Does increasing leverage in an account result in delayed position stop out time under fixed trading conditions?

Better not to say "stop out time". But the answer is "yes".

Thank you for your response,

Would please explain what you mean by Better not to say "stop out time" ? I am still a bit confused.

I commenced a trade that ended up with a stop out before reaching the margin call. After taking your advice into account, I am interested in knowing the number of pips at which the account will stop out if we decide to re-enter the trade with a leverage of 1000. I am uncertain if the account will stop out at 25 pips once more or if it will stop out at 250 pips due to the ten-fold surge in leverage.

Thank you for your response,

Would please explain what you mean by Better not to say "stop out time" ? I am still a bit confused.

I commenced a trade that ended up with a stop out before reaching the margin call. After taking your advice into account, I am interested in knowing the number of pips at which the account will stop out if we decide to re-enter the trade with a leverage of 1000. I am uncertain if the account will stop out at 25 pips once more or if it will stop out at 250 pips due to the ten-fold surge in leverage.

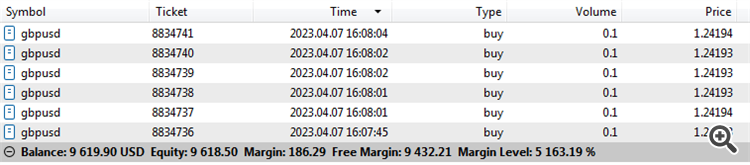

1. stop out is a percentage level (not time).

2. margin level(%) = ((Free margin)/Margin+1)*100

when margin level reaches stop out level the broker closes all positions automatically.

bigger leverage ==> smaller Margin(per trade volume) ==> Bigger margin level ==> more loss it takes to reach stop out level

1. stop out is a percentage level (not time).

2. margin level(%) = ((Free margin)/Margin+1)*100

when margin level reaches stop out level the broker closes all positions automatically.

bigger leverage ==> smaller Margin(per trade volume) ==> Bigger margin level ==> more loss it takes to reach stop out level

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hey dear veterans,

There is this problem I can't solve,

Considering the same account balance, stop loss level, trading volume, and currency pair:

Let's assume we buy one lot with an account leverage of 100, and we don't set a stop loss. In this scenario, the account stops out at 25 pips from the entry point.

Now, with the same parameters (i.e., the same account balance, trading volume, and stop loss level), if we increase the leverage to 1000 and buy again, how many pips from the entry point will the account stop out? Will it still be 25 pips, or will the account stop out at 250 pips due to the tenfold increase in leverage?

Does increasing leverage in an account result in delayed position stop out time under fixed trading conditions?