You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Another interesting signal for arbitrage entry was found. Sell copper-silver spread:

SELL HGG2 - BUY SIH2 = 2^1

The price lines here have diverged and are set to converge. And the spread indicator line has deviated upwards and seems to be preparing for a downward reversal:

We'll see how it ends here on Monday! Good luck everyone!

I got up too late today and therefore my entry was too late. Nevertheless, now I closed positions with total profit. Really tiny....

Ideally, I should have entered the spread on Friday, before the trading was closed. But I missed it - I noticed this signal too late!

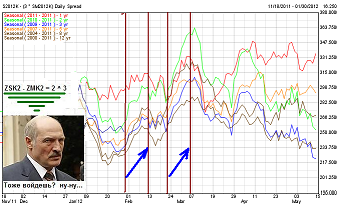

As of the end of January, the soybean spread is supposed to be bought: buy ZSK2 - sell ZMK2 (flour-beans). To make the spread more balanced m reduce the risk - I use here, in MT4 not the exchange ratio of 1:1, but take ZSK2-ZMK2=2^3!

The figure below is a more detailed chart of multi-year seasonal trends (1-2-3-5-8-12) for the specified position size ratio. Here we can clearly see that we'd better split the buying of this soy spread into 2 stages:

The first stage is tomorrow's buying before February 12. And the second stage, - buying from February 22 until around March 5!

Closed this spread now with a profit! Since the seasonality ends, besides the average long-term profit of the first half of February, this spread has already worked out:

It remains to be regretted that I was stingy and entered with small amounts on this spread!

Now we wait for February 22 and again we will evaluate the situation for another seasonal buying of ZS-ZM=2^3 spread!

By the way, just today the MRSI website's home page has the seasonal new entries freely available:

buying soybean oil and ...... http://www.mrci.com/web/index.php

For detailed statistics - click on any of the charts there and wait 10-15 seconds for detailed table charts to load!

Not really on topic. But since there was an announcement here, we should put a point! Soybean oil did very decently in the seasonality of the first half of February (first arrow)! But now there is a correction coming (and it already started at night), so it makes sense to temporarily close the oil purchases and resume them after February 18-20, according to the situation:

The current situation for ZL oil is on the chart below. The price broke through the support trend line and is clearly set for a further correction or sideways movement:

===========

An arbitrage situation has occurred at the silver-gold spread, XAGUSD - XAUUSD = 1^2

Wait for the price lines to converge (triangle will turn sideways to the right) and buy the spread: BUY SIH2 - SELL GCJ2 = 1^2

Good luck to all!

An arbitrage situation has occurred in the silver-gold spread, XAGUSD - XAUUSD = 1^2. Wait for the price lines to converge (the triangle will turn sideways to the right) and buy the spread: BUY SIH2 - SELL GCJ2 = 1^2 . Good luck to all!

The price lines have almost converged! And the spread line has reached (well, almost!) the upper limit of the channel. I am closing positions at a small total profit, - as expected!

Congratulations to those who took advantage of the recommendation!

The price lines have practically converged! And the spread line has reached (well, almost!) the upper limit of the channel. I am closing positions in a small total profit, - as expected!

Congratulations to those who took advantage of the recommendation!

Hello, Leonid - I looked at Broco - there are no contracts with such a long delivery month yet... so I'm not using the full range of opportunities, even from the ones you suggested

Of options... As long as I trade with them in demo mode, it's a bit uncomfortable to ask their support team for quotes for months like J-April...

Maybe then come here to test approaches to trade spreads, while in demo - options ... Recommend... Thank you.

Good afternoon.

You should have written about this problem a long time ago. It is solved in a couple of minutes. On a simple demo there are really only short-term (often illiquid) contracts. Right now, open a new demo account, but set the server to "Contest" (any of the two). There are at least 2-3 contracts for each instrument there!

By the way. The Orange Juice Spread is now a possible prospective buy through February 25-26:

Here is the seasonal spread chart:

Yes and singles juice is now turning around - you can clearly see it in the chart above. The down-trend in seasonality should change to an uptrend by the end of February (JO juice trading starts at 5pm Moscow time):

You should have written about this problem a long time ago. It is solved in a couple of minutes. On a simple demo there are really only short-term (often illiquid) contracts. Right now, open a new demo account, but set the server to "Contest" (any of the two). There are at least 2-3 contracts for each instrument there!

By the way. The Orange Juice spread is now available for prospective buying until February 25:

Here is the seasonal spread chart:

Yes and singles juice is now reversing - you can clearly see it on the chart. The up-trend in seasonality should change to an uptrend by the end of February (JO-juice trading starts at 5pm Moscow time):

Oh! Thank you, Leonid (I thought we were on a first-name basis). I'm doing it. I'm working it out.

All done. Thank you, Leonid.

Could you please show a screenshot or a description of the indicator parameters - my indicator refuses to draw channels...

And what is the ratio of open volumes... If you don't specify it, is it 1:1 by default?

Right - on "you" - remembered!

Yes, - calendar spreads (i.e. for different contracts of the same instrument) are always taken 1:1 (and EquityScale = FALSE for calendar spreads).

Channel width ( Env.Show = true; // Show Env.

selected by the Env.Dev parameter // Env deviation in percents

Charge the spread indicator to the ticker chart #I (and the Price Line Ind. is not needed here at all):