Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.01 10:04

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)

GOLD (XAU/USD) - "The positive economic data likely means the Fed remains on course to raise interest rates at least twice this year, and probably more, providing ongoing support for the Dollar. It also follows hawkish comments regarding the US interest rate policy from several Fed members earlier in the week. This is all bad news for gold prices, although support has been seen at the $1,240 level. However, political risks may change that narrative next week, as Donald Trump meets his Chinese counterpart President Xi Jin Ping at his Mar-a-Lago retreat in Florida. Trump says this highly anticipated meeting "will be a very difficult one." If it drives risk aversion in the markets, then gold could enjoy some more upside potential."

Forum on trading, automated trading systems and testing trading strategies

XAUUSD Analysis

fxtelegram_, 2017.04.03 16:58

If it remains above 1249, target 1258

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.08 08:52

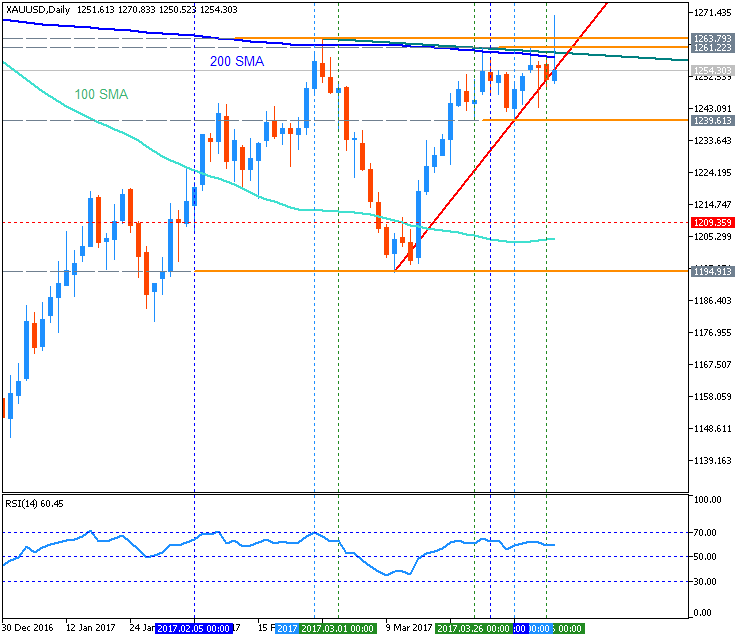

Gold Technical Analysis - daily ranging within 100-day SMA/200-day SMA waiting for the bullish reversal (based on the article)

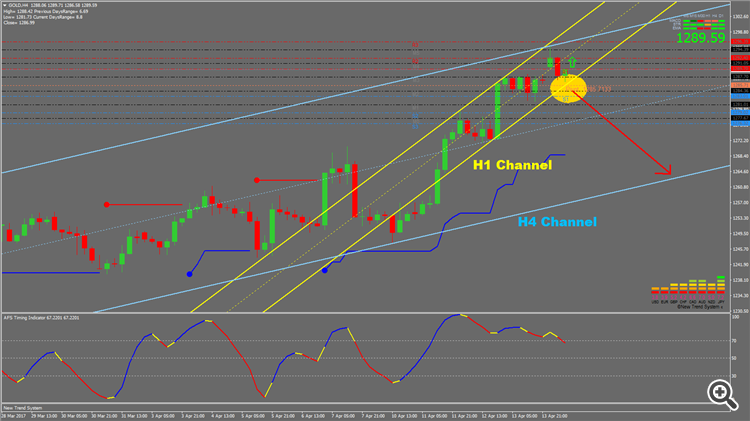

Daily price is on ranging within 100 SMA/200 SMA area waiting fr the strong trend to be started. For now, the price is on breaking 200 SMA together with 1,263 resistance level to above for the reversal of the daily price movement from the bearish ranging to the primary bullish market condition.

- "U.S. Non-Farm Payrolls report on Friday showed a gain of only 98K but the underlying metrics were strong with the headline unemployment rate falling to 4.5%, its lowest reading since mid-2007. The under-employment rate (U6) also saw an outsized downtick to the tune of 8.9% from 9.2%. Gold spiked on the release only to reverse sharply early in the US session."

- "Heading into next week, the trade remains vulnerable sub-1258 with interim support eyed at 1241- Note that a longer-term median-line rests just lower and a break below this level would suggest a more meaningful correction is underway with such a scenario targeting February 27th weekly reversal close at 1234 & the Janay highs at 1220. Critical resistance remains up at 1278/79, where the 100% etc. & the 61.8% retracement converges on long-term slope resistance."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.15 10:48

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)

XAU/USD - "Comments made by President Donald Trump regarding overvaluation in the greenback further fueled the advance, taking prices through key regions of resistance on Wednesday. Despite the president’s comments, the markets seemed primed for the upcoming Fed normalization (3 additional hikes this year) and from a fundamental standpoint, the long-USD argument may be nearing exhaustion in the interim. The DXY is down more roughly 1.6% on the year and more than 3% off the yearly high. That said, while the risk does remain for further dollar losses near-term, the knee-jerk trump rally in gold is unlikely to sustain prices at these levels and leaves the immediate advance vulnerable heading into next week."

Forum on trading, automated trading systems and testing trading strategies

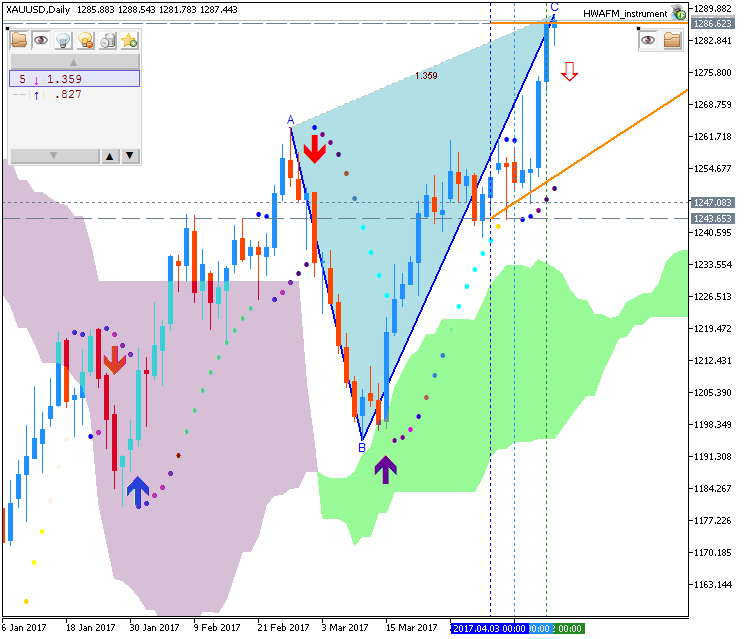

GOLD

Thaodo, 2017.04.20 12:56

Tech on gold

Resistance 3: $ 1 286 (76,4% FIBO $ 1337- $ 1122)

Resistance 2: $ 1263 (February 27 high)

Resistance 1: $ 1255/58 (61,8% FIBO $1337- $1122, February 28 high)

Current price: $ 1244.00 (-0.35%)

Support 1: $ 1229/31 (50,0% FIBO $1337- $1122, February 22 low)

Support 2: $ 1226 (February 21 low)

Support 3: $ 1216 (February 15 low

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.25 17:47

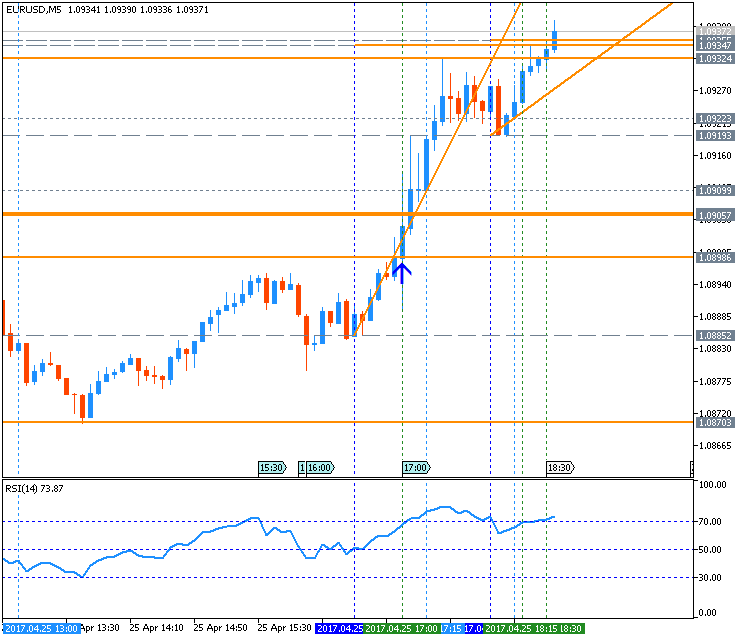

Intra-Day Fundamentals - EUR/USD and GOLD (XAU/USD): The Conference Board Consumer Confidence

2017-04-25 15:00 GMT | [USD - CB Consumer Confidence]

- past data is 124.9

- forecast data is 123.7

- actual data is 120.3 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report:

- "The Conference Board Consumer Confidence Index®, which had increased in March, declined in April. The Index now stands at 120.3 (1985=100), down from 124.9 in March. The Present Situation Index decreased from 143.9 to 140.6 and the Expectations Index declined from 112.3 last month to 106.7."

- "Consumer confidence declined in April after increasing sharply over the past two months, but still remains at strong levels,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers assessed current business conditions and, to a lesser extent, the labor market less favorably than in March. Looking ahead, consumers were somewhat less optimistic about the short-term outlook for business conditions, employment and income prospects. Despite April’s decline, consumers remain confident that the economy will continue to expand in the months ahead."

==========

EUR/USD M5: range price movement by CB Consumer Confidence news events

==========

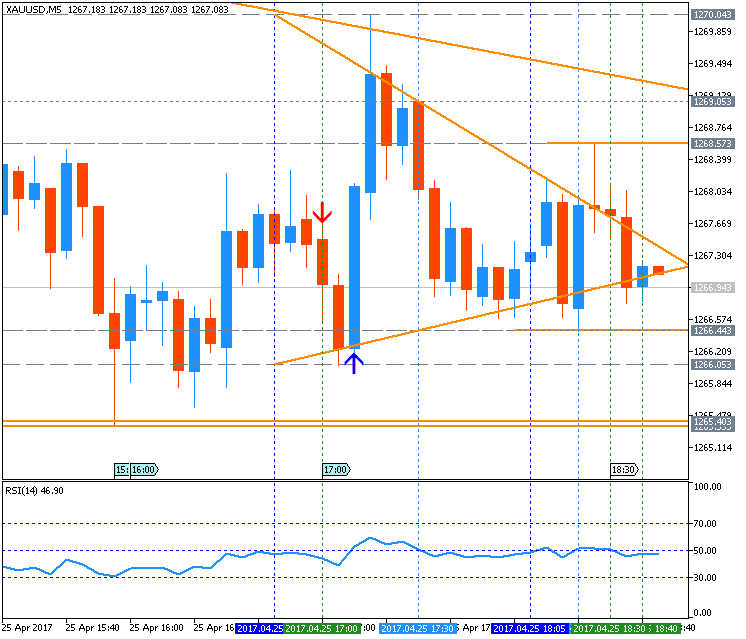

GOLD (XAU/USD) M5: range price movement by CB Consumer Confidence news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.29 17:26

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)

XAU/USD - "The FOMC rate decision is on tap next week and although the central bank is widely expected to leave policy unchanged, traders will be looking for changes in the statement as Yellen & Co look to prep markets for upcoming adjustments to the benchmark interest rate. Improving labor market metrics (save last month’s off-beat miss) and a 2% read on 1Q Core PCE (Personal Consumption Expenditure) on Friday will continue to put pressure on the Fed to further normalize policy. As it stands, markets are pricing 1-2 additional hikes this year with Fed Fund Futures noting a 67% likelihood of a June hike. That said, for gold the emphasis will remain on the timing and scope of future rate increases. Remember that higher interest rates will tend to weigh on non-yielding assets such as gold."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

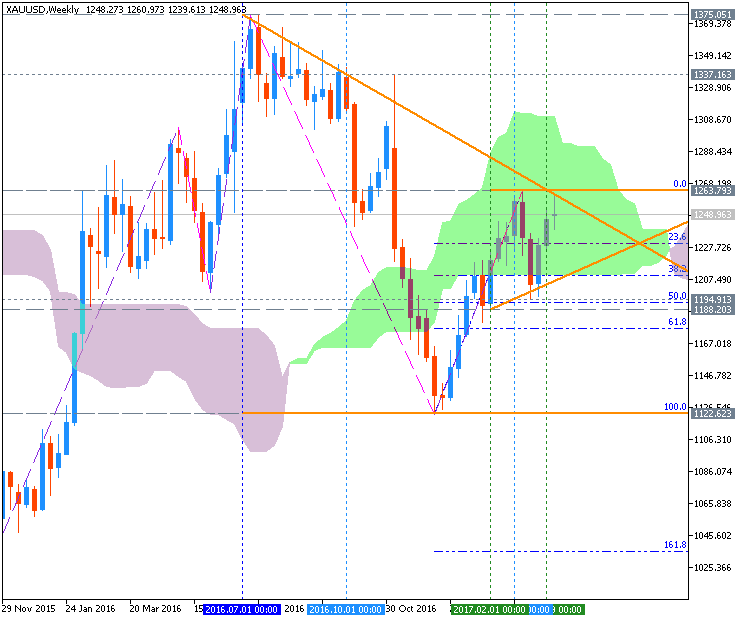

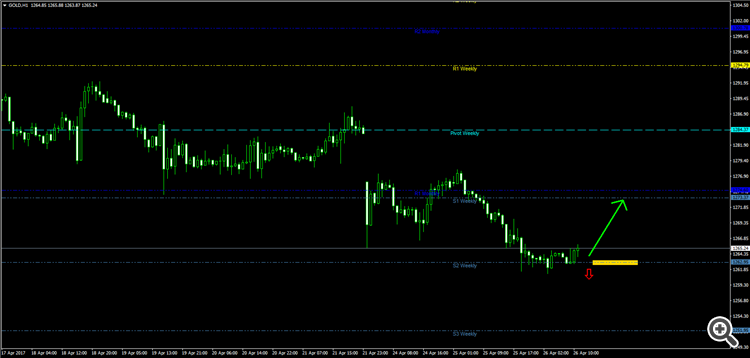

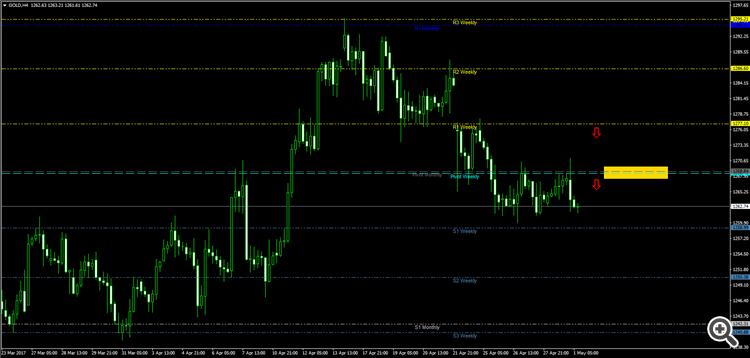

W1 price is located inside Ichimoku cloud for the ranging market condition within the following support/resistance levels:

Chinkou Span line is below the price indicating the possible bullish breakdown by direction, Trend Strength indicator is estimating the trend as a bullish, and Absolute Strength indicator is evaluating the trend as a secondary ranging. By the way, ascending triangle pattern was formed by the price to be crossed to above for the bullish, and Tenkan-sen line is going to be crossed with Kijun-sen signal to above for the bullish trend to be resumed in the near future.

Trend:

W1 - ranging