You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

No market is in an uncertainty as soros claims. I dont know any trader bigger than soros.

Soros was just a lucky man.

While I was browsing the forum I had find, someone who had share an interesting hedging strategy, I don't know if it work, cause I'm not a big fanatic of hedging.

Have a look at the following link: https://www.mql5.com/en/forum/227775/page22

Soros was just a lucky man.

While I was browsing the forum I had find, someone who had share an interesting hedging strategy, I don't know if it work, cause I'm not a big fanatic of hedging.

Have a look at the following link: https://www.mql5.com/en/forum/227775/page22

why lucky men are so rare?

no one can make billions of dollars during several years by just being lucky..

Luke is 1 ,2 or 3 times not most of the times.

he is a genius man i think with deep understanding about how market are working and market structure.

he can go in depth in fundamental analysis in macro economies.

and yes even he had losing positions . so most of us can not understand markets deeply as well as he do. so hedging is necessary

for us to make consistent profit in the long term

but thanks for your comment.

why lucky men are so rare?

no one can make billions of dollars during several years by just being lucky..

Luke is 1 ,2 or 3 times not most of the times.

he is a genius man i think with deep understanding about how market are working and market structure.

he can go in depth in fundamental analysis in macro economies.

and yes even he had losing positions . so most of us can not understand markets deeply as well as he do. so hedging is necessary

for us to make consistent profit in the long term

but thanks for your comment.

He just had his once in a life time lucky by making billions of $.

Ever hear that it is easy to make more money once you are a billionaire!

The more money you have the easier it is to multiply that money.

It is much easier to make $ 1.00 for some one who has $ 1000.00, that person will never find it hard and will not mind making $1.00

Most of us will not settle for $ 1.00 profit per day on a $ 1000.00 account balance. Where else we will be satisfy making anything above $ 50.00 per day on a $ 1000.00 account.

For a guy who has $ 1 billion he can settle for a $ 100k per month. Making $ 100k on a $ 1 billion account balance is like making $ 0.01 on a $ 1000.00 account balance, that shouldn't be a problem.

he lost the same exact amount of money in 2016

but that was 2% of his account anyway

Don't suggest or promote commercial products in this forum, its not permitted.

ok i will replace that.

lets finish useless debates and start focusing on hedging systems...

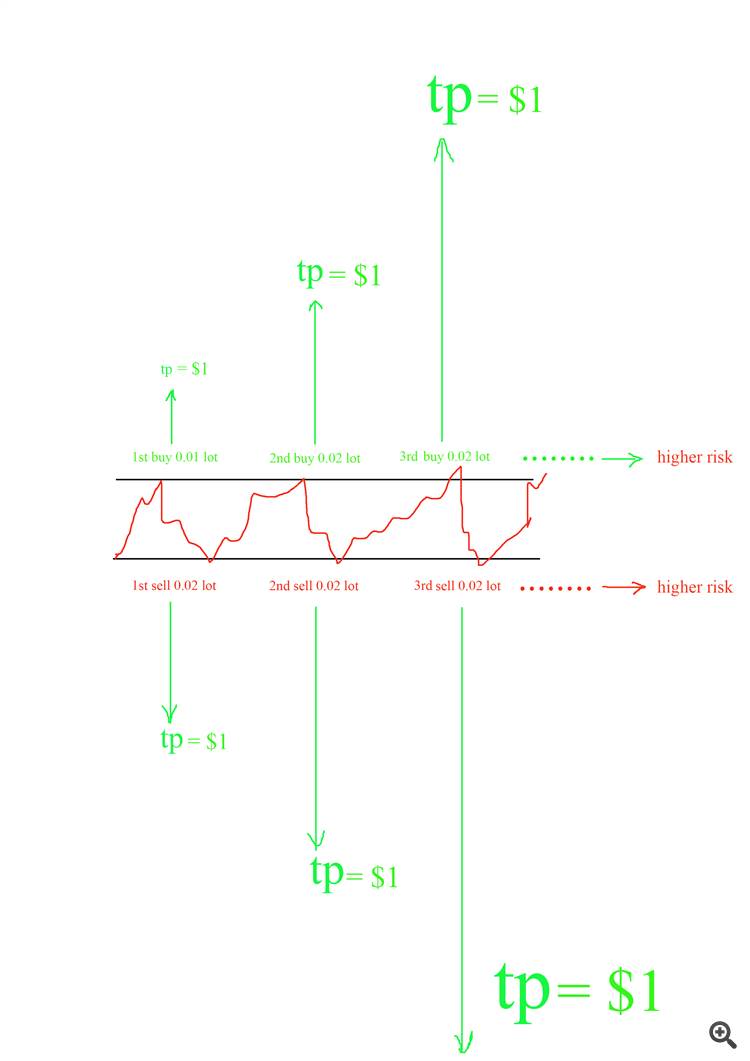

see the picture please.

this is a sure fire hedging strategy ...

the 1st problem is 1.this system only works on trending markets and in middle term or long term choppy market it will fail if will not blow up your trading account.

question: which strategy is better for that to don't fail in choppy markets and even make money in such conditions .?

the 2nd problem is by opening each new position you have to bring your tp point further to make the same amount of profit as initial trade.

question: what to do to decrease trade opening number in long term choppy market.?

the 3rd problem is spread and its widening by broker.

question: what to do if broker widened its spread so recovery zone will be wider . so some opposite trades in both directions will be closer to each other

here is the image

and some of them will be further from each other.

the 4th problem is fast market movement and price gaps that causes opposite orders open further that trader wanted.

question:what to do if between 1st buy and 1st sell or 2nd buy and 2nd sell or any other consecutive trades market will make a huge price gap ?because this causes 2 consecutive orders placing far from each other while another orders are close to each other.

how to manage such situations?

these are not all problems that we must resolve them but an important part of them i will add further question later...

don't forget using trailing stops can improve you success by increasing your winners and decreasing your risks.

please answer each question on its place.

here is the image

come here and give your opinion....

here is the image

Forum on trading, automated trading systems and testing trading strategies

don't attach an image, insert the image

Thank you.