Forex and CFD's are not centralised markets, and brokers have different liquidity providers and data feeds.

Your brokers real live tick data will almost certainly not be the same as Dukascopy data. So, test against your broker's own tick data as well to compare the results.

However, don't over-fit your optimisations. Make your strategy and EA adaptable to variations in data, and to different contract specifications and trading conditions.

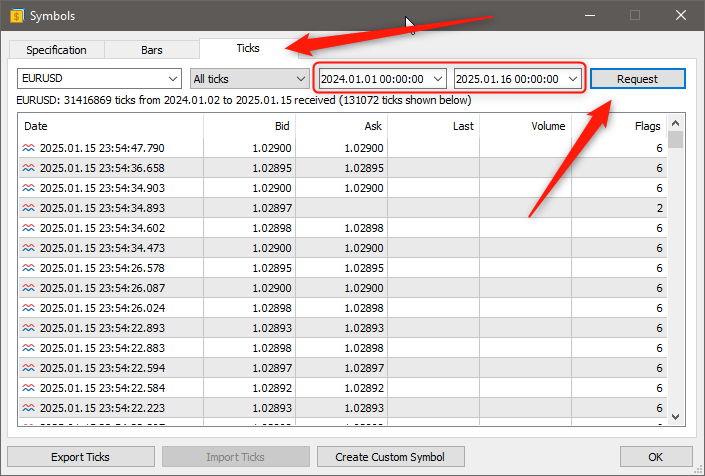

Just connect to your broker's account and run the back-test on that account. To prevent the initial delay on the first test and to see how much data the broker provides ...

... just use the Symbols (Ctrl-U) panel, click on the "Ticks" tab, select a symbol, select the time range, and click "Request".

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi , i am currently testing my algo on XAUUSD , my strategy is based on how the candles close, my entry is done only after the candle is closed , and also my exit rules are as follows: one tp ,one stoploss , and 3 more rules that close the trade based only on how the last candle closes , so for my trade to be closed before a candle close can occur only if the stoploss or tp is hit .

Now , my issue is that i tested my strategy with both every tick based on real ticks and every tick data , i compared them with a live account results . the every tick based on real ticks performs much worse than the real account performs , and the every tick data performs pretty close to the live account , both backtest were made with 100% tick data from dukas copy . what would be the issue? Can the every tick data be more accurate in my case taking into consideration that my strategy is 90% based on how the candles close?

Thanks!