Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.04 06:34

Forex Weekly Outlook April 6-10 (based on forexcrunch article)

The US dollar had a rough week, making gains in Q1 but erasing them in the wake of Q2, especially towards the end. US ISM Non-Manufacturing PMI, rate decision in Australia, Japan and the UK, FOMC Meeting Minutes, US unemployment claims, Canadian employment data are the major market movers on Forex calendar. Here is an outlook on the highlights of this week.

Initial good figures and end-of-quarter adjustments helped the greenback. However, the US Non-Farm Payrolls missed expectations with a smaller than expected job addition of 126,000 in March, much worse than expected and coupled with downwards revisions. The rise in wages and the drop in the “real unemployment rate” didn’t compensate. While some blame the weather and say it is a one-off, others see the weak economy finally hitting jobs. In the euro-zone, the Greek issues still weigh, while politics also impact the pound. The fall in commodity prices hit the Aussie but the loonie was resilient in the face of the deal with Iran, which could hurt oil prices. What’s next after Easter?

- US ISM Non-Manufacturing PMI: Monday, 14:00. The US service sector expanded more than expected in February, rising to 56.9 from 56.5 in February. Economists expected a lower reading of 56.5 in February. The New Orders Index posted 56.7, 2.8 points less than January’s 59.5. The Employment Index edged up 4.8 points to 56.4 from 51.6 in January, rising for the 12th consecutive month. The Prices Index increased 4.2 points from the January reading of 45.5 to 49.7. The elevated figures indicate economic conditions are improving. US service sector PMI is expected to reach 56.6 this time.

- Australian rate decision: Tuesday, 4:30. Australia’s central bank maintained its cash rate despite calls for another rate cut. However, implied further easing measures may be introduced in the next policy meeting. The RBA preferred to assess the impact of February’s cut before lowering rates once again. Australian cash rate is predicted to remain at 2.25%, but a cut could also come on the background of falling commodity prices. This is a critical event.

- Japan rate decision: Wednesday. The BOJ maintained its monetary policy in March and continue with its plan to raise monetary base to an annual pace of JPY 80 trillion reaching the Bank’s 2% inflation target. However Haruhiko Kuroda, Bank of Japan governor, admitted for the first time, he could not rule out deflation in the coming months, due to the oil price crush, but assured it won’t necessarily affect the underlying trend in inflation in the long term. The BoJ expects a gradual rise in demand will boost inflation forecasting price rises of 1% in the fiscal year ending in March 2016 and 2.2% for 2017. The BOJ is expected to keep its monetary policy unchanged, but pressure is mounting.

- US FOMC Meeting Minutes: Wednesday, 18:00. In the last meeting, the Fed removed the “patience” wording regarding interest rates and also left some dovish hints, especially with the dot plot. The latter showed slower rate hikes this year. We will now see what members were thinking. A dovish look will enhance the NFP impact, while a hawkish one could leave markets puzzled.

- UK rate decision: Thursday, 11:00. The Bank of England kept its benchmark rate at 0.50% in its March meeting. BoE’s Governor Mark Carney, noted that the next move will be up despite current deflationary pressures. Low inflation may be a blessing in disguise for the UK economy, providing households with greater spending power, in times of sluggish wage growth. Furthermore, cheap imports are also positive for consumers boosting spending and economic growth. The BOE is expected to maintain rates at 0.50%.

- US Unemployment Claims: Thursday, 12:30. The number of new claims filed for unemployment benefits in the US declined considerably last week to 268,000 from 286,000 in the week before. The 20,000 fall reasserts the positive trend in the US labor market. Analysts expected only a minor drop in the number of claims. The number of people continuing to receive jobless benefits declined by 88,000 to 2.33 million. The number of claims is expected to reach 271,000 this week.

- Canadian employment data: Friday, 12:30. Canada’s job market showed signs of weakness amid the global oil slump. Job contraction occurs in crude-rich provinces affecting the overall unemployment rate. The labor market shed 1,000 jobs in February, increasing the jobless rate to 6.8% from 6.6% in January. Analysts expected a job loss of 3,500, but predicted a slower rise of 0.1% in the unemployment rate. The major decline in oil prices also lead the BOC’s decision to cut interest rates in January. Canadian job market is expected to rise by 0.1% while the unemployment rate is forecast to remain at 6.8%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.05 19:44

Range Trading on the USD/CAD (based on invezz article)

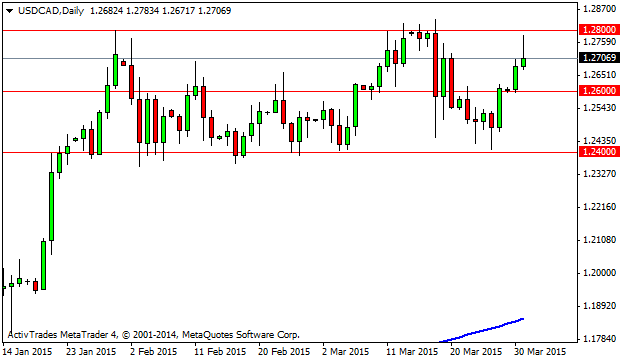

If we take a look, we can see that the support has been around the 1.2400 level and the resistance around the 1.2800 level. The middle of the range is the 1.2600 level and we can tell from the chart that the price has also found that level to be a temporary support or resistance zone.

The general theory when trading within a range is that short or sell positions are taken on the resistance and long or buy positions on the support, but this is easier said than done, because first of all, we cannot be so sure about the range until the price has already tested the upper and lower boundaries a couple of times and the consolidation becomes clear.

The risk of taking short positions at the resistance and long positions at the support is that at any moment the price may break that resistance or that support and we may get stuck with a position on the opposite direction of the breakout. This is what makes range trading more difficult. That is why when trading within a range, we must be aware of the risks involved and we should accommodate our stop loss to a level that does not represent a huge loss to our account. Remember that usually when the price breaks out of these ranges, it tends to accelerate its momentum in the direction of the breakout and it may be not very wise to trade against that momentum or speed.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.05 08:29

USD/CAD Weekly Fundamental Analysis, April 6 – April 10, 2015 – Forecast (based on fxempire article)

The USD/CAD finished lower last week led by heavy selling pressure following the release of a weaker-than-expected U.S. Non-Farm Payrolls report. The abysmal report casts doubts on the timing of the Fed interest rate hike, most likely eliminating a June rate hike and putting in jeopardy a September move. We’ll find out early next week what investors are thinking when the major market players return to action after stepping to the sidelines for Good Friday.

According to the Department of Labor, the U.S. economy added 126,000 new jobs in March, badly missing the consensus forecast of 248K. Despite the low figure, the unemployment rate managed to remain unchanged at 5.5%. Hourly average wages, however, improved by 0.3%, beating the 0.2% estimate.

After consolidating since the beginning of the year, the USD/CAD may have finally found the catalyst that could trigger a breakout of the range. The U.S. jobs report should fuel a break, however, losses are likely to be limited because of expectations for weaker crude oil prices.

Late Thursday, it was announced that Iran and the six global powers had reached solutions on key parameters of the country’s nuclear program. If Iran follows the plan then the United States and the European Union would likely ease sanctions on the country. Iran would agree to cut its nuclear capacity while agreeing to monitoring and modernization of its facilities. A final deadline for the talks was set for June 30.

Lifting the sanctions on Iran could bring millions of additional Iranian crude oil barrels onto the global market. This would be bearish for prices. A breakdown in crude prices will be bearish for the Canadian Dollar.

The direction of the market is likely to be determined by whether the investors believe the weak jobs report outweighs the impact of the Iran nuclear deal. Since the jobs data came out after the Iran news and the USD/CAD weakened, traders are likely to open Monday’s session with fresh selling pressure.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.06 16:31

2015-04-06 15:00 GMT (or 17:00 MQ MT5 time) | [CAD - Ivey PMI]- past data is 49.7

- forecast data is 51.1

- actual data is 47.9 according to the latest press release

if actual > forecast (or previous data) = good for currency (for СФВ in our case)

[CAD - Ivey PMI] = Level of a diffusion index based on surveyed purchasing managers. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

Canadian Ivey PMI drops to 47.9 in March

"Canada's Ivey purchasing managers’ index contracted at a faster rate than expected in March, fuelling concerns over the country’s economic outlook, industry data showed on Monday.

In a report, the Richard Ivey School of Business said its purchasing managers’ index fell to 47.9 last month from a reading of 49.7 in February. Analysts had expected the index to inch up to 51.1 in March.

A figure above 50.0 indicates industry expansion, below indicates contraction.

USD/CAD was trading at 1.2460 from around 1.2466 ahead of the release of the data."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

USDCAD M5: 29 pips price range movement by CAD - Ivey PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.05 19:58

Weekly Economic & Political Timeline (based on dailyforex article)

This week opens quietly, with most of Europe and the Western world on holiday, with the exception of the U.S.A. and Canada. Following the holiday, it should be a fairly significant week as it opens the month, as usual, with central bank statements and actions for the USD, JPY, GBP and AUD. The major political area of interest that is likely to result in unscheduled, market-moving breaking news remains the European Greek crisis. Additional political focus is beginning to fall on the U.K. as next month’s election approaches and opinion polls continue to forecast a parliamentary balance that would make it almost impossible for any plausible government to be formed.

U.S. DollarThis will be a big week for the U.S. Dollar as following last week’s disappointing Non-Farm Payroll numbers, all eyes will be on the FOMC Minutes that will be released on Wednesday. There will actually be a data release earlier on Monday with the ISM Non-Manufacturing PMI numbers. On Thursday, the day following the FOMC release, there will be additional economic data given with the Unemployment Claims numbers.

Japanese YenThis will be a significant week for the Japanese Yen with the Bank of Japan’s Monetary Policy Statement being given plus a press conference on Wednesday.

British PoundOn Tuesday there will be a release of Services PMI data. Thursday will see the release of the Bank of England’s MPC Rate Statement and Official Bank Rate, followed on Friday by Manufacturing Production data.

Australian DollarTuesday is going to be a big day for the Australian Dollar, with the RBA Rate Statement, Cash Rate, and Retail Sales data all due for release within a three-hour window before the London open.

EuroAlthough most countries in Europe will be enjoying public holidays this Monday, Spain will be at work as usual, and will be releasing Spanish Unemployment Change data this day. This is the only high-impact news scheduled for the Euro this week.

Canadian DollarThere will be a release of Ivey PMI data on Monday followed by further releases at the end of the week. On Thursday there will be Building Permits data followed on Friday by Unemployment Change and Unemployment Rate data.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.07 05:47

USD/CAD Retail FX Flips Net-Long at 1.2400 Support (based on dailyfx article)

- USD/CAD Retail FX Crowd Flips Net-Long; 1.2400 Support Stands Despite Dismal Ivey PMI.

- AUD/USD Rebound Vulnerable to RBA Rate Cut, Toughened Verbal Intervention.

- 1.2390 (161.8% expansion) to 1.2420 (161.8% expansion) support zone in focus for USD/CAD despite the dismal Ivey Purchasing Manager Index (PMI), which shows a larger-than-expected contraction in March.

- Even though USD/CAD looks largely range-bound, risk remains skewed to the downside as the bearish momentum in the Relative Strength Index (RSI) gathers pace ahead of Canada’s Employment report, which is expected to show a flat reading for March following a 1.0K contraction the month prior.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.07 14:45

USD/CAD: Well-Defined Range, 2 Drivers (based on efxnews article)

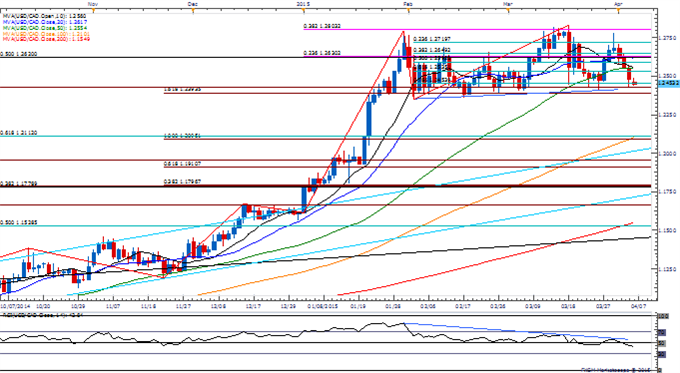

USD/CAD continues to trade in a well-defined range between 1.24 and 1.28. We remain bearish on CAD and continue to look for USD/CAD to test 1.30 sometime in Q2.

Notably, two drivers should continue to underpin CAD weakness.

First, this week Canada releases the Ivey PMI index for March. Another print below 50 which suggests that the economy contracted in Q1 with an average reading of 47.6 in the first two months of the year. What is more relative to trend is that headline PMI continues to suggest a deepening slowdown in activity, which may force the BoC to cut its 2015 growth forecast.

Second, the external backdrop in Canada continues to worsen. Indeed, in 2015, market consensus expects the current account deficit to widen to -2.8% from -2.2% previously. This reflects the drag from exports and lower oil prices but also the rise in import growth, which averaged 7.8% per annum from January 2014 to January 2015. The deterioration in the external balance suggests that Canada will need to attract fresh capital to support CAD. Against a backdrop of low rates and weak growth we doubt Canada can attract the needed flows. Canada economic growth weak and contracting Canada’s capital

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.08 06:24

USDCAD moves higher in early trade (based on nasdaq article)

The U.S. dollar was higher against its Canadian counterpart on Tuesday, as the greenback regained some strength after weakening broadly due to Friday's disappointing report on U.S. employment.

USD/CAD hit 1.2522 during early U.S. trade, the pair's highest since April 3; the pair subsequently consolidated at 1.2519, gaining 0.30%.

The pair was likely to find support at 1.2405, the low of March 26 and resistance at 1.2654, the high of April 2.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.08 15:47

USDCAD drops to 1-month lows in early trade (based on investing.com article)

The U.S. dollar dropped to one-month lows against its Canadian counterpart on Wednesday, as demand for the greenback weakened broadly before the highly-anticipated minutes of the Federal Reserve's latest policy meeting.

USDCAD hit 1.2388 during early U.S. trade, the pair's lowest since February 25; the pair subsequently consolidated at 1.2421, declining 0.68%.

The pair was likely to find support at 1.2309, the low of January 22 and resistance at 1.2524, Tuesday's high.

Market participants were eyeing the Fed's upcoming meeting minutes for indications on the central bank's next policy moves after Friday's downbeat jobs data fuelled uncertainty over the timing of a rate hike.

The Labor Department reported Friday that the U.S. economy added 126,000 new jobs in March, less than half of February’s gain and the smallest increase since December 2013.

The loonie was higher against the euro, with EURCAD shedding 0.28% to 1.3486.

Also Wednesday, data showed that retail sales in the euro zone fell 0.2% in February, in line with market expectations. On a year-over-year basis, retail sales rose 3.0% also in line with forecasts.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.09 06:38

Dollar extends gains as hawks hear hike in Fed talk (based on reuters article)- Dollar index at one-week highs, euro dips below $1.0800

- Canadian dollar hit by slide in oil prices

- Fed officials keep rate hike talk alive

New York Fed President William Dudley and Fed Governor Jerome Powell on Wednesday sketched out scenarios in which the central bank could make an initial move earlier than many now expect and then proceed in a slow and gradual manner on further rate increases.

Yet, minutes of the Fed's March meeting showed there was a wide divergence of views among policymakers, suggesting no consensus on the timing of a move.

"The final arbiter will be the data, recent data argued for delayed rate lift-off. A June 18 rate lift-off is now being priced as quite a slim chance," said David de Garis, senior economist at NAB.

Still, the chance of a hike at all this year is a stark contrast to Europe and Japan where quantitative easing has years to run. So dollar bulls took heart and bid up the dollar index to a one-week high of 98.197, further away from Monday's trough of 96.329. It last stood at 98.063.

The euro slipped to $1.0784 and was now more than 2 percent lower from this week's peak of $1.1036 set on Monday.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

USDCAD M5: 47 pips price movement by FOMC Meeting Minutes news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

W1 price is on bullish ranging between 1.2351 support and 1.2834 resistance levels

MN price is on primaruy bullish with 1.2834 resistance level

If D1 price will break 1.2410 support level on close D1 bar so the primary bullish trend will be reversed to the bearish with secondary ranging market condition

If D1 price will break 1.2783 resistance level so the primary bullish will be continuing

If not so the price will be ranging between 1.2410 and 1.2783 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2015-04-06 15:00 GMT (or 17:00 MQ MT5 time) | [CAD - Ivey PMI]

2015-04-06 15:00 GMT (or 17:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2015-04-08 14:30 GMT (or 16:30 MQ MT5 time) | [USD - FOMC Member Dudley Speech]

2015-04-08 19:00 GMT (or 21:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2015-04-09 13:30 GMT (or 15:30 MQ MT5 time) | [CAD - Building Permits]

2015-04-10 02:30 GMT (or 04:30 MQ MT5 time) | [CNY - CPI]

2015-04-10 13:30 GMT (or 15:30 MQ MT5 time) | [CAD - Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movementSUMMARY : ranging

TREND : breakdown