Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.07 08:52

EUR/USD Weekly Fundamental Analysis July 7 – 11, 2014 Forecast

The EUR/USD closed the week below the 1.36 range falling steadily after the ECB decision and the dovish Mario Draghi on Thursday. On Friday German factory orders missed expectations driving down the shared currency. The euro closed the week at 1.3588. ECB officials, led by President Mario Draghi, left monetary policy unchanged after Thursday’s meeting in Frankfurt, according to analysts. The ECB unveiled unprecedented stimulus measures at its previous meeting on June 5, including negative deposit rates that tend to weaken a currency. Markets largely shrugged off the European Central Bank’s latest monetary policy meeting, but the euro weakened against the dollar following stronger -than-expected jobs growth in the U.S.

ECB Chief Mario Draghi struck a cautious tone in his monthly news conference Thursday, running through technical details of the central bank’s plan to provide cheap loans to euro-area banks. Longer term, some analysts think last month’s easing package could make a bigger dent in the euro.

Mr. Draghi said its program of cheap loans to banks could total as much as a trillion euros.

“If Draghi is right the ECB balance sheet would grow considerably

over time. Given the historic link between [the Eurodollar exchanged

rate] and the ratio of Fed/ECB balance sheet—this should underscore the

downside risks to [the euro],” said Valentin Marinov at Citigroup.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.07 09:09

2014-07-07 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Industrial Production]

- past data is -0.3%

- forecast data is 0.3%

- actual data is -1.8% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - German Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. It's a leading indicator of economic health - production reacts quickly to ups and downs in the business cycle and is correlated with consumer conditions such as employment levels and earnings.

Also Called : Industrial Output.

==========

German industrial production declined unexpectedly in May, official data indicated Monday.

Industrial output fell 1.8 percent in May from the prior month, Destatis reported. This was the third consecutive fall in production. Economists had forecast a 0.2 percent rise after declining by revised 0.3 percent in April.

Production in industry excluding energy and construction decreased 1.6 percent in May.

Within industry, the production of intermediate goods and consumer goods decreased by 3 percent and 3.5 percent. The producers of capital goods, however, reported a slight increase of 0.3 percent on the previous month.

Energy production gained 1 percent in May, while the production in construction slid 4.9 percent from April.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 7 pips price movement by German Industrial Production news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.07 15:49

Euro subdued by German data, dollar holds on to recent gains

The euro slipped on Monday, testing a 22-month trough against the British pound, after weak German industrial data highlighted the divergent economic prospects between the euro zone and those of its biggest trading partners.

German industrial output fell 1.8 percent on the month in May, its biggest drop in more than two years, surprising most analysts, who had forecast an unchanged reading.

The weak data kept alive expectations that the European Central Bank may need to loosen monetary policy further in coming months in the face of disinflationary pressures and subdued economic growth.

ECB policymaker Benoit Coeure said at the weekend that rates will remain very low for a long time, regardless of developments in the rest of the world.

In contrast, the Bank of England is expected to tighten policy either before the end of this year or early next year. Investors have also brought forward their view on the timing of the first rate hike by the U.S. Federal Reserve to mid-2015 after a stellar jobs report last week.

That helped the dollar index trade near its highest in nearly two weeks, at 80.359. The euro was down slightly at $1.3590, having fallen to $1.3576 earlier in the European session, its lowest since July 26. It fell to a 22-month low against the pound of 79.14 pence after the German data, but recovered to trade at 79.35 pence.

"The German data was a bit weak and in line with recent euro zone data. This will add to selling pressure in the euro in the near term," said Yujiro Goto, currency analyst at Nomura.

He expected euro/dollar to drift lower, especially in light of last week's U.S. jobs data. The strong non-farm payrolls report prompted traders to slightly increase bets that the Fed will lift rates in June next year.

Most traders, though, are cautious about adding to long dollar bets, aware that Fed policymakers will probably err on the side of caution or wait for wage inflation to pick up before hiking interest rates.

FED MINUTES IN FOCUS

Fed minutes, due to be released later this week, should shed more light on how the debate within the rate-setting committee is shaping up, traders said.

"The FOMC minutes this week could reveal how the Fed views the recent rise in inflation and stronger data. The risk is that there is a divergence between the doves and the hawks on the committee," Morgan Stanley analysts said in a note.

"With (Fed chair Janet) Yellen staying firmly dovish, the minutes may reflect this and has a chance to put the dollar under pressure."

The dollar's failure to make much headway has been the big disappointment on currency markets this year. Most traders say that unless two-year Treasury yields rise sharply, the dollar, which has a good correlation to U.S. yields, is unlikely to push much higher.

The dollar fell against the yen to 101.90 yen, after having risen 0.7 percent last week. The euro also shed 0.2 percent to trade at 138.51 yen with falling stock markets offering the safe-haven yen some support.

Sterling, however, slipped against the dollar to $1.7125, off last week's six-year high of $1.7180. The Canadian dollar, also in favour at the moment, stood at C$1.0643 per USD , just off a six-month high of C$1.0620 struck on Thursday.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.08 05:59

EUR/USD Above 1.36 with Focus on Fed Minutes

The U.S. dollar inched higher against the euro on Monday but pared some early gains, as investors continued to digest last week's strong U.S. employment report and speculated about when the Federal Reserve is likely to begin raising rates.

The dollar stabilized after a week of gains, with no major U.S. economic releases due this week and trading expected to be relatively light after the Independence Day holiday.

The dollar has gained and the Treasuries yield curve has flattened after data on Thursday showed nonfarm payrolls increased by 288,000 jobs last month and the unemployment rate fell to 6.1 percent from 6.3 percent in May.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.08 13:03

EURUSD Elliott Wave Morning Review

The FX market is slow, same on metals while stocks are moving slightly bearish. On the USD pairs we are still observing corrective price action from where USD is expected to strengthen against the majors, such as EUR, CHF, AUD and even JPY.

On the EURUSD chart we are looking at a three wave rally against the

five wave decline that occurred last week. Nice resistance for this pair

comes in at 1.3620-1.3640 from where we expect a resumption of a

downtrend. Invalidation level is at 1.3700 as current corrective rally

must not retrace more than 100% of preceding, impulsive decline.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.09 08:41

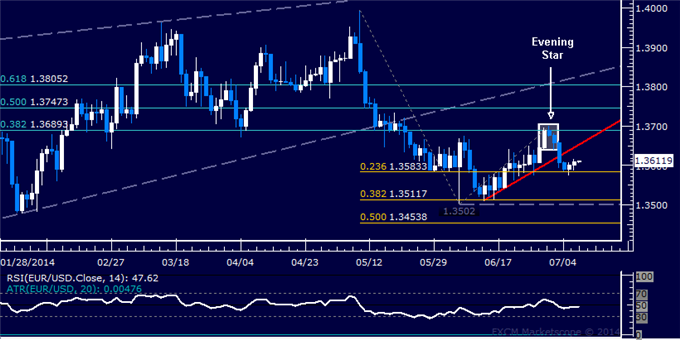

EUR/USD Technical Analysis: Support Met Below 1.36 Mark

- EUR/USD Technical Strategy: Pending Short

- Support: 1.3583, 1.3502-12, 1.3454

- Resistance:1.3653, 1.3689, 1.3747

The Euro fell against the US Dollar as expected after the pair produced a bearish Evening Star candlestick pattern below the 1.37 figure. A daily close below support is at 1.3583, the 23.6% Fibonacci expansion, targets the 1.3502-12 area marked by the June 5 low and the 38.2% level. Alternatively, a turn above rising trend line support-turned-resistance at 1.3653 clears the way for a challenge of the 38.2% Fibonacci retracement at 1.3689.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.09 21:04

2014-07-09 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Meeting Minutes] = It's a detailed record of the FOMC's most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

Acro Expand : Federal Open Market Committee (FOMC).

==========

Fed’s Asset Purchase Could End In October – FOMC Minutes

Minutes of the Federal Open Market Committee's June meeting show that officials have decided to end their asset purchasing program in October if the economy continues to show economic growth.

“If the economy progresses about as the Committee expects, warranting reductions in the pace of purchases at each upcoming meeting, this final reduction would occur following the October meeting,” the minutes said.

However, the minutes also mentioned three times that the Federal Reserve’s quantitative easing program is not on a “preset course.”

The minutes showed that the committee remains optimistic that the U.S. economy will recover in the second half of the year, despite lowering its economic growth forecast at its June monetary policy meeting. According to projections released at the June meeting, committee members see 2014 growth between 2.1% to 2.3%, compared to their March forecast of 2.8% to 3.0%

“Members judged that the economy had sufficient underlying strength to support ongoing improvement in labor market conditions and a return of inflation toward the Committee's longer-run 2 percent objective,” the minutes said. “Most participants viewed the risks to the outlook for the economy, the labor market, and inflation as broadly balanced.”

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 23 pips price movement by USD - FOMC Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.10 08:52

2014-07-10 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Trade Balance]

- past data is 35.9B

- forecast data is 37.3B

- actual data is 31.6B according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[CNY - Trade Balance] = Difference in value between imported and exported goods during the previous month. Export demand and currency demand are directly linked because foreigners usually buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

Acro Expand : Customs General Administration of China (CGAC).

==========

une exports grew 7.2% year-on-year, a touch above the 7% posted in May, but it fell short of the 10.4% that the market was hoping for. Imports rose 5.5%, improving from a dip of 1.6%, just slightly under the Bloomberg consensus forecast of 6%.

This led to China’s June trade surplus narrowing to $31.6 billion from $35.92 billion in May, and below consensus estimates of $36.9 billion.

On the news, AUD/USD dipped over 0.2% and found some support at the 0.9397 level.

There’s a bit of optimism with China’s customs office expecting exports

growth to accelerate in the third quarter. Imports could also pick up

based on improving signs of manufacturing and service activities over

the past two months.

Still, there are concerns that the recovery has been patchy, particularly with the soft property sector and worries that the earnings season underway might turn out to be disappointing.

There is also some expectation that the government will have to do

more to jumpstart the recovery with further stimulus measures to meet

its 7.5% growth target. That argument got some backing when China’s

June’s CPI was released yesterday, which came in at 2.3% year-on-year.

This was down from 2.5% in the previous month and under the 2.4% market

forecast.

China’s exports growth will also hinge on the recovery of other key

economies especially the Euro Zone. The global outlook became a bit more

uncertain after the International Monetary Fund warned earlier this

week that global investment spending was still lacklustre.

We’ll get a better picture next week with the release of China’s Q2 GDP on Wednesday 16 July. This will perhaps be the clearest indication so far on how well China’s mini-stimulus measures have helped and how much more is needed since their roll-out back in April. The market consensus forecast for Q2 GDP is 7.4% growth, unchanged from Q1 which was the slowest in six quarters.

Indonesia will also be keenly watching China’s recovery story. Regardless who wins the election, the new president will take over a slowing economy with weakening fundamentals. With economic reforms a long term process, Indonesia’s outlook and policy decisions in the interim could hinge closely on China’s demand for commodities.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 6 pips price movement by CNY - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.10 16:49

2014-07-08 01:30 GMT (or 03:30 MQ MT5 time) | [USD - Wholesale Inventories]

- past data is 1.0%

- forecast data is 0.6%

- actual data is 0.5% according to the latest press release

if actual < forecast = good for currency (for USD in our case)

[USD - Wholesale Inventories] = Change in the total value of goods held in inventory by wholesalers. It's a signal of future business spending because companies are more likely to purchase goods once they have depleted inventories.

==========

U.S. Wholesale Inventories Rise 0.5% In May, Slightly Less Than Expected

Wholesale inventories in the U.S. rose by slightly less than anticipated in the month of May, according to a report released by the Commerce Department on Thursday.

The report said wholesale inventories increased by 0.5 percent in May after jumping by a revised 1.0 percent in April.

Economists had expected inventories to climb by about 0.6 percent compared to the 1.1 percent increase originally reported for the previous month.

While inventories of durable goods surged up by 1.0 percent in May, the increase was partly offset by a 0.3 percent drop in inventories of non-durable goods.

Meanwhile, the Commerce Department said wholesale sales rose by 0.7 percent in May after soaring by 1.3 percent in the previous month.

The report said sales of durable goods edged up by 0.2 percent, while sales of non-durable goods jumped by 1.1 percent.

With inventories and sales both rising, the inventories/sales ratio for merchant wholesalers was unchanged compared to the previous month at 1.18.

The Commerce Department noted that wholesale inventories in May were up by 7.9 percent compared to the same month a year ago, while wholesale sale were up by 6.6 percent year-over-year.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 13 pips price movement by USD - Wholesale Inventories news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

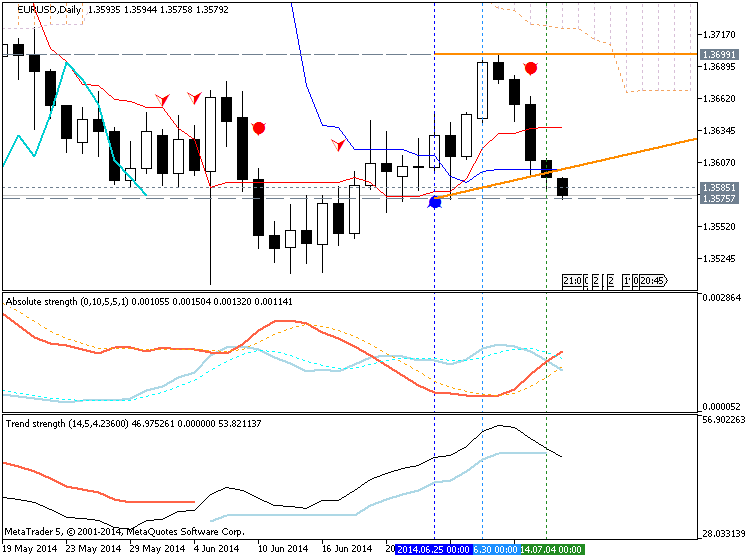

D1 price is on breakdown started on open bar within primary bearish. The price is trying to break 1.3596 support and 1.3575 support levels for the breakout to be continuing.

H4 price is on flat condition of primary bearish, and W1 price is ranging within 1.3502 support and 1.3676 resistance levels.

If D1 price will break 1.3575 support level together with Chinkou Span line crossing the price from above to above on close D1 bar so the breakdown will be continuing.If not so we may see ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-07-07 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Industrial Production]

2014-07-08 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Trade Balance]

2014-07-08 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Trade Balance]

2014-07-08 17:45 GMT (or 19:45 MQ MT5 time) | [USD - FOMC Member Kocherlakota Speaks]

2014-07-09 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-07-09 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2014-07-10 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Trade Balance]

2014-07-10 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Industrial Production]

2014-07-10 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - ECB Monthly Bulletin]

2014-07-11 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Final CPI]

2014-07-11 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Budget Balance]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : breakdown

Intraday Chart