FOREX - Trends, forecasts and implications 2015 - page 189

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Can someone explain to me again how (what) to look at the data in the CME and build levels on it

http://ruforum.mt5.com/threads/42855-arhiv-optsionnie-urovni-avtorskie-ili-nestandartnie-metodi?p=7647265&viewfull=1#post7647265

Here, Rena, is a worthy task.))

"You can calculate the delta for N steps ahead roughly as follows:

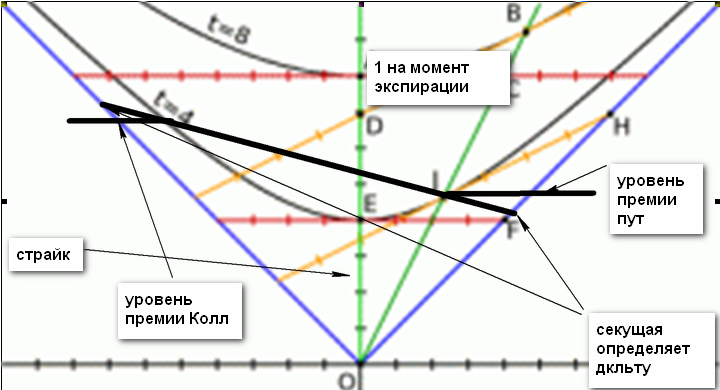

The horizontal axis represents the price and the vertical axis represents the premium (delta). The ordinate axis corresponds to the strike price. From above, the ordinate axis (delta) is limited by the value of one, which is the maximum that is reached at the time of expiration. The delta is approaching asymptotically to the maximum (minimum) value up to the moment of the expirationThe price moves on the abscissa axis from the strike from its minimum to maximum value. The delta (for put and call) is determined by the value of the secant at the points of intersection of the hyperbola.

The figure shows two hyperbola lines. The figure is slightly wrong - the upper hyperbola should be drawn below the hyperbola marked t=4. The parameters of the hyperbola change daily and depend on the amount of temporal decay, with the top of the hyperbola being "drawn" to the origin each day, the hyperbola itself being "drawn", its branches approaching the asymptotes. This means that the parameters of the hyperbola are determined by the time decay. These parameters can be calculated using the Greeks.

Now, why the hyperbola.

It follows from the delta ratio formula for puts and calls, given that there must be a balance of infused funds. If you think about it, the formula takes the form :

1

________ , where X is the delta

1 - 1/X

Such a picture can be calculated for each strike.

Options is a non-linear instrument, and therefore the price of a pip when the spot and futures price changes by one, in options trading is not equal to one, i.e. the price of each pip is different and is determined by the delta. That is why the delta is primary. That is why the price cannot be determined numerically, but only with a certain error - due to the non-linearity of its change.

http://ruforum.mt5.com/threads/42855-arhiv-optsionnie-urovni-avtorskie-ili-nestandartnie-metodi?p=7647265&viewfull=1#post7647265

Strange, if the volume flows from open to closed - will it change? And the premium is exactly the same.... And the futures will close completely - it won't. That's the whole mechanism of dynamics for the month, which does not change the level and the solution to the problem is already here...

An example can be given, preferably by the pound)))

We speculators are only interested in where and where to make an advance. The premium is a matter for the futures holders. The example is in the calculation - where to go and from where, because by making the calculation we get two prices. One is before the calculation and the other is after the calculation. There is an entry and an exit. The strategy will work until the expiry occurs.

No way))))

Just what I was looking for.

http://ruforum.mt5.com/threads/42855-arhiv-optsionnie-urovni-avtorskie-ili-nestandartnie-metodi?p=7629283&viewfull=1#post7629283

On the pound, the sell has moved to boo, as it is not clear with the direction

No way))))

Just what I was looking for.

http://ruforum.mt5.com/threads/42855-arhiv-optsionnie-urovni-avtorskie-ili-nestandartnie-metodi?p=7629283&viewfull=1#post7629283

No way))))

Just what I was looking for.

http://ruforum.mt5.com/threads/42855-arhiv-optsionnie-urovni-avtorskie-ili-nestandartnie-metodi?p=7629283&viewfull=1#post7629283