You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.01 14:57

Intra-Day Fundamentals - EUR/USD, GBP/USD and USD/JPY: Non-Farm Employment Change

2017-09-01 13:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report :

==========

EUR/USD M5: range price movement by Non-Farm Payrolls news events

==========

GBP/USD M5: range price movement by Non-Farm Payrolls news events

==========

USD/JPY M5: range price movement by Non-Farm Payrolls news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.03 10:25

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "The British Pound had a much better week at the end of August. It rallied against the US Dollar both before and after Friday’s weaker-than-expected payrolls data, and it firmed against the Euro both before and after signs emerged that the European Central Bank may not announce a decision on reducing its monetary stimulus program for the Euro-Zone economy until October at the earliest because of the Euro’s strength. The week ahead is another relatively quiet one for economic data but it will be interesting to see whether the construction and service-sector PMIs on Monday and Tuesday also come in better than expected ahead of Friday’s batch of official data on industrial production, construction output and international trade."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.04 11:05

GBP/USD Intra-Day Fundamentals: United Kingdom Markit/CIPS Construction Purchasing Managers Index (PMI) and range price movement

2017-09-04 09:30 GMT | [GBP - Construction PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Construction PMI] = Level of a diffusion index based on surveyed purchasing managers in the construction industry.

==========

From official report :

==========

GBP/USD M5: range price movement by U.K. Construction PMI news event

Forum on trading, automated trading systems and testing trading strategies

GBPUSD IS FLAT?

adeyjet4, 2017.09.07 08:33

Gbpusd buy since Tuesday but, now sturdy since morning. Is it trying reverse? Trader, be watchful.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.09 07:30

Weekly GBP/USD Outlook: 2017, September 10 - September 17 (based on the article)

"Looking ahead to the coming week, after the focus on the dollar and the euro over the last couple of weeks, it is the turn of the pound to be in focus in the coming week as we have the CPI data and the rate announcement and statement from the BOE. We also have the CPI and PPI data from the US in the coming week and a combination of all these should guarantee a lot of volatility in the GBPUSD pair. The price is now in a key region and clean and clear break through 1.3260 should carry the pair towards 1.34 and 1.35 while a dovish BOE is likely to push the pair back towards 1.30."Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.12 08:45

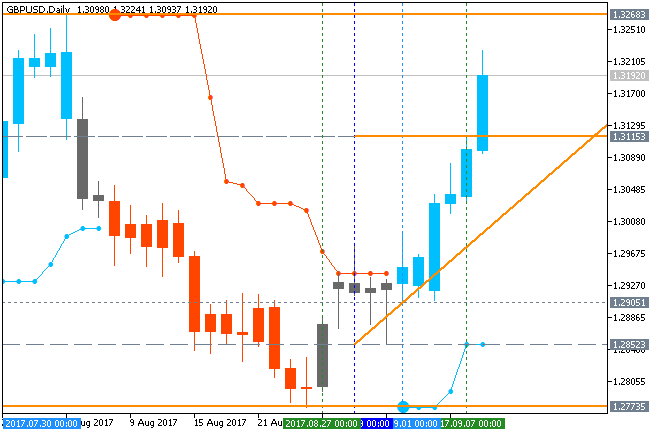

GBP/USD - intra-day bullish ranging within narrow s/r levels waiting for the strong trend to be started (based on the article)

H4 price is located far above 100 SMA/200 SMA in the bullish area of the chart. The price is on ranging within 1.3223 resistance level for the bullish trend to be continuing and 1.3158 support level for the secondary correction to be started.

Daily price broke Ichimoku cloud for the bullish reversal: the price is testing resistance level at 1.3297 for the bullish trend to be continuing, otherwise - bullish ranging within the levels.

Weekly price is breaking Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. If the price breaks 1.3267 resistance to above on weekly close bar so we may see the reversal of the weekly price movement to the primary bullish market condition.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.13 14:35

Intra-Day Fundamentals - EUR/USD, GBP/USD and AUD/USD: U.S. Producer Price Index

2017-09-13 13:30 GMT | [USD - PPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

From official report :

==========

EUR/USD M5: range price movement by U.S. Producer Price Index news events

==========

GBP/USD M5: range price movement by U.S. Producer Price Index news events

==========

AUD/USD M5: range price movement by U.S. Producer Price Index news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.14 13:21

GBP/USD Intra-Day Fundamentals: BoE Interest Rate Decision and range price movement

2017-09-14 12:00 GMT | [GBP - Official Bank Rate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BOE lends to financial institutions overnight.

==========

From official report :

==========

GBP/USD M5: range price movement by BoE Interest Rate Decision news event

-----

Arrows on the chart above = BrainTrend2Sig indicator from Codebase (free to download).