You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Yes) You're right, it's just that when I catch fat tails in advance... The order system works fine for me in any direction... but sometimes the loss of the prices is just "shaking" exceeds the statistical risks when I can use market situations with a given risk of the deposit and earn... then I have to increase risks... or just wait and hope that the next trading sessions will be profitable enough in total, to cover losses quickly enough...

I have a number of questions, thank you, CheGevara. What is primary, MM or all the same MO> 0? If we put at stake the assumption that after all the market is random, exponential (geometric in terms of discreteness) random walk model will not make money on outliers (or a small deviation in the proverbial 2% non-randomness, covered by the total spread), eventually gives zero or about that, then the game in a random event in its favour when using MM. Or on the contrary: the market gives a chance, then with all power of MM increase the chance proportionally

no... the market leaves no chance... you have to open deals before the anticipated surge... otherwise you'll be out of the money... the MM is also important, and before you open orders you have to calculate the possible amounts of losses depending on the situation...

On the proportion "square of displacement ~ time" and the applicability of Brownian motion theory to prices. https://www.mql5.com/ru/articles/1530:

The illusory nature of this notion is that the process is not Wienerian

And the process in the market is not a Wiener process. It is Laplace motion, or as Novaja correctly pointed out - Variance gamma process.

There is still the "square of displacement ~ time" proportion, but it's more complex. There is no escaping this universal law. We are very lucky that it is so. The only unlucky thing is that we, dubya, cannot derive a formula for the probable variance in the market at a given moment in time.

I can't reveal what I know ... and I don't need to. i can't reveal what i know ... and i don't have to ... as your rails that you follow may open more than i did ... but out of respect for people like Novaja, Aleksandr_K i'll give a hint ... here you see the growth of tick volumes ... i don't see a pattern ... I'm not talking about signals, I'm saying that randomness is randomness in 98% ... but the character of random movement can give something important considering the fact that thick tails are formed after the red line. Novaja knows approximately what I mean) I didn't come to it based on the volumes themselves, it's just that those signals, which are not related to any volumes at all, were especially profitable and approximately coincide with those places where the red line is... not in all places where this line is... it's understandable... but exactly where one of the red lines is.

build a correlation of the analysis of events preceding to what has already happened, and you'll see what you need to see and where you need to see it.

End of American session, beginning of Asian session. Change in forex. Picking up the dough at the exchanges. Closing of the banking day. Accrual of swaps on open trades. Number of deals drops sharply.

:))))

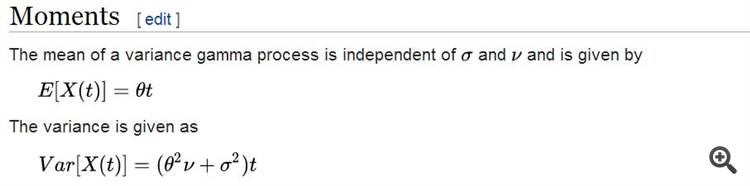

Here is the expectation and variance for the Variance gamma process:

As we can see, the deviation of the process from the expectation (in which demolition is taken into account) is also proportional to the "root of t".

But, - cleverly.

Not sigma*sqrt(t), as in Wiener process, but much more interesting, including drift factor...

Here, who first understands this and implements it in TC, can silently go for the Nobel Prize.

I don't know what they're ***ing around for.

to think, to laugh, to bullshit. I'm happy with everything, no complaints))))

What to do - the eternal question. For starters, remember regularisation and rattle.

See how Gorchakov got in (from 22 min)youtu.be/uhfi4Vc0178 and what he did... If anything

get to remember the simulated stress tests with the sub-mix of noise and so on, so as not to get caught in the

next time. Forget about 25% per month and try to make a model pulling a little in the +...

Here, even Goncharov cuts gaps for intraday as they are bigger increments.

Here is the expectation and variance for Variance gamma process:

As you can see, the deviation of the process from the expectation (in which drift is taken into account) is also proportional to the "root of t".

But, - tricky.

Not sigma*sqrt(t), as in Wiener process, but much more interesting, including drift factor...

Here, who first understands and implements it in TS, may go for Nobel Prize silently.

So, mat expectation == linear function of time? not a constant? Or is it an error?

Calm down with the Nobel Prize, and use your brain.i.e., expectation == linear function of time? not a constant? Or is that a mistake?

Taken from Wikipedia...

Honestly, I've never dealt with this process, but apparently yes, linear in time.

Taken from Wikipedia...

Honestly, I've never dealt with this process, but apparently yes, linear in time.

I see you've already put Kolmogorov on the same board as Wikipedia... it's sad.