Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.05 19:46

Forex Weekly Outlook September 8-12Mark Carney and Haruhiko Kuroda speeches, New Zealand rate decision, Australian employment data, US Unemployment Claims, Retail sales and Consumer sentiment are the major events on our calendar for this week. Here is an outlook on the main market-movers coming our way.

Last week Non-Farm Payrolls declined below the 200,000 level with only a 142,000 job gain in August, considerably lower than the 230,000 gain expected by analysts. The unemployment rate fell by 0.1%, but was attributed to a 0.1 drop in the participation rate. Despite a rebound in economic growth during the second quarter, the recent employment data suggests the economy shifts to lower gear. Will this trend continue?

- Mark Carney speaks: Tuesday, 8:30. BOE Governor Mark Carney will speak in Liverpool and may speak about his intentions to raise rates before wages increase. The International Monetary Fund expects U.K. growth to soar this year. However wage growth is not expanding according to projections. Carney stated that the banks have made “substantial progress” in returning to normal and the expansion trend is gathering momentum.

- New Zealand Rate decision: Wednesday, 21:00. The Reserve Bank of New Zealand raised its official Cash Rate to 3.5% in July from 3.25% in the previous month. This was the fourth hike in five months amid a growth trend in the economy. The rise was in line with market forecast but economists believe this was the last rise in this hike series, after which the Bank will assess the tightening measures impact on the economy. The Reserve Bank has previously announced another rate hike of 1.25% by the end of 2014 and 2015 reaching a ‘neutral’ level of 4.5%. The bank said the economy was expected to expand at an annual pace of 3.7% in 2014. No changes are forecasted this time.

- Australian employment data: Thursday, 1:30. Australia’s unemployment rate soared to a 12-year high of 6.4% in July from 6.0% in the previous month while economists expected the rate to remain at 6.0%. The economy contracted 300 jobs following a 15,900 job addition in June. Full-time positions increased by 14,500 while part-time roles declined 14,800. The participation rate, increased by 0.1% to 64.8%. Economists believe this decline is only a temporary glitch reflecting the volatility of month-to-month data. Australia’s job market is expected to gain 15,200 jobs while the Unemployment rate is expected to decline to 6.3%.

- US Unemployment Claims: Thursday, 12:30. The number of jobless claims increased by 4,000 last week to 302,000, a bit higher than the 300,000 expected by analysts. The four-week moving average of initial claims edged up 3,000 last week to 302,750. The level of continuing claims declined by 64,000 from the previous week and the level of unadjusted continuing claims fell by 95,339 to 2,306,286. Overall, the level of claims last week was well below the 4,388,758 posted a year ago. Jobless claims are expected to increase by 306,000.

- Haruhiko Kuroda speaks: Friday, 6:05. BOJ Governor Haruhiko Kuroda will speak at the National Graduate Institute for Policy Studies in Tokyo. He may talk about the central bank’s intentions to raise the sales tax again in order to narrow government deficit. Kuroda remained optimistic about pulling out of deflation and reaching the 2% inflation target. BOJ Governor is also positive that Japan’s economy will continue to expand in the months ahead.

- US Retail sales: Friday, 12:30. U.S. retail sales unexpectedly halted in July, remained unchanged from June, suggesting some loss of momentum in the economy at the beginning of the third quarter. However gob growth continued to be positive, indicating sales activity is bound to strengthen in the coming months. The main fall occurred in the automobile sector declining 0.2% after a 0.3% fall. Meanwhile, core retail sales, excluding automobiles, gasoline, building materials and food services inched up 0.1% in July. Retail sales are predicted to increase 0.3% while core sales are expected to gain 0.2%.

- US Prelim UoM Consumer Sentiment: Friday, 13:55. American consumer confidence unexpectedly dropped in August to a nine-month low of 79.2 points from 81.8 points in July, missing predictions for a reading of 82.7. The unexpected fall was led by concerns over economic outlook as households projected an inflation rate of 3.4% over the next year, distinctly higher than the 0.4% wage growth forecasted. This pessimistic projection may impact consumer spending in the coming months. American consumer confidence is expected to pick-up to 83.2 this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.06 14:28

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral- AUD/USD Consolidates As Dovish Policy Bets Diminish Amidst Return To Yield

- Void of Major Regional Data To Leave ‘Period of Stability’ Rates Scenario Intact

- Carry Demand May Support AUD As Traders Look Past Geopolitical Tensions

The Australian Dollar is heading for another relatively flat finish to

the week ahead of the Jackson Hole Symposium. The currency was afforded

some support as RBA policy expectations shifted away from the more

dovish end of the spectrum. This came on the back of a status-quo set

of RBA Meeting Minutes and a relatively optimistic set of comments from

Governor Stevens on the domestic economy. Additionally, a broader

return to high-yielding instruments helped offset some of the negative

cues provided by a deterioration in Chinese economic data.

Looking ahead, RBA policy bets as well as general market risk appetite

remain the dominant themes to monitor for the Aussie. On the policy

front; a void of local economic data is on the calendar heading into

the end of the month. This is likely to leave the ‘period of stability’

baseline scenario for rates intact. Which in turn could keep the

currency supported via its yield spread over its major counterparts.

Of course, the appeal of the currency’s interest rate advantage is

intrinsically linked to broader risk sentiment. Implied volatility

remains near multi-year lows despite a small recovery for the gauge

over the past month. This suggests traders are pricing in a relatively

small probability of major market swings in the near-term. Such an

environment raises the attractiveness of carry trades and bodes well

for the Aussie.

Further, the threat posed to investor optimism by ongoing geopolitical

turmoil appears to have diminished in recent weeks. Storm clouds

continue to loom over Eastern Europe and the Middle East. Yet traders

seem to have become desensitized to the latest flare-ups. This suggests

it would likely take a material escalation in the regional turmoil to

threaten the resilience of the Australian Dollar.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.09 08:17

2014-09-09 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Home Loans]- past data is 0.1%

- forecast data is 1.1%

- actual data is 0.3% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - Home Loans] = Change in the number of new loans granted for owner-occupied homes. It's a leading indicator of demand in the housing market - most homes are financed, so it provides an excellent gauge of how many qualified buyers are entering the market.

==========

The total number of home loans in Australia was up a seasonally adjusted 0.3 percent on month in July, the Australian Bureau of Statistics said on Tuesday - coming in at 52,251.

That missed forecasts for an increase of 1.0 percent, and down from the downwardly revised 0.1 percent gain in June (originally 0.2 percent).

The value of home loans for owner-occupied housing was flat on month at A$17.058 billion - down from the 1.7 percent increase in the previous month.

Investment lending climbed 6.8 percent on year to A$11.513 billion, after adding 0.1 percent a month earlier.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 25 pips price movement by AUD - Home Loans news event

newdigital:

If D1 price will break 0.9392 resistance level on close bar so we may see good breakout with possible reversal from bearish to the bullish market condition..

If not so we may see the ranging market condition within primary bearish.

- Recommendation for long: watch D1 price for breaking 0.9392 resistance level on close bar for possible buy trade

- Recommendation to go short: n/a

- Trading Summary: ranging

0.9392 resistance level (which is 0.9402 for now) was not broken - the price was reversed for good breakdown:

- Chinkou Span line broke the price from above to below on close D1 bar

- The price broke Ichimoku cloud (both Sinkou Span A and Sinkou Span B lines) from above to below

- .9188 support level is going to be broker on close D1 bar

This is fully reversal of D1 price movement from secondary ranging to primary bearish.

I expected bullish breakdown but received bearish breakdown ... so - why the price was moved on this way? Because of fundamental news events, and one of the event which moved the price was the following:

2014-09-10 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.10 12:14

2014-09-10 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]- past data is 3.8%

- forecast data is n/a

- actual data is -4.6% according to the latest press release

if actual > forecast (or actual data) = good for currency (for AUD in our case)

[AUD - Home Loans] = Change in the level of a diffusion index based on surveyed consumers. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

Bad time for Australia. Share market falls as consumer confidence drops

The Australian share market has suffered its worst fall in more than a month, with investors influenced by losses on Wall Street and an unexpected fall in consumer confidence.

All sectors fell but finance companies managed to post the slimmest losses.

The NAB and ANZ bank fell by 0.4 per cent and 0.25 per cent respectively, while the Commonwealth closed steady. Westpac gained 0.4 per cent.

The All Ordinaries index and the ASX200 both fell 34 points or 0.6 per cent to close at 5,574.

The mining sector was one of the hardest hit; BHP Billiton dropped 0.8 per cent and Rio Tinto 0.4 per cent, as the benchmark Chinese iron ore price softened a touch more overnight Tuesday.

Atlas Iron dropped 4.2 per cent and Fortescue Metals Group fell 2.7 per cent, but gold miner Newcrest gained 1.25 per cent.

The Westpac Melbourne Institute Consumer Confidence index fell sharply and unexpectedly in its latest reading, erasing the gains it had made over the previous three months.

The index is now 4.6 points lower at 94, with any reading below 100 indicating that pessimists outnumber optimists.

The Australian dollar was also hurt by the confidence index and continued its slide on speculation that US interest rates will begin increasing before those domestically.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.11 06:22

AUDUSD Technical Analysis (based on dailyfx article)

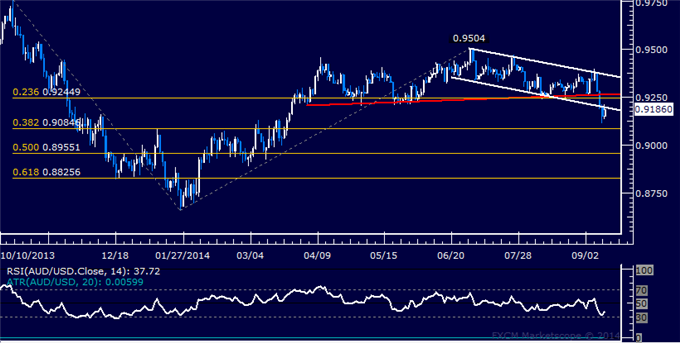

- AUD/USD Technical Strategy: Short at 0.9186

- Support:0.9085, 0.8955, 0.8826

- Resistance: 0.9195, 0.9264, 0.9365

The Australian Dollar appears poised to continue lower against the US Dollar after sliding to the weakest level in close to five months. A break below support at the bottom of a falling channel set from mid-June exposes the 38.2% Fibonacci expansion at 0.9085, with a further push beyond that targeting the 50% level at 0.8955. Alternatively, a reversal back above the channel floor – now recast as resistance at 0.9195, opens the door for a test of the 0.9245-64 area marked by a rising trend line set from April and the 23.6% expansion.

AUDUSD Technical Analysis (based on morning finance article)

The pair confirmed a weak closing below the 200 days line suggesting further weakness. Only a recover above the line at 0,9183 will help to stabilize the pair! The indicators of the daily chart are still well negative while those of the s/t ones already turned mixed supporting some consolidation/ correction. Possible an extension of the corrective move up suggesting a retest of the 0,9250 area with even a possible overshooting toward the 200 hours line, now found at 0,9296!! We stay on the sideline waiting for higher levels to sell!!

- Ilya Spivak

- www.dailyfx.com

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.12 08:04

Technical Analysis: AUDUSD & NZDUSD trade similarly for different reasons

The NZDUSD made new lows on the back of comments from RBNZ’s Wheeler who said that the currency was overvalued and that rates would stay on hold until 1Q of 2015. Meanwhile in Australia, the AUDUSD made it’s new move lows despite much stronger employment statistics that had the market questioning the seasonals.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is inside Ichimoku cloud for breaking Sinkou Span A line together with Chinkou Span/price breakout on open bar which is indicating future possible reversal of the price movement from primary bearish to the primary bullish market condition.

W1 price is inside the cloud/kumo with ranging bullish - the price is floating between 0.9470 resistance and 0.9235 support levels.

H4 price is on bullish fior trying to break 0.9402 resistance for bullish to be continuining.

If D1 price will break 0.9392 resistance level on close bar so we may see good breakout with possible reversal from bearish to the bullish market condition..

If not so we may see the ranging market condition within primary bearish.

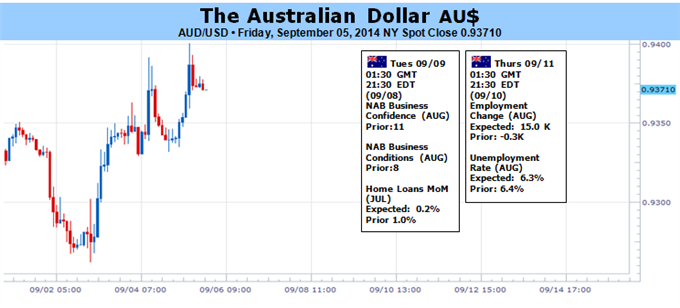

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-09-08 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - ANZ Job Advertisements]

2014-09-09 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

2014-09-09 14:00 GMT (or 16:00 MQ MT5 time) | [USD - FOMC Member Tarullo Speaks]

2014-09-10 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

2014-09-11 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Employment Change]

2014-09-11 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-09-11 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-09-12 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-09-12 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movementSUMMARY : bearish

TREND : ranging

Intraday Chart