02 resistance level within the primary bullish condition

If D1 price will break 118.49 support level on close D1 bar so the primary bearish will be continuing without secondary ranging

If D1 price will break 120.28 resistance level so we may see the reversal to the primary bullish condition on this timeframe

If not so the price will be ranging between 118.49 and 120.28 levels with primary bearish

- Recommendation for long: watch close D1 price to break 120.28 for possible buy trade

- Recommendation to go short: watch D1 price to break 118.49 support level for possible sell trade

- Trading Summary: breakout

The situation is the same one for now: D1 price was stopped by 120.28 resistance level moving in sideways:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.05 14:58

2015-05-05 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Trade Balance]- past data is -35.9B

- forecast data is -41.2B

- actual data is -51.4B according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

==========

"The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $51.4 billion in March, up $15.5 billion from $35.9 billion in February, revised. March exports were $187.8 billion, $1.6 billion more than February exports. March imports were $239.2 billion, $17.1 billion more than February imports.

The March increase in the goods and services deficit reflected an increase in the goods deficit of $14.9 billion to $70.6 billion and a decrease in the services surplus of $0.6 billion to $19.2 billion.

Year-to-date, the goods and services deficit increased $6.4 billion, or 5.2 percent, from the same period in 2014. Exports decreased $11.7 billion or 2.0 percent. Imports decreased $5.3 billion or 0.8 percent."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

USDJPY M5: 34 pips price movement by USD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.05 19:39

Aussie dollar breaks higher as USDJPY falls below 120.00 (based on forexlive article)

The aussie has kept its bid after the RBA and the USD falling has given it the extra push.

For USDJPY, 119.45/50 is the next major support point ahead of 119.30/35 and the 100 dma at 119.20. We're already finding resistance around 119.85/95 and will probably see more around 120.00 and 120.10.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.06 10:38

USD/JPY Technical Analysis: Treading Water Near 120.00 (based on dailyfx article)

The US Dollar corrected narrowly lower after seemingly completing an upside breakout against the Japanese Yen late last week. A daily close above the 38.2% Fibonacci expansion at 120.68 exposes the 50% level at 121.41. Alternatively, a reversal below trend line resistance-turned-support at 119.56 opens the door for a challenge of the April 3 lowat 118.71.

| Resistance | Support |

|---|---|

| 120.68 | 119.56 |

| 121.41 | 118.71 |

| 122.13 | 118.32 |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.06 14:14

Non-farm Payrolls (based on forexlive article)

Goldman Sachs analyst say "the best spots to buy the US dollar are against the euro, yen and Canadian dollar on expectations of an upward surprise".

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

USDJPY M5: 61 pips range price movement by USD - Non-Farm Employment Change news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price was on bearish ranging market condition since the middle of April this year located inside Ichimoku cloud/kumo. The reversal from the primary bearish to the bullish condition was started on Friday last week by breaking Sinkou Span A line from below to above on close D1 bar. For now the daily price was stopped by 120.28 resistance level for the bullish trend to be continuing.

D1 price is on reversal from the primary bearish to primary bullish condition:

W1 price is on bullish market condition with secondary ranging between 118.32 (W1) support level and 122.02 (W1) resistance level

MN price is stopped by 122.02 resistance level within the primary bullish condition

If D1 price will break 118.49 support level on close D1 bar so the primary bearish will be continuing without secondary ranging

If D1 price will break 120.28 resistance level so we may see the reversal to the primary bullish condition on this timeframe

If not so the price will be ranging between 118.49 and 120.28 levels with primary bearish

SUMMARY : reversal

TREND : ranging