Forum on trading, automated trading systems and testing trading strategies

How to calculate take profit from currency

Fernando Carreiro, 2022.09.05 17:00

These are all the same equation written in different ways ...

[Volume] = [Money Value] * [Tick Size] / ( [Tick Value] * [Stop Size] ) [Stop Size] = [Money Value] * [Tick Size] / ( [Tick Value] * [Volume] ) [Money Value] = [Volume] * [Stop Size] * [Tick Value] / [Tick Size] [Volume] in lots [Stop Size] in quote price change [Money Value] in account currency

Forum on trading, automated trading systems and testing trading strategies

SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_VALUE) sometimes zero

Fernando Carreiro, 2022.08.23 16:51

Instead of using the Tick Value directly, consider using the function OrderCalcProfit, because it will apply the correct profit calculation method depending on the CALC_MODE for that symbol.Forum on trading, automated trading systems and testing trading strategies

SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_VALUE) sometimes zero

Fernando Carreiro, 2022.08.23 17:41

You can! These are the steps I take. I supply the function with a lot size equal to the “Max Lot Size” allowed for the symbol in question, then calculate the ratio needed to achieve the fractional risk that I wish to apply, to get the correct volume for the order. I then align that with the “Lot Step” and finally check it against both the maximum and minimum allowed lots for the symbol.

The reason I use the “maximum” lots instead of just “1.0” lots as a reference value is because there is no guarantee that the value of 1.0 is within the minimum and maximum values allowed. Given that using 1.0, or the maximum, gives equivalent results anyway (by using the ratio method), I choose to use the “max lots” as the reference point which also offers the most precision for the calculation.

Something like this ...

// This code will not compile. It is only a example reference if( OrderCalcProfit( eOrderType, _Symbol, dbLotsMax, dbPriceOpen, dbPriceStopLoss, dbProfit ) ) { dbOrderLots = fmin( fmax( round( dbRiskMax * dbLotsMax / ( -dbProfit * dbLotsStep ) ) * dbLotsStep, dbLotsMin ), dbLotsMax ); // the rest of the code ... };

Forum on trading, automated trading systems and testing trading strategies

Please advice me how to calculate average TP for Grid.

Fernando Carreiro, 2022.12.26 13:47

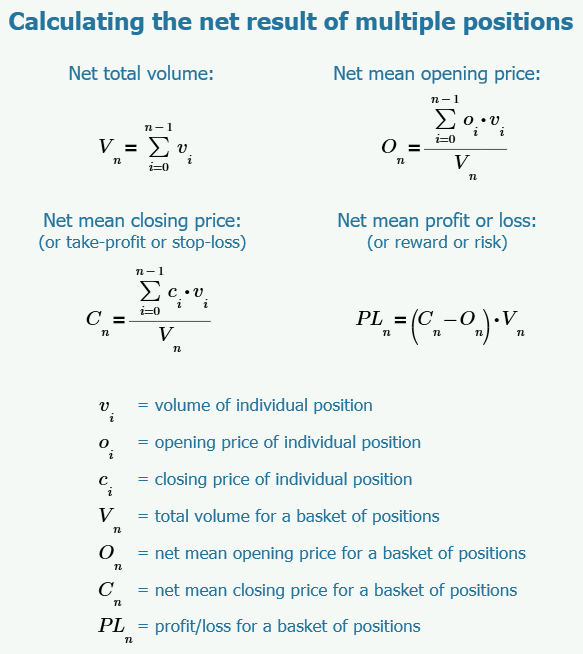

Here is the maths for calculating net values for a batch of positions:Martingale is not a strategy. It's a betting system.

Hedging, grid trading, same as Martingale.

Martingale, Hedging and Grid : MHG - General - MQL5 programming forum (2016)

Martingale, guaranteed to blow your account eventually. If your strategy is not profitable without, it is definitely not profitable with.

Martingale vs. Non Martingale (Simplified RoR vs Profit and the Illusions) - MQL5 programming forum (2015)

Why it won't work:

Calculate Loss from Lot Pips - MQL5 programming forum (2017)

THIS Trading Strategy is a LIE... I took 100,000 TRADES with the Martingale Strategy - YouTube (2020)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi .I am building a strategy based on martingale.

Because the pipe size of TP and SL is not the same in all positions and is different, I am confused about the position volume calculation, please guide me.

The basis of the work is that the position is first opened based on the fixed volume of 0.01 lot. And if the position wins, the volume will still be the same 0.01 lot.

if lost,In first I read the position history of the amount that I have lost, and in the second position, based on the pip size of the TP point, I want to determine the size of the position, if the TP is touched.

If my SL is touched again, I will add the amount of money I have lost in two positions together and I want to determine the size of the position based on the TP point in next position.