This is an interesting indicator and I am looking at it more. I did have some problems with it drawing correctly after loading... I'm new to coding but it looks to me that the temp buffer has the wrong index set. I think it should be 2 rather than 1... I changed it on my copy and it worked OK for me.

This is an interesting indicator and I am looking at it more. I did have some problems with it drawing correctly after loading... I'm new to coding but it looks to me that the temp buffer has the wrong index set. I think it should be 2 rather than 1... I changed it on my copy and it worked OK for me.

Viffer, could you please post your copy on here?

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video May 2014

newdigital, 2014.05.22 10:30

Strategy Video: Strategy For Low and Extreme Volatility Conditions

- The VIX Volatility Index slipped below 12% for only the third time in the past 7 years

- Activity levels in the FX and other financial markets are equally extreme

- While these exceptional conditions will eventually reverse, we should think of more timely strategies

Volatility readings slid to extreme lows this past session - implying a correction in activity levels and markets may soon be at hand. From the equities-based VIX, a slide between 12 percent draws us to levels only seen two other times in the past seven years. Readings in FX and other financial assets have sported similar elevations. Our natural inclination is to project a reversal to match the magnitude of our current extremes. However, that eventual systemic change may take time and numerous false starts. There are more immediate opportunities for oscillations in activity levels. We look at this situation from a short, medium and long-term perspective while also highlighting the different trade options through the scale in today's Strategy Video.

The $VIX is the 30-day annualized implied volatility of the S&P 500 Index Options. In addition, the $VXN is the 30-day annualized implied volatility of the Nasdaq 100 Index Options. When markets crash or move downward quickly, put options become popular. Traders bid up the price of these put options, which manifests itself as an increase in the implied volatility level; thus an increase in the $VIX and $VXN index. The basic relationship between stock and index prices and the $VIX and $VXN is presented next:

- When prices fall, the $VIX and $VXN Indexes rise.

- In contrast, when prices rise, the $VIX and $VXN Indexes fall.

This basic relationship is summed up by a famous traders' saying: "When the VIX is high it's time to buy; when the VIX is low it's time to go."

The following chart of the S&P 500 exchange traded fund (SPY), top half

of chart, shows the inverse relationship between it and the $VIX Volatility

Index, bottom half of chart:

Notice how an uptrend in the price of the S&P 500 is accompanied by a downtrend in the level of the $VIX.

The next chart of the Nasdaq 100 exchange traded fund (QQQQ) shows how great

buying opportunities are when the $VXN spikes higher:

When the $VIX or $VXN spike (usually they both spike during the same periods) buy. If history repeats itself, which it has done often, buying $VIX and $VXN spikes has proven quite profitable. Nevertheless, the Mutual Fund mantra applies: "Past performance is not indicative of future performance".

The trend of the $VIX and $VXN Indexes can add another helpful level of analysis to price and volume indicators. A technical indicator that might be of interest is the Volatility indicator3 Reasons Volatility Might Increase (adapted from Forbes article)

Where art thou volatility? Not here, nor there, but soon to revive, me

thinks. Volatility in risk markets is simply the measurement of

variation in prices which is often calculated over certain time periods

and against the idea of a normal distribution. The most important

markers are historical (statistical) volatility and implied volatility.

Historical volatility is a retrospective measurement of actual pricing

variations whereas implied volatility is the theoretical price of an

asset taking into account actual prices, historical volatility, a time

component and the risk free rate within a pricing model such as the

Black-Scholes model. Both historical and implied volatility have

recently declined to cycle lows in many asset classes. The consensus

call is for continued calm waters and a potential further decrease in

volatility. The consensus call for tame volatility may be

underestimating three potential drivers to higher volatility this year:

rising inflation and Federal Reserve policy, a taper tantrum and

geopolitical unknowns.

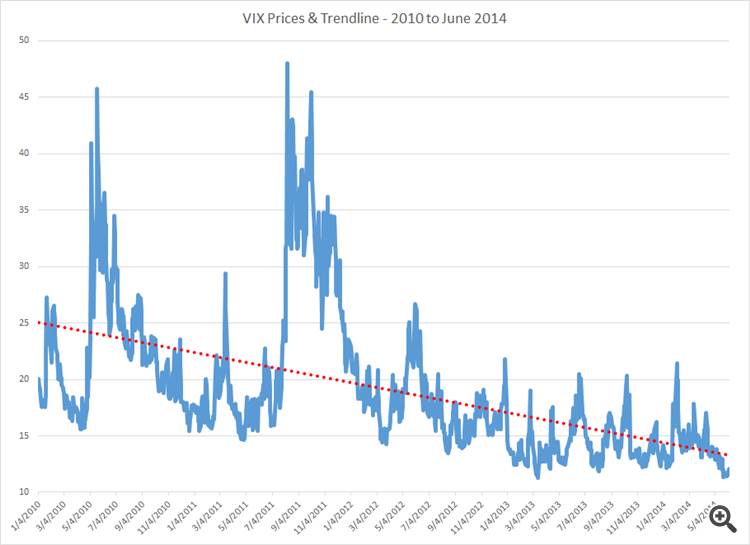

The most popular measure of market volatility in the US is the CBOE

Market Volatility Index (the “VIX”) which is also known rather ominously

as the “fear gauge.” The VIX measures a weighted average of the

implied volatility of a wide range of S&P 500 options with a 30 day

maturity. Quite simply, the VIX is the implied volatility of the

S&P 500 and is frequently thought of as the market’s broad

expectation of volatility over the next 30 day period. The VIX has been

on a downward trajectory since 2010.

The VIX has an audience across asset classes as it can give insight into

the short term biases and leanings of US equity market participants.

To be clear, the VIX is one tool to measure perceived volatility and

although a high VIX or an upward trend is most often the result of a

declining equity market, the gauge can increase as well when call

holders refuse to sell options absent a larger premium. Thus, the VIX

can be a measure of upside or downside moves with higher numbers

representing the anticipation of sharper moves. Somewhat ironically,

there are many instances where higher VIX prices correlate strongly to

higher prices in the S&P 500 as the fear dissipates and markets

readjust.

The VIX and other measurements of volatility have continued to trend

down for many reasons including the fact that the world’s central banks

have maintained highly accommodative monetary policies. The European

Central Bank has just announced a program of direct asset purchases

including the cessation of the “sterilization” of their current markets

program. Moreover, secondary central banks like the Bank of Mexico have

cut rates in an effort to spur higher inflation. Assuming a direct

correlation between liquidity and volatility, all of these programs

should act as a governor to higher volatility. Other reasons offered to

explain the calmness in markets include exceedingly low trading volumes,

range bound markets, recently improving economic data and fewer

economic surprises, the transparency of corporate reporting, and the

perception that there is no immediate catalyst to drive volatility

higher.

Although the trend in volatility is clearly downwards, current

complacency should not be mistaken for a permanent drift to lower levels

without significant bumps higher and mini-reversals within the trends.

Once again, investors are putting their faith into central banks which

are doing the one thing that they ostensibly know how to do and have

done continuously since 2008 – providing ever increasing amounts of

liquidity. To be sure, the ultimate effect of non-traditional monetary

policy is unknown and the Federal Reserve and the Bank of England are

poised to withdraw some of their stimulus in the medium term. Already,

markets are pricing in rate hikes in the US for mid-2015 yet doing so

without increased volatility. It is reasonable to suggest that the

greatest risk to increased volatility and general market stability may

be a mismatch between Federal Reserve policies, the expectations of the

bond market and microeconomic data. This triumvirate of fast friends

may find itself in an increasingly uncomfortable alliance should US

inflation data significantly or unexpectedly increase. Admittedly,

higher US inflation in a world currently exporting deflation to US

shores is not likely to result in the sustained kind. However, the

prospect of Chair Yellen attempting to explain away asymmetric inflation

readings as transitory should push up volatility in the bond market.

There is also sensibility in remembering that monetary policy changes

frequently take longer to translate to market prices than assumed. It is

quite possible that the lingering effects of central bank liquidity

will not be felt as a primary cause of higher volatility but rather a

second derivative premised upon some otherwise routine market upheaval.

When long positions are longer and short positions are shorter, based

upon liquidity rather than fundamentals, the correlation between

liquidity and volatility cited as calming the markets may cut both ways.

Increased liquidity may provide for smooth markets at the outset but

higher levels of risk may creep upon casually disciplined risk managers

and with it the miasma of higher volatility.

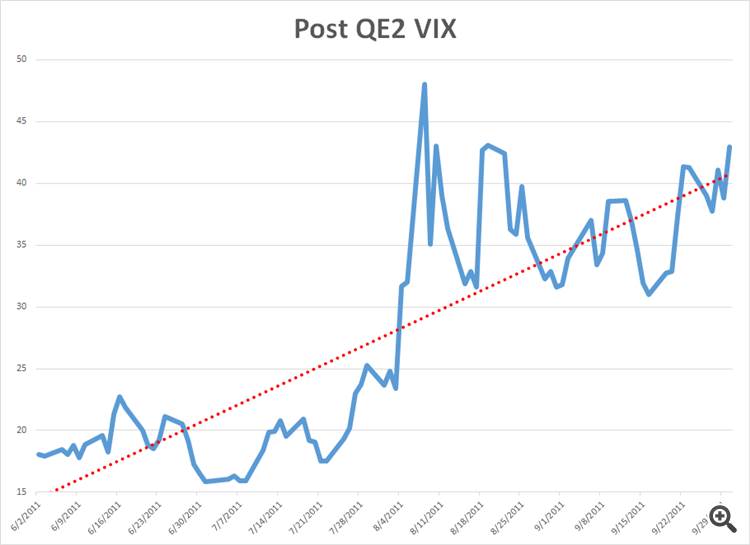

Another reason that volatility could creep higher is the possibility of a

“taper tantrum” over the final end of Quantitative Easing. As an

analogue one need only to look at the increase in volatility as measured

by the VIX after QE2 ended in June of 2011.

The Federal Reserve’s “stock versus flow” argument will be put to the

ultimate test assuming tapering continues apace and QE ends toward the

end of 2014.

Volatility may also temporarily and dramatically increase due to

unexpected geopolitical events. There is a mini civil war in Ukraine

right now and it threatens to draw European powers into supporting a

proxy contest for Eastern Ukraine between Russia and the West. While

Europeans go about deciding where to holiday this summer, the conflict

in Ukraine is likely to remain in a sort of pressure cooked stasis. Once

the weather turns cold and natural gas for heating is no longer an

abstraction the conflict in Ukraine will either resolve quickly or find

another gear. Beyond Ukraine, nuclear negotiations with Iran continue to

simmer, China and Japan yap at each other and Assad kills off his

critics in Syria. Any of these issue may cause a spike in volatility and

to expect all of these issues to transpire exactly as a game planned

seems rather naïve.

It is true that volatility has decreased. The CBOE Commitments of

Traders Report for VIX futures shows a significant net long position for

financial players confirming the bias to groupthink towards

increasingly lower volatility. This tendency towards anticipating ever

decreasing or steadily low volatility flies in the face of the fact that

the VIX currently trades at a 45% discount to its longer term

historical price average of $20. The odds of a temporary spike in

volatility are very good over the remainder of the year and a reversal

to slightly higher trend volatility is especially plausible should

microeconomic conditions warrant even a slight rethink of monetary

policy scenarios. To profit from volatility, is usually to buy it when

it is not needed, rather than when the consensus theory is

“unexpectedly” being pilloried and volatility is exploding higher.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

EES V Speed:

Author: eesfx