You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

A high level of smoothing is also not a good result - an increase in profitability. Increasing the smoothness will in any case lead to an increase in latency. But even supposing we have zero delay, the increased smoothness will lead to skipping of smaller trades which will decrease the amount of trades and respectively decrease the profit and therefore increase the drawdown.....

Even on the chart you can clearly see that a part of quite large trades, which theoretically could have been taken, has not been taken, hence, the profit has decreased.....

A high level of smoothing is also not good at increasing profits. Increasing the smoothness will in any case lead to an increase in latency. But even if we suppose that we have zero delay, the increased smoothing will lead to skipping of smaller trades and, consequently, to the decrease of trades, respectively, the decrease of profit and the increase of drawdowns.....

Adaptively adjust to the best variant.

>> The case you described is the problem with all the time dependent indicators. Do away with time in the classical sense and use other methods.

I have long ago abandoned such TCs and use other methods....Just wrote the post as an opinion on what increasing smoothness can lead to )))))

I have long since given up on such TCs and use other methods....I just wrote a post as an opinion on what increasing smoothness can lead to )))))

Can I write you a letter?

Plus to all this we need to add errors (losses) from increasing the delay (no need to be altruistic) and the question of profit can hang in the air .....))))

I'm willing to argue about the authorship of the idea. Most likely the idea is as old as the MA. :))

And in general the subject is interesting for me - I am engaged in it myself. Naturally, not everything is as beautiful as in your drawing. It clearly lacks a lot of arrows.

Now in order:

In my opinion, such a system will not give profit without an aggressive MM.

Well, comrade! - So we're going the right way.

The figure shows a very schematic illustration of the method of opening/closing positions.

The argument is debatable (equality of the second derivative to zero), so it requires an argument from your side. As for the extremum (equality to zero of the first derivative), there seems to be no need for argumentation.

The requirement of the MA closeness to the quotation and the simultaneous requirement of its smoothness do not (and cannot) conflict, but complement each other. A striking example is the usual exponential average EMA. Its recursive form is obtained precisely from minimization of the functional, which requires proximity and smoothness simultaneously.

3. this can be seen as a development of the method. To begin with, a solution must be obtained for the obvious requirements for the form of the functional.

Swetten wrote >>

I beg your pardon, what is FZ?

FZ - phase delay. A term from DSP.

TheXpert 19.01.2009 14:45

Is the target function based on the reference to the outline?

Too much smoothing will not give us a good result - it will increase the profit. Increasing smoothness will in any case lead to an increase in delay. But even if we suppose we have zero lag, the increased smoothing will lead to skipping of smaller trades and, consequently, to the decrease of trades, respectively, the decrease of profit and the increase of drawdown.....

Maybe try it sequentially?

Make an initial variant, analyse it.

Like like this and that, don't like that, so we'll take this and that out of the way and make it up.

It's just that I see there's a lot of confusion, and the original idea was great.

Should we try it sequentially?

Make an initial version, analyse it.

Like like this and that, don't like that, so we remove this and that, and make a mess of it.

It's just that I see a lot of confusion here, and the original idea was great.

There's no mess!

If there's nothing else, let's remember the basic requirements for a perfect MA:

1. proximity to the original VR. This requirement is equal to the smallness of the distance between the quotient X (green line in the picture) and the smoothed curve Y (blue). It can be written that on average, over a large sample, it must satisfy: (X[i]-Y[i])^2-->min

2. Smoothness of MA. This requirement is equal to the smallness of the distance between neighboring samples of the smooth curve: (Y[i]-Y[i-1])^2-->min.

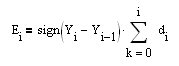

3. The Equity curve that will be composed of the pieces chopped from the initial BP taking into account the direction (sign) of the opened positions (between vertical lines in the picture) should be increasing. The sign of the position opening is equal to the sign of the MA derivative. In our terminology, sign(Y[i]-Y[i-1]). In this case, the equity curve will be composed of kotier pieces that will be butted together according to the sign of the position to be closed. This is how it can be implemented. Let's construct a first difference series (FDD) d[i]=X[i]-X[i-1] for the kotier: , then a fast growth of the equity curve (

, then a fast growth of the equity curve ( ), is equivalent to the requirement to maximize the first derivative from it: dE[i]/dt=E[i]-E[i-1]= sign(Y[i]-Y[i-1])*(X[i]-X[i-1]) or with a small, but acceptable, in our case, stretch {(Y[i]-Y[i-1])*(X[i]-X[i-1])}^2-->max It is obvious that maximization of some expression equals its minimization with opposite sign:-{(Y[i]-Y[i-1])*(Х[i]-Х[i-1])}^2-->min.

), is equivalent to the requirement to maximize the first derivative from it: dE[i]/dt=E[i]-E[i-1]= sign(Y[i]-Y[i-1])*(X[i]-X[i-1]) or with a small, but acceptable, in our case, stretch {(Y[i]-Y[i-1])*(X[i]-X[i-1])}^2-->max It is obvious that maximization of some expression equals its minimization with opposite sign:-{(Y[i]-Y[i-1])*(Х[i]-Х[i-1])}^2-->min.

That's it. We get the required functional for the minimization:

S=w1*(X-Y)^2+w2*(Y[i]-Y[i-1])^2-w3*{(Y[i]-Y[i-1])*(Х[i]-Х[i-1])}^2-->min

We need to find its minimum relative to Y[i], where i is the current datum.

No scatter!

If there are no more wishes, let's refresh our memory on the basic requirements for a perfect MA:

IMHO, the Y function view is missing. Or did I miss something?

Great, found such a solution for some time period. Then what?

Like what? We earn -- profitability is invested in the target function.