You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.16 14:51

Weekly Outlook: 2017, September 17 - September 24 (based on the article)

The US dollar staged an impressive recovery, based on better data, political calm and more. Is this a correction or a total change of trend? The highly anticipated Fed decision is easily the most important event.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.16 10:39

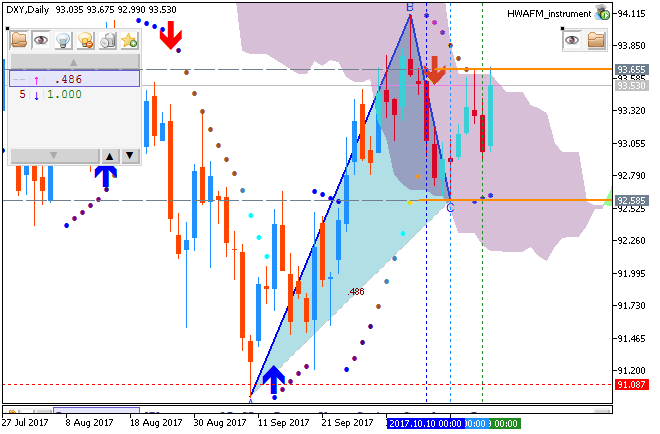

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The big U.S. data point for this week was Thursday’s release of inflation for the month of August. And while this came-out in a rather encouraging format, with headline printing at 1.9% versus an expectation of 1.8% while core came-in at 1.7% versus the 1.5% estimate, bulls were unable to hold on to the previous week’s gains as sellers took over ahead of a pivotal Federal Reserve meeting next week. This better-than-expected inflation print is the second consecutive month of higher prices for the U.S. economy; and this comes after a troubling turn in the beginning of the year that saw inflation swan-dive from a 2.7% high in February down to a low of 1.6% in June. Normally – a print such as we saw yesterday would bring at least a day’s worth of strength into the Dollar; but the context with which we are currently operating can’t quite be considered normal as a huge FOMC meeting looms on the docket for next week, when the bank may announce the start of Quantitative Tightening."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.19 18:41

Dollar Index Intra-Day Fundamentals: U.S. Residential Building Permits and range price movement

2017-09-19 13:30 GMT | [USD - Building Permits]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From Forbes article :

==========

Dollar Index M5: range price movement by U.S. Residential Building Permits news event

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.23 08:15

Weekly Outlook: 2017, September 24 - October 01 (based on the article)

The US dollar rallied on the Fed decision but its strength faded away. What’s next? The German elections, durable goods orders, and several GDP publications stand out as Q3 draws to a close. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.23 19:08

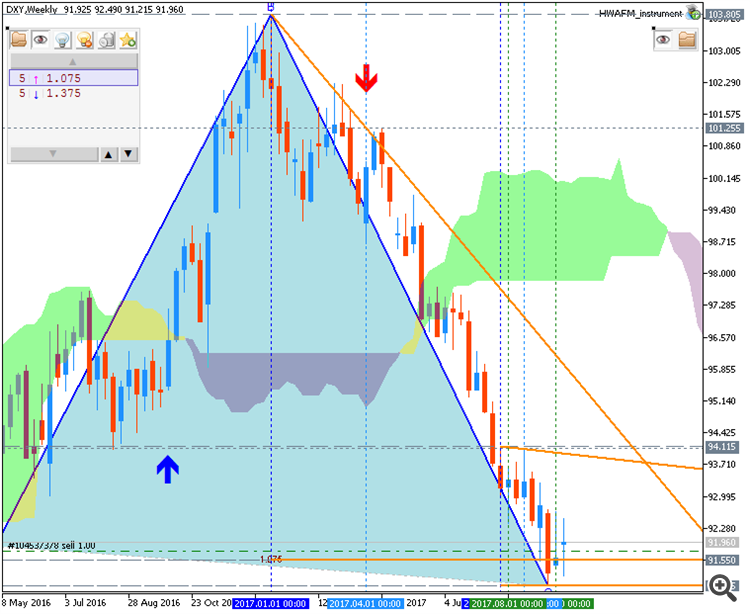

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The US Dollar was spared a fifth consecutive week of losses, with the Fed monetary policy announcement helping prices to rebound from a 15-month low. Chair Janet Yellen and company stood by near- to medium-term rate hike projections despite disinflation in the first half of the year, which markets saw as comparatively hawkish (as expected). They also announced the start of “quantitative tightening” (QT). The Eurozone’s monetary authority will decide on the fate of its QE asset purchases next month, with many market participants seemingly primed for a cutback. Meanwhile, the BOC has launched its own rate hike cycle recently and the BOE has signaled it is preparing to follow suit in the near term. Bargain-hunting in the early stages of tightening outside the US may prove too compelling to pass up for investors."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.01 08:06

Dollar Index - ranging bearish; 90.98/94.05 are the keys (based on the article)

Weekly price is located very far below from Ichimoku cloud in the primary bearish area of the chart: the price is on ranging within 90.98 bearish continuation support level and 94.05 resistance level for the secondary rally to be started.

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.07 08:17

Weekly Outlook: 2017, October 08 - October 15 (based on the article)

The US dollar remained strong and enjoyed mostly upbeat data. Can we expect further gains? The focus remains on the greenback with the FOMC minutes, US retail sales and the all-important inflation figures Here are the highlights for the upcoming week.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.07 16:50

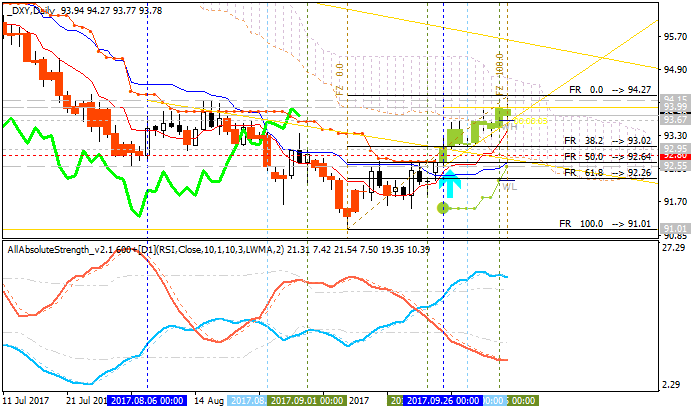

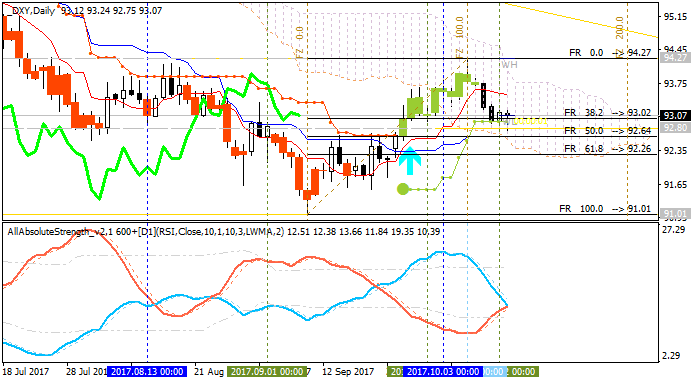

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The week ahead offers plenty of fodder for continued speculation. Minutes from September’s FOMC meeting will help clarify policymakers’ thinking but a wealth of commentary since the sit-down has already established a clearly hawkish bias. That stance is by no means unanimous, but the driving core of the rate-setting committee seems to buy the case for on-coming reflation and the resulting need to tighten."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.15 18:02

Weekly Outlook: 2017, October 15 - October 22 (based on the article)

The greenback was unable to hold onto its rally as weak inflation continues weighing. What’s next? We will hear some Fed reactions and also a wide variety of figures from all over the world Here are the highlights for the upcoming week.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.22 08:46

Weekly Outlook: 2017, October 22 - October 29 (based on the article)

The US dollar advanced against most currencies, but the moves were limited.The upcoming week is quite busy, featuring initial GDP reads from the US and the UK, rate decisions from the BOC and the ECB, and more.