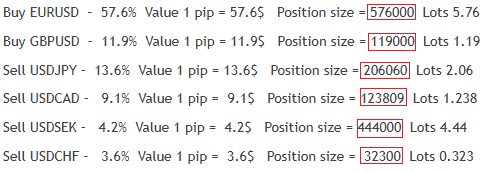

How to calculate the position size of the red box in the picture below?

Hello, Mr. Cho

Thank you for your message.

These Positions were calculated using Dukascopy Pip Calculator and JForex 4.2.9 demo trading platform. MT4 and my FOREX provider do not offer this kind of calculations.

Let me know if you have other questions!

Cheers :) Julian

Hello, Mr. Cho

Thank you for your message.

These Positions were calculated using Dukascopy Pip Calculator and JForex 4.2.9 demo trading platform. MT4 and my FOREX provider do not offer this kind of calculations.

Let me know if you have other questions!

Cheers :) Julian

To create an MQL4 position size calculator, you need to consider various factors such as risk percentage, stop loss distance, account balance, and currency pair volatility. Here's a basic example of an MQL4 function to calculate position size based on these inputs:

- CalculatePositionSize function calculates the position size based on the risk percentage, stop loss distance, and account balance.

- riskPercentage is the percentage of the account balance that you're willing to risk on a single trade.

- stopLossDistance is the distance in pips from the entry price to the stop loss price.

- accountBalance is the current account balance.

Make sure to verify the pip value calculation for the specific currency pair being traded, as it can vary. Also, consider additional factors such as leverage and margin requirements based on your broker's specifications. This example is a basic one and may need modifications to suit your specific trading strategy and requirements.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hedge_Dollar_Index_Against_Forex_Pairs_V1:

Hedge Dollar index USIDX against its constitutive FOREX pairs EURUSD GBPUSD USDJPY USDCAD USDSEK USDCHF

Author: Iulian Persinaru