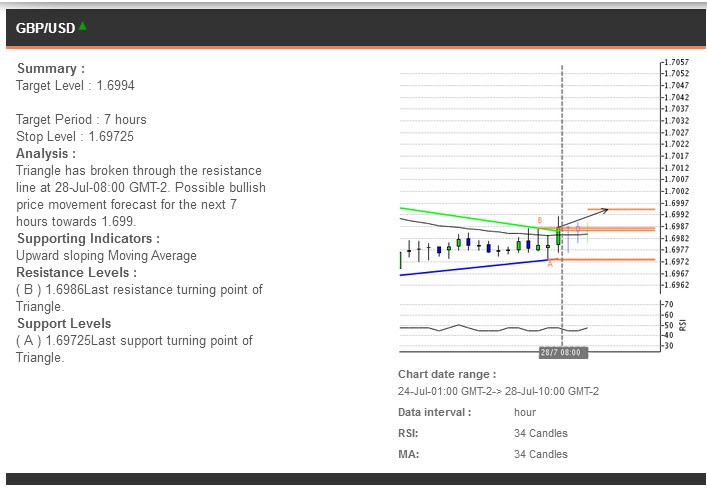

Exchange | FOREX |

Symbol | GBPUSD |

Interval | 60 Min |

Pattern | Triangle |

Identified Time | 07-28 13:00 |

Length | 20 Candles |

Direction | |

Trend Change | Continuation |

Quality | |

Initial Trend | |

Volume | N/A |

Clarity | |

Breakout | |

Forecast Price | 1.6994 |

The US Dollar rose against most of its major counterparts on Friday. On the economic data front, Durable Goods orders rose 0.7% (0.5% expected) MoM in June. Capital Goods Shipments Ex Air fell by 1% (+1.3% expected) MoM in June.

Autocharts

| GBP/USD Intraday: the downside prevails. |

| Pivot: 1.7 Our preference: Short positions below 1.7 with targets @ 1.696 & 1.692 in extension. Alternative scenario: Above 1.7 look for further upside with 1.702 & 1.705 as targets. Comment: The pair remains under pressure and is challenging its support. |

Forum on trading, automated trading systems and testing trading strategies

GBPUSD Buy Point Buy it from 1.6967 SL 1.6870 TP 1.7150

razzsohan, 2014.07.29 11:52

its good time to recover the loses of GBP

GBPUSD Buy Point Buy it from 1.6967 SL 1.6870 TP 1.7150

| GBP/USD Intraday: the downside prevails. |

| Pivot: 1.702 Our preference: Short positions below 1.702 with targets @ 1.696 & 1.692 in extension. Alternative scenario: Above 1.702 look for further upside with 1.705 & 1.7085 as targets. Comment: The pair remains under pressure and ia approaching its support. |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.29 13:22

Well ... I found it your sources :) You are just copy-pasting without source link ...

-------------

- All external content should be uploaded to this one thread only: Press review

- if you want to use external content to any of your thread - use "to pocket" feature:

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 09:51

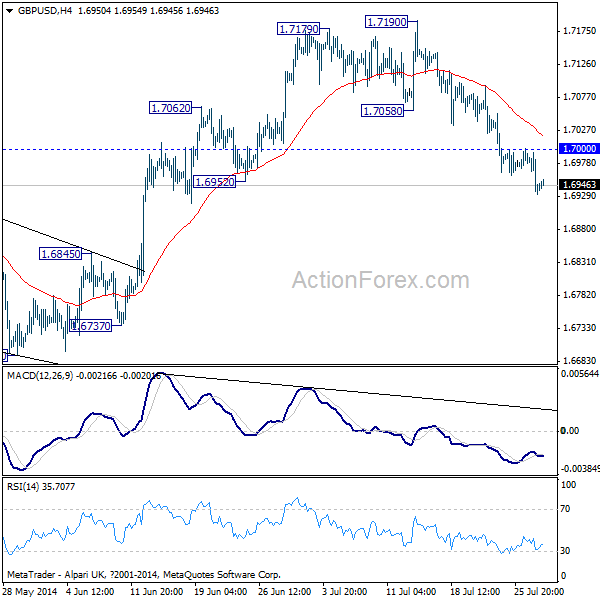

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.6918; (P) 1.6956; (R1) 1.6980; More...

Intraday bias in GBP/USD remains on the downside for the moment. The break of 1.6952 support is taken as a signal of medium term reversal. This is supported by the break of medium term channel support. Deeper fall should now be seen to 1.6692 support. On the upside, above 1.7000 minor resistance will turn bias neutral. But near term outlook will stay cautiously bearish as long as 1.7058 resistance holds.

In the bigger picture, price actions from 1.3503 (2009 low) are treated as consolidations to long term down trend from 2.1161. Based on unconvincing medium term momentum, we'd expect strong resistance from 50% retracement from 2.1161 to 1.3503 at 1.7332 to limit upside and bring reversal. Sustained break of 1.6692 will indicate medium term reversal and would turn outlook bearish for 1.4813 support.

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 10:11

Is GBP/USD Oversold And Ready For A Rebound?

It is difficult to understand how the GBP/USD has sharply transitioned from registering a new 5-year high (1.7189) to recording eight days of successive losses for the first time since May 2010. The pair declined by a further 50 pips and reached a six-week low on Tuesday after the latest UK Mortgage Approvals were stronger than expected. Bank of England (BoE) Governor, Mark Carney had previously expressed opinion that the UK housing sector posed one of the largest threats to the UK economy.

A major contributing factor behind the recent GBPUSD decline is not necessarily due to faltering UK economic optimism, but due to international geopolitical tensions attracting the attention of the financial markets. Over the past week, investors have been attracted to safe havens, such as the USD, and this has devalued the GBP/USD.

Looking at the Daily timeframe, as long as geopolitical tensions quieten down technical traders could now be observing an ideal time to look into this pair. Both the Stochastic Oscillator and RSI are each suggesting that the GBP/USD is oversold and looking at the historical correlation between these two momentum indicators, the price seems to quickly rebound after approaching the oversold boundaries. Additionally, the pair is now only a fractional distance away from a bullish trendline that has controlled the overall direction of the GBP/USD since November 2013. If the trendline is touched, it should either act as a dynamic support level or further support can be found at 1.6919.

In order for the GBPUSD to bounce back, the bulls need a reason to rally. Tomorrow afternoon, the US 2nd Quarter GDP release may provide an opportunity. It is currently expected that the US GDP will be announced at around 3%, but the markets will be keeping a very close eye on what proportion of the 1st quarter GDP contraction was recovered in the following quarter.

I remain unconvinced that the US economy recovered as much of the 2.9% Q1 contraction as currently expected. A large amount of the economic contraction was caused by reduced consumer expenditure and construction activity. Recent US consumer data can be considered soft, such as the past three Advance Retail Sales missing expectations, alongside average wage growth declining. This raises a threat that a proportion of the reduced consumer expenditure in Q1 (which reportedly accounts for 70% of the overall US GDP), might not have been recovered in Q2. In reference to the US construction sector, it is possible projects that were delayed during the atrocious winter weather period have since commenced, but only 6,000 construction jobs were created by the US economy in June. Furthermore, the US construction sector remains over 20% bellows its peak before the global financial crisis emerged.

If the US GDP does disappoint, this will likely bring some risk appetite back into the currency markets. It will also allow an opportunity for the GBPUSD to begin rebuilding some of the previous week’s lost momentum. Due to the UK economic calendar being light this week, exactly how the markets react to the US GDP release will likely determine the GBPUSD’s next move. In regards to the next noticeable economic release from the United Kingdom, RBS are currently suggesting that Friday’s Manufacturing PMI for June will be recorded at a yearly high.

If this is confirmed, we can expect the GBP bulls to wake up.

Written by Jameel Ahmad, Chief Market Analyst at FXTM.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Our preference: Short positions below 1.702 with targets @ 1.696 & 1.692 in extension.

Alternative scenario: Above 1.702 look for further upside with 1.705 & 1.7085 as targets.

Comment: The pair remains under pressure and ia approaching its support.