You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Is The USD Waking-Up To Fed Risk Again? US 2y yields are around their highest levels seen since Fed Chair Yellen’s dovish speech as continued gains in equity and crude prices raises concerns that the Fed could deliver a more hawkish message.

While a further repricing of Fed expectations could extend a bit in the days ahead, USD gains are likely to trigger higher USDCNY fixings and potentially derail the oil price recovery, we suspect that feedback to the risk environment would prevent markets form pricing significant prospects for a June rate hike.

We added a long USDCAD on Wednesday*

BoJ To Go Deeper Into Negative Next Week; USD/JPY To Stabilize Above 110 In Japan, the focus next week will be on the Bank of Japan’s (BoJ) monetary policy meeting on 27-28 April. Pressure on the BoJ to ease monetary policy is mounting as USD/JPY has declined more than 10% since the beginning of the year, while the nominal effective JPY exchange rate has increased to 2013 levels. 2016 is proving to e a very challenging year for the BoJ, as the JPY has been carried forward in recent months by what could be viewed as a perfect storm for the currency. Besides the recent strengthening of the JPY which is putting further downward pressure on inflation and inflation expectations and erodes confidence in the bank, a weaker economic outlook implied by both the PMI and Tankan surveys and a likely technical recession in Q1-Q4 are also supporting the case for additional easing.

We expect the BoJ to cut its policy rate by 20bp to -0.3% in connection with its monetary policy meeting ending 28 April.Moreover, we think it is likely that the BoJ may focus on qualitative measures such as scaling up ETF and J-REIT (real estate investment trusts) from the current JPY3trn and JPY90bn, respectively, in order to optimise its asset purchases. Pricing in the Japanese money market implies only a little probability of a rate cut in April, while the overnight interest rate is priced to fall to -0.25% in November 2016. In relation to the yen, a stretched long JPY positioning combined with USD/JPY being oversold according to our short-term financial model, implies that a BoJ rate cut could have an effect on USD/JPY this time around. Moreover, the relatively dovish pricing of the Fed, which currently implies around 15% probability of a June hike (40% in September) and only 55% probability of a hike by the end of 2016, indicates that headwinds stemming from relative rates are likely to ease. We look for a stabilisation of USD/JPY above 110, targeting the cross at 112 in 1-3M.

source

Post-Brexit UK-U.S. trade deal could take a decade A trade deal between Britain and the United States could take five to 10 years to negotiate if Britain votes to leave the European Union at a June 23 referendum, U.S. President Barack Obama told the BBC in an interview broadcast on Sunday.

"It could be five years from now, 10 years from now before we're actually able to get something done," Obama told the British broadcaster in an excerpt posted online.

Obama, who is in the last nine months of his presidential term, has spent the last three days in London urging Britons to remain part of the EU as a divided British public prepares to vote on whether to remain a member of the 28-country bloc.

He told the BBC that Britain would not get preferential treatment over the EU when it came to negotiating a new trade deal.

"The UK would not be able negotiate something with the United States faster than the EU," Obama said. "We wouldn't abandon our efforts to negotiate a trade deal with our largest trading partner, the European market."

Obama's visit and decision to intervene in the EU debate has angered the Eurosceptic "Out" campaign, which has repeatedly argued that Britain could easily negotiate deals and get better terms outside the EU.

Germany IFO business climate April 106.6 vs 107.1 exp The April IFO survey results now out 25 April

No revisions to previous release.

Softer than expected across the board but euro unfazed with EURUSD at 1.1256 just off session highs.

EUR/USD Technical Analysis: Euro Driven by Soft Dollar The EUR/USD major currency pair has broken a minor trendline resistance at $1.1285 and support at $1.1250.

The European session offers no data that could alter investors wait and see approach, hence the pair is likely to remain muted until the US session when more relevant data is due.

The euro is still taking advantage of the softer dollar, which remains under pressure from the Federal Reserve (Fed) meeting that starts today. The US Commerce Department is also scheduled to publish the durable goods orders report later on Tuesday.

On the daily chart, the EUR/USD major is correcting lower from the previous April 14 high of $1.1465.

At the same time, the EUR/USD is currently above the 50-, 100- and 200-day moving averages, with both the Moving Average Convergence/Divergence (MACD) and the Relative Strength Index (RSI) indicator trending downward and pointing to a corrective downtrend.

read more

Tech Targets: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/JPY

EUR/USD: Shift from bearish to neutral: Likely in 1.1200/1.1400 range.

The break of 1.1330 (high of 1.1338) suggests that the bearish phase that started about 2 weeks ago has ended (target at 1.1145 was not met).

The outlook from here is viewed as neutral and we expect this pair to trade between 1.1200 and 1.1400 for now (only a clear break below 1.1200 or above 1.1400 would indicate the start of a directional move).

GBP/USD: Bullish: Take partial profit at 1.4670.

We just turned bullish yesterday and GBP quickly approaches our 1.4670 target (high of 1.4640). As mentioned, 1.4670 is a very strong resistance and this level may not be easy to break. Thus, those who are long may like to take some partial profit at this level.

That said, a clear break above 1.4670 would shift the focus to the year-todate high of 1.4815.

AUD/USD: Shift from bullish to neutral: In a 0.7595/0.7765 range.

The break below 0.7660 earlier indicates that the recent high of 0.7835 is the extent of the bullish phase (target at 0.7850 not met).

We hold a neutral view for now and expect AUD to trade in a broad 0.7595/0.7765 range for now.

NZD/USD: Neutral: Corrective pull-back has scope to extend to 0.6765.

We continue to hold the view that the current corrective pullback has scope to extend lower to 0.6765. Only a move back above 0.6940 would indicate that the immediate downward pressure has eased.

USD/JPY: Bullish: Target a move to 112.20.

There is no change to the bullish USD view as highlighted yesterday. However, overbought short-term indicators would likely lead to a couple of days of consolidating first.

The target and stoploss remain unchanged at 112.20 and 109.80 respectively.

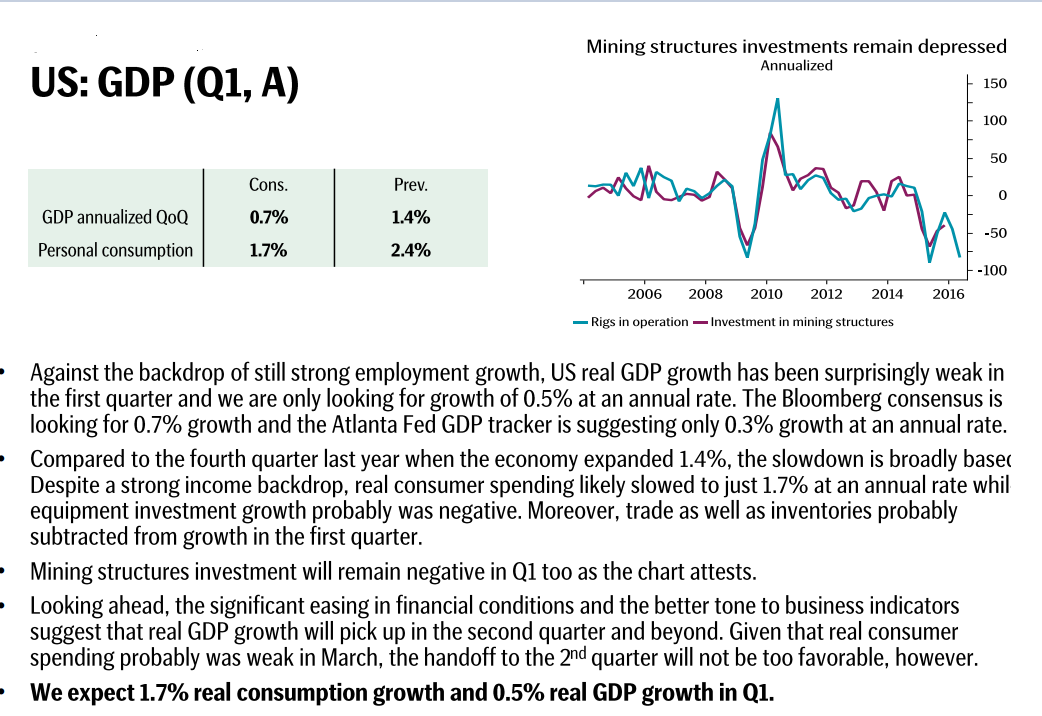

Preview: Real GDP, 1Q (A)

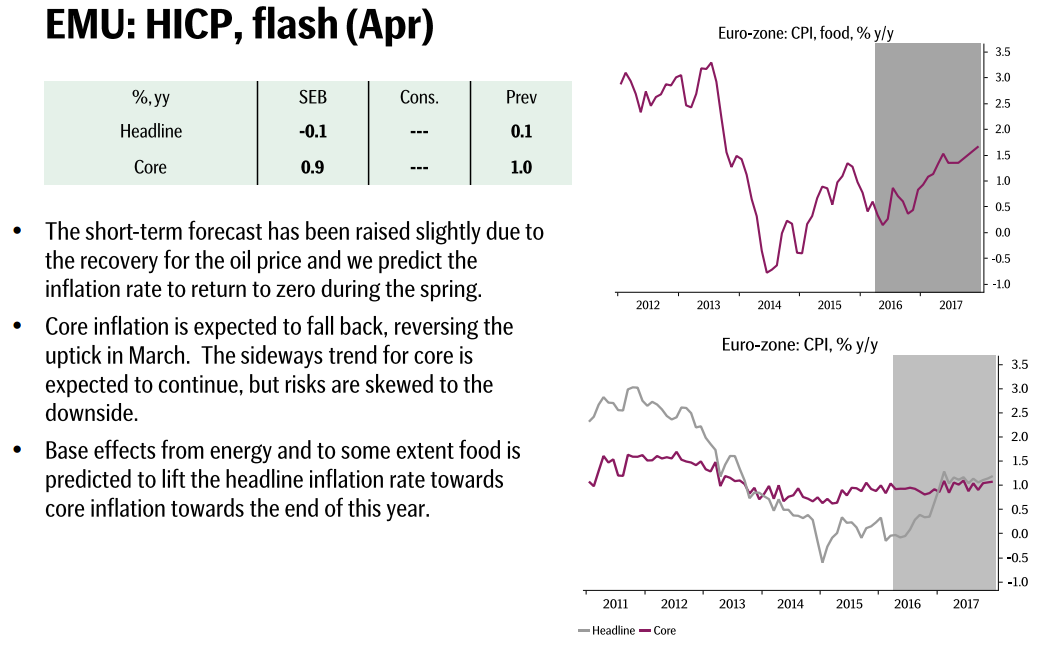

Preview: Eurozone: HICP, Flash (Apr) - GDP (Q1 A) - EMU Unemployment (March)

5 Things to Watch on the Economic Calendar This Week

1. U.S. nonfarm payrolls report

The U.S. Labor Department will release its April nonfarm payrolls report at 12:30GMT, or 8:30AM ET, on Friday.

The consensus forecast is that the data will show jobs growth of 200,000 last month, following an increase of 215,000 in March, the unemployment rate is forecast to hold steady at 5.0%, while average hourly earnings are expected to rise 0.3% after gaining 0.3% a month earlier.

An upbeat employment report would help support the case for the Federal Reserve to gradually tighten monetary policy this year.

2. U.S. ISM PMI surveys

The U.S. Institute of Supply Management is to release data on April manufacturing activity at 14:00GMT, or 10:00AM ET, on Monday. The gauge is expected to inch down 0.4 points to 51.4. Anything above 50.0 signals expansion.

Meanwhile, the ISM is to report on April service sector activity on Wednesday, amid expectations for a modest increase.

3. Fed speakers

Market players will pay close attention to a number of speeches from Federal Reserve officials during the week to judge the balance of opinion among policymakers on the prospect of further rate hikes.

The Fed speakers start Sunday with New York Fed President William Dudley, the official viewed as most closely aligned with Fed Chair Janet Yellen. On Monday, San Francisco Fed President John Williams will speak at a public event.

Tuesday sees Cleveland Fed President Loretta Mester and Atlanta Fed President Dennis Lockhart take the stage, followed by Minneapolis Fed President Neel Kashkari on Wednesday.

On Thursday, Atlanta Fed's Lockhart, Dallas Fed President Rob Kaplan, St. Louis Fed President James Bullard and San Francisco Fed's Williams are all due to participate in a panel discussion titled "International Monetary Policy and Reform in Practice" at the Hoover Institute conference.

4. China manufacturing PMIs

China is to publish results of the Caixin manufacturing index at 1:45GMT on Tuesday, or 9:45PM ET Monday. It is seen rising to 49.9 in April from 49.7 in March

The official China's manufacturing purchasing managers' index published Sunday dipped to 50.1 last month from 50.2 in March, compared to expectations for a reading of 50.4.

5. Reserve Bank of Australia rate decision

The RBA's latest interest rate decision is due on Tuesday at 4:30GMT, or 12:30AM ET. Most economists expect no policy change, while some believe the central bank can surprise with a 25 basis point rate cut in an effort to boost inflation and spur economic activity.

source

Strong NFP May Not Be Enough To Reignite Dollar Rally

The die is cast. The Federal Reserve is on an extended pause after the rate hike last December. The market remains convinced that the risks of a June hike are negligible (~ less than 12% chance). The ECB has yet to implement the TLTRO and corporate bond purchase initiatives that were announced in March. The impact of its programs have to be monitored before being evaluated. It is unreasonable to expect any new initiative in the coming months.

The Bank of Japan did not take advantage of the opportunity to ease policy as it cut both growth and inflation forecasts. The focus ahead of the G7 meeting in late-May, being hosted by Japan, will likely be on fiscal policy, where the Abe government is reportedly trying to cobble together a front-loaded spending bill for earthquake relief and economic support. There have been some calls for a JPY20 trillion (~$185 bln) package, in part funded by a new bond issuance that would be included in the BOJ asset purchase program. (Note that Japanese markets are closed for a couple of days in the week ahead for Golden Week celebrations).

The US jobs data is typically the data highlight of the first week of a new month. It has lost its mojo. This is more because of the Federal Reserve's reaction function than the ADP estimate that comes out a couple of days earlier. The Fed accepts that the labor market continues to strengthen. The nearest real-time reading of the labor market, the weekly jobless claims report, has recently fallen to its lowest level since 1973, and continuing claims are at 16-year lows. It is clearly not sufficient for the FOMC to lift rates.

read more