Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.05 15:03

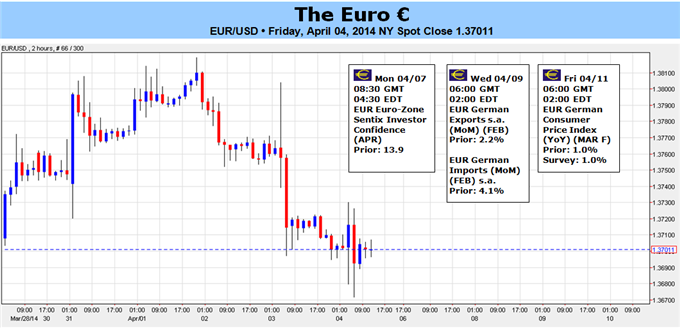

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: Bearish- The Euro saw its highs early in the week but was generally weaker into the ECB rate decision.

- The ECB rate decision carried a heavy dovish connotation, leading to bearish opportunities in several EUR-crosses.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.05 18:15

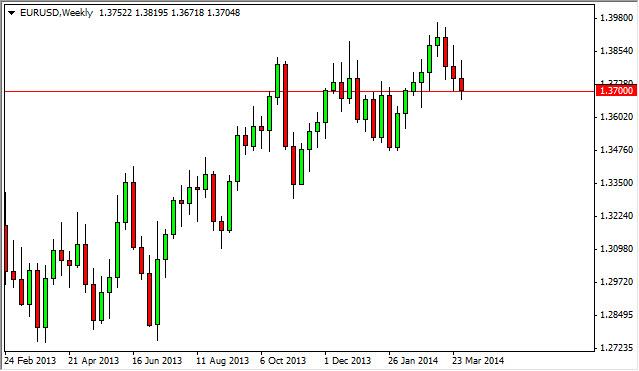

EUR/USD forecast for the week of April 7, 2014, Technical AnalysisThe EUR/USD pair ended up forming a shooting star for the week, but as you can see on the daily charts, we formed a hammer for the Friday session. The 1.37 level has offered support in the past, and it appears that it’s doing so now. However, if you only look at the weekly chart, you will not see that there is in fact underlying support at the moment. With that in mind, it’s a bit difficult to get involved in the long side, simply because the longer-term chart looks a bit on the soft side right now, even though the daily chart tells you the exact opposite. Nonetheless, we certainly wouldn’t sell this market, because there is so much support shown not only on the daily chart, but the fact that there is a cluster that goes all the way down to the 1.3450 level.

With this, we believe that this market may continue to have a slightly positive bias, but quite frankly it’s a difficult one to be concerned about for a longer-term trader, as it will more than likely simply offer headaches had, and not necessarily profits.

Even if we broke down here, is going to be difficult to hang onto the trade to the downside Sibley because there is so much in the way of noise below and the volatility would be a bit much for us to be interested in being involved in. There are easier markets out there to trade, and the EUR/USD pair will more than likely continue to be one that is preferred buying short-term traders, especially once the trade very short timeframe charts.

On the other hand, if we broke above the top of the shooting star from either this week or last week, we believe at that point in time the market would break out to the upside eventually, and clear the 1.40 level would be a longer-term buy-and-hold type of situation in the making

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.06 16:42

Forex Fundamentals - Weekly outlook: April 7 - 11The dollar pared back gains against the euro on Friday and fell against the yen, despite the latest U.S. employment report indicating that the economic recovery is on track.

The Labor Department reported Friday that the U.S. economy added 192,000 jobs in March, below expectations for jobs growth of 200,000. February’s figure was revised up to 197,000 from a previously reported 175,000. The U.S. unemployment rate remained unchanged at 6.7%, compared to expectations for a tick down to 6.6%.

The data disappointed some market expectations for a more robust reading but indicated that the Federal Reserve is likely to stick to the current pace of reductions to its asset purchase program.

EUR/USD ended Friday’s session down 0.12% to 1.3703, after falling to a five-week low of 1.3673 earlier. For the week, the pair lost 0.52%.

The shared currency remained under pressure after the European Central Bank said Thursday it would use unconventional measures if necessary to stave off the risk of deflation in the euro zone.

ECB President Mario Draghi said the governing council was "unanimous" in its commitment to using all unconventional instruments within its mandate to cope with the risk of low inflation becoming entrenched. He added that the bank discussed the possibility of negative deposit rates. The comments came after the bank left rates on hold at a record low 0.25%.

USD/JPY fell 0.63% to end Friday’s session at 103.27, after hitting session highs of 104.13 immediately following the release of the jobs report.

Elsewhere, the Canadian dollar rose to five-week highs against the greenback, bolstered by a stronger-than-forecast domestic jobs report for March.

Statistics Canada reported that the economy added 42,900 jobs last month, well above the forecast jobs growth of 21,500, while the unemployment rate unexpectedly ticked down to 6.9% from 7.0% in February.

USD/CAD fell 0.51% to settle at 1.0980, after falling to a session low of 1.0955 after the release of the data. For the week, the pair ended down 0.67%.

The Australian and New Zealand dollar were also higher against the greenback on Friday, with AUD/USD settling at 0.9292, not far from the four month peaks of 0.9306 hit earlier in the session. NZD/USD was up 0.63% to 0.8598.

In the week ahead, markets will be focusing on Wednesday’s minutes of the Fed’s most recent policy setting meeting. Monetary policy meetings by the Bank of Japan and the Bank of England will also be closely watched.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, April 7

- Markets in China will be closed for a national holiday.

- The Swiss National Bank is to publish data on its foreign currency reserves. This data is closely scrutinized for indications of the size of the bank’s operations in currency markets. Switzerland is also to release data on consumer price inflation.

- The Bank of Canada is to publish its quarterly business outlook survey.

- Both Australia and New Zealand are to publish private sector reports on business confidence.

- The BoJ is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision. The announcement is to be followed by a press conference. Japan is also to publish data on the current account.

- Switzerland is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.K. is to release a report on industrial and manufacturing production, a leading indicator of economic health.

- Canada is to produce data on building permits.

- Australia is to release private sector data on consumer sentiment, as well as official data on home loans.

- Both Germany and the U.K. are to produce data on the trade balance, the difference in value between imports and exports.

- Later Wednesday, the Federal Reserve is to publish what will be the closely watched minutes of its latest policy meeting.

- New Zealand is to release private sector data on manufacturing activity.

- Australia is to release data on the change in the number of people employed and the unemployment rate, in addition to private sector data on inflation expectations.

- Japan is to produce a report on core machinery orders.

- The BoE is to announce its benchmark interest rate.

- Canada is to publish data on new house price inflation.

- In the U.S., the Labor Department is to release its weekly report on initial jobless claims.

- The BoJ is to publish monetary policy meeting minutes.

- China is to produce data on consumer price inflation.

- The U.S. is to round up the week with data on producer price inflation and the preliminary report on the University of Michigan’s consumer sentiment index.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.06 17:26

EURUSD - Fundamentals - weekly outlook: April 7 - 11The dollar pulled back from one-month highs against the euro on Friday after the release of data showing that the U.S. economy added slightly fewer than expected jobs in March.

EUR/USD ended Friday’s session down 0.12% to 1.3703, after falling to a five-week low of 1.3673 earlier. For the week, the pair lost 0.52%.

The pair is likely to find support at 1.3673 and resistance at 1.3730, Friday’s high.

The Labor Department reported Friday that the U.S. economy added 192,000 jobs in March, below expectations for jobs growth of 200,000. February’s figure was revised up to 197,000 from a previously reported 175,000. The U.S. unemployment rate remained unchanged at 6.7%, compared to expectations for a tick down to 6.6%.

The data disappointed some market expectations for a more robust reading but indicated that the Federal Reserve is likely to stick to the current pace of reductions to its asset purchase program.

The shared currency remained under pressure after the European Central Bank said Thursday it would use unconventional measures if necessary to stave off the risk of deflation in the euro zone.

ECB President Mario Draghi said the governing council was "unanimous" in its commitment to using all unconventional instruments within its mandate to cope with the risk of low inflation becoming entrenched. He added that the bank discussed the possibility of negative deposit rates.

The central bank left rates on hold at a record low 0.25% at its monthly meeting, despite data earlier in the week showing that the annual rate of euro zone inflation slowed to 0.5% in March, the lowest since November 2009.

The ECB targets an inflation rate of just under 2%.

In the week ahead, markets will be focusing on Wednesday’s minutes of the Fed’s most recent policy setting meeting. German trade data will also be watched in data light week.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets. The guide skips Monday and Tuesday as there are no relevant events on these days.

Wednesday, April 9

- Germany is to produce data on the trade balance, the difference in value between imports and exports.

- The Federal Reserve is to publish what will be the closely watched minutes of its latest policy meeting.

- Thursday, April 10

- In the U.S., the Labor Department is to release its weekly report on initial jobless claims.

- The U.S. is to round up the week with data on producer price inflation and the preliminary report on the University of Michigan’s consumer sentiment index.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.08 20:20

EURUSD Technical Analysis (based on investing article)

The euro rose against the dollar on Tuesday as investors avoided the greenback ahead of the release of the minutes from the Federal Reserve's March policy meeting on Wednesday, while broad demand for emerging-market currencies pushed the U.S. currency lower as well.

In U.S. trading, EUR/USD was trading at 1.3800, up 0.43%, up from a session low of 1.3738 and off a high of 1.3808.

The pair was likely to find support at 1.3673, Friday's low, and resistance at 1.3820, Wednesday's high.

The dollar weakened as investors avoided the U.S. currency ahead of Wednesday’s minutes of the Fed’s March meeting, which could provide insight as to the direction of monetary policy.

Last week’s U.S. payrolls report came in slightly below expectations, which spooked investors, as Fed Chair Janet Yellen has said slack labor markets will call for accommodative policies to stay in place for some time.

Demand for the euro remained firm after European Central Bank officials on Monday stressed that while fresh easing measures may be needed to steer the euro zone away from deflationary pressures, implementation of such tools is not imminent.

Last week the ECB left the door open to further stimulus measures, saying that unconventional monetary policy instruments may be necessary to avert the risk of ongoing low inflation in the euro zone.

Elsewhere, emerging-market currencies rose across the board on sentiments that even though the Federal Reserve will continue to unwind its bond-purchasing program this year, policy will remain loose and make higher-yielding currencies more attractive.

The euro was down against the pound, with EUR/GBP slipping 0.30% to 0.8249, and down against the yen, with EUR/JPY trading down 0.50% at 140.97.

The yen rose against most currencies after BoJ Governor Haruhiko Kuroda indicated that the bank was unlikely to implement further stimulus measures at present. He added that growth and inflation were likely to continue to pick up in the coming months despite a sales tax increase in April.

Earlier Tuesday, the BoJ voted to keep its key policy target of increasing base money unchanged at an annual pace of ¥60 trillion to ¥70 trillion after ending its two-day policy meeting.

On Wednesday, Germany and the U.K. are to produce data on the trade balance, the difference in value between imports and exports.

Later Wednesday, the Federal Reserve is to publish what will be the closely watched minutes of its latest policy meeting.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.09 08:57

2014-04-09 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Trade Balance]

- past data is 17.2B

- forecast data is 17.8B

- actual data is 15.7B according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

German Exports Fall More Than Forecast In February

Germany's exports declined more than expected in February, but imports continued to rise for the second consecutive month, official data revealed Wednesday.

Exports fell 1.3 percent in February from January, which was the second fall in three months, Destatis said. Exports were forecast to fall 0.5 percent after expanding 2.2 percent in January.

At the same time, imports gained 0.4 percent month-on-month, faster than the expected 0.1 percent growth. However, the rate slowed from the 4.1 percent increase seen in January.

As a result, the trade surplus fell to EUR 15.7 billion, from EUR 17.3 billion in January.

On a yearly basis, exports advanced 4.6 percent and imports climbed 6.5 percent in February.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of EUR 13.9 billion in February compared to a EUR 15.7 billion surplus in the prior year.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 14 pips price movement by EUR - German Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.09 20:13

2014-04-09 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

==========

FOMC Meeting Minutes give USD another blow

The FOMC meeting minutes lean to the dovish side, with several members saying the statement overstates the rate rise pace. These are the minutes for the first FOMC meeting under Chair Janet Yellen. In that decision, the Fed dropped the forward guidance and just said that low rates would remain at hand for a long time after the bond buying program (QE) ends. In the accompanying press conference, Yellen surprised by saying that a considerable time is “6 months”. This gave a boost to the greenback. In the meantime, it lost its shine, even thogh nothing has really changed in the big picture of the US economy.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 43 pips price movement by USD - FOMC Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.10 21:06

EUR/USD extends gains on dovish Fed policy meeting minutes

The dollar slid against the euro on Thursday after minutes from the Federal Reserve's March policy meeting revealed monetary authorities unanimously voted to scrap a threshold that would trigger rate hikes.

A better-than-expected report on weekly jobless claims in the U.S. cushioned losses but only slightly.

In U.S. trading, EUR/USD was up 0.25% at 1.3890, up from a session low of 1.3836 and off a high of 1.3899.

The pair was likely to find support at 1.3673, last Friday's low, and resistance at 1.3948, the high from March 17.

The Federal Reserve Board of Governors unanimously voted to scrap a threshold that would hike interest rates once the unemployment rate hits 6.5%, according to the minutes of the Fed's March policy meeting released Thursday.

In the past, the Fed had indicated rates were set to rise when the unemployment rate hits or approaches 6.5% provided that figure accompanied a 2.5% inflation rate.

Today, the headline unemployment rate stands at 6.7%, not far from the previous threshold, labor markets remain slack and inflation remains well below 2.5%.

The Federal Reserve decision to do away with its rate-hike target left markets convinced that interest rates will remain low for some time to come, even after the U.S. central bank winds down monetary stimulus programs.

Elsewhere, the Labor Department reported that the number of individuals filing for initial jobless benefits in the week ending April 4 fell by 30,000 to 300,000, the lowest since May of 2007, from the previous week's upwardly revised total of 332,000.

Analysts had expected jobless claims to decline to 320,000, though the numbers did little to boost the dollar against the euro.

In the euro zone, Greece made a successful return to the financial markets on Thursday, raising €3 billion in its first bond auction since 2010, when Athens sought its first bailout.

The euro was up against the pound, with EUR/GBP up 0.32% to 0.8276, and down against the yen, with EUR/JPY down 0.31% at 140.86.

The Bank of England left the benchmark interest rate unchanged at 0.50% earlier Thursday, in a widely anticipated move.

On Friday, the U.S. is to round up the week with data on producer price inflation and the preliminary report on the University of Michigan's consumer sentiment index.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Chinkou Span line is crossing historical price on open bar for good possible breakdown. D1 price is trying to be reversed from bullish to primary bearish by breaking 1.3698 support level and Sinkou Span A line which is the virtual border between bullish and bearish market condition

If D1 price will break 1.3698 support level on close bar together with Chinkou Span line crossing historical price from above to below so we may see good breakdown and possible price reversal to primary bearish on D1 timeframe.

If not so EURUSD D1 price will be on market rally within primary bullish (counter trend)

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-04-07 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Industrial Production]

2014-04-07 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Consumer Credit]

2014-04-08 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Trade Balance]

2014-04-08 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Job Openings]

2014-04-08 17:30 GMT (or 19:30 MQ MT5 time) | [USD - FOMC Member Speech]

2014-04-08 18:45 GMT (or 20:45 MQ MT5 time) | [USD - FOMC Member Speaks]

2014-04-09 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Trade Balance]

2014-04-09 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2014-04-10 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Trade Balance]

2014-04-10 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Industrial Production]

2014-04-10 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - ECB Monthly Bulletin]

2014-04-10 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-04-10 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Budget Balance]

2014-04-11 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-04-11 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German CPI]

2014-04-11 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

2014-04-11 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : breakdown

TREND : reversal

Intraday Chart