You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

10 things you need to know before the opening bell Here is what you need to know.

Chinese stocks crashed. China's Shanghai Composite tumbled 6.4%, posting its biggest one-day retreat since January 26. The industrial and telecom sectors were hardest hit, each losing more than 8%. Bloomberg says a spike in short-term money market rates contributed to the slide. Thursday's close was the worst since February 3.

China is the billionaire capital of the world. The South China Morning Post reports that the new Hurun Global Rich List says the number of billionaires in China has surpassed that of the US. Of the 2,188 billionaires in the world, 568 are Chinese, while 535 are American. Bill Gates remained the richest person in the world, with a net worth of $80 billion.

Greek and Portuguese banks don't have to participate in the stress test. A sample of 51 banks that will be put through the European Banking Authority's stress test won't include Greek or Portuguese banks. A statement released by the EBA said the banks would be tested on their ability to withstand "foreign demand shocks, financial shocks, and domestic demand shocks." Only banks with €30 billion or more in assets were eligible to participate.

The ECB's favorite inflation reading is at a record low. On Thursday, the final reading of euro-area inflation for January was revised down to 0.3% year-over-year from its previous look of 0.4%. More worrying for the European Central Bank was that its favorite inflation gauge, the five-year eurozone breakeven forward, hit a record low below 1.40%. According to a Reuters poll, the ECB is expected to cut its deposit rate by 10 basis points to -0.40% at its March meeting in an effort to jump start inflation expectations. The euro is higher by 0.2% at 1.1032.

read more

Collapsing German inflation sends the euro into ECB expectation mode We're seeing some big moves from the German regions Here's the latest and what's been out so far (all y/y)

North Rhine the only one posting positive inflation. Those are pretty big shifts and that's helped tip the euro lower. Draghi & Co has said that Eurozone CPI could turn negative this year and these numbers will be telling the market they may be right. Given the closeness to the ECB meeting, this data will be further confirmation that the ECB will act.

We might also need to think about seeing the main German number come out worse than expected. Currently HICP is estimated at 0.0% vs 0.4% prior y/y and CPI at 0.1% vs 0.5% prior y/y. That's at 13.00 GMT

Before then we have the Eurozone economic sentiment data which will include the final consumer confidence number and more importantly, the consumer inflation expectations (2.3 prior, selling price expectations -4.2 prior). If we see another big drop there the euro could find itself under more pressure.

Until then we're just holding above 1.1000 at 1.008, down from 1.1065 not long ago

source

Top 5 Things to Know In the Market on Friday 1. PBoC and BoJ hint at more easing

Both China’s and Japan’s central bank hinted at the possibility of taking additional accommodative measures in their respective monetary policy. The Chinese Shanghai Composite index rebounded from a 6% loss on Thursday as the governor of the People's Bank of China Zhou Xiaochuan said at the G20 finance meeting that the Asian giant has more room and tools to combat the economic slowdown.

Bank of Japan governor Harihuko Kuroda also left the door open to more easing as he stated in a parliamentary session that it was “technically possible” to take a key rate further into negative territory.

2. EU consumer become more pessimistic

Consumers in the European Union were becoming more pessimistic, according to data reported on Friday. UK consumer confidence hit a 14-month low due to continuing worries over the “Brexit”, as the possibility of Britain leaving the EU is known, and concerns about the U.K. economy increased.

Eurozone economic sentiment, a measure of business and consumer confidence, also fell more than expected and hit its lowest point since June 2015.

3. Euro zone deflation pressure may force ECB’s hand

While waiting for the publication of the CPI from the euro zone’s number-one economy, Germany, at 13:00GMT or 8:00AM ET, France, Spain and the German region Saxony already reported deflationary figures. The experts at Capital Economics took note on Friday that “next week’s euro zone figures may show the return of deflation”.

Although they noted that the decrease would primarily be due to lower commodity prices, “it would likely reinforce the European Central Bank’s concerns about potential second round effects on wages and price setting”. The ECB will announce its next policy decision on March 10.

4. Crude stages rebound; March meeting among producers in focus

Oil prices rose back above $33 following reports that Saudi Arabia, Qatar, Venezuela and Russia will meet in March to discuss capping crude oil production.

Crude oil futures for April delivery jumped 1.91% to $33.70 at 11:12AM GMT or 6:12AM ET, while Brent oil traded up 1.98% to $35.99.

5. Investors await key U.S. data

Traders will focus on the publication of the second estimate for Q4 GDP at 13:30GMT or 8:30AM ET. Analysts forecast the data to be revised down to 0.4% growth from the prior quarter, compared to the initial reading of 0.7%.

At the same time, investors will also take note of consumer behavior with Department of Commerce’s personal spending data for January. Consensus expected the data to show a 0.3% rise compared to the flat reading in December.

source

5 Things to Watch on the Economic Calendar This Week 1. U.S. nonfarm payrolls report

The U.S. Labor Department will release its highly-anticipated report on February nonfarm payrolls at 13:30GMT, or 8:30AM ET, on Friday.

The consensus forecast is that the data will show jobs growth of 193,000 last month, following an increase of 151,000 in January, the unemployment rate is forecast to hold steady at 4.9%, while average hourly earnings are expected to rise 0.2% after climbing 0.5% a month earlier.

2. China manufacturing PMIs

The China Federation of Logistics and Purchasing is to release data on February manufacturing sector activity at 1:00GMT on Tuesday, or 8:00PM ET Monday, followed by the Caixin manufacturing index at 1:45GMT, or 8:45PM ET.

The official China's manufacturing purchasing managers' index is forecast to inch down 0.1 points to a three-year low of 49.3 in February, while the Caixin survey is expected to dip to 48.2 from 48.4 in the preceding month.

A reading below 50.0 indicates industry contraction.

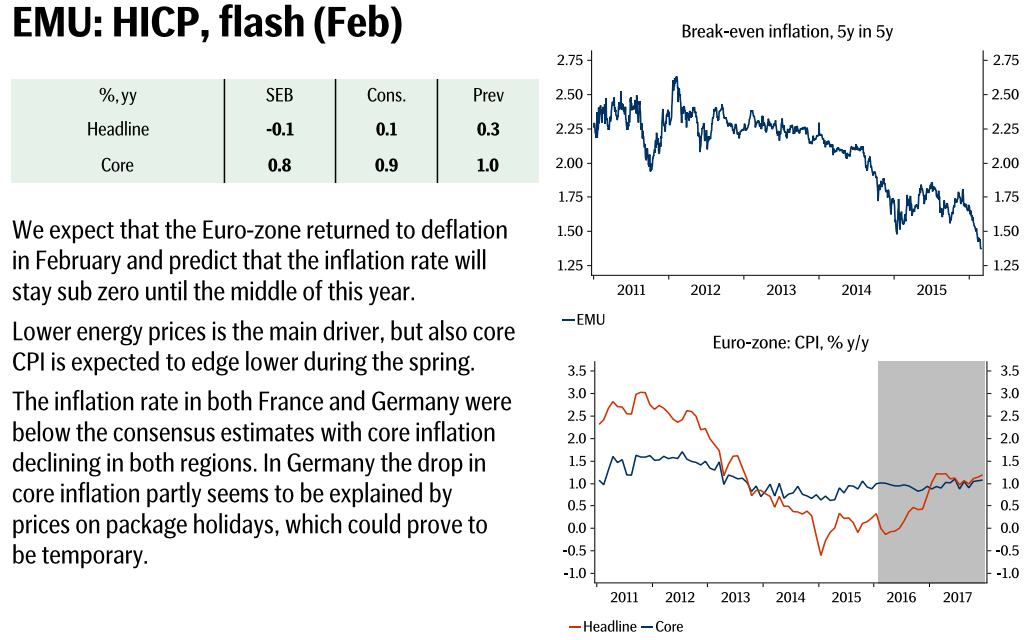

3. Euro zone flash February inflation figures

The euro zone will publish flash inflation figures for February at 10:00GMT, or 5:00AM ET, Monday. The consensus forecast is that the report will show consumer prices inched up 0.1% this month, slowing from 0.3% a month earlier, while core prices are expected to rise 0.9%, compared to a gain of 1% in January.

European Central Bank Mario Draghi signaled recently that fresh easing measures could be rolled out as soon as the bank’s next meeting on March 10 in response to sluggish inflation and a weakening global economy.

4. U.S. ISM PMI surveys

The U.S. Institute of Supply Management is to release data on February manufacturing activity at 15:00GMT, or 10:00AM ET, on Tuesday. The gauge is expected to ease up 0.4 points to 48.6. Anything below 50.0 signals contraction.

Meanwhile, the ISM is to report on February service sector activity on Thursday, amid expectations for a modest decline. Service sector activity in the U.S. grew at the slowest pace in almost two years in January.

5. Reserve Bank of Australia policy meeting

The RBA's latest interest rate decision is due on Tuesday at 3:30GMT, or 10:30PM ET Monday. Most economists expect no policy change, while some believe the central bank can surprise with a 25 basis point rate cut in an effort to boost inflation and spur economic activity.

Preview: EMU Inflation, Flash (Feb) - SEB

More from Dudley: Recent market turbulence not due to Fed actions NY Fed head still speaking in China at PBOC symposium

Given that the fwd guidance by Fed and BOE amongst others has been rubbish thus far those last comments are a bit rich.

Top 5 Things to Know In the Market on Wednesday 1. Oil prices move lower after API report shows huge build, pending EIA data

Oil moved lower on Wednesday after the American Petroleum Institute, an industry group, said that U.S. oil inventories rose by 9.9 million barrels in the week ended February 26, surprising market players who were expecting a gain of 2.5 million barrels.

Crude oil futures for April delivery tumbled 2.06% to $33.69 at 10:57AM GMT or 5:57AM ET, while Brent oil lost -0.92% to $36.47.

The U.S. Energy Information Administration will release its weekly report on oil supplies at 15:30GMT, or 10:30AM ET, Wednesday, amid expectations for a gain of 3.6 million barrels.

2. Global economic data sparks risk-on appetite

A strong showing of economic data from the U.S. to Australia boosted risk appetite across the board. Australian fourth-quarter GDP growth surprised to the upside on Wednesday with quarter-on-quarter growth of 0.6% and a year-on-year expansion of 3.0%, beating consensus estimates of 0.4% and 2.5%, respectively.

The news followed a better-than-expected increase in both growth in the Canadian economy and U.S. manufacturing activity, while American construction spending also hit an eight-year high.

3. Markets digest central bank comments for clues on rate action

Investors kept on an eye on comments from both the European Central Bank (ECB) and the Federal Reserve (Fed) on Wednesday as the clock ticked down for monetary policy decisions to be announced on March 10 and March 16, respectively.

ECB member and Bank of France chief Francois Villeroy warned on Wednesday that euro zone inflation remains too low, suggesting that region’s central bank may need to take additional easing measures, while fellow central bank member Benoit Coeure stressed the importance of the central bank’s commitment to push inflation up via accommodative monetary policy.

Meanwhile, San Francisco Fed president John Williams showed a more hawkish stance in an interview with Financial Times. He told the British financial paper that he doesn’t understand warnings about an imminent U.S. recession as there are no signs of weakening domestic demand which is more than compensating for economic slack abroad. In line with the U.S. central bank’s current rhetoric, Williams repeated that Fed rate hikes would be gradual.

4. Investors await U.S. employment “preview”

Traders will focus on the publication of the ADP nonfarm employment change for the month of February at 13:15GMT or 8:15AM ET. Analysts forecast the data from the private provider of business outsourcing solutions to show the creation of 190,000 jobs, down slightly from the prior reading of 205,000.

Although ADP has a questionable track record, markets still watch the data as an indicator for the official U.S. government report to be realized on Friday.

5. Global stocks move broadly higher; U.S. futures take profits

Asian and European stocks followed the U.S. higher after the aforementioned data bolstered investor sentiment.

The Nikkei 225 closed with hefty gains of 4.12%, while Dow Jones Shanghai surged 4.35% and Australia celebrated its growth data with an advance of 2%.

At 11:04AM GMT or 6:04AM ET, European stocks markets moved broadly higher with the European benchmark Euro Stoxx 50 rising 0.45%, the DAX edging up 0.02%, the CAC 40 gaining 0.18%.

The outlier was the FTSE 100 turned around despite hitting a 2016 high in early trading after it was reported that growth in the UK construction sector hit a 10-month low. The London index slipped 0.14%.

U.S. futures were also in the red as investor took profits after solid gains in Tuesday’s session when the Dow registered its second best day of the year and the Nasdaq tacked on the biggest gain so far this year. Futures initially reacted positively to the Super Tuesday results as Hillary Clinton and Donald Trump appeared to solidify positions but, at 11:13AM GMT or 5:13AM ET, the blue-chip Dow futures fell 0.26%, S&P 500 futures dropped 0.27% and the Nasdaq 100 futures traded down 0.17%.

source

USD Into NFP: Good News For Medium-Term Bulls - Deutsche Bank As we look to the coming payroll report, it’s worth considering that even in the midst of a possible ‘slow patch’, the US is still expected to generate 195K payroll jobs in February, only marginally down from the 6m, 12m, 24m, 36m averages of 215K, 222K, 238K and 223K respectively.

A 195K number is very consistent with the UE rate continuing on a familiar rapid path lower, with the U3 rate declining by 0.5% or more per annum.

The unemployment rate, like most single variables does not have a unblemished record, but tends to lead the USD TWI by close to 1 year - so it is always good news for medium-term USD bulls, when a signal that leads by this long, is still not showing signs of finding a bottom, and is a long way from signaling a USD top.

German Factory Orders Fall for 2nd Month in January Industrial orders in Germany fell for the second consecutive month in January on a monthly basis, after volatile results posted over the last year, data from the German statistical office Destatis revealed on Monday.

German factory orders came in at -0.1% in the reported period, measured on a monthly and seasonally adjusted basis, up from the previous revised reading of -0.2% booked in the last month of 2015.

Industrial orders climbed 1.1% in January year-on-year, after a plunge of a revised -2.2% in December and the sharpest decline in 2015.

The factory orders indicator shows total manufacturing orders received by producers of capital goods, as well as manufacturers of intermediate and consumer goods in the country. The higher reading is seen as positive, as it shows a quite important and valuable insight into the country's economic growth.

The indicator was volatile over the last year, with six months in red territory on a monthly basis, posting the deepest decreases in January, July and August.

read more

EUR/USD: Euro Turns Bearish Ahead of ECB Following its spike to more than one-week highs in the previous session, the euro consolidated below the $1.10 handle on Wednesday as traders expect a dovish outcome from the European Central Bank (ECB) meeting on Thursday.

The common currency saw a deterioration from its previous session high of $1.1058, down 0.24% to $1.0984.

Neither side of Atlantic offers any relevant data today, hence the sentiment on the EUR/USD will be driven by the general market tone. However, rather cautious trading is expected ahead of the ECB meeting.

Markets anticipate a further slash to the Bank's depo rates at the meeting. The speculation only increased after last week's disappointing set of services and manufacturing data from the currency bloc.

The decision of the ECB to expand the current asset purchasing program would be in line with its extra dovish rhetoric of late, as the Bank struggles to meet its inflation target of close to, but not exceeding 2%.

read more