Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.13 11:22

Forex Weekly Outlook Dec.15-19The US dollar retraced some of the previous gains but managed to retrace the retracement as well. Japan’s Lower House Elections, UK inflation and employment data and the most important event: the last Fed decision for the year are the main highlights for this week. Follow along as we explore the Forex market movers.

The US consumer is certainly upbeat: US retail sales release showed Americans spent 0.7% more in November compared to the previous month and core sales followed suit. Also confidence is high, the highest since January 2007 according to UoM. This is partially attributed to the collapse in oil prices, which is hurting the Canadian dollar. In the euro-zone, the highly anticipated TLTRO fell short of predictions, strengthening the notion that QE is coming to the old continent. The antipodean currencies took different directions: the Aussie got a target of 0.75 from the central bank, while the New Zealand’s central bank seemed upbeat. Volatility continues being high despite the upcoming holidays. And now, we have the most important central bank speaking out:

- Japan Lower House Elections: Sunday. Japanese Prime Minister Shinzo Abe’s ruling party is expected to win sweeping victory according to media projection. Abe’s Liberal Democratic Party (LDP) is expected to take 303-320 seats of the powerful chamber’s 475 seats, reaching “super majority” needed to override votes in the upper house. The elections were called after Abe decided to push back the next sales tax hike as the previous one threw the country into recession. With high expectations, a failure to win a convincing majority could send the yen soaring and USD/JPY plunging down.

- UK inflation data: Tuesday, 9:30. UK inflation edged up to an annual rate of 1.3% in October, following 1.2% in the previous month. Analysts expected CPI to remain at 1.2%. Prices in the recreation and culture sectors increased while transport costs, as well as food and non-alcoholic beverages, fell. Despite this rise, the Bank of England warned the inflation rate could dip to as low as 1% in the coming months. However, the small rise in the rate of inflation is unlikely to alter the central bank’s decision to keep its key interest rate at 0.5% for the time being. Inflation is expected to reach 1.2% in November.

- German ZEW Economic Sentiment: Tuesday, 10:00. German economic sentiment rebounded in November, rising 15.1 points from October to 11.5. Analysts expected a modest improvement of 4.5 points towards 0.9 points. The recent encouraging signs of growth in the Eurozone suggesting the economy is stabilizing, contributed to the rise in sentiment. Economic sentiment is expected to edged up to 19.8 in December.

- UK Governor Mark Carney speaks: Tuesday, 10:30. Mark Carney, head of the Bank of England is scheduled to hold a press conference and talk about the Financial Stability Report in London. Despite elevated household confidence, as well as other economic indicators, including a recent positive trend in wage growth, the Eurozone struggling economy poses the major threat to the UK’s recovery.

- US Building Permits: Tuesday, 10:30. The number of permits for single- and multi-family housing edged up 4.8% in October, reaching a 1.08 million-unit pace, the highest since June 2008. The sharp rise in October was preceded by another increase in the prior month indicate a recovery trend in the housing market. However, the recent acceleration in demand is expected to boost wages and contribute to economic growth. The number of permits for single- and multi-family housing is forecasted t reach 1.06 million.

- UK employment data: Wednesday, 9:30. The number of unemployed in the UK fell by 20,400 in October, reaching 931,700, the lowest level since August 2008. The sharp drop continued a positive trend in the UK labor market with an 18,400 fall in September and a 33,400 decline in August. The ongoing improvement in the job market is an encouraging sign that wages will eventually pick-up and boost UK’s domestic economy. Claimant Count Change is expected to drop by 19,800 this time. It is also important to note wages: a rise of 1.3% is expected in average hourly earnings. The unemployment rate is predicted to tick down to 6% from 5.9% last time.

- US inflation data: Wednesday, 13:30. U.S. consumer prices remained unchanged in October, following September’s rise of 0.1%. Analysts expected a 0.1% decline in October. On a yearly base, consumer price index also remained unchanged from September’s increase of 1.7%. Excluding food and energy costs core consumer prices gained 0.2% in line with market forecast. On an annual basis, core CPI rose 1.8%, and remains below the Federal Reserve’s target of 2.0%. CPI is expected to decline 0.1%, while core CPI is predicted to gain 0.1%.

- Fed decision: Wednesday, 19:00, press conference at 19:30. In the last FOMC gathering in October, the Fed ended QE3 as expected, ending all doubts. Their bullish view of the labor market gave a boost to the dollar. The main focus of this meeting is the “considerable time” phrase related to the timing of the first rate hike. There is speculation that the Fed will alter the phrasing and call for patience on the rate hikes. Given the recent jobs report, which finally included a rise in wages, there is also a chance that the Fed totally removes this wording thus hinting of an earlier rate hike, perhaps even in March. In addition to the statement, the Fed releases its forecasts, including the famous “dot chart”. The last release showed rates rising to 1.375 on average by the end of 2015. Will this average be pushed back with lower inflation expectations? And last but not least, Fed Chair Janet Yellen meets the press and reporters will likely try to extract some more specific wording about the timing of rate hikes. There are quite a few wild cards here and volatility is certainly expected to be wild. All in all, an upbeat view on the US economy should keep the dollar bid, while dovish caution, something that the Fed does very often, would weigh on the greenback.

- NZ GDP: Wednesday, 21:45. New Zealand’s economy expanded at the fastest pace in 10 years in the second quarter, as Gross domestic product edged up 3.9% on a yearly base and 0.7% from the first quarter. Both readings exceeded market forecast. Strong domestic demand is the major growth force in New Zealand’s economy, but surging exports to China have also contributed to this expansion. Gross Domestic Product is expected to gain 0.7% in the third quarter.

- German Ifo Business Climate: Thursday, 9:00. German business sentiment rebounded in November, reaching 104.7 from 103.2 posted in the prior month. The reading was better than the 103 points forecasted by analysts, signaling the downturn trend in German economy has halted. The slowdown in economic activity was led by the euro-area partners’ sluggish demand and a sharp drop in exports to Russia. The third quarter growth rate reached just 0.1% after a 0.1% contraction in the first quarter. However recent economic data suggest an ongoing improvement in the German economy. German business sentiment is expected to improve further to 105.6.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing initial claims for unemployment benefits dropped 3,000 last week, reaching 294,000, staying below the 300,000 level. Analysts expected claims to reach 299,000. However, despite the fall in weekly claims, the number of continuing claims increased from 2.372 million to 2.514 million. The 4-week moving average increased to 299,250, from 299,000 posted last week. The number of initial claims for unemployment benefits is expected to reach 297,000 this week.

- US Philly Fed Manufacturing Index: Thursday, 15:00. The Philly Fed manufacturing survey jumped from 20.7 in October to 40.8 in November posting the highest reading since December 1993. The big rise suggests increased growth in manufacturing activity. New orders and shipments showed similar improvement this month. Employment was higher and the outlook indicator showed expected growth will continue over the next six months. Manufacturing activity in the Philadelphia area is predicted to rise to 26.3 this time.

- Japan rate decision: Friday. The Bank of Japan’s November Statement revealed the bank is willing to step up its operations of quantitative and qualitative monetary easing and presented its assessment of the outlook of the Japanese economy. The Policy Board members stated the weaknesses in demand after the consumption tax hike implementation. Prime Minister Shinzo Abe announced he would postpone the 2 percentage point tax hike scheduled for next October and also called for a general election.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.15 16:25

Technical analysis for EURUSD and AUDUSD (based on dailyfx article)

- EUR/USD has moved steadily higher since finding support early last week ahead of the 15th square root relationship of the year’s high in the 1.2250 area

- A daily close over the 2nd square root relationship of the year’s low at 1.2470 will turn us positive on the exchange rate

- Weakness below 1.2360 is needed to reinstill downside momentum in the euro

- A very minor turn window is eyed on tomorrow/Wednesday

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | 1.2360 | 1.2415 | 1.2425 | 1.2470 | 1.2495 |

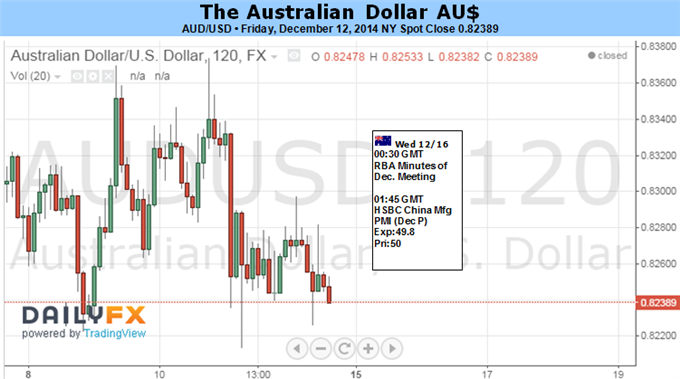

- AUD/USD fell to a new low for the year on Monday before rebounding again off a median line related to the 2013 high

- Our near-term trend bias is lower in the Aussie while below .8405

- A close under .8205 is needed to set off a new leg lower in the rate

- A turn window of some importance is eyed right here

- A close above .8405 would turn us positive on AUD/USD

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| AUD/USD | .8125 | .8205 | .8225 | .8280 | .8405 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.13 11:29

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral- Australian Dollar Torn Between Conflicting Year-End Liquidation Forces

- FOMC Outcome, RBA Minutes May Break Deadlock and Sink the Aussie

The Australian Dollar finds itself torn between conflicting forces as

year-end liquidation on trends dominating markets in 2014 gathers

momentum. Swelling risk appetite – embodied by a relentless push upward

by the S&P 500 – and a firming US Dollar have been defining themes

in the past year. Profit-taking on these trades ahead of the transition

to 2015 has produced a parallel downturn in the greenback and the

benchmark stock index.

This dynamic carries conflicting implications for AUDUSD. On one hand,

the prices are being offered support by a market-wide unwinding of

long-USD exposure. On the other, the shedding of risk-on exposure is

putting downward pressure on the sentiment-geared Aussie Dollar. Not

surprisingly, this produced relative standstill, with prices locked in a narrow range and waiting for guidance even as notable reversals are recorded elsewhere in the anti-USD space.

A shift in the relative monetary policy outlook may break the deadlock

in the week ahead. Shifting expectations over recent weeks have

delivered a priced-in G10 forecast that sees the RBA as one of the most

dovish central banks in 2015. Indeed, with OIS rates implying at least

one interest rate cut in the coming 12 months, the Australian monetary

authority leads on the conventional policy easing front. Only the BOJ

and the ECB may edge out Glenn Stevens and company for the most-dovish

crown, and then only via expansions of non-standard measures.

This stands in stark contrast with the policy trajectory at the

Federal Reserve. Markets are betting on at least one rate hike in 2015

and have been flirting with the possibility that US officials will be

able to squeeze in two of them before year-end. US economic news-flow

appears to be gathering steam relative to consensus forecasts once

again. Data from Citigroup suggests that, on the whole, realized

outcomes are now outstripping expected ones by the widest margin since

mid-September. This has already encouraged markets to bet on the sooner

arrival of the first post-QE rate hike. Next week’s FOMC policy

announcement – this time complete with an updated set of economic

projections and press conference from Chair Janet Yellen – may see the

timeline shorten further.

On the domestic front, minutes from December’s RBA meeting will be in

the spotlight. The markets were not meaningfully swayed against betting

on a 2015 rate cut by the neutral statement that emerged out of that

sit-down. This suggests that anything but a convincing hawkish

rhetorical shift – an outcome that seems overwhelmingly unlikely even

on a relative basis – will keep bets on a 25-75 basis point pro-USD

move in the policy spread comfortably in place. Taken together with

guidance from the Fed, that may tip the scales to produce a bearish

break out of consolidation for the Aussie.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.14 17:43

Forex - Weekly outlook: December 15 - 19

The dollar gained ground against the euro on Friday following the

release of strong U.S. economic data and surged to more than five year

highs against the commodity-exposed Canadian dollar as oil prices

continued to drop.

EUR/USD was up 0.44% to 1.2461 in late trade. The dollar was boosted

after data showing U.S. consumer sentiment rose to an almost eight-year

high in December.

The preliminary reading of the University of Michigan's consumer

sentiment index rose to 93.8, the highest level since January 2007 and

ahead of forecasts of 89.7. Consumer sentiment was boosted by the

improving outlook for employment and wage growth and lower gasoline

prices.

The data underlined expectations for a hike in U.S. interest rates by the Federal Reserve next year.

The U.S. dollar index, which measures the greenback against a basket of

six major currencies, recovered from session lows of 88.12 following the

report to settle at 88.34, still off 0.26% for the day. On Monday the

index rose to a five year high of 89.53.

The dollar also pushed higher against the yen, with USD/JPY at 118.77 in late trade, off lows of 118.05.

Elsewhere, the Canadian dollar fell to five-and-a-half year lows, with

USD/CAD hitting highs of 1.1590, before easing back to 1.1578 in late

trade.

Oil prices dropped to their lowest level in five years on Friday after

the International Energy Agency cut its forecast for global oil demand

for the fifth time in six months.

Canada is a major oil exporter and the currency's sensitivity to crude prices has intensified as prices continued to tumble.

The Russian ruble fell to record lows against the dollar on Friday and

the Norwegian krone fell to 11-year lows after rate hikes by both

countries central banks on Thursday failed to offset the selling

pressure brought to bear by the continued decline in oil prices.

USD/RUB jumped 3.23% to 58.20 late Friday while USD/NOK was up 0.98% to

settle at 7.36 after hitting highs of 7.39 earlier, the most since

September 2003.

In the week ahead, investors will be awaiting the outcome of Wednesday’s

Federal Reserve policy meeting for further clarification on when

interest rates might start to rise. Japan’s central bank is also to hold

a policy setting meeting next week. The euro zone is to produce what

will be closely watched reports on private sector activity.

Monday, December 15

- Japan is to publish reports on the Tankan manufacturing and non-manufacturing index.

- Switzerland is to publish data on producer price inflation.

- In the euro zone, Germany’s Bundesbank is to publish its monthly report.

- The U.K. is to release private sector data on industrial order expectations.

- Later Monday, the U.S. is to release reports on manufacturing activity in the New York region and industrial production.

- The Reserve Bank of Australia is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective.

- China is to publish the preliminary reading of its HSBC manufacturing index.

- In the U.K., the Bank of England is to publish its financial stability report. BoE Governor Mark Carney is to hold a press conference about the report.

- The U.K. is also to release data on consumer inflation, which accounts for the majority of overall inflation.

- The euro zone is to publish preliminary data on private sector activity, while Germany and France are to also to publish data on private sector growth.

- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- Canada is to produce data on manufacturing sales and foreign securities purchases.

- The U.S. is to publish reports on building permits and housing starts.

- Later in the day, New Zealand is to release data on its current account.

- Japan is to publish a report on its trade balance.

- The U.K. is to release data on the change in the number of people employed, the unemployment rate and average earnings. In addition, the BoE is to publish the minutes of its latest policy meeting.

- The euro zone is to produce revised data on consumer price inflation.

- Canada is to publish a report on wholesale sales.

- The U.S. is to release data on consumer inflation and the current account. Later Wednesday, the Federal Reserve is to publish its rate statement and economic projections for the next two years. Fed Chair Janet Yellen is to hold what will be a closely watched press conference.

- New Zealand is to release data on gross domestic product, the broadest indicator of economic activity and the leading measure of the economy’s health.

- Switzerland is to report on its trade balance.

- The Ifo Institute is to release a report on German business climate.

- The U.K. is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.S. is to release data on initial jobless claims and manufacturing activity in the Philadelphia region.

- New Zealand is to release private sector data on business confidence.

- The Bank of Japan is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision. The bank will hold a press conference following the announcement.

- Germany is to release a report by Gfk on consumer climate.

- The U.K. is to release data on public sector net borrowing, as well as a private sector report on retail sales.

- Canada is to round up the week with reports on retail sales and consumer inflation.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.14 17:45

AUD/USD weekly outlook: December 15 - 19

The Australian dollar ended close to the lowest level in more than four

years against its U.S. counterpart on Friday, amid indications a

strengthening U.S. economic recovery will force the Federal Reserve to

start raising interest rates sooner and faster than previously thought.

AUD/USD fell to 0.8213 on Thursday, the pair's lowest since June 2010,

before subsequently consolidating at 0.8246 by close of trade on Friday,

down 0.28% for the day and 0.78% lower for the week.

The pair is likely to find support at 0.8213, the low from December 11, and resistance at 0.8374, the high from December 11.

The preliminary reading of the University of Michigan's consumer

sentiment index released Friday rose to 93.8, the highest level since

January 2007 and ahead of forecasts of 89.7.

Consumer sentiment was boosted by the improving outlook for employment and wage growth and lower gasoline prices.

The data underpinned expectations for a hike in U.S. interest rates by the Federal Reserve next year.

Economic reports pointing to a slowdown in China also fuelled risk aversion.

Official data released Friday showed that industrial production in China

rose 7.2% in November, missing expectations for an increase of 7.5% and

slowing from a 7.7% gain in October.

The disappointing data added to fears that China will miss its annual

growth target of 7.5% and boosted speculation that the government will

need to roll out fresh stimulus measures to avert a sharper slowdown.

The Asian nation is Australia's largest trade partner.

Meanwhile, in Australia, data published Thursday showed that the number

of employed people increased by 42,700 last month, beating expectations

for a 12,400 rise.

The report also showed that Australia's unemployment rate ticked up to

6.3% in November from 6.2% the previous month, in line with

expectations.

In the week ahead, investors will be awaiting the outcome of Wednesday’s

Federal Reserve policy meeting amid speculation that policymakers could

drop an assurance that interest rates will stay low for a "considerable

time".

Monday, December 15

- The U.S. is to release reports on manufacturing activity in the New York region and industrial production.

- The Reserve Bank of Australia is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective.

- China is to publish the preliminary reading of its HSBC manufacturing index.

- The U.S. is to publish reports on building permits and housing starts.

- The U.S. is to release data on consumer inflation and the current account. Later Wednesday, the Federal Reserve is to publish its rate statement and economic projections for the next two years. Fed Chair Janet Yellen is to hold what will be a closely watched press conference.

- The U.S. is to release data on initial jobless claims and manufacturing activity in the Philadelphia region.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.17 15:01

2014-12-17 13:30 GMT (or 15:30 MQ MT5 time) | [USD - CPI]- past data is 0.0%

- forecast data is -0.1%

- actual data is -0.3% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.3 percent in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.3 percent before seasonal adjustment.

The gasoline index posted its sharpest decline since December 2008 and was the main cause of the decrease in the seasonally adjusted all items index. The indexes for fuel oil and natural gas also declined, and the energy index fell 3.8 percent. The food index rose 0.2 percent with major grocery store food groups mixed.

The index for all items less food and energy increased 0.1 percent in November. The shelter index rose 0.3 percent, and the indexes for medical care, airline fares, and alcoholic beverages also rose. In contrast, the indexes for apparel, used cars and trucks, recreation, household furnishings and operations, personal care, and new vehicles all declined in November.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 12 pips price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.17 21:01

2014-12-17 19:30 GMT (or 21:30 MQ MT5 time) | [USD - FOMC Press Conference]- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Press Conference] = It's among the primary methods the Fed uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, along with commentary about economic conditions such as the future growth outlook and inflation. Most importantly, it provides clues regarding future monetary policy.

==========

The Fed is unlikely to start its rate hike process for "at least the next couple of meetings," Fed Chair Janet Yellen said.

The Fed surprised some Wednesday

by leaving the phrase "considerable time" in its statement, but as a

reference to the timing of rate hikes rather than a policy.

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 110 pips price movement by USD - FOMC Press Conference news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.18 05:59

AUD/USD Daily OutlookAUD/USD dropped further to as low as 0.8106 so far and met mentioned target of 100% projection of 0.9401 to 0.8642 from 0.8910 at 0.8151. Intraday bias remains on the downside and deeper fall should be seen to 0.7945/8066 key support zone. On the upside, above 0.8235 minor resistance will turn bias neutral and bring consolidations first. But break of 0.8539 is needed to confirm near term reversal. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, recent development in AUD/USD suggests that it's building downside momentum and the fall from 1.1079 is accelerating again. Focus is now on 0.8066 key support level, 61.8% retracement of 0.6008 to 1.1079 at 0.7945. Decisive break there will carry long term bearish implication and pave the way to long term fibonacci level at 0.7182 and below. On the upside, break of 0.9504 is needed to confirm medium term reversal. Otherwise, we won't turn bullish even in case of strong rebound.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.19 03:57

AUD/USD Exhaustion Trade- Shorts at Risk Above 8064 (based on dailyfx article)

- AUDUSD coming into key support threshold / inflection range 8065-8118

- Region defined by the 1.618% ext off the 2011 high & the 2010 low

-

Shorts at risk into this region- bullish invalidation

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish market condition with trying to break 0.8214 support level:

W1 price is on primary bearish market condition with breaking 0.8301 support on open W1 bar for now.

MN price is on bearish breakdown by breaking 0.8479 support level on W1 close bar.

If D1 price will break 0.8214 support level so the primary bearish will be continuing

If D1 price will break 0.8541 resistance level so the secondary rally may be started within the primary bearish with possible reversal to bullish condition

If not so we may see the ranging within bearish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-12-15 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - New Motor Vehicle Sales]

2014-12-15 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Mid-Year Economic and Fiscal Outlook]

2014-12-16 00:15 GMT (or 02:15 MQ MT5 time) | [AUD - RBA Assist Gov Debelle Speech]

2014-12-16 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Monetary Policy Meeting Minutes]

2014-12-16 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Flash Manufacturing PMI]

2014-12-16 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Building Permits]

2014-12-17 13:30 GMT (or 15:30 MQ MT5 time) | [USD - CPI]

2014-12-17 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Federal Funds Rate]

2014-12-18 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : bearish

TREND : breakdown