Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.12 18:27

Forex Weekly Outlook Apr. 14-18The US dollar had a terrible week, falling across the board. Can it stabilize now, or will the sell off continue? US retail sales, German ZEW Economic Sentiment, US Inflation data, Janet Yellen and US Haruhiko Kuroda speeches, Unemployment Claims and the Philly Fed Manufacturing Index are the highlights of this week. Here is an outlook on the main market movers coming our way.

The greenback took a big hit following the relatively dovish FOMC minutes release where forward guidance was forsaken for a promise of low rates after the bond buying program ends. Fed Chair Yellen also surprised markets by saying that bond buying will finish in 6 months. However, later that week, the Jobless claims release was a positive surprise, plunging 32,000 to 300,000 claims, the lowest level since December 2013, indicating the US job market is on a solid growth trend. Will the US economy continue its growth trend after the QE is over? In the euro-zone, weak inflation data from France was dismissed. Strong industrial data from the UK boosted the pound, upbeat Australian data energized the Aussie and the lack of action from the BOJ fueled the yen.

- US Retail sales: Monday, 13:30. U.S. retail sales expanded more than expected in February, after harsh weather conditions slowed activity in recent months. Retail sales edged up 0.3%, following a revised 0.6% decline in January. The reading was higher than the 0.2% rise anticipated. Meanwhile Core sales, excluding automobiles, gasoline, building materials and food services increased 0.3% after a 0.3% decline in the previous month. Analysts anticipate retail sales would improve further in the coming months. U.S. retail sales are expected to rise 0.8%, while core sales are predicted to gain 0.5%.

- UK inflation data: Tuesday, 9:30. The UK inflation rate fell to a four-year low of 1.7% in February, amid a sharp decline of 0.8% in petrol prices. This was the second consecutive reading falling below the BOE’s 2% inflation target. Prime Minister David Cameron noted that the figures support the government’s economic strategy to provide stability and security for hard-working people. But Labour’s Shadow Treasury Minister Catherine McKinnell said prices are still rising faster than wages badly affecting household consumption. CPI is expected to rise 1.6%.

- German ZEW Economic Sentiment: Tuesday, 10:00. Investor sentiment in Germany continued to decline in March, falling for the third consecutive month to 46.6 points, from 55.7 in February. The release came in below forecasts of a 52.8 points reading. The possible reasons for this weak reading could be, a softer outlook for emerging market activity, a strong euro and mounting deflation risks and tensions in the Ukraine. Investor climate is expected to reach 46.3.

- US Inflation data: Tuesday, 13:30. U.S. inflation stayed mild in February. Consumer Price Index inched 0.1% for the second month consecutive month after a drop in gasoline prices offset the largest rise in the cost of food in nearly 2-1/2 years. On a yearly base, consumer prices increased only 1.1%, weaker than the 1.6% rise in January. Meanwhile Core prices, excluding volatile energy and food components increased 0.1% for a third straight month and remained steady at 1.6% on a yearly base. However, the stable state of inflation is positive for business planning for hiring and capital spending. Both CPI and Core CPI are expected to gain 0.1%.

- Janet Yellen speaks: Tuesday, 13:45, Wednesday 17:15. Federal Reserve Chair Janet Yellen will speak in Stone Mountain and in New York. Yellen may speak about the recent improvement in the US job market as well as the ongoing tapering process, its duration and its effects on the US economy. Volatility is expected, especially after her previous important comment triggered a big USD rally.

- UK employment data: Wednesday, 9:30. The UK’ unemployment rate remained stable at 7.2% for the third consecutive month, however, the number of people claiming unemployment benefits declined more than expected, reaching 34,600, indicating the labor market continues to improve. The BoE revised its forward guidance policy, which linked interest rate decisions to the unemployment rate, since the rate fell unexpectedly towards the 7%, marking the start of rate hikes. The Bank hinted that the first rate hike will occur in the second quarter of 2015. UK number of unemployed is expected to decline by 30,200, while the unemployment rate is expected to remain 7.2%.

- US Building Permits: Wednesday, 13:30. The number of building permits surged in February to 1.018 million units from January’s total of 945,000. These four-month high topped analysts’ predictions for 970,000 units. Contrary to this release, U.S. housing starts declined by 0.2% in February a seasonally adjusted 907,000 units from January’s total of 909,000, disappointing expectations for an increase of 3.4% to 910,000 units. Nevertheless the rise in the number of permits ensures the continuation of growth in the housing industry. The number of building permits is expected to reach 1 million.

- Canadian rate decision: Wednesday, 15:00. The Bank of Canada was concerned about the soft inflation rate on its last meeting in March, despite the rise in consumer prices occurred in January. The bank noted that a rate change is possible in the next policy meeting however analysts do not expect a rate change until the third quarter of 2015. The rate report was nearly unchanged from January when Governor Stephen Poloz said the door was “slightly more open to a rate cut. Meanwhile, the Canadian dollar, dipped in value against its U.S. counterpart in recent months which may help to boost exports, business confidence and investment. Interest rates are expected to remain unchanged at 1.00%.

- Canadian inflation data: Thursday, 13:30. Canadian consumer prices edged up 0.8% in February, following a 0.3% rise in the previous month. The rise was better than the 0.6% predicted by analysts. However, on a yearly base, the index dropped to 1.1% from 1.5% in January. Canadian Core prices rose 0.7% while expected to reach 0.5%. The year-over-year core rate moderated to 1.2% from 1.4% in January. The sharp rise indicates that seasonal factors were involved. However, despite the recent increase, inflation remains rather tame. CPI is expected to edge up 0.4% and Core CPi is expected to increase by 0.3%.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing initial claims for unemployment benefits dropped sharply last week to the lowest level since December 2013, reaching 300,000, signaling a pick-up in the US job market. Positive weather and stronger growth boosted the labor market causing the 32,000 drop. This stronger than expected release will also contribute to the second quarter growth rate. Unemployment claims are expected to increase to 316,000.

- US Philly Fed Manufacturing Index: Thursday, 15:00. Manufacturing activity in the Philadelphia-region soared in March, reaching 9 points after posting minus 6.3 in February, easing concerns over the U.S. economic outlook. Analysts had forecasted the index to rise to 4.2 in March. The survey’s showed new orders, and shipments increased and recorded positive readings indicating growth trend is returning following weather-related weakness in February. Manufacturing activity is expected to improve further to 9.6 points.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.12 18:44

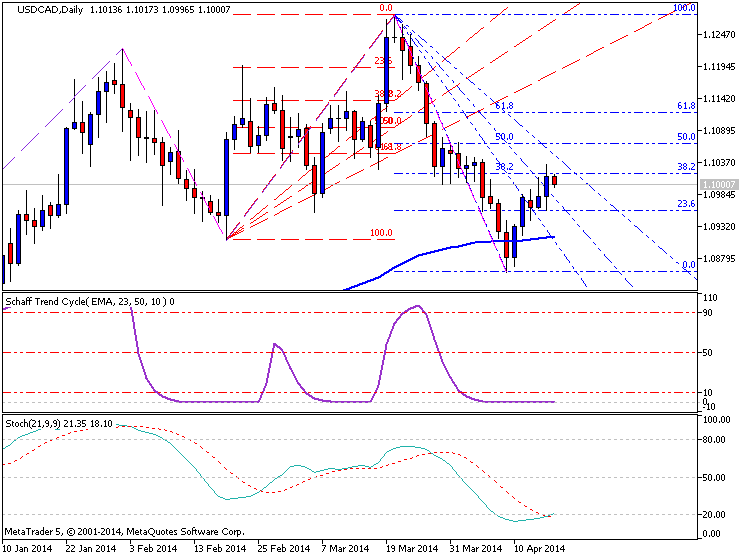

USD/CAD forecast for the week of April 14, 2014, Technical AnalysisThe USD/CAD pair initially fell during the week, but found enough support to bounce and form a nice-looking hammer this hammer of course is a very bullish sign, and the fact that it is focused on the 1.09 area leads us to believe that the market should continue to go higher given enough time. That being the case, we are bullish of the USD/CAD pair given enough time, as the bullish momentum should continue based upon not only the hammer, but the fact that the hammer formed exactly where did leads us to believe that we are going to continue to consolidate in a market that has been very bullish to begin with. Typically, and these situations consolidation in some been continuation.

The recent action in this marketplace suggests to us that perhaps a rest was needed, and as a result we should continue to go higher, probably testing the 1.12 level which is the top of this rectangle. With that, if we break above the 1.12 level, this market should head to the 1.15 level given enough time. At the end of the day, we believe that the Canadian dollar is in trouble overall, and this hammer of course only suggests the same thing. After all, the Bank of Canada recently suggested that Ray cuts warrant necessarily out of the question, which is the complete opposite with going on in the Federal Reserve. The Federal Reserve is trying to cut back on quantitative easing which of course is bullish for the US dollar.

It is not until we break down below this hammer that we would consider selling, but at the end of the day we believe that the support comes back into play at the 1.07 level, which extends all the way down to the 1.06 handle. With that, we would only be short-term bearish, and then start looking for the supportive candle in order to go higher as we would still be in an uptrend at that point as well. One thing to keep in mind though, you can draw an uptrend line that would touch the bottom of this hammer.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.14 15:26

2014-04-14 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

- past data is 0.7%

- forecast data is 0.8%

- actual data is 1.1% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Retail Sales Jump 1.1% In March Amid Improved Weather

With Americans heading back to the stores after the unusually rough winter, the Commerce Department released a report on Monday showing that U.S. retail sales rose by more than expected in the month of March.

The report showed that retail sales jumped by 1.1 percent in March after climbing by an upwardly revised 0.7 percent in February.

Economists had expected sales to increase by about 0.9 percent compared to the 0.3 percent increase originally reported for the previous month.

Peter Boockvar, managing director at the Lindsey Group, said, "Retail sales in March showed a nice bounce back after the weather influenced previous months."

The stronger than expected retail sales growth was partly due to a notable increase in sales by motor vehicle and parts dealers, which surged up by 3.1 percent in March after climbing by 2.5 percent in February.

Excluding the increase in auto sales, retail sales still rose by 0.7 percent in March compared to economist estimates for an increase of 0.5 percent.

The report also showed a significant rebound in sales by building materials and supplies dealers, which rose by 1.8 percent in March after falling by 0.6 percent in February.

General merchandise stores and non-store retailers also saw strong sales growth, with sales rising by 1.9 percent and 1.7 percent, respectively.

On the other hand, the report said sales at electronic and appliance stores dropped by 1.6 percent. Sales at gas stations also fell by 1.3 percent.

Core retail sales, which exclude autos, gasoline, and building materials, increased by 0.8 percent in March compared to economist estimates for 0.5 percent growth.

"Bottom line, consumers clearly responded to the winter thaw and the sales gains m/o/m were pretty broad based," Boockvar said.

"With the upside to the core portion of the data, Q1 GDP estimates should go up by about .1-.2 but still may print below 2%," he added. "The sustainability of the sales gains, as opposed to just a onetime weather rebound, will now be the focus."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 22 pips price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.14 20:22

USD/CAD rebounds off key support (based on dailyfx article)

- USD/CAD found support last week at the 4th square root relationship of the year’s high near 1.0860

- Our near-term trend bias is lower in Funds while below 1.1010

- A move under 1.0910 is needed to re-instill immediate downside momentum

- The next couple of days are a cycle turn window for USD/CAD

- A daily close over 1.1010 would turn us positive on the exchange rate

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.15 08:01

2014-04-14 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Business Inventories]

- past data is 0.4%

- forecast data is 0.5%

- actual data is 0.4% according to the latest press release

if actual < forecast = good for currency (for USD in our case)

==========

U.S. Business Inventories Rise 0.4% In February, Less Than Expected

Business inventories in the U.S. rose by less than expected in the month of February, according to a report released by the Commerce Department on Monday, although the report also showed a notable rebound in business sales during the month.

The report showed that business inventories rose by 0.4 percent in February, matching the increase seen in January. Economists had expected inventories to increase by about 0.6 percent.

The increase in business inventories was partly due to higher inventories at manufacturers, which rose by 0.7 percent in February after edging up by 0.2 percent in January.

Inventories at merchant wholesalers also increased by 0.5 percent in February after climbing by 0.8 percent in the previous month.

On the other hand, the report said inventories at retailers came in unchanged in February after rising by 0.3 percent in January.

Meanwhile, the Commerce Department also said business sales increased by 0.8 percent in February after tumbling by 1.1 percent in the previous month.

Sales by manufacturers rose by 0.9 percent in February after falling by 0.7 percent in January, while sales by both retailers and merchant wholesalers increased by 0.7 percent.

With inventories and sales both rising, the total business inventories/sales ratio was unchanged from the previous month at 1.31. The ratio came in at 1.28 in the same month a year ago.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 20 pips price movement by USD - Business Inventories news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.15 15:06

2014-04-15 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Manufacturing Sales]

- past data is 0.8%

- forecast data is 1.1%

- actual data is 1.4% according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

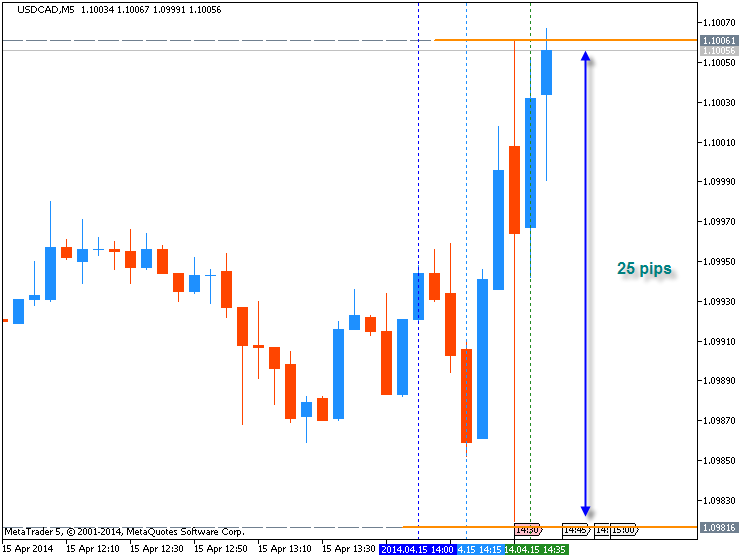

USDCAD M5 : 25 pips range price movement by CAD - Manufacturing Sales news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.16 08:39

2014-04-16 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - GDP]

- past data is 7.7%

- forecast data is 7.3%

- actual data is 7.4% according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China's gross domestic product expanded 7.4 percent on year in the first quarter of 2014, the government said on Wednesday.

That topped expectations for 7.3 percent following the 7.7 percent gain in the previous three months.

On a seasonally adjusted quarterly basis, GDP added 1.4 percent - shy of expectations for 1.5 percent and slowing from 1.8 percent in the three months prior.

The government also revealed that industrial production gained 8.8 percent on year in March - missing forecasts for 9.0 percent but up from 8.6 percent in February.

Retail sales climbed 12.2 percent, beating expectations for 12.1 percent and up from 11.8 percent in the previous month.

Fixed-asset investment climbed an annual 17.6 percent - missing forecasts for 18.0 percent and down from 17.9 percent a month earlier.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 10 pips rabge price movement by CNY - GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.16 14:42

2014-04-16 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - International Transactions in Securities]

- past data is 1.22B

- forecast data is 4.57B

- actual data is 6.08B according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 14 pips price movement by CAD - International Transactions in Securities news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.16 16:41

2014-04-16 14:00 GMT (or 16:00 MQ MT5 time) | [CAD - BOC Interest Rate]- past data is 1.00%

- forecast data is 1.00%

- actual data is 1.00% according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

Bank of Canada interest rate statement

The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1 per cent. The Bank Rate is correspondingly 1 1/4 per cent and the deposit rate is 3/4 per cent.

Inflation in Canada remains low. Core inflation is expected to stay well below 2 per cent this year due to the effects of economic slack and heightened retail competition, and these effects will persist until early 2016. However, higher consumer energy prices and the lower Canadian dollar will exert temporary upward pressure on total CPI inflation, pushing it closer to the 2 per cent target in the coming quarters. We expect total CPI inflation will remain close to target throughout the projection, even as upward pressure from energy prices dissipates, because the impact of retail competition will gradually fade and excess capacity will be absorbed.

The global economic expansion is expected to strengthen over the next three years as headwinds that have been restraining activity dissipate. The economic recovery in the United States appears to be on track, despite soft readings in the last few months largely due to unusual weather. Indeed, private demand could turn out to be stronger than anticipated. Europe’s economy is growing modestly, but inflation remains too low and the nascent recovery could be undermined by risks emanating from the Russia-Ukraine situation. In China and other emerging-market economies growth is expected to be solid, although there are growing concerns about financial vulnerabilities. Overall, global growth is expected to pick up to 3.3 per cent in 2014 and increase further to 3.7 per cent in 2015 and 2016 – largely unchanged from the January Monetary Policy Report (MPR).

The Bank continues to expect Canada’s real GDP growth to average about 2 1/2 per cent in 2014 and 2015 before easing to around the 2 per cent growth rate of the economy’s potential in 2016. Competitiveness challenges continue to weigh on Canadian exporters’ ability to benefit from stronger growth abroad. However, a range of export subsectors have been growing in line with fundamentals, which suggests that as the U.S. recovery gathers momentum and becomes more broadly-based, many of our exports will benefit. The lower Canadian dollar should provide additional support. We continue to believe that rising global demand for Canadian goods and services, combined with the assumed high level of oil prices, will stimulate business investment in Canada and shift the economy to a more sustainable growth track.

Recent developments are in line with the Bank’s expectation of a soft landing in the housing market and stabilizing debt-to-income ratios for households. Still, household imbalances remain elevated and would pose a significant risk should economic conditions deteriorate.

In sum, the Bank continues to see a gradual strengthening in the fundamental drivers of growth and inflation in Canada. This view hinges critically on the projected upturn in exports and investment. With underlying inflation expected to remain below target for some time, the downside risks to inflation remain important. At the same time, the risks associated with household imbalances remain elevated. The Bank judges that the balance of these risks remains within the zone for which the current stance of monetary policy is appropriate and therefore has decided to maintain the target for the overnight rate at 1 per cent. The timing and direction of the next change to the policy rate will depend on how new information influences the balance of risks.

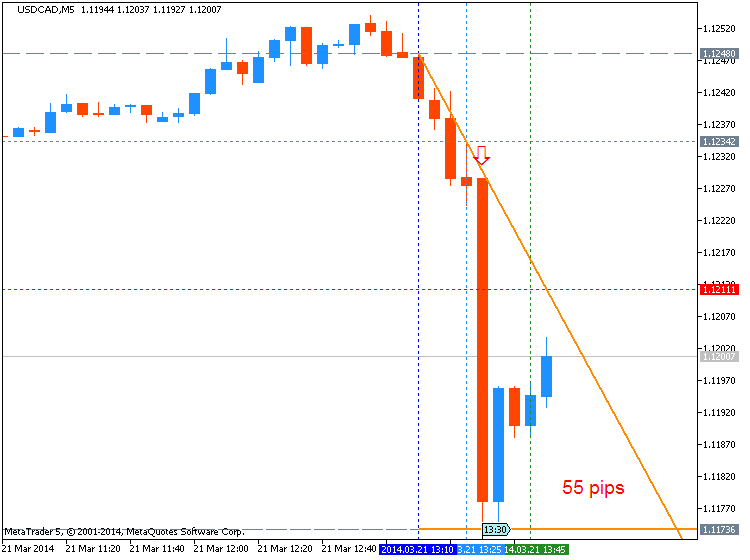

USDCAD M5 : 57 pips range price movement by CAD - BOC Interest Rate price movement :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.17 10:47

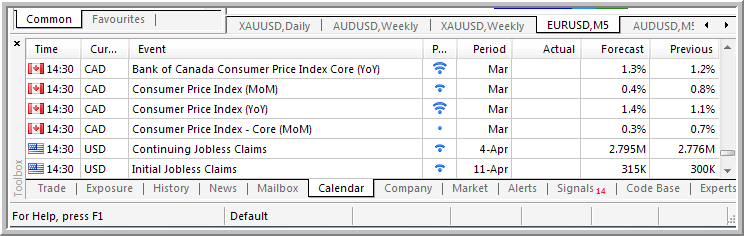

Trading the News: Canada Consumer Price Index (based on dailyfx article)

- Canada Headline & Core Inflation to Rebound in March.

- Consumer Price Index (CPI) has Held Above 1.0% for Last Three-Months.

A rebound in Canada’s Consumer Price Index (CPI) may spur a near-term

pullback in the USD/CAD as it dampens bets of seeing the Bank of Canada

(BoC) further embark on its easing cycle.

What’s Expected:

Event Important:

Heightening price pressures may keep the BoC on the sidelines as it limits the threat for deflation, and Governor Stephen Poloz may endorse a more neutral tone for monetary policy as the central bank head sees a ‘soft landing’ in the Canadian economy.

Rising input costs paired with the pickup in private sector consumption may encourage Canadian firms to boost consumer prices, and a marked uptick in the CPI may spur a near-term pullback in the USD/CAD as it limits the threat for deflation.

However, the headline reading for inflation may continue to undershoot amid the slowing housing market along with the downturn in business sentiment, and a weaker-than-expected CPI print may heighten the bearish sentiment surrounding the Canadian dollar as it puts increased pressure on the BoC to further embark on its easing cycle.

How To Trade This Event Risk

Bullish CAD Trade: Price Growth Climbs 1.4% or Greater

- Need red, five-minute candle after the CPI report to consider short USD/CAD entry

- If the market reaction favors a bullish Canadian dollar trade, establish short with two position

- Set stop at the near-by swing high/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle following the release to look at a long USD/CAD trade

- Carry out the same setup as the bullish loonie trade, just in reverse

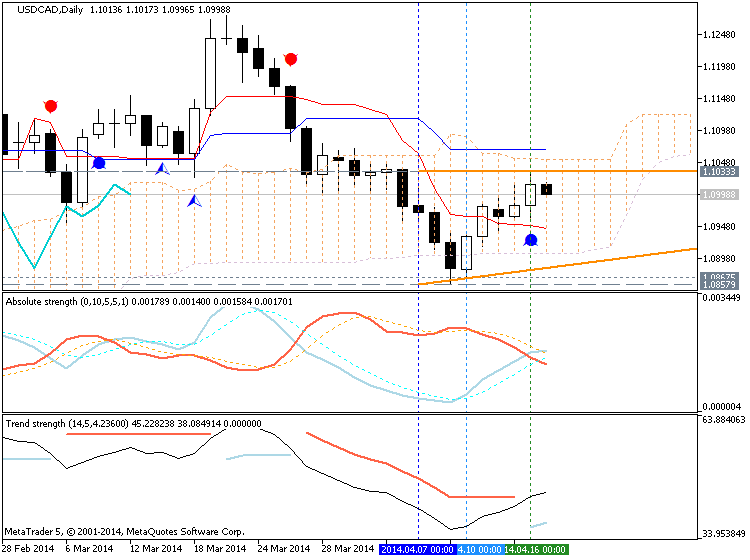

USD/CAD Daily

- Carves Higher Low (1.0857) in April; Long-Term Bias Remains Bullish

- Need Topside Break in Relative Strength Index for Conviction on Higher High

- Interim Resistance: 1.1310 Pivot to 1.1320 (61.8% expansion)

- Interim Support: 1.0850 (61.8% retracement) to 1.0870 (100% expansion)

USDCAD M5 : 55 pips price movement by CAD - CPI news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is inside Ichimoku cloud/kumo ranging between the border of the cloud - Sinkou Span A and Sinkou Span B after reversal from bullish to primary bearish in the end of March this year. Chinkou Span line of Ichimoku indicator came to be very close to historical price trying to cross is from below to above for good breakout.

The same situation is for H4 timeframe : Chinkou Span line is very near to be crossed the price for breakout, and the price is crossing 1.0983 resistance level on open bar.

If D1 price will break 1.1069 resistance level on close bar together with Chinkou Span line to be crossed with the price from below to above so we may see good breakout of the price movement with the reversal to primary bullish market condition.If not so the ranging market condition will be continuing.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2014-04-14 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-04-15 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-04-15 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Manufacturing Sales]

2014-04-15 12:45 GMT (or 14:45 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-04-15 13:00 GMT (or 15:00 MQ MT5 time) | [USD - TIC Long-Term Purchases]

2014-04-16 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - GDP]

2014-04-16 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Industrial Production]

2014-04-16 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Retail Sales]

2014-04-16 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2014-04-16 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - International Transactions in Securities]

2014-04-16 14:00 GMT (or 16:00 MQ MT5 time) | [CAD - BOC Interest Rate]

2014-04-16 16:15 GMT (or 18:15 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-04-17 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - CPI]

2014-04-17 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movement

SUMMARY : bullish

TREND : bullish

Intraday Chart