You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

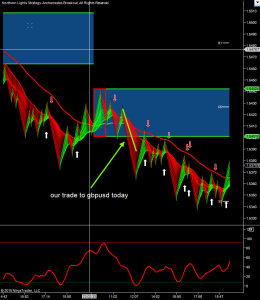

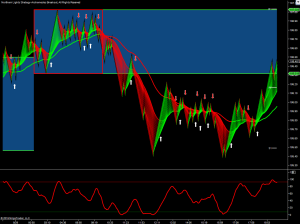

forex scalping from ranging to breakout

Today I have made two videos with forex scalping.The first one is about handling ranging conditions in gbpusd signal which appeared some time after the London open.https://www.mql5.com/go?link=https://www.youtube.com/watch?v=5zDnY44GTJUThe second one is how I take the breakout from ranging conditions close theÂ* forex scalping target and convert it in intraday trade.https://www.mql5.com/go?link=https://www.youtube.com/watch?v=jINauzhn0WYTwo events helped the bears like me today.a.Fresh USD bids hit the GBP/USD pair and pushed it to a session low of 1.5434 after Fed’s George, a well known dove, sounded less dovish.Offered below Key fib levelThe spot was quickly offered to daily lows once it broke below 1.5460 (61.8% of June rally). The USD bulls made a comeback today after the spot failed to sustain above 1.55 levels. The bearish pressure on the Sterling intensified after the upside breakout from the multi week range of 1.5460-1.5690 quickly failed as the spot made its way back in the range.The focus now shifts to the second estimate of the US Q2 GDP, which is expected to show the economy expanded 3.2%, compared to the initial reading of 2.3%.GBP/USD Technical LevelsThe pair currently trades around 1.5440. The immediate support is seen at 1.5409 (38.2% of Apr-June rally), under which the spot could drop to 1.5369 (200-DMA). On the other hand, resistance is seen at 1.5468 (100-DMA) and 1.55 levels.b.The GBP/USD pair dropped to a fresh session low of 1.5415 after the upward revision of US Q2 GDP pushed up 2-yr treasury yield indicating a rise in the rate hike bets.GBP/USD at lowest since July 10The spot breached the support at 1.5424 (Aug 7 low) to trade at its lowest since July 10. The upwardly revised GDP pushed the 2-year treasury yield to a session high of 0.707%. The yield has now erased entire losses witnessed in the recent bout of risk aversion.Moreover, short-end yields represent rate hike bets. Consequently, an uptick in the 2-yr yield is leading to broad based USD strength. Meanwhile the drop in the US weekly jobless claims further added to the bullish tone on the USD.GBP/USD Technical LevelsThe spot is hovering near 1.5415 levels. The immediate support is seen at 1.5409 (38.2% of Apr-June rally), under which the spot could drop to 1.5369 (200-DMA). On the other hand, resistance is seen at 1.5468 (100-DMA) and 1.55 levels.The three pairs I am watching dailygbpusd gbpjpy

gbpjpy eurjpy

eurjpy

forex scalping-ideal time duration for a scalping trade

Fridays the trade is weird ,ranging choppy and might hav3e a lot of surprises.The two jpy pairs we are watching were not ideally so we concentrated in pound dollar during the European session.Pound dollar gave a short signal and we waited with patience to take a breath backwards in order to enter.Our entry was almost perfect two pips out from the maximum breath.The forex scalping target achieved 6 minutes after the entry which is the ideal time for the first scalping target.Five to ten minutes for the first target is the ideal time duration for a forex scalping trade.The higher time frame saw also a broken trendline and our entry was almost in the testing level.The trade then converted in intraday and the trailing stop start locking profit.The momentum was extremely good and before we count thirty minutes we were counting approx 60 pips.A get out of trade divergence appeared but we were waiting a support to form in our trigger chartÂ* order to close the trade.Then price pierced the spine of northern lights and set course in the median trendline were our trailing stop was.Trailing stop then hit and we finished for our trading Friday with approx 40 pips for our intraday trade.All was recorded in the video ,have a nice weekendhttps://www.youtube.com/watch?v=7wPtH69PdpAThe three pairs we watch every day and their signalsGBPUSD GBPJPY

GBPJPY EURJPY

EURJPY

best brokers for forex scalping-seven steps to forex scalping success

There is a global law for anything:you get what you payThe other general principal forÂ* our accounts is:the more capital you have the better services , the less commissions and spreads you pay.As bullet point we can mention what we are looking for in a broker1. Brokers must allow all trading including scalping techniques2. Non Dealing Desk / ECN3. Clearly regulated.4. Offering high leverage.5. LOW SPREAD6. No bad reports (Such traders do not get paid, etc.).Many people dont uderstand this vital difference so I will explain it as simple as I can.Firstly, you must know that almost all of the MT4(metetrader platform) brokers are running a "bucket shop".http://en.wikipedia.org/wiki/Bucket_shop_(stock_market)So when you are trading with an MT4 broker, your order is not appeared in the international interbank market, but it appears in the dealing desk of your MT4 broker.Basically you are trading either with the server, or with someone in the dealing desk of your broker.So while in demo you might be profitable but when you deposit real money for your live account ,"mystery spikes",(or requotes,slippage,no executions) not appearing in any other broker close your positions with loss(stop loss hunting)So your broker is earning from the spread and from the above "unexplainable spikes and events".An ECN broker is giving you the interbank feed as it is delivered by the ECN network and he is charging commisions for each transaction.http://en.wikipedia.org/wiki/Electro...cation_NetworkSo the broker earns only this commision and the feed you see is not manipulated.If you want to see a pure feed you must pay a separate feed with monthly subscription.The spread you will pay depends from the volatility and the pair in the specific moment.Pure demand and supply.You can see zero spread in EURUSD and some times in EURJPY.The higher the capital you have in your live account, the lower the commisions will be.Commisions vary from one ECN broker to another and if you are trading a lot of lots each month you can negotiate the commisions with your broker.The lower the commisions you pay the higher the minimum of lots you are obliged to trade. e.g. Institutional accounts.If you need any clarifications, I will be happy to answer.https://www.mql5.com/go?link=https://www.youtube.com/watch?v=C3DMXvtL680

I cant find the edit button so I will repost it

best brokers for forex scalping-seven steps to forex scalping success

Which are the best brokers for forex scalping ?I will try to point to the correct direction today.There is a global law for anything:

you get what you pay

The other general principal for our accounts is:

the more capital you have the better services , the less commissions and spreads you pay.

As bullet point we can mention what we are looking for in a broker

1. Brokers must allow all trading including scalping techniques

2. Non Dealing Desk / ECN

3. Clearly regulated.

4. Offering high leverage.

5. LOW SPREAD

6. No bad reports (Such traders do not get paid, etc.).

Many people don't understand this vital difference so I will explain it as simple as I can.

Firstly, you must know that almost all of the MT4(metatrader platform) brokers are running a "bucket shop".

https://en.wikipedia.org/wiki/Bucket_shop_(stock_market)

So when you are trading with an MT4 broker, your order is not appeared in the international interbank market, but it appears in the dealing desk of your MT4 broker.

Basically you are trading either with the server, or with someone in the dealing desk of your broker.

So while in demo you might be profitable but when you deposit real money for your live account ,"mystery spikes",(or re quotes,slippage,no executions) not appearing in any other broker close your positions with loss(stop loss hunting)

So your broker is earning from the spread and from the above "unexplainable spikes and events".

An ECN broker is giving you the interbank feed as it is delivered by the ECN network and he is charging commissions for each transaction.

http://en.wikipedia.org/wiki/Electro...cation_Network

So the broker earns only this commission and the feed you see is not manipulated.

If you want to see a pure feed you must pay a separate feed with monthly subscription.

The spread you will pay depends from the volatility and the pair in the specific moment.Pure demand and supply.You can see zero spread in EURUSD and some times in EURJPY.

The higher the capital you have in your live account, the lower the commissions will be.

Commissions vary from one ECN broker to another and if you are trading a lot of lots each month you can negotiate the commissions with your broker.

The lower the commissions you pay the higher the minimum of lots you are obliged to trade. e.g. Institutional accounts.

If you need any clarifications, I will be happy to answer.

forex scalping with ecn

[YOUTUBE]C3DMXvtL680[/YOUTUBE]

https://www.mql5.com/go?link=https://www.youtube.com/watch?v=C3DMXvtL680

forex scalping 31 8 2015

Today the day was very slow and choppyWe took two scalping trades one in eurjpy and one in gbpusd.EURJPY delivered slowly the scalping target of 10 pips in approx one hour ,then for the next two hours stayed almost in the same levels but presented a high probability pattern I use and name as crocodile which saw north.While I was waiting the pattern to deploy with small stop loss a short signal in gbpusd appeared and entered a limit order in the breath of the pair.The order triggered but things went slow for this pair too.While I was in this pair I have closed the eurjpy trade because I saw the reversal coming ,Finally after almost one hour and in the starting of New York gbpusd delivered the scalping target and closed everything since the choppiness and slow market tired me.This pair also tried to reverse just after I closed the trade by sawing opposite signal and then again reversed with a final signal which produced 60 pips.The end of the month is always full of ranging and unexpected moves and today's chartsÂ* and trading present this in a clear way.All of the above is written in the two hour video.Below you can check the threeÂ* pairs we watch every day with the trades on and the remarks.https://www.mql5.com/go?link=https://www.youtube.com/watch?v=4fTkqVbzCFEEURJPY GBPUSD

GBPUSD GBPJPY

GBPJPY

forex scalping 1 9 2015 trading with the trend

Hello,Today forex scalpingÂ* was more smoothly than yesterday.GBPUSD and EURJPY responded quickly approx one hour after the London open and start trading south.We took short signals in both but none of them took a breath .The GBPUSD has probed lower inÂ* trading today - moving below the low prices from July and August in the process.Approx 80 pips for pound dollar and 95 pips for euro yen.Waiting with patience aÂ* retracement came in pound dollar three and half hour after London open in the median line.Then a resistance is formed and the moment a double top formed in the trigger chart I have entered a short trade with nine pips stop loss ignoring a long signal whic was counter trend in the higher time frame chart.Forex scalping target achieved quickly in less than 15 minutes and then left the rest with trailing stop.Knowing that at 7.30 EST the economic announcement of Canadian GDP will influence the dollar I didn't gamble the profits and close the trade at 25 plus pips even if I saw 36 in a moment.The problem is that there have been two breaks below this area. The first failed.Â* The ensuing correction stalled near the 200 day MA at the 1.53635 (the high stalled at 1.53685).Â* The second probe moved to new day lows and is back up testing that break area (between 1.5329-38).Â* If the price can not stay below, the patience of the sellers may wain and the seller could switch to buyers instead.ISM data is due. So risk is increased.Â* The market will be looking for clues from the data. A more bullish number and new lows can be expected. If weaker, the sellers will likely become buyers again and we should see a rotation higher in the pair.The whole trade is written in the video from the beginning .https://www.mql5.com/go?link=https://www.youtube.com/watch?v=FCOvwa8B2SYHere is the three pairs I watch every day with remarks on them.gbpusd eurjpy

eurjpy gbpjpy

gbpjpy As long as you are new to trading and you are learning always look at the higher time frame and take your scalps and trades to the direction they dictate.Counter trend trades are dangerous to your account and psychology.Don't try to catch bottoms andÂ* top of the mountains you will bankrupt your account.

As long as you are new to trading and you are learning always look at the higher time frame and take your scalps and trades to the direction they dictate.Counter trend trades are dangerous to your account and psychology.Don't try to catch bottoms andÂ* top of the mountains you will bankrupt your account.

forex scalping 1 9 2015 trading with the trend

Hello,

Today forex scalping was more smoothly than yesterday.

GBPUSD and EURJPY responded quickly approx one hour after the London open and start trading south.We took short signals in both but none of them took a breath .

The GBPUSD has probed lower in trading today - moving below the low prices from July and August in the process.

Approx 80 pips for pound dollar and 95 pips for euro yen.

Waiting with patience a retracement came in pound dollar three and half hour after London open in the median line.

Then a resistance is formed and the moment a double top formed in the trigger chart I have entered a short trade with nine pips stop loss ignoring a long signal whic was counter trend in the higher time frame chart.

Forex scalping target achieved quickly in less than 15 minutes and then left the rest with trailing stop.

Knowing that at 7.30 EST the economic announcement of Canadian GDP will influence the dollar I didn't gamble the profits and close the trade at 25 plus pips even if I saw 36 in a moment.

The problem is that there have been two breaks below this area. The first failed. The ensuing correction stalled near the 200 day MA at the 1.53635 (the high stalled at 1.53685). The second probe moved to new day lows and is back up testing that break area (between 1.5329-38). If the price can not stay below, the patience of the sellers may wain and the seller could switch to buyers instead.

ISM data is due. So risk is increased. The market will be looking for clues from the data. A more bullish number and new lows can be expected. If weaker, the sellers will likely become buyers again and we should see a rotation higher in the pair.

The whole trade is written in the video from the beginning .

[video=youtube;FCOvwa8B2SY]https://www.youtube.com/watch?v=FCOvwa8B2SY[/video]

https://www.mql5.com/go?link=https://www.youtube.com/watch?v=FCOvwa8B2SY

Here is the three pairs I watch every day with remarks on them.

gbpusd

eurjpy

gbpjpy

As long as you are new to trading and you are learning always look at the higher time frame and take your scalps and trades to the direction they dictate.

Counter trend trades are dangerous to your account and psychology.

Don't try to catch bottoms and top of the mountains you will bankrupt your account.

Hello Traders,

Today the market was choppy and was lucking momentum.

We took two scalps.One in gbpusd during the European session approx 100 minutes after London open and one in the American session in eurjpy approx 45 minutes after DOW open.

In the first trade gbpusd gave as the most appropriate conditions since it moved in a very narrow range during Tokyo and gave us a signal after London open.

We wait with patience the retracement breath I like to call it and we entered in the trade.

The entry wasn't ideal but the pair gave us the scalping target after approx 20 minutes.Then the trailing begun and in a point we saw 25 + pips .After this we saw a support forming ,an opposite signal in the middle trigger chart and we wisely decided to take all the trailing profit and get out.As you see in the chart below we did well because the pair reversed.

We didn't touch eurjpy and gbpjpy in the European session since both of them moved in wide ranges during Tokyo. Approx 150 pips for gbpjpy 100 pips for eurjpy.

Then in the American session eurjpy broke the Tokyo range (Archimedes breakout)entered in a small retracement of 10 pips from the brake and took the forex scalping target as you see in the pictures for the two thirds of the position.

Left the rest on trailing but while the trailing stop reached the entry point eurjpy retraced and hit the stop loss.

So with these two trades we secured our primary target to remain consistent profitable one more day.

The first trade is written on video were I explain what I call Archimedes breakout (Tokyo range breakout) and the second is in the pictures below.

https://www.mql5.com/go?link=https://www.youtube.com/watch?v=PcXhPSdOwOw

The eurjpy trade. The entry

The hit of the scalping target

The trailing stop is hit

Our gbpusd trade

The gbpjpy today was the pair to avoid

forex scalping intraday trading 3 9 2015

The day was difficult initially because the two first trades hit stop loss.

GBPUSD and GBPJPY had volatility during the night and they didn’t producedÂ* fresh signals in the London open.In addition we had pound news

EURJPY on the contrary had a very narrow range during Tokyo and ranging for long hours.

The pair produced a fresh signal a few minutes before London open so I waited carefully for a retracement.

The retracement came and I enter the short trade.The minutes was passing and the pattern I call crocodile formed the bollingers in the trigger chart contracted and inner support and resistances formed .

The breakout was eminent and it would be a large one after so many hours of ranging.

The pair violated the resistance to the upside and due to high probability of breakout I went long to the fresh long signal loosing 5 pips in the first tradeÂ* .I was taking also a counter trend trade to my higher time frame chart.Some minutes passed and the momentum wasn’t there.The pair started to fall slowly ,the pair pierced the support inside the range again and decided to try for third and last time short again .The procedure of the three trades took approx one and half hour

Placed the stop loss ten pips above and closed the platform .

I have checked again in London close to find 162 pips in my intraday trade.Finally closed 158.

Thursday have statistically very good intraday trades and they are consider from the trending days of the week.

https://www.mql5.com/go?link=https://www.youtube.com/watch?v=YfSFAQqtTeQ

eurjpy trigger and main chart with marked trades on them and remarks

Main chart eurjpy

The other to pairs I watch daily gbpusd and gbpjpy

forex scalping 4 9 2015,the crocodile pays again

Hello traders,

Forex scalping didn’t start well in the morning

Pound dollar and pound yen had a party last night in the Tokyo session with no fresh signals.

Euro yen had a party last night after deploying a bear flag but had a fresh signal and a divergence pointing up.So I took the trade with the usual stop of 20 pips.

As you know in trading nothing works 100% of the time, so trade went sour and our stop loss is hit.

Since it was NFP day I knew it will produce weird and choppy trading so I closed the platform and I was looking for a chance after the release to take back what the market charged me for the morning counter trend trade.

Approx one and half hour after DOW open I have spotted a very tide range in gbpjpy with repetitive short and long signals in my main chart.

I spotted a fakey breakout upside and the moment the pair reversed and broke the opposite support I enter in the trade with tide stop loss.

I took the cream of the trade with the momentum hitting approx 50 pips took my losses back and some nice profit.

Everything is written in the video and trades are on the pictures with remarks.

https://www.mql5.com/go?link=https://www.youtube.com/watch?v=bXXCd3yDqEU

Have a nice weekend.

The main chart of eurjpy

The trigger and main chart of gbpjpy

The main chart of gbpusd