Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.10 08:13

Forex Fundamentals - Weekly Outlook May 12-16US Federal Budget Balance, retail sales, inflation and employment data, Philly Fed Manufacturing Index and Prelim UoM Consumer Sentiment are the main events on Forex calendar. Here is an outlook on the highlights of this week.

Last week, Fed Chair Janet Yellen testified before the US Congress repeating her speech made earlier before the Joint Economic Committee. Yellen noted the economy is on track for solid growth and that accommodative policy will continue as long as required. The Fed will normalize interest rates when the economy improves. Yellen believes US balance sheet will return to normal in 5 to 8 years. However, despite the positive tone, there were some troubled spots such as the Russia-Ukraine conflict and the recent setback in the housing market imposing on the ongoing economic recovery. Will the positive note continue in the coming weeks?

Let’s start,

- US Federal Budget Balance: Monday, 18:00. US budget debt narrowed more than expected in in March, reaching $36.9 billion, following $193.5 billion posted in February. Analysts expected a more modest decline to $76.5 billion. The overall trend is positive with a rise in receipts led by 11% fiscal year-to-date increase in corporate taxes and a 7 percent increase in individual taxes and the spending side is coming down including a 6% decline in defense spending. US Budget Balance is expected to reach a surplus of $112.6 billion.

- German ZEW Economic Sentiment: Tuesday, 9:00. German investor confidence continued to slide in April reaching 43.2 after posting 46.6 in March. Despite the strong recovery in the first quarter, the six month outlook survey revealed growing concerns about the Russia-Ukraine crisis and its possible effects on manufacturers and exporters in Germany. German investor confidence is expected to continue its downward trend towards 41.3.

- US retail sales: Tuesday, 12:30. U.S. retail sales surged to a 1-1/2 –year high of 1.1% in March indicating strong recovery in the US economy after a sluggish winter. The increase was evident in all sectors and followed a 0.7% gain in February. Meanwhile Core sales, excluding automobiles edged up 0.7%, the biggest rise in a year. These impressive figures raised new hopes for a boost in growth this year. U.S. retail sales are expected to climb 0.5%, while core sales are expected to increase 0.6%.

- UK employment data: Wednesday, 8:30. The number people claiming jobless benefits in March declined by 30,400 reaching to 1.14 million after a 37,000 drop in the previous month, indicating an ongoing improvement in Britain’s labor market. The unemployment rate also improved to 6.9% from 7.2% in February. Average earnings in the three months to February increased by 1.7% compared with a year earlier. Chancellor of the Exchequer, George Osborne, hailed the “strong jobs numbers” as further evidence that the coalition government’s economic plan is working. The number of jobless aid seekers are expected to decline further by 31,200 pushing the unemployment rate down to 6.8%.

- Mark Carney speaks: Wednesday, 9:30. Mark Carney, the Governor of the Bank of England will speak in a press conference, together with other MPC members, about the Inflation Report, in London. Carney stated in March that the Bank’s 2% inflation target became ‘dangerous distraction’ for the UK’s policymakers veiling the true progress made in the UK’s economy. Market volatility is expected.

- US PPI: Wednesday, 12:30. U.S. producer prices edged up 0.5% in March, posting their largest increase in nine months, amid a rise in the cost of food and trade services. The increase was well above market consensus following a 0.1% fall in February. The unexpected rise may be explained by weather related factors, but the wholesale inflation is expected to settle down in April. U.S. producer prices are expected to climb 0.2% this time.

- Haruhiko Kuroda speaks: Thursday, 4:25. BOJ Governor Haruhiko Kuroda will speak in Tokyo. Market volatility may occur.

- US inflation data: Thursday, 12:30. U.S. consumer prices increased slightly more than expected in March, rising 0.2% after a 0.1% climb in the previous month, suggesting inflation is back. In the 12 months through March, consumer prices rose 1.5% after increasing 1.1% over the 12 months through February. Meanwhile, core CPI, excluding volatile energy and food components, also edged up 0.2% in March after rising 0.1% in the prior month. The central bank is expected to end the QE bond purchases later this year. Domestic demand and the labor markets are improving but a rate hike is not expected before the second half of 2015. U.S. consumer prices are expected to increase by 0.3%, while core CPI is predicted to climb 0.2%.

- US Unemployment Claims: Thursday, 12:30. The number of new claims for unemployment aid filed last week fell 26,000 to 319,000, indicating the setback seen in the Easter holiday was temporary and the US job market is regaining its strength. Despite the drop in the number of applications. The four-week average increased by 4,500, to a seasonally adjusted 324,750 due to temporary layoffs around the Easter holiday but it is far better than the 343,000 average for 2013. Jobless claims is expected to rise to 321,000.

- US Philly Fed Manufacturing Index: Thursday, 14:00. Factory activity in the U.S. mid-Atlantic region increased in April to 16.6 from 9.0 in March beating market forecast of a 9.6 reading. New orders edged up to 14.8, the highest level since October, from 5.7. The employment component improved to 6.9 from 1.7, but business conditions for the next six months fell to 26.6 from 35.4. Overall, the survey shows positive growth prospects for the US economy in the coming months. Factory activity in the Philadelphia area is anticipated to decline to13.9.

- Janet Yellen speaks: Thursday, 23:00. Federal Reserve Chair Janet Yellen will speak in Washington DC at the National Small Business Week. Yellen may talk about her latest testimony at the US congress. Market volatility is expected.

- US Building Permits: Friday, 12:30. US building permits fell by 2.4% in March reaching an annualized rate of 990,000.The reading suggests the pace of starts will increase further in the coming months. Single-family starts increased 0.2% compared to the previous year. Economists expect an acceleration in housing construction based on stronger household construction later this year and in 2015. US building permits are expected expand to an annualized rate of 1.01 million.

- US Prelim UoM Consumer Sentiment: Friday, 13:55. Consumer confidence strengthened in April to the highest level since July, rising to 82.6 compared to 80 in March. Improvement in the US labor market contributed to this rise. The reading was better than the 81.2 projected by analysts. Increased employment opportunities and better wages will continue to lift consumer spending as well as consumer sentiment. Consumer confidence is expected to improve further to 84.7.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.10 15:20

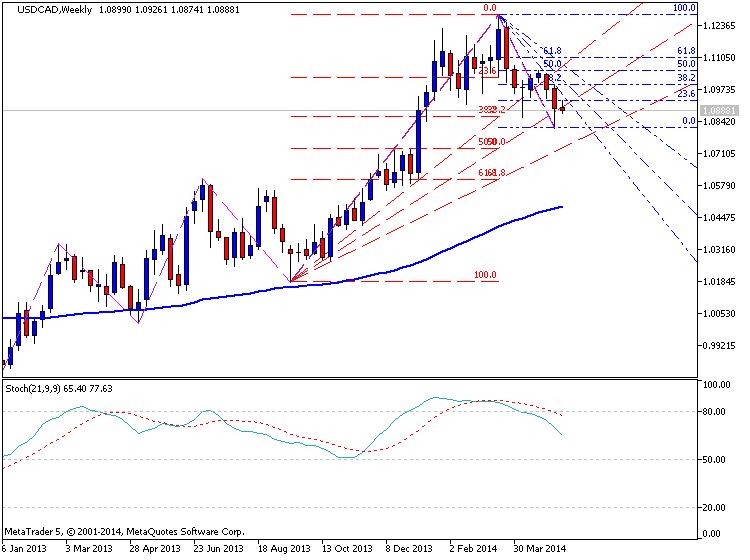

USD/CAD forecast for the week of May 12, 2014, Technical AnalysisThe USD/CAD pair fell during most of the week, but as you can see bounced enough to form a hammer overall. The 1.09 level was a level that needed to hold by the end of the week, and that’s essentially where we have closed. Because of this, it still very likely that we will bounce, and a move above the 1.10 level has the market looking for the 1.1250 handle over the course of the next several weeks. On the other hand, there is the possibility that we break down, but the downside seems to be somewhat limited in our opinion.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.11 14:18

USD/CAD Fundamentals - weekly outlook: May 12 - 16The U.S. dollar strengthened against the Canadian dollar on Friday, rebounding from four-month lows after data showed that the Canadian economy unexpectedly shed jobs in April.

USD/CAD was at 1.0897 late Friday, up 0.62% for the day, after falling as low as 1.0813 in the previous session. For the week, the pair was still down 0.55%.

The pair was likely to find support at 1.0813 and resistance at 1.0960.

The Canadian dollar weakened after Statistics Canada reported that the economy shed 28,900 jobs in April, confounding expectations for jobs growth of 12,000.

The unemployment rate remained unchanged at 6.9%, in line with expectations but the labor force participation rate, which measures those still actively looking for work, ticked down to 66.1% in April from 66.2% the previous month.

The decline in employment was the largest since December 2013.

The weak data added to concerns over the prospect of weaker-than-expected economic growth in the second quarter and underline expectations that the Bank of Canada will keep rates on hold for longer.

The U.S. dollar weakened against the other major currencies earlier in the week after Federal Reserve Chair Janet Yellen struck a dovish tone on the economy during testimony to the Joint Economic Committee of Congress on Wednesday.

Ms. Yellen said that a high degree of monetary accommodation remains warranted given the slack in the economy.

The Fed chief also said the bank expects economic growth to accelerate this year despite the slowdown in the first quarter but warned that the recent housing market slowdown "could prove more protracted than currently expected."

In the week ahead, the data calendar for Canada is light so investors will be looking ahead to U.S. reports on retail sales, consumer prices and consumer sentiment.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, May 12

- The U.S. is to publish data on the federal budget balance.

- The U.S. is to produce data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity, as well as reports on import prices and business inventories.

- The U.S. is to release data on producer price inflation.

- Canada is to release a report on manufacturing sales.

- The U.S. is to release data on initial jobless claims, consumer inflation and industrial production, as well as a report on manufacturing activity in the Philadelphia region.

- Canada is to publish data on foreign securities purchases.

- The U.S. is to round up the week with reports on building permits and housing starts, and a preliminary reading on consumer sentiment from the University of Michigan.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.14 17:50

USD/CAD Fundamental Analysis May 15, 2014 Forecast

The USD/CAD eased by 4 points to trade at 1.0901 after the US dollar made healthy gains throughout the early part of the week. The loonie rose 0.08 of a cent to 91.74 cents US amid general U.S. dollar weakness. Analysts point to low expectations for first quarter U.S. gross domestic product growth, owing to the impact of severe winter weather and suggestions that the economy may actually have contracted during the January-March period. “Accordingly the expectations for Fed interest rate hikes have been pared back slightly,” said Camilla Sutton, Chief FX Strategist, Managing Director Scotiabank Global Banking and Markets.

It’s a light week for Canadian data. Statistics Canada releases the March report on manufacturing shipments on Thursday.

Markets are relatively quiet with the USD focused on individual domestic stories and negative developments for EURForum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.14 19:56

USD/CAD little changed in rangebound tradeThe U.S. dollar was almost unchanged against the Canadian dollar on Wednesday, as trade remained subdued without any significant economic data to give investors a clear direction.

USD/CAD was last trading at 1.0902 and was moving in a range of 1.0894 to 1.0922.

The pair was likely to find support at 1.0875 and resistance at 1.0925, Tuesday's high.

The pair showed little reaction after data released earlier Wednesday showed that U.S. producer prices rose more than expected in April, while core prices also beat expectations.

U.S. producer prices increased by 0.6% last month the Commerce Department said, above forecasts for a 0.2% gain, after rising 0.5% in March.

The producer price index rose at an annualized rate of 2.1% in April, above expectations for a 1.7% increase and up from 1.4% in the preceding month.

The core producer price index advanced 0.5% last month, compared to expectations for a 0.2% increase, and was up 1.9% from a year earlier.

Elsewhere, the loonie, as the Canadian dollar is also known, was almost flat against the euro, with EUR/CAD at 1.4947.

The euro came under renewed selling pressure on Wednesday following reports that the European Central Bank is preparing to cut rates next month.

Reuters reported that the ECB is preparing a "package of measures" including cuts to all interest rates, with negative rates on bank deposits, as well as measures to bolster lending to small and medium size businesses.

The report came one day after the Wall Street Journal reported the Germany's Bundesbank would back monetary easing measures by the ECB if they were needed to keep low levels of inflation from becoming entrenched in the region.

Later last week, the ECB indicated that it could ease monetary policy as soon as its next meeting in June, to stop inflation in the euro zone from falling too low.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.15 14:32

2014-05-15 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Manufacturing Sales]

- past data is 1.4%

- forecast data is 0.3%

- actual data is 0.4% according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

CAD Manufacturing Sales = Change in the total value of sales made by manufacturers

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 10 pips price movement by CAD - Manufacturing Sales news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on ranging market condition within primary bearish: price is far away from Ichimoku cloud/kumo.

H4 price is on bearish too ranging between 1.0915 and 1.0814 levels.

If D1 price will break 1.0814 support so the primary bearish will be continuing.Otherwise - ranging.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2014-05-13 05:30 GMT (or 07:30 MQ MT5 time) | [CNY - Industrial Production]

2014-05-13 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-05-14 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

2014-05-15 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Manufacturing Sales]

2014-05-15 16:30 GMT (or 18:30 MQ MT5 time) | [CAD - Gov Council Member Speech]

2014-05-15 23:00 GMT (or 01:00 MQ MT5 time) | [USD - Fed Chair Yellen Speaks]

2014-05-16 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - International Security Transactions]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart