Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video November 2013

newdigital, 2013.11.14 07:48

Pretty cool way to use the RSI. How to trade using RSI Trading Strategy

=========

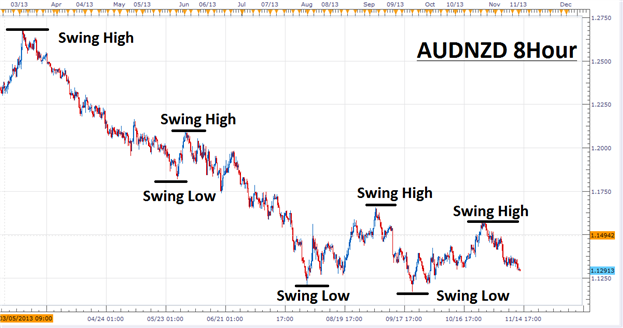

Identify the Trend

The first step to trading any successful trend based strategy is to find

the trend! One of easiest ways to find the trend is through identifying

a charts swing highs and swing lows. Traders can work from left to

right on their graph and identify the outliers in price. If you see the

peaks and valleys of price declining consistently, you are looking at a

downtrend. If highs and lows are advancing, traders would consider a

currency pair to be trending upward.

Given this information, traders should look to sell the AUDNZD as long as price continues to decline towards lower lows. If the trend continues, expectations are that price will decline allowing traders to look for new areas to sell the market.

RSI for Entry

Once a strong trend is established, traders will look to join that trend

with a technical market trigger. Oscillators are a family of indicators

that are designed specifically to determine if momentum is returning to

an existing trend. Below we can again see the AUDNZD 8 Hour chart, but

this time the RSI (Relative Strength Index) indicator has been added.

Since we have identified the AUDNZD as being in a downtrend, traders

will look to sell the pair when the RSI indicator crosses back below a

value of 70 (overbought). This will signal momentum returning lower

after the creation of a new swing high.

Below you will find several previous examples of RSI entries signaled on the AUDNZD. Remember since the trend is down, only new sell positions should be initiated. At no point should a buy position be considered as price declines.

Manage Risk

Every good strategy needs a risk management component. When trading

strong trends such as the AUDNZD, it is important to realize that they

will eventually come to an end! Traders have a variety of choices when

it comes to stop placement, but one of the easiest methods is to use a

previous swing high on the chart. In the event that price breaks towards

higher highs, traders will wish to exit any existing sell biased

positions and look for new opportunities elsewhere.

Wether you are trading live money or just practicing on a demo it is

also recomended to review your trades. This way you can track your

progress while making sure you adhere to the strategy rules!

=========

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

RSIWithFlat_HTF:

The RSIWithFlat indicator with the timeframe selection option available in input parameters.

Author: Nikolay Kositsin