- Mt5 how to fix 0.01 lot size?

- Controlling Lot size when copy trades from signal perovider

- lot size of signal copy

I collected some posts/links etc which may help with this situation for example:

The question of how exactly the Subscriber's deposit will participate in trading via Signals service is one of the most critical ones. When solving this issue, we followed the already mentioned principle - providing maximum protection for each participant. As a result, we can offer a secure solution for Subscribers.

When enabling signals in the terminal and subscribing to one of them, Subscribers should select what part of the deposit is to be used when following the signals. There was an alternative solution of setting the ratio between Subscriber's and Provider's position volumes. But such a system could not guarantee the security of the Subscriber's deposit. For example, suppose that Provider's deposit is 30 000$, while Subscriber's one is 10 000$ and the ratio of 1:1 has been selected. In that case, the Signals Provider may just wait out temporary drawdown having a large volume order, while the Subscriber may lose all the funds with all his or her positions closed by Stop Out. The situation may get even worse if the Provider's balance suddenly changes (top up or withdraw), while previously specified volumes ratio remains intact.

To avoid such cases, we have decided to implement the system of percentage-based allocation of the part of a deposit, which is to be used in trading via the Signals service. This system is quite complicated as it considers deposit currencies, their conversion and leverages.

Let's consider a specific example of using the volumes management system:

- Provider: balance 15 000 USD, leverage 1:100

- Subscriber1: balance 40 000 EUR, leverage 1:200, deposit load percentage 50%

- Subscriber2: balance 5 000 EUR, leverage 1:50, deposit load percentage 35%

- EURUSD exchange rate = 1.2700

Calculation of Provider's and Subscriber's position volumes ratio:

- Balances ratio considering specified part of the deposit in percentage terms:

Subscriber1: (40 000 * 0,5) / 15 000 = 1,3333 (133.33%)

Subscriber2: (5 000 * 0,35) / 15 000 = 0,1166 (11.66%) - After considering the leverages:

Subscriber1: the leverage of Subscriber1 (1:200) is greater than Provider's one (1:100), thus correction on leverages is not performed

Subscriber2: 0,1166 * (50 / 100) = 0,0583 (5.83%) - After considering currency rates of the deposits at the moment of calculation:

Subscriber1: 1,3333 * 1,2700 = 1,6933 (169.33%)

Subscriber2: 0,0583 * 1,2700 = 0,0741 (7.41%) - Total percentage value after the rounding (performed using a multistep algorithm):

Subscriber1: 160% or 1.6 ratio

Subscriber2: 7% or 0.07 ratio

Thus under the given conditions, Provider's deal with volume of 1 lot will be copied:

- to Subscriber1 account in amount of 160% - volume of 1.6 lots

- to Subscriber2 account in amount of 7% - volume of 0.07 lots

Be careful not to confuse the percentage value of the used part of the deposit and the actual ratio of position volumes. The trading terminal allows setting the part of the deposit in percentage value. This value is used to calculate the ratio of position volumes. This data is always fixed in the log and is shown in the following way:

Subscriber1:

2012.11.12 13:33:23 Signal '1277190': percentage for volume conversion selected according to the ratio of balances and leverages, new value 160%

2012.11.12 13:27:55 Signal '1277190': signal provider has balance 15 000.00 USD, leverage 1:100; subscriber has balance 40 000.00 EUR, leverage 1:200

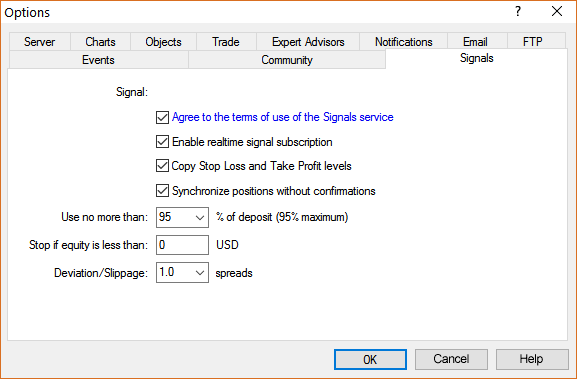

2012.11.12 13:27:54 Signal '1277190': money management: use 50% of deposit, equity limit: 0.00 EUR, deviation/slippage: 1.0 spreads

Subscriber2:

2012.11.12 13:33:23 Signal '1277191': percentage for volume conversion selected according to the ratio of balances and leverages, new value 7%

2012.11.12 13:27:55 Signal '1277191': signal provider has balance 15 000.00 USD, leverage 1:50; subscriber has balance 5 000.00 EUR, leverage 1:50

2012.11.12 13:27:54 Signal '1277191': money management: use 35% of deposit, equity limit: 0.00 EUR, deviation/slippage: 1.0 spreads

---------------

Forum on trading, automated trading systems and testing trading strategies

Signal Subscriber Lot Size Question

Sergey Golubev, 2017.02.02 07:42

Besides, you can use Calculator of the Signals (to calculate everything 'automatically' based on any pre-selected signal for example).And this small thread as well (with answers) -

signal provider has minimal volume 0.01, subscriber has 0.10 - how to change minimal volume ????and finally (just to make it shorter) -

Forum on trading, automated trading systems and testing trading strategies

Different Standard Lot Size between subscriber broker and signal broker

Alain Verleyen, 2014.02.15 10:18

About rounding of ratio, please read the Frequently Asked Questions about the Signals service point 15. How the lot size itself is rounded I am not sure, in your example (10% applied to 0.20 lot) it seems you are right. Can you provide more details ?Forum on trading, automated trading systems and testing trading strategies

Can you change the ratio in which a signal is subscribed to?

Alain Verleyen, 2014.02.04 13:31

You have only 2 ways to act on the calculated ratio :

- Increase "% of deposit used" in Signals settings.

- Add more capital to your account.

Hi, I've bought signals but the seller use a small size for my account. How can I increase my lot size for this signals?

If you increase your position size, you are increasing your risk at the same time, so if the signal provider has a history drawdown of say 35% and you double your lot size, then you will end up with 70% drawdown.

If by any chance (and believe me, always happens) the drawdown increase to 40-50% you will end up destroying your account, while the signal provider will continue operating normally.

Just take a moment and think about it, before make any haste decisions.

If you increase your position size, you are increasing your risk at the same time, so if the signal provider has a history drawdown of say 35% and you double your lot size, then you will end up with 70% drawdown.

If by any chance (and believe me, always happens) the drawdown increase to 40-50% you will end up destroying your account, while the signal provider will continue operating normally.

Just take a moment and think about it, before make any haste decisions.

I have an account 20 times bigger than provider's account. I want to make size right for my account deposit

I have an account 20 times bigger than provider's account. I want to make size right for my account deposit

Then your copy ratio should be 2000% and your position size 20 times larger than signal provider, if not you have set something wrong.

The copying ratio is calculated automatically by MQL5 signal copying system.

Have you put your account's participation in signal copying to the maximum 95% in signal settings?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use