....

Disadvantages:

1. Little liquid market for "long-distance" futures.

2. due to the fact that there are no exact dividend payment dates,

The difficulty in determining the range of traded prices.

Any idea of "negating" the disadvantages?

1. Become a market maker for long term futures?

2. To take over all firms and boards of directors at the same time. And set exact payment dates + one more day (for convenience).

I don't see any other way. )))

Range, easily from 0 to + infinity. All prices will fit.

3. With the central bank, it's more complicated. Even a takeover won't help because the interest rate change dictates the economy...

For more specific suggestions, you need a more precise description of the algorithm (trading idea). Many forexists have no idea what a calendar spread is and how it is eaten.

Thanks in advance for the literacy.

1. Become a market maker for long distance futures ?

2. To subdue all firms and boards of directors at the same time. And set exact payment dates + one more day (for convenience).

I don't see any other way. )))

And on the third disadvantage, the range, easily from 0 to + infinity. All prices will fit.

For more specific suggestions, you need a more precise description of the algorithm (trading idea). Many forex traders have no idea what a calendar spread is and how it is eaten.

Thanks in advance for the literacy.

Calendar spread. (I didn't write the article)

I trade futures on the same asset with different execution and expiration dates.

It is important to remember that at the moment of expiration, the futures price should be equal to the price of the underlying asset.

So if you have two futures for the same asset with different start dates but the same expiration date, and they're not worth the same,

Then you can make an arbitrage operation, sell a more expensive contract and buy a cheaper one. And before expiry, when the value of the contracts will equalise,

you close the trade and make a profit equal to the difference between the initial price of the futures and the current prices. Since the rules of mathematics are undeniable, this transaction is one of the riskiest.

Unfortunately, in our market it's difficult to find contracts with the same expiration date, so we trade the change from one futures to another, for example there are two contracts, the close one 3.13 and the far one 6.13.

Since the long contract has substantially lower liquidity and its price differs significantly from the underlying asset, in contrast to the short-term contract, so this difference can be traded.

Of course, in this case no one promises the full convergence on the expiration date, but with some skill this risk can be easily controlled.

Now let us have a closer look at how the position is managed depending on the entry and exit points.

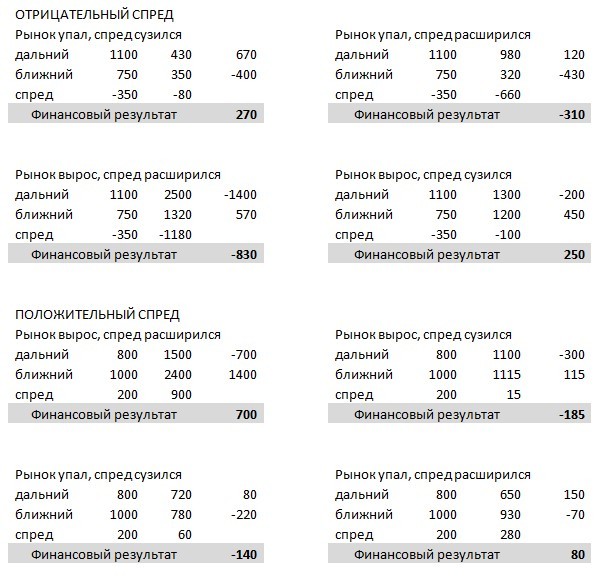

First, let's define the initial conditions, the spread is considered as long minus short, long is short futures, short is long. Since the long may be higher or lower than the short,

then the spread would be a negative or positive number, respectively. After entering the position the spread, following the general market movement, can widen or narrow.

From this we obtain data like this:

A careful examination of this table allows us to establish some simple rules for taking profits and controlling losses in any position:

1. you should enter a position with a negative spread when further spread widening is statistically unlikely, but if the spread widens, it can be bought back by averaging the position.

2. entering into a position with a positive spread is more likely to result in a loss than a gain, so reverse the position in order to sell an expensive instrument and buy a cheap one.

3. taking into account the large spread and hence the size of the profit, a good tactic would be to gradually dial in the position and close the trade by the time the spread tapers off sharply before expiry. 200% per annum is not the limit.

As an example of working on the calendar spread we can offer you to consider trading the spread between the ruble-dollar futures, Si.

So for example the spread in the pair of futures with an expiration date of 9.11 and 9.15 is 5000 rubles per pair, which gives 200% profit. Of course, this is not fast money and you have to wait 4 years, the yield will be 50% per annum,

which is not provided by any bank deposit, while you can talk about a relatively risk-free operation. Example of a specific transaction, in September 2011 the spread in the pair rose to 10000 pips,

we went into the trade as it was an abnormal divergence due to the sharp drop in our market. At the end of December 2011 we closed the deal at 5300 pips spread, thus getting almost 100% return in four months.

With the calendar spread everything seems clear, then let's consider trading spread in the low liquid instrument's order book.

The strategy is a variant of the spread, only it is related to the calendar spread.

If we take any long term futures, we can see from 20 to 100 pips difference between the bid and ask, so buying and selling the contract at the best price, we will pocket the difference.

And in order to avoid losses due to price movements against us at the moment of a trade execution, we hedge our position with a counter-directional trade with a more liquid futures contract.

For example, if our limit order to buy a distant RTS futures is executed, we immediately sell a close one on the market, then we set a limit order to sell a distant RTS futures, and after the order is executed, we buy a close contract, thus fixing the profit from the arbitrage operation.

To make a decision to enter into a trade, we need to calculate the overhead for the operation, this will be the commission for buying the sale of two contracts and losses from the mark-to-market transaction with the close contract, usually it is 1-2 price increments.

In our example with the RTS futures, it is 8 roubles standard commission for intraday transactions (exchange + broker) and 6 roubles losses on the market totaling 14 roubles. At the point value of 0.629 point minimum "interesting" spread of the long contract is 30-40 points.

An important bonus of these transactions is that the exchange, when simultaneously buying and selling near and far contracts, takes only one, larger, CS for two contracts, thanks to us, thus creating liquidity.

Если мы возьмём любой дальний фьючерс, то можем заметить от 20 до 100 пунктов разницы между бидом и аском, поэтому купив и продав контракт по лучшей цене, мы это разницу положим к себе в карман.

А что бы в момент совершения сделки не получить убыток из-за движения цены против нас, мы хеджируем свою позицию противоположной по направлению сделкой более ликвидного ближнего фьючерса.

Например, исполняется наша лимитная заявка на покупку дальнего фьючерса РТС, мы тут же продаём ближний по маркету, далее выставляем на продажу лимитом дальний РТС и после исполнения заявки покупаем ближний контракт, зафиксировав, таким образом, прибыль от арбитражной операции.

I have thoughts of implementing such a thing. But I don't know about the pitfalls. I need to investigate. Overlay ticks on top of each other for a start.

And if the long futures, in view of weak liquidity, are in a moment put on the bar against my position - then the account is dead, if too big a contract.)

I have thoughts of implementing such a thing. But I don't know about the pitfalls. I need to investigate. Overlay ticks on top of each other for a start.

And if in view of weak liquidity the long futures may be momentarily put on the bar against my position - then the account is dead, if too big a contract.)

"Not bad", because the long futures will be in effect for another 3 months, after the expiration of the short futures.

I mean margin call with forced closing.

This situation is practically impossible, you buy one and sell the other - a position in terms of funds = neutral

Your income (loss) is the difference in price between the futures at the time of entry/exit!

The rest of the time you lose NOTHING, but you gain nothing = neutral position.

(Go on the INTERNET and look up "The Calendar Spread" - there are innumerable detailed descriptions of this strategy.)

This situation is practically impossible, you buy one and sell the other - position by means = neutral

I mean that on illiquidity in the moment against the position can shoot out so it's better to have a strong enough safety margin not to get into a margin call... .

For example - took long of short and short of long. Shorted long has gone up - someone foolishly or intentionally bought on the market, or limit sellers have all gone - only one left under the bar. On the near one the position is about zero, and on the far one - minus account. Well, this is so - hypothetically.) I may be wrong. I need to investigate, it's a very interesting topic.

I mean that on illiquidity in the moment against the position can shoot out so it's better to have a strong enough safety margin not to get into a margin call... .

For example - took long of short and short of long. Shorted long has gone up - someone foolishly or intentionally bought on the market, or limit sellers have all gone - only one left under the bar. On the near one the position is about zero, and on the far one - minus account. Well, it's so - hypothetically.) I have to look into it, it's a very interesting topic.

Once again, I repeat that this situation cannot exist!

( Read and think! Futures on ONE underlying asset - therefore the price of (both) futures changes in ONE direction!)

There may be delays in illiquid futures, but they are temporary.

Once again, there can be no such situation!

( Read and think!)

"It's not a hullabaloo, because the far futures will be valid for another 3 months, after the expiry of the near futures.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Good afternoon!

I invite you to discuss in this thread strategies and ways to implement them

on the FORTS derivatives market.

I will start with the first one.

Strategy - Futures Calendar Spread.

Advantages:

1. Small (relatively) investment of funds.

2. CS discounts on many futures.

3. Theoretically 100% breakeven.

4. Not affected by the currency component.

5. Not very difficult to implement.

6. Not very critical to order execution speed.

Disadvantages:

1. Low liquidity market for "long-range" futures.

2. no exact dividend payment dates,

difficult to determine the range of traded prices.

3. Too frequent changes of interest rates

4. Weak volatility between pairs (e.g. Si-6.15 and Si-9.15).

Any ideas on how to "reverse" the weaknesses?