You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I recommend closing the trade.

Who opened it and when?

The profit is 35 pips.

Actually, if everything is so reliable and profitable, why don't you register the signal?

13:15 08.09.2018 г. Let's see how events have unfolded since my previous post. For clarity, on a time interval of not two but three days.

Well. The sign has changed. Now the situation is as follows: EURUSD should be bought, GBPUSD should be sold with the same volume.

Expected profit = 49 pips of the fourth sign of 0.0001.

In terms of difference and ratio it looks like this:

Next week we will see how it will profit.

This system is only possible under one prerequisite: the key rates of the ECB and the Bank of England are unchanged and will not be revised in the future. Otherwise, the charts could diverge and no longer converge. There is always some condition at the heart of correlation. And it is more correct to talk about the cause, not the effect. Sometimes two instruments correlate just wonderfully and it may seem that one depends on the other. But in fact they both depend on the third, which for some reason is not even considered. In trading, mathematics is of secondary importance. It helps where cause and effect relationships are already properly placed. And the approach used by the author, in fact, does not differ from the two wagons, which now converge, and then diverge. One can sell from the upper wand and buy from the lower one, and close both deals when they intersect. The logic is almost the same.

1. No key stakes have any relevance. Pure mathematics. She's not interested in what those curves are at all. They could be temperature charts in Gadukino village.

2. The graphs cannot diverge and no longer converge. This would be possible (or rather unavoidable) if Aq and Bq correlated with coefficient = 1 strictly. But this is not the case.

3. Correlation in no way means that there are any dependencies - there is no question of that. However, you are right in the sense that, of course, when looking at EURUSD and GBPUSD charts,

we are not talking about the correlation of euro and pound, but about the correlation of the relations to dollar, and in them (in relation to euro-dollar and pound-dollar) the dollar has the role equal in importance to euro and pound, respectively. But all that is irrelevant. What is important is that additional curves correlate, not primary curves.

4. Mathematics (or rather physics, for mathematics is only the language of physics) is not of secondary, but of only importance in trading. Nothing else is of any importance.

5. The logic is almost the same, but there is a nuance: the result of transactions on "Zacks" will be the result of changes in deviation relative to "Zacks" plus the result of deviation of "Zacks" relative to each other, and it is unpredictable and can easily exceed the result of price changes relative to "Zacks". If instead of "Mašeks" the curves correlated with the coefficient of nearly one, then these additional curves will show the resultant contribution into the transaction through their mutual convergence or divergence, which is always guaranteed to be much smaller than the contribution from price changes (primary curves) relative to additional curves.

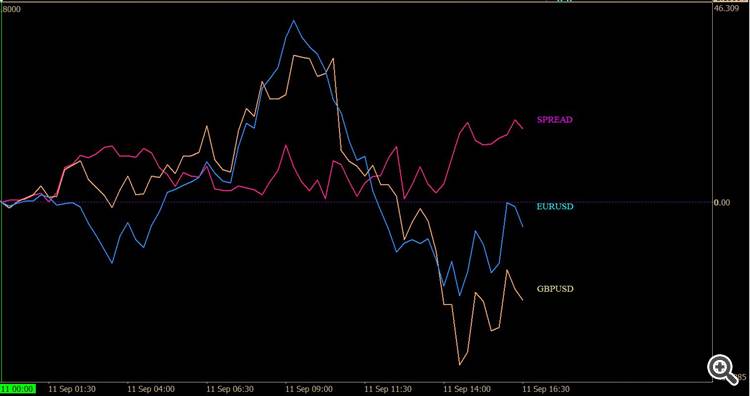

Time 19:20 10.09.2018 Current situation:

Pouring in the same direction.

namely buying the EURUSD - GBPUSD difference.

Expected profit: 105 pips.My indicator relative to the start of the day currently shows this:

The absolute value of the spread is displayed here.So, colleagues, 18:00 MSc on 11.09.2018. Let's look at the layout at the moment.

In fact, there has been no change in the past 24 hours. We stand calmly in the same position and wait for the guaranteed profit.

In terms of difference and ratio:

... Waiting for guaranteed profits.

You picked the wrong place to talk about guaranteed profits in the financial markets. Profit is only guaranteed when you withdraw it from a trading account. In all other cases, profits are not guaranteed, even in a closed trade.

19:20 Moscow time on 12.09.2018. The case is dragging on. What can you do. The market is like that. The important thing is that profits are still guaranteed. And it doesn't matter that it won't be today but tomorrow. The situation has not changed noticeably again over the past years. We maintain the same position: EURUSD Buy, GBPUSD with the same volume of sell:

in terms of difference and ratio:

You picked the wrong place to talk about guaranteed profits in the financial markets. Profit is only guaranteed when you withdraw it from a trading account. In all other cases the profit is not guaranteed, even in a closed trade.

By guarantee I meant the behaviour of the market. Everything else is beside the point. If you get cheated by your broker, it has nothing to do with the market.