Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read February 2015

newdigital, 2015.02.18 16:37

Quantitative Investing: Strategies to exploit stock market anomalies for all investorsby Fred Piard

This book provides straightforward quantitative strategies that any investor can implement with little work using simple, free or low-cost tools and services. But what exactly is quantitative investing? There are various possible definitions of quantitative investing, but the author defines it as: "Identifying reasonable and measurable hypotheses about behaviours of the financial market so as to make investment decisions with an acceptable confidence in expected returns and risks." The main advantages in using quantitative models are that they: - make the investment process independent of opinions and emotions (the most important factor for an individual investor), and - make it reproducible by anyone at any time (the most important factor for a fund) With a set of good strategies, quantitative investing allows one to act in the market at specific pre-planned times. It is possible to work on this just once a week or month, and ignore charts and the news. It removes most of the doubts and emotions with the discipline of keeping a long-term vision and sensible money management. This book will show you how.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read February 2014

newdigital, 2014.01.31 08:52

Getting Started Patterns : Thomas Bulkowski

An accessible guide to understanding and using technical chart patterns

Chart pattern analysis is not only one of the most important investing

tools, but also one of the most popular. Filled with in-depth insights

and practical advice, Getting Started in Chart Patterns is designed to

help both new and seasoned traders profit by tracking and identifying

specific chart patterns. Expert Thomas Bulkowski opens with a basic

discussion of chart pattern formation and how bad habits can hurt

trading. He then moves on to introduce over 40 key chart formations as

well as numerous trading tactics that can be used in conjunction with

them. Readers will benefit from the specifics (actual trades with dollar

amounts) outlined throughout the book and the frank discussions of how

trading behavior can affect the bottom line. Anecdotes from Bulkowski's

own trading experiences are also included to shed light on how one of

the best in the business goes about trading with chart patterns.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read April 2014

newdigital, 2014.04.07 12:38

How I Made $2,000,000 in the Stock Market: Now Revised & Updated for the 21st Century

by Nicolas Darvas and Steve Burns

How did a world-famous dancer with no knowledge of the stock market, or

of finance in general, make 2 million dollars in the stock market in 18

months starting with only $10,000? Darvas is legendary, and with good

reason. In this new edition: How I Made $2,000,000 in the Stock Market:

Now Revised & Updated for the 21st Century Steve Burns uses his

experience to offer explanations as to why the methods are still

reliable. Updating a classic book is a monumental task. The basic

philosophy of the writer cannot be changed. Steve Burns approach this

work with the eye of a master restorer who looks at a classical painting

that is being refurbished. He carefully studied the text to bring

Nicolas Darvas wisdom into the twenty-first century. Steve Burns

illuminate the dramatic changes in the market to show how Nicolas Darvas

principles are more useful now than ever.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read June 2014

newdigital, 2014.06.04 15:02

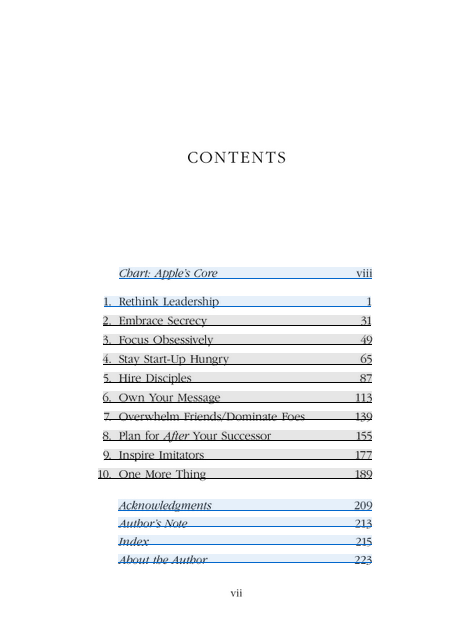

Inside Apple: How America's Most Admired--and Secretive--Company Really Works

INSIDE APPLE reveals the secret systems, tactics and leadership

strategies that allowed Steve Jobs and his company to churn out hit

after hit and inspire a cult-like following for its products.

If Apple is Silicon Valley's answer to Willy Wonka's Chocolate Factory,

then author Adam Lashinsky provides readers with a golden ticket to step

inside. In this primer on leadership and innovation, the author will

introduce readers to concepts like the "DRI" (Apple's practice of

assigning a Directly Responsible Individual to every task) and the Top

100 (an annual ritual in which 100 up-and-coming executives are tapped a

la Skull & Bones for a secret retreat with company founder Steve

Jobs).

Based on numerous interviews, the audiobook offers exclusive new

information about how Apple innovates, deals with its suppliers and is

handling the transition into the Post Jobs Era. Lashinsky, a Senior

Editor at Large for Fortune, knows the subject cold: In a 2008 cover

story for the magazine entitled The Genius Behind Steve: Could

Operations Whiz Tim Cook Run The Company Someday he predicted that Tim

Cook, then an unknown, would eventually succeed Steve Jobs as CEO.

While Inside Apple is ostensibly a deep dive into one, unique company

(and its ecosystem of suppliers, investors, employees and competitors),

the lessons about Jobs, leadership, product design and marketing are

universal. They should appeal to anyone hoping to bring some of that

Apple magic to their own company, career, or creative endeavor.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read January 2014

newdigital, 2014.01.09 16:52

Harmonic Trading, Volume One: Profiting from the Natural Order of the Financial Markets: Scott M. Carney: 9780137051502: Amazon.com: Books

Harmonic Trading creator Scott Carney unveils the entire methodology to

turn patterns into profits. These strategies consistently identify the

price levels and market turning points that reveal the natural order

within the chaos of the financial markets. Analogous to the predictable

behavior of many of life’s natural processes, Harmonic Trading examines

similar relationships within the financial markets to define profitable

opportunities in an unprecedented manner. Carney introduces new

discoveries such as the Bat pattern, Alternate AB=CD structures, the

0.886 retracement, and more. These strategies are entirely new to the

trading community, and they represent a profound advancement beyond all

other Fibonacci methodologies!

After you’ve discovered how to identify harmonic patterns, Carney

presents a complete methodology for applying them in trade execution and

handling them throughout the entire trade management process. From

savage bear to rampaging bull, Harmonic Trading can be employed in all

markets--equities, currencies, commodities, and foreign markets--for

both short- and long-term timeframes.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read January 2014

newdigital, 2014.01.10 09:14

Harmonic Trading, Volume Two: Advanced Strategies for Profiting from the Natural Order of the Financial Marketsby Scott M. Carney

Now, in Harmonic Trading: Volume 2, Carney takes a quantum leap forward, introducing new strategies, patterns, and methods that make Harmonic Trading an even more powerful tool for trading the financial markets. For the first time, he reveals how to utilize harmonic impulse waves and introduces measurement techniques that identify market turning points even more accurately. Finally, he demonstrates how to integrate the Relative Strength Indicator (RSI) with advanced Harmonic Trading techniques to separate minor “reactive” moves from major opportunities.

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

newdigital, 2013.07.15 21:19

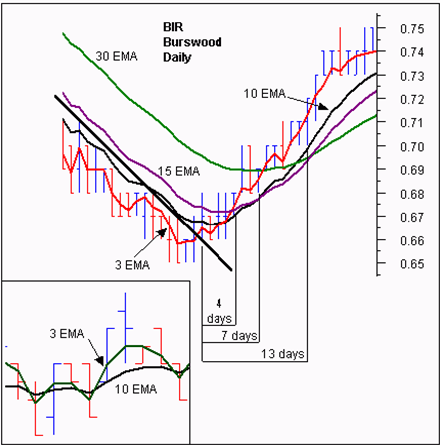

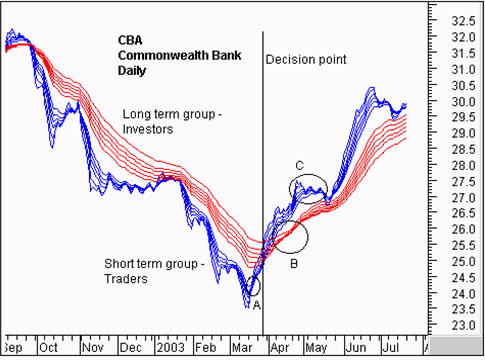

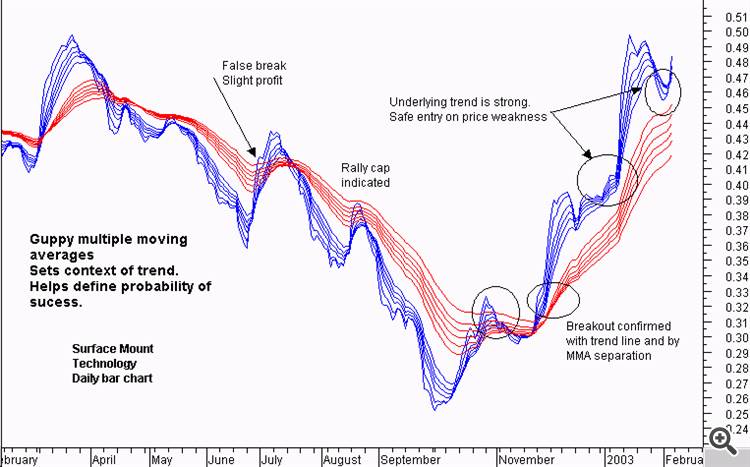

Just good indicator found in Metatrader 5 CodeBase : GUPPY MULTIPLE MOVING AVERAGES :

These are two groups of exponential moving averages. The short term group is a 3, 5, 8, 10, 12 and 15 day moving averages. This is a proxy for the behaviour of short term traders and speculators in the market.

The long term group is made up of 30, 35, 40, 45, 50 and 60 day moving averages. This is a proxy for the long term investors in the market.

The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart.

The relationship between the two groups tells the trader about the strength of the market action. A change in price direction that is well supported by both short and long term investors signals a strong trading opportunity. The crossover of the two groups of moving averages is not as important as the relationship between them.

When both groups compress at the same time it alerts the trader to increased price volatility and the potential for good trading opportunities.

==========

The Guppy Multiple Moving Average (GMMA) is an indicator that tracks the inferred activity of the two major groups in the market. These are investors and traders. Traders are always probing for a change in the trend. In a downtrend they will take a trade in anticipation of a new up trend developing. If it does not develop, then they get out of the trade quickly. If the trend does change, then they stay with the trade, but continue to use a short term management approach. No matter how long the up trend remains in place, the trader is always alert for a potential trend change. Often they use a volatility based indicator like the count back line, or a short term 10 day moving average, to help identify the exit conditions. The traders focus is on not losing money. This means he avoids losing trading capital when the trade first starts, and later he avoids losing too much of open profits as the trade moves into success.

We track their inferred activity by using a group of short term moving averages. These are 3, 5, 8, 10, 12 and 15 day exponentially calculated moving averages. We select this combination because three days is about half a trading week. Five days is one trading week. Eight days is about a week and a half.

The traders always lead the change in trend. Their buying pushes prices up in anticipation of a trend change. The only way the trend can survive is if other buyers also come into the market. Strong trends are supported by long term investors. These are the true gamblers in the market because they tend to have a great deal of faith in their analysis. They just know they are right, and it takes a lot to convince them otherwise. When they buy a stock they invest money, their emotions, their reputation and their ego. They simply do not like to admit to a mistake. This may sound overstated, but think for a moment about your investment in AMP or TLS. If purchased several years ago these are both losing investments yet they remain in many portfolios and perhaps in yours.

The investor takes more time to recognize the change in a trend. He

follows the lead set by traders. We track the investors inferred

activity by using a 30, 35, 40, 45, 50 and 60 day exponentially

calculated moving average. Each average is increased by one week. We

jump two weeks from 50 to 60 days in the final series because we

originally used the 60 day average as a check point.

This reflects the original development of this indicator where our focus was on the way a moving average crossover delivered information about agreement on value and price over multiple time frames. Over the years we have moved beyond this interpretation and application of the indicator. In the notes over the coming weeks we will show how this has developed.

Our starting point was the lag that existed between the time of a genuine trend break and the time that a moving average cross over entry signal was generated. Our focus was on the change from a downtrend to an up trend. Our preferred early warning tool was the straight edge trend line which is simple to use and quite accurate. The problem with using a single straight edge trend line was that some breakouts were false. The straight edge trend line provided no way to separate the false from the genuine.

On the other hand, the moving average crossover based on a 10 and 30 day calculation, provided a higher level of certainty that the trend break was genuine. However the disadvantage was that the crossover signal might come many days after the initial trend break signal. This time lag was further extended because the signal was based on end of day prices. We see the exact cross over today, and if we were courageous, we could enter tomorrow. Generally traders waited for another day to verify that the crossover had actually taken place which delayed the entry until 2 days after the actual crossover. This time lag meant that price had often moved up considerably by the time the trade was opened.

The standard solution called for a combination of short term moving averages to move the crossover point further back in time so that it was closer to the breakout signaled by a close above the straight edge trend line. The drawback was that the shorter the moving average, the less reliable it became. In plotting multiple moving averages on a single chart display four significant features emerged.

They were:

- A repeated pattern of compression and expansion in a group of six short term averages.

- The behavior was fractally repeated across different time frames. These short and long term groups were useful in understanding the inferred behavior of traders and investors.

- The degree of separation within groups and between groups provides a method of understanding the nature of the trend and trend change.

- The synchronicity was independent of the length of the individual moving averages. That is, at major trend turning points compression occurred across both long and short term groups and this provided early validation of signals generated by the straight edge trend line

- The relationship between moving averages and price was better understood as a relationship between value and price. The crossover of two moving averages represented an agreement on value over two different time frames. In a continuous open auction which is the mechanism of the market, agreement on price and value was transient and temporary. Such agreement often preceded substantial changes in the direction of the trend. The GMMA became a tool for identifying the probability of trend development.

These broad relationships, and the more advanced relationships used with the GMMA are summarized in the chart. Over the following series of articles we will examine the identification and application of each of these relationships.

This is the most straightforward application of the GMMA and it worked well with “V’ shaped trend changes. It was not about taking the lag out of the moving average calculation. It is about validating a prior trend break signal by examining the relationship between price and value. Once the initial trend break signal is validated by the GMMA the trader is able to enter a breakout trade with a higher level of confidence.

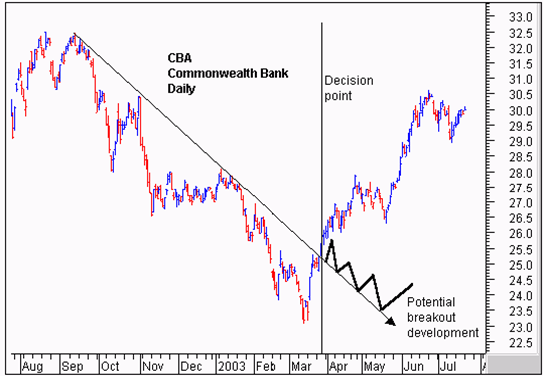

The CBA chart shows the classic application of the GMMA. We start with the breakout above the straight edge trend line. The vertical line shows the decision point on the day of the breakout. We need to be sure that this breakout is for real and likely to continue upwards. After several months in a downtrend the initial breakout sometimes fails and develops as shown by the thick black line. This signals a change in the nature of the trend line from a resistance function prior to the breakout to a support function after the breakout.

The GMMA is used to assess the probability that the trend break shown by the straight edge trend line is genuine. We start by observing the activity of the short term group. This tells us how traders are thinking. In area A we see a compression of the averages. This suggests that traders have reached an agreement on price and value. The price of CBA has been driven so low that many traders now believe it is worth more than the current traded price. The only way they can take advantage of this ‘cheap’ price is to buy stock. Unfortunately many other short term traders have reached the same conclusion. They also want to buy at this price. A bidding war erupts. Traders who believe they are missing out on the opportunity outbid their competitors to ensure they get a position in the stock at favorable prices.

The compression of these averages shows agreement about price and value. The expansion of the group shows that traders are excited about the future prospects of increased value even though prices are still rising. These traders buy in anticipation of a trend change. They are probing for a trend change.

We use the straight edge trend line to signal an increased probability of a trend change. When this signal is generated we observe this change in direction and separation in the short term group of averages. We know traders believe this stock has a future. We want confirmation that the long term investors are also buying this confidence.

The long term group of averages, at the decision point, is showing signs of compression and the beginning of a change in direction. Notice how quickly the compression starts and the decisive change in direction. This is despite the longest average of 60 days which we would normally expect to lag well behind any trend change. This compression in the long term group is evidence of the synchronicity relationship that makes the GMMA so useful.

This compression and change in direction tells us that there is an increased probability that the change in trend direction is for real – it is sustainable. This encourages us to buy the stock soon after the decision point shown.

The GMMA picks up a seismic shift in the markets sentiment as it

happens, even though we are using a 60 day moving average.. Later we

will look at how this indicator is used to develop reliable advance

signals of this change. This compression and eventual crossover within

the long term group takes place in area B. The trend change is

confirmed. The agreement amongst investors about price and value cannot

last. Where there is agreement some people see opportunity. There are

many investors who will have missed out on joining the trend change

prior to area B. Now the change is confirmed they want to get part of

the action. Generally investors move larger funds than traders. Their

activity in the market has a larger impact.

The latecomers can only buy stock if they outbid their competitors. The stronger the initial trend, the more pressure there is to get an early position. This increased bidding supports the trend. This is shown by the way the long term group continue to move up, and by the way the long term group of averages separates. The wider the spread the more powerful the underlying trend.

Even the traders retain faith in this tend change. The sell off that takes place in area C is not very strong. The group of short term averages dips towards the long term group and then bounces away quickly. The long term group of averages show that investors take this opportunity to buy stock at temporarily wakened prices. Although the long term group falters out at this point, the degree of separation remains relatively constant and this confirms the strength of the emerging trend.

The temporary collapse of the short term group comes after a 12% appreciation in price. Short term traders exit the trade taking short term profits at this level of return and this is reflected by the compression and collapse of the short term group of averages. As long term investors step into the market and buy CBA at these weakened prices, traders sense that the trend is well supported. Their activity takes off, and the short term group of averages rebounds, separates, and then run parallel to the long term group as the trend continues.

The GMMA identifies a significant change in the markets opinion about CBA. The compression of the short term and long term groups validates the trend break signal generated by a close above the straight edge trend line. Using this basic application of the GMMA, the trader has the confidence necessary to buy CBA at, or just after the decision points shown on the chart extract.

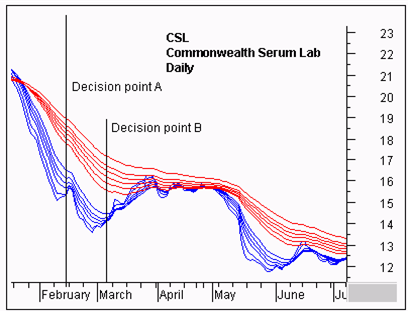

Using this straightforward application of the GMMA also kept traders out of false breakouts. The straight edge trend line provides the first indication that a downtrend may be turning to an up trend. The CSL chart shows two examples of a false break from a straight edge trend line. We start with decision point A. The steep downtrend is clearly broken by a close above the trend line. If this is a genuine trend break then we have the opportunity to get in early well before any moving average crossover signal.

This trend break collapses quickly. If we had first observed this chart near decision point B then we may have chosen to plot the second trend line as shown. This plot takes advantage of the information on the chart. We know the first break was false, and by taking this into account we set the second trend line plot. Can this trend break be relied upon? If we are right we get to ride a new up trend. If we are wrong we stand to lose money if we stay with a continuation of the downtrend. The straight edge trend line by itself does not provide enough information to make a good decision.

When we apply the GMMA we get a getter idea of the probability of the trend line break actually being the start of a new up trend. The key relationship is the level of separation in the long term group of averages, and trend direction they are traveling. At both decision point A and decision point B the long term group is well separated. Investors do not like this stock. Every time there is a rise in prices they take advantage of this to sell. Their selling overwhelms the market and drives prices down so the downtrend continues.

The degree of separation between the two groups of moving averages also makes it more difficult for either of the rallies to successfully change the direction of the trend. The most likely outcome is a weak rally followed by a collapse and continuation of the down trend. This observation keeps the trader, and the investor, out of CSL.

Looking forward we do see a convergence between the short term group of averages and the long term group of averages. Additionally the long term group begins to narrow down, suggesting a developing level of agreement about price and value amongst investors in April and May. In late March the 10 day moving average closes above the 30 day moving average, generating a classic moving average buy signal.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read February 2014

newdigital, 2014.02.03 09:22

Guppy Trading, Essential Methods For Modern Trading : Daryl Guppy

A compilation of the very best of Daryl Guppy

Daryl Guppy has been one of Australia's foremost experts on share

trading and charting for almost 20 years. His first book, Share Trading,

is still a must-read for people wanting to learn about the market and

is widely accepted as the best-selling trading book ever in Australia.

Guppy Trading contains detailed analysis of many topics, including:

making effective trades based on news events and informed trading

advanced application of the Guppy Multiple Moving Average to assess the true strength of a trend

how to establish and improve trade entry, exit and stop loss points in volatile markets

effective trading of international markets

safely integrating derivatives to boost portfolio returns.

Guppy Trading contains 23 of the most enduring and important chapters

from Guppy's earlier books, completely revised, and combines them with

10 entirely new chapters. These new chapters detail new trading methods

and instruments that have been developed to create additional

opportunities and ensure survival in interconnected modern markets. This

comprehensive compendium is critical reading for traders looking to

maximise their returns.

=================

MT5 CodeBase :

by Daryl Guppy

If you have no time to follow the market closely, then Trend Trading is the book for you. Trend trading is one of the most effective and easy-to-use methods for making money in the market. Success depends on identifying the trend with confidence and catching the trend after it has started, and on getting out as soon as possible after the uptrend turns into a downtrend.

The book examines in detail the steps in finding, assessing, selecting, managing and monitoring a long-term trend trade. These are proven, successful methods which are easy to understand and apply. Included are the most recent updates and developments in using the count back line and the Guppy Multiple Moving Average. Daryl Guppy also includes a practical look at setting stop loss conditions to protect capital and profits, and a bonus section on Darvas-style trend trading which is the first significant update of this technique in forty years.

Trend Trading shows readers how to use and apply the analysis tools to find effective long-term trades. These can be applied to any group of selected stocks, whether chosen on fundamental criteria, from stock tip newsletters, or found using database technical scans. From this starting point, Guppy shows how the better trades are identified, how risk is managed, and how the trades are closed successfully. The book includes examples of Daryl's personal trades.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read May 2014

newdigital, 2014.04.28 10:33

Chan: Algorithmic Trading: Winning Strategies and Their Rationale (Wiley Trading)

Engaging and informative, Algorithmic Trading skillfully covers a wide

array of strategies. Broadly divided into the mean-reverting and

momentum camps, it lays out standard techniques for trading each

category of strategies and, equally important, the fundamental reasons

why a strategy should work. The emphasis throughout is on simple and

linear strategies, as an antidote to the over-fitting and data-snooping

biases that often plague complex strategies. Along the way, it provides

comprehensive coverage of:

- Choosing the right automated execution platform as well as a backtesting platform that will allow you to reduce or eliminate common pitfalls associated with algorithmic trading strategies

- Multiple statistical techniques for detecting "time series" mean reversion or stationarity, and for detecting cointegration of a portfolio of instruments

- Simple techniques for trading mean-reverting portfolios—linear, Bollinger band, and Kalman filter—and whether using raw prices, log prices, or ratios make the most sense as inputs to these tests and strategies

- Mean-reverting strategies for stocks, ETFs, currencies, and futures calendar and intermarket spreads

- The four main drivers of momentum in stocks and futures, and strategies that can extract time series and cross sectional momentum

- Newer momentum strategies based on news events and sentiment, leveraged ETFs, order flow, and high-frequency trading

- Issues involving risk and money management based on the Kelly formula, but tempered with the author's practical experience in risk management involving black swans, Constant Proportion Portfolio Insurance, and stop losses

- Mathematics and software are the twin languages of algorithmic trading. This book stays true to that view by using a level of mathematics that allows for a more precise discussion of the concepts involved in financial markets. And it includes illustrative examples that are built around MATLAB© codes, which are available for download.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read October 2014

newdigital, 2014.10.01 12:04

New Book - Open Secret of Libor Manipulation

Open Secret: The Global Banking Conspiracy That Swindled Investors Out of Billions is the new book written by Erin Arvedlund.

The book goes behind the scenes of the elite firms that trafficked in LiBOR based products, including Barclays Capital, UBS, Rabobank, and Citigroup to show the negative impact they had on both ordinary investors and borrowers.

Erin’s claim to fame was a column she wrote in Barron’s in the early 2000s outing Bernie Madoff as a fraud. It was a national bestseller titled Too Good to Be True.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This is the thread about books related for stocks, forex, financial market and economics. Please make a post about books with possible cover image, short description and official link to buy (amazon for example).

Posts without books' presentation, without official link to buy and with refferal links will be deleted.Posts with links to unofficial resellers will be deleted