You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Are we talking about H1?

Yes, EURUSD H1, on large timeframes also +/- 1%, on other instruments the picture is different

We will calculate the deviation of the tick flow intensity from the average by the formula:

[Flow Intensity] = ([Number of ticks of the current bar] - [Average number of ticks of the last 100 bars])/ [Average number of ticks of the last 100 bars].

Well, and ?

Eugene, where do you get your data?

Have you checked them? At least on the addition of the number of ticks on different periods. Once I remember, I took the archived 15-minute and minute data from the terminal. It appeared, that the 15-minute ticks amount (if we are speaking about "volume") is not equal to the sum of ticks in minutes of the same 15-minute period in the same archive.

How about you?

Eugene, where do you get your data?

Have you checked them? At least on the addition of the number of ticks on different periods. Once I remember, I took the archived 15-minute and minute data from the terminal. It appeared, that the 15-minute ticks amount (if we are speaking about "volume") is not equal to the sum of ticks in minutes of the same 15-minute period in the same archive.

How about you?

Didn't check it, just took H1 ticks data from the chart. But the structure of tick-flow diagram of different segments is similar, i.e. there is a certain regularity.

Vladimir:

Once I remember, I took the archived 15-minute and minute data from the terminal. It appeared that the 15-minute ticks (if we are speaking about the indicator "Volume") is not equal to the sum of ticks in minutes of the same 15-minute period of the same archive.

I remember, I did the same thing and the result was really different. Apparently, they draw it the way they want.

Analysis of the intensity of tick flows has shown consistent patterns at different time intervals - year, month, days.

But what about the hourly volatility? Let's find out.

Study 2 - the aim is to determine the deviation of the hourly volatility from the average value depending on the time of day.

Let's define the period of the average value as being equal to 100 hours.

The deviation of volatility from the average will be calculated using a similar formula, only instead of ticks we will take R = (High - Low) H1 bars:

R_value = ([Swing of the current bar] - [Average of the last 100 bars])/ [ Average of the last 100 bars ].

Now we go through the sliding window in the same way and collect the necessary data. We process the obtained values by dividing the sum of hourly volatility deviations for each hour separately by the number of observations.

We look at the graphs of the obtained results.

As can be seen, the structure of the graphs is identical to that of Study 1. The constancy at different time intervals is the same - the whole history, month, days of week. The most volatile hours are from 09:00 to 19:00 (server time: UTC+2, in summer time: UTC+3),

Didn't check it, just took H1 tick data from the chart. But the structure of the tick stream chart for different sections is similar, which means there is a certain regularity.

I remember, I did the same thing and it really had different results. Apparently they draw it the way they want.

So why do you take data that you do not believe?

What reasons do you see for believing the conclusions you draw from them?

The charts are similar in terms of ticks, volumes, OHLC -> activity)

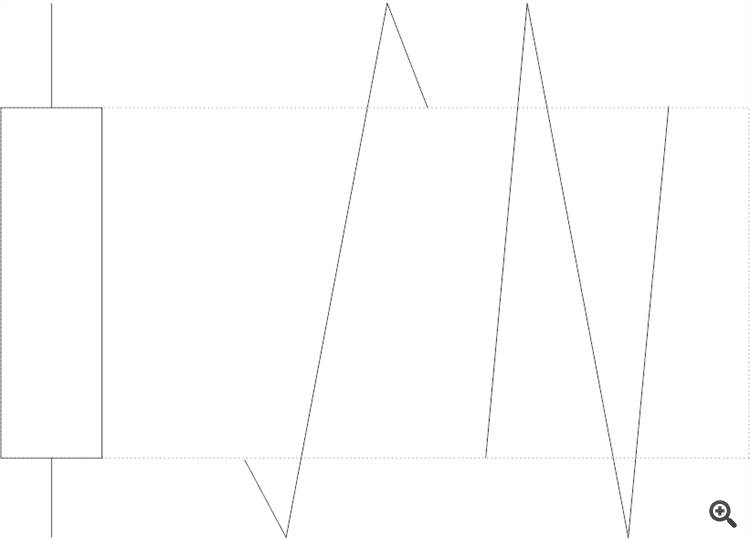

I have noticed an interesting thing; the body of an average candle is a little over 51%, i.e. we can assume statistically of course) that the new candle will close in the range ofa little over 51% of the opening)

The charts are similar in terms of ticks, volumes, OHLC -> activity)

I noticed an interesting thing; the body of an average candlestick is a little over 51%, which means, statistically of course), that the new candlestick will close in the range ofa little over 51% of the opening)

It's just a matter of identifying the unknown (on an unformed candle) min, max and colour of the candle. inside the 'candle' the price moves along approximately one of the two 'patterns'.

Inside the candlestick itself you can form many more candlesticks with the same patterns...

Why do you take data for research that you don't believe yourself?

What reasons do you see for believing the conclusions drawn from it?

Well, as you see the graphs of ticks (test 1) and the graphs of volatility (range high - low, test 2) are similar, which is logical, and therefore whether the sum of ticks coincides with a lower timeframe or not is not so important. Probably ... ))

Everyone can repeat such experiments and draw conclusions.

It's better to discuss how to apply the information to good use... or without benefit and it may be - it's even more likely to be ;)

even more interesting to calculate the average of the body, lower and upper shadow

Can do. I used a period of the last 9 years, more than 60,000 bars, I don't have a better history, if you have it please attach a csv file with the full history we will recalculate, the formulas are ready, just insert new data) So we got 0.44% of candlesticks without shadows, 0.64% without bodies, 3.48% without upper shadow, 4.43% of candlesticks without lower shadow.

These are the intraday averages of all the bars together in pips throughout the day. Rows 1,2,3 are upper shadow, body, lower shadow as on the bar chart: