Hello Friend.

This is my work and Last version to Download:https://www.mql5.com/ru/code/223

- votes: 13

- 2010.12.16

- Vladislav Andruhenko | Russian English Spanish Portuguese

- www.mql5.com

The More Intelligent Trailing Stop

- Trailing Stops can reduce risk but increase the chances of being stopped out prematurely.

- Manually trailing our stops each time there is a new swing high/low reduces this whipsaw effect.

- An Asymmetrical Fractal can provide guidance on when to move our stop.

The Flaw in Trailing Stops

Trailing stops are a more advanced type of stop loss order that

adjusts itself to a more favorable rate as a trade moves in our favor.

The result is a reduced stop loss (reducing risk) that is based solely

on how price moves. It is at that moment that a traditional trailing

stop shows its flaw. The stop moves to a level based on how far a trade

moves in our favor, rather than moving based on key price levels. All

support and resistance analysis previously performed is thrown out the

window as our stop moves freely to a random level X pips away from the

currency pair’s high water mark.

Therefore our stop we set beyond the most recent swing low will suddenly

move to a level above the swing low and be at much greater risk of

being hit by a sudden downward whipsaw.

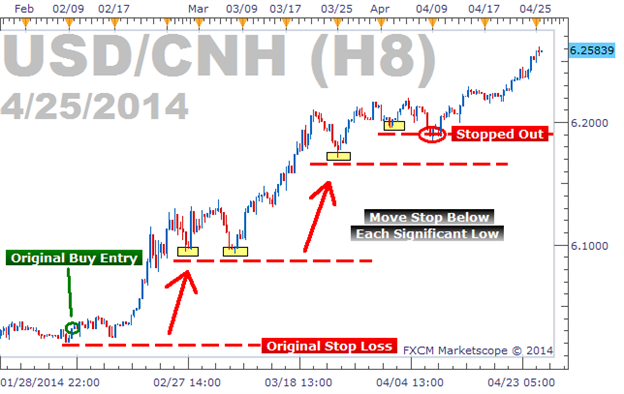

Trailing Stop Getting Whipsawed on USD/CNH :

Manual Trailing Stop

So what can we do about trailing stops’ tendency of getting stopped out

too early, but still have the benefits of reducing our risk during the

life of our trades? The secret is in manually trailing our stop losses

ourselves, always basing our stops around support and resistance levels

along the way. A rare example of having your cake and eating it too.

Let’s take a look.

Manual Trailing Stop in an Uptrend :

The image above shows the same trade we placed on the USD/CNH, but with

much better results. Rather than using a traditional trailing stop that

blindly moved up as price moved up, we moved our stop only when a new

swing low was created. We set our stop below each new swing low as price

progressed and were able to ride this monster uptrend 1500 pips before

being stopped out.

It can take some time to be able to “eyeball” significant swing highs

and lows and know exactly when a stop should be moved.

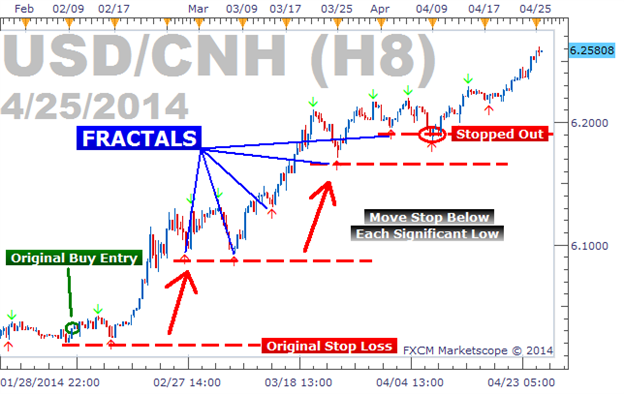

The Asymmetrical Fractal

A fractal is a tool that draws an arrow on each candle that’s highest

price is higher than the high of the two candles to the left and two

candles to the right. It also draws arrows on each candle that’s lowest

price is lower than the low of the two candles to the left and two

candles to the right. It can be used to note potential turning points in

the market, or in this case, can be used to identify swing highs and

swing lows that we can base our stop off of.

Some settings will create less fractals than the traditional version due to the stipulation that the candle’s high or low price must be higher or lower than the previous 5 candles and the following 9 candles. Now that we see the asymmetric fractals on our charts, we can see their value immediately. Each time we see a fractal, that is a level where we could manually move our stop since it is a significant swing high or swing low. I’ve overlaid our fractals on to our USD/CNH chart used earlier to show how our manual trailing stop moved almost 100% in sync with the fractals created over the same period:

The Buck Stops Where?

Hopefully, this article has given us a better way to trail our stops. We

always want our stop to be beyond the most recent swing high or swing

low, and the asymmetric fractals can help identify those levels.

- 2014.01.14

- Rob Pasche

- www.dailyfx.com

Hello Friend.

This is my work and Last version to Download:https://www.mql5.com/ru/code/223

Its not working anymore?

this is...may be for old sestem....may be XP

in win 7 ....it look like this...look screen shot

any one please help

its look like a good EA

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Exp5-VirtualTradePad for mt5 v 4 (Contest version):

Author: Влад