This article and a huge series of articles about genetic algorithms are fiction.

That's too bad,

Real tests don't match the articles ((

Can you do a test on a trained piece of history?

Hi, Sergey!

The Expert Advisor is implemented in such a way that it trades on a section unfamiliar to neuronics. You can use prints to display trading results on the training section directly in the TargetFunction. You can save the history of virtual trades during training in csv and then display the balance in excel or chart.

1. This article is about simple MLP network usage, not about optimisation algorithms (all of which you wrongly called genetic algorithms). What is the fiction? The source codes are attached to the article, the results are exactly what I got myself.

2. Which tests and in which articles do not coincide with the real ones? It would be good to give examples of such "mismatches" here in order to communicate in a meaningful way.

If we talk about the MLP Expert Advisor from this article, we should understand that only two simple indicators and normalised bar values are used as inputs, i.e. the information fed to the neuron is rather primitive, so we should not expect great results. The MLP Expert Advisor in the article is presented for educational purposes to understand how to start using neural networks quickly and easily enough. It is necessary to experiment with the information fed to the neural network, of course, it is hardly worth expecting that someone will post a ready-to-use grail in the article (you can't get a fish out of the pond without labour).

And if we talk about the optimisation algorithms described in the articles, they are all ready-to-use tools without any conditions and restrictions on their use.

Hello Andrey,

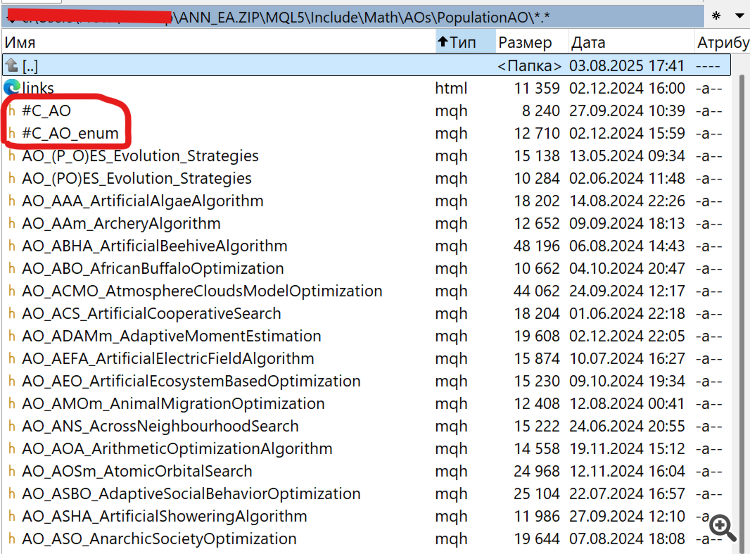

This looks like a great article tha interests me. However, I am perplexed. First, the include files, #C_AO amd #C_AO_enum, are not present in either zip that I could discover. Did I miss them ? And secondly, how can I test your results as I cannot find either the symbol or time frame you used. To me it looks like these variables are obtained from the chart setup.

Hi Andrey,

Got it, thanks for the quick response.

CapeCoddah

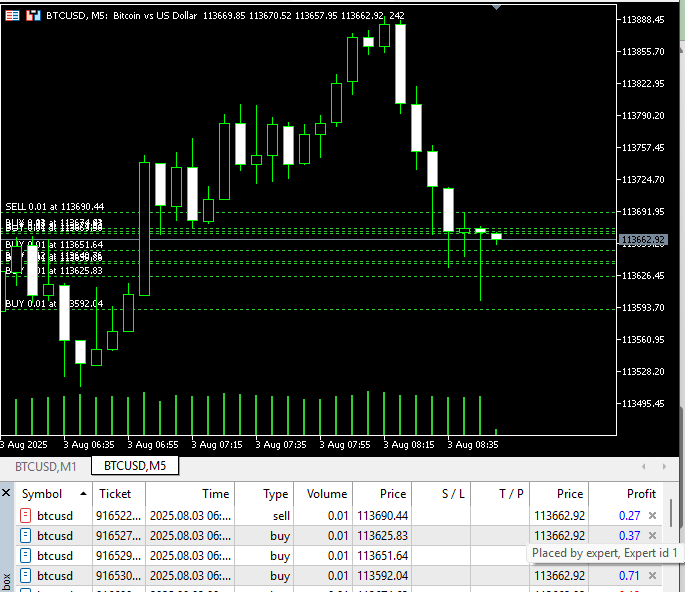

Try it on a netting type account. The article gives only an idea, you have to adapt the EA to the trading conditions of your broker.

Thank you so much for sharing this article, and the insight. Great idea. I Implemented some independent position handling and got it working on hedging account (my broker)

You are the best.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Check out the new article: Expert Advisor based on the universal MLP approximator.

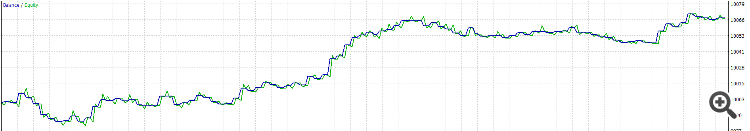

The approach I propose belongs to the second type - unsupervised learning. In this method, we do not try to "teach" the neural network how to trade correctly and do not tell it where to open or close positions, since we ourselves do not know the answer to these questions. Instead, we let the network make its own trading decisions, and our job is to evaluate its overall trading results.

In this case, we do not need to normalize the evaluation function or worry about problems such as "weight explosions" and "network stall", since they are absent in this approach. We logically separate the neural network from the optimization algorithm and give it only the task of transforming the input data into a new type of information that reflects the trader's skills. Essentially, we are simply converting one type of information into another, without any understanding of the patterns in the time series or how to trade to make a profit.

A type of neural network such as MLP (multilayer perceptron) is ideal for this role, which is confirmed by the universal approximation theorem. This theorem states that neural networks can approximate any continuous function. In our case, by "continuous function" we mean a process occurring in the analyzed time series. This approach eliminates the need to resort to artificial and subjective concepts, such as "noise" and "overfitting", which have no quantitative value.

Figure 1. Transformation of one type of information into another

Author: Andrey Dik