You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.27 15:52

Intra-Day Fundamentals - GBP/USD, USD/CNH and Brent Crude Oil: U.S. Gross Domestic Product

2017-10-27 13:30 GMT | [USD - GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

GBP/USD M1: range price movement by U.S. Gross Domestic Product news events

==========

USD/CNH M1: range price movement by U.S. Gross Domestic Product news events

==========

Brent Crude Oil M1: range price movement by U.S. Gross Domestic Product news events

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.28 11:24

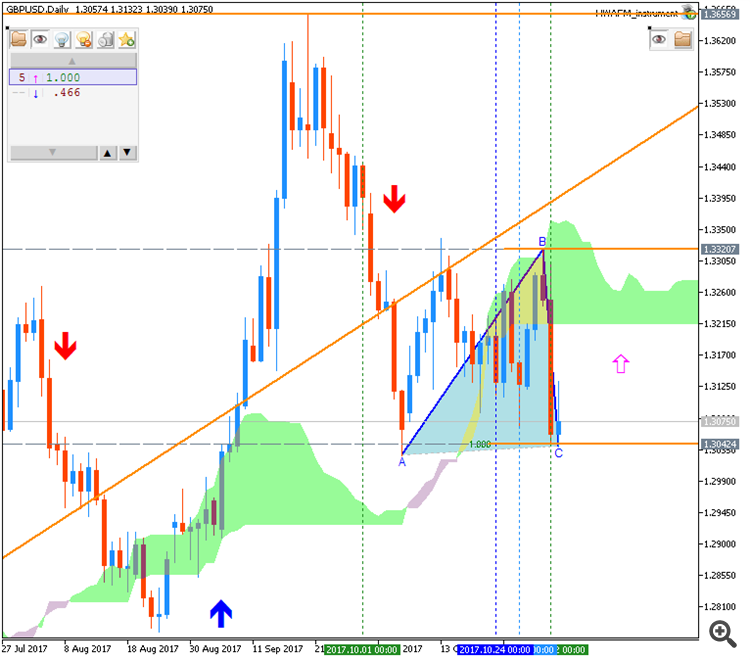

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "The Bank of England will almost certainly double the benchmark UK Bank Rate to 0.5% on “Super Thursday”, increasing it for the first time in more than a decade. However, with the markets pricing in a probability of around 88% of a hike, there is a risk that the British Pound will fall back on the news, just as the Euro fell after the European Central Bank announced the predicted tightening of Euro-Zone monetary policy in the past week."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.01 13:54

GBP/USD Intra-Day Fundamentals: UK Manufacturing PMI and range price movement

2017-11-01 09:30 GMT | [GBP - Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Manufacturing PMI] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

GBP/USD M1: range price movement by UK Manufacturing PMI news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.02 13:42

GBP/USD Intra-Day Fundamentals: Bank of England (BoE) Interest Rate Decision, BoE Inflation Report and range price movement

2017-11-02 12:30 GMT | [GBP - Official Bank Rate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BoE lends to financial institutions overnight.

==========

From official report :

==========

GBP/USD M30: range price movement by BoE Official Bank Rate news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

==========

Same systems for MT4/MT5:

The beginning

After

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.05 08:42

Weekly GBP/USD Outlook: 2017, November 05 - November 12 (based on the article)

GBP/USD had a mixed week amid big events. The upcoming week may be calmer but still, consists of important events. The trade balance and industrial output stand out. Here are the key events.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.10 10:27

GBP/USD - daily bearish ranging near Senkou Span reversal level (based on the article)

The price on the daily chart is on ranging below Ichimoku cloud: price is within the following support/resistance levels:

By the way, 1.3027 is the weekly support level, and if the price breaks this level to below on close weekly bar so the long-term bearish reversal will be started with the secondary ranging way.

==========

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicators from CodeBase:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.11 08:47

Weekly GBP/USD Outlook: 2017, November 12 - November 19 (based on the article)

GBP/USD was looking for a new direction after that dovish hike from the BoE and as Brexit talks are trying to get out of the ditch. The upcoming week features three top-tier publications: inflation, jobs, and retail sales.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.13 12:49

GBP/USD - bullish ranging within narrow levels for direction (based on the article)

Daily price is above 200 SMA to be on ranging near and below 55 SMA: the price is within 1.3039/1.3229 s/r levels for the bullish trend to be resumed or for the correction to the bearish reversal to be started.

==========

The chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.14 12:16

GBP/USD Intra-Day Fundamentals: U.K. Consumer Price Index and range price movement

2017-11-14 09:30 GMT | [GBP - CPI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report :

==========

GBP/USD M5: range price movement by U.K. Consumer Price Index news event

==========

The chart was made on MT5 with MACD Scalping system uploaded on this post and this post, and using standard indicators from Metatrader 5 together with following indicators: