Forum on trading, automated trading systems and testing trading strategies

Indicators: Moving Average of Oscillator (OsMA)

newdigital, 2014.03.21 07:04

Scalping with MACD (based on dailyfx article)

- Scalpers should look to systematize their approaches and strategies.

- Multiple Time Frame Analysis can help day-traders see ‘the bigger picture.’

- Traders can use MACD to initiate positions in a day-trading approach.

When a scalper begins their day, there are usually quite a few questions that need to be answered before ever placing a trade.

What’s moving the market this morning?

Which markets are most active?

What drivers (or news) might come out to push the market further?

Is my coffee ready yet?

These are just a few examples… but suffice it to say that those who are

day-trading in markets have quite a bit on their mind every single

trading day.

The Setup

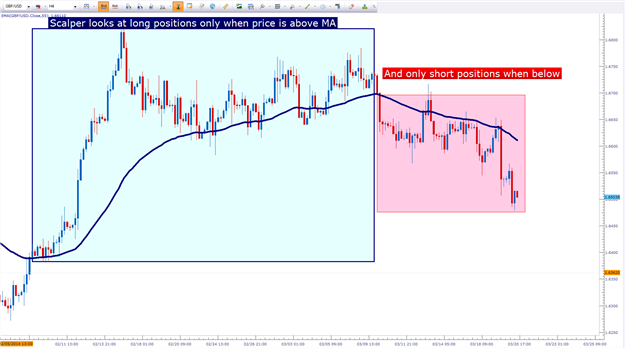

Before a scalper ever triggers a position they need to first find the appropriate market environment.

For fundamental-based traders, Multiple Time Frame Analysis can be

helpful; but more important is their outlook or opinion and the fact

that that outlook or opinion should mesh with the ‘bigger picture’ view

of what’s going on at the moment.

For scalpers, the hourly and 4-hour charts carry special importance, as

those are the ideal timeframes for seeing the bigger picture.

After that, traders should look to diagnose the trend (or lack thereof).

A great indicator for investigating trend strength is the Average Directional Index (ADX). Also popular for investigating trends is the Moving Average Indicator.

The Entry

After the day-trader has found a promising setup, they then need to

decide how to trigger into positions, and MACD can be a very relevant

option for such situations.

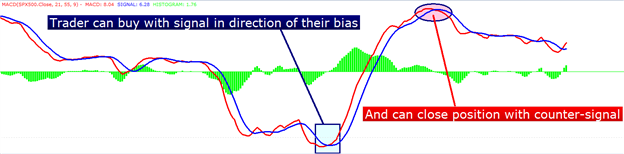

Because the trader already knows the direction they want to trade in,

they merely need to wait for a corresponding signal via MACD to initiate

the position.

When MACD crosses up and over the signal line, the trader can look to go long.

After a long position is triggered, the trader can look to close the

position when MACD moves down and under the signal line (which is

usually looked at as a sell signal, but because you did the ‘bigger

picture analysis’ with the longer-term chart, this is merely a ‘close

the long signal.’)

Scalpers can trigger positions when MACD Signal takes place in direction of their bias

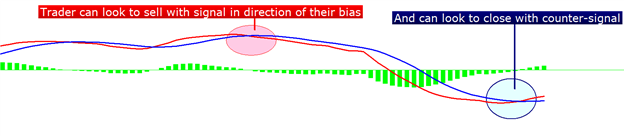

On the other side of this equation: If the trader had determined the

trend to be down on the longer-term chart or if their fundamental bias

is pointing lower, they can look for MACD to cross down and under the

signal line to trigger their short position.

And once MACD crosses up and over the signal line, the trader can look to cover their short position.

Scalpers can close positions when opposing MACD Signal takes place

The Context

The aforementioned approach can work phenomenally in a

day-trading/scalping approach. But the fact-of-the-matter is that

scalping profitably entails a lot more than just a trading plan, and an

entry strategy.

Risk management is the undoing of most new traders; and day-traders and

scalpers fall victim to this susceptibility even more so than most.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

MACD Momentum:

Author: ffoorr