Discussion of article "Can Heiken-Ashi Combined With Moving Averages Provide Good Signals Together?"

Thanks for sharing!

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

New article Can Heiken-Ashi Combined With Moving Averages Provide Good Signals Together? has been published:

Combinations of strategies may offer better opportunities. We can combine indicators or patterns together, or even better, indicators with patterns, so that we get an extra confirmation factor. Moving averages help us confirm and ride the trend. They are the most known technical indicators and this is because of their simplicity and their proven track record of adding value to analyses.

As with any proper research method, the aim is to test the strategy and be able to see for ourselves whether it is worth having as an add-on to our pre-existing trading framework or not.

The first step is creating the trading rules. When will the system buy, and when will it go short? In other words, when is the signal given that tells the system that the current market will go up or down?

The trading conditions we can choose from are:

We have to keep in mind the frequency of the signals when we are developing a trading algorithm. The signal function used to generate the triggers based on the conditions mentioned.

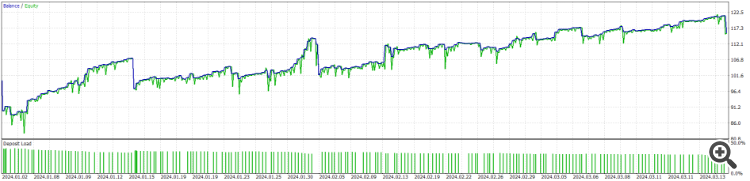

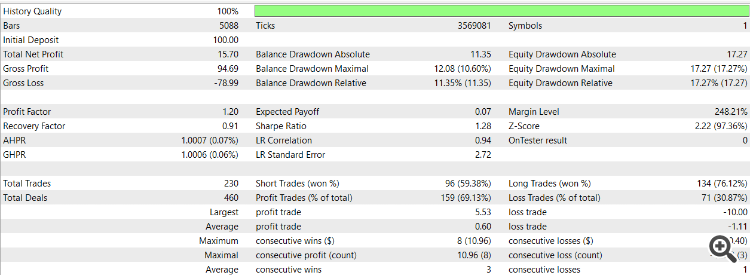

These are results for the EURUSD symbol from January 1st 2022 to 5 of July 2023 for a 30 minutes time period. Better results should arrive with optimization and other time periods. To use it with all symbols, optimization and testing should be done.

Author: Javier Santiago Gaston De Iriarte Cabrera