Hi,

I'm using different EA's for trades it's possible large sizing trades face more slippage compare to small size?

Thanks for your repay and experience

Yes of course.

Do you understand what a trade is ?

See : The Process of Selling and Buying. Slippage. The Concept of Liquidity

- 2015.02.26

- Vasiliy Sokolov

- www.mql5.com

Yes of course.

Do you understand what a trade is ?

See : The Process of Selling and Buying. Slippage. The Concept of Liquidity

Then what is solution with same broker I need multi accounts to split funds with this process lot sizing will be reduce ?

Can you please measure what is normal trade size in Forex for less slippage?

Looking replay

Then what is solution with same broker I need multi accounts to split funds with this process lot sizing will be reduce ?

Can you please measure what is normal trade size in Forex for less slippage?

Looking replay

Depends of what is "big", also depends of the broker. In Forex, liquidity is very big.

Yes, if your order is so big that no counter-side can fulfill, your bidding (in general, not the "bid" in financial market) price has to become "worse" .Graphically speaking, you just "eat up" all the middle part of market depth chart.

However, this is not the same meaning to which we normally refer "slippage". Slippage usually refers to cheating conducted by market makers.

(please do not waste time to set the slippage in OrderSend() ...you get it ;-)

Yes, if your order is so big that no counter-side can fulfill, your bidding (in general, not the "bid" in financial market) price has to become "worse" .Graphically speaking, you just "eat up" all the middle part of market depth chart.

However, this is not the same meaning to which we normally refer "slippage". Slippage usually refers to cheating conducted by market makers.

(please do not waste time to set the slippage in OrderSend() ...you get it ;-)

Let's say we have a broker with STP/ECN model instead of Market Maker then in forex what is a normal trade size which gets less slippage i.e

.01 to .25 less slippage

.25 to .50 normal slippage

.50 to .99 more slippage

can we set these figures for trading?

Let's say we have a broker with STP/ECN model instead of Market Maker then in forex what is a normal trade size which gets less slippage i.e

.01 to .25 less slippage

.25 to .50 normal slippage

.50 to .99 more slippage

can we set these figures for trading?

1.

RefreshRates(); double bid=Bid; Print("right before OrderSend ",bid); OrderSend(Symbol(),OP_SELL,0.01,bid, ...); //replace Bid with Ask for OP_BUY

2.

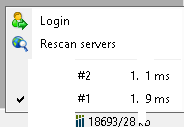

Please go to the "Experts" tab in "Terminal", looking for lines similar to the following:

![]()

3.

Now, the price difference is the abnormal slippage to (since I have eliminated external factors such as latency and illiquidity with really small lot and low latency).

(I would not opt for an arbitrary threshold to dichotomize whether the slippage is normal or not).

Looking forward to constructive criticism.

Let's say we have a broker with STP/ECN model instead of Market Maker then in forex what is a normal trade size which gets less slippage i.e

.01 to .25 less slippage

.25 to .50 normal slippage

.50 to .99 more slippage

can we set these figures for trading?

It really depends on market conditions, but you shouldn't be getting much slippage on ECN with less than one lot.

The answer already been given:

Forum on trading, automated trading systems and testing trading strategies

Large size trade gets more slippage?

Alain Verleyen, 2017.08.16 20:59

Depends of what is "big", also depends of the broker. In Forex, liquidity is very big.There is no clear cut answer.

If it is really that important, run an A B test for your situation and measure.

within MT5, you can see the orderdepth which includes the available liquidity at each price. Depending on your broker, the liquidity will be different. In normal cases, the best bid and ask only offer 1 Lot and the next level up or down of 1 pipette can be 5 lots.

Unfortunately in Forex, you broker normally doesn't allow interaction of real buy limits or sell limits and these orders will execute as a market order

when price reaches that limit order price. Trade at futures is recommended.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi,

I'm using different EA's for trades it's possible large sizing trades face more slippage compare to small size?

Thanks for your repay and experience