You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD: Doji Formation; USD/CHF: H&S Formation - SocGen EUR/USD: After probing a multi month descending trend and early February lows of 1.08, EUR/USD embarked on a rebound. The recovery seems to be running out of steam as the pair has faced resistance at graphical level of 1.1060/1.11 which also corresponds with the 50% retracement of recent down move.

Formation of a doji at those levels suggests that the pair has failed to clearly re-integrate within a daily ascending channel. Upside is likely to remain capped as highlighted by weekly indicator which is testing a down sloping trend resistance.

Only a move beyond 1.1060/1.11 will lead to extension in rebound.

Very short term, a down move towards 1.0940 looks likely; recent lows of 1.08 will decide if a retest of December lows at 1.0570/1.05 takes shap.

USD/CHF: USD/CHF is forming a probable H&S pattern at 1.00/1.003, the 61.8% retracement from February highs.

A move towards neckline at 0.9890/50 looks on cards, a break below will mean a deeper retracement towards recent lows at 0.9750/0.97.

German CPI Feb final mm +0.4% as expected

No gremlins in the final reading as expected.

EURUSD steady around 1.1165 still.

Top 5 Things to Know In the Market on Friday 1. Crude pushes higher after IEA calls bottom, investors await U.S. rig count

The International Energy Agency (IEA) suggested on Friday that oil prices might have bottomed out due to production declines in the U.S. and other non-OPEC countries while Iran’s supply increase has not been overdone.

Investors turn their attention to Friday's weekly rig count from Baker Hughes for further indications of the supply outlook on U.S. domestic energy markets. U.S. oil rigs fell by eight to 392 for the week ending on Feb. 26, moving lower for the 11th consecutive week. With the declines, the rig count fell to its lowest level since Dec. 4, 2009 and one away from an all-time record low.

U.S. crude oil futures gained 2.35 % to $38.73at 10:55AM GMT or 5:55AM ET, while Brent oil advanced 1.88% to $40.77.

2. Euro zone sovereign bonds stabilize after the "Draghi effect"

Euro area sovereign bonds stabilized on Friday with Germany 2-Year heading for their largest weekly gain since early December.

The move came after the large sell-off on Thursday that was triggered by comments by European Central Bank (ECB) chief Mario Draghi in the press conference after announcing unprecedented monetary policy measures.

Markets focused on the ECB president’s remark that he didn’t anticipate the need for further interest rate cuts and looked past his emphasis on the fact that economic fundamentals could change.

3. China’s banks suffer from possible PBOC action, data on the horizon

Though Chinese indices managed to hold onto gains on Friday, banks led the decliners on the report that country’s central bank could be planning to allow debt-to-equity swaps by commercial lenders, an action viewed by some investors as revealing the need to prop up week balance sheets.

Meanwhile, market participants are waiting for the release of industrial output and retail sales on Saturday that should further fill out readings on activity during the Chinese New Year.

4. Rate hike expectations for BoE rise as U.K. growth estimate cut

According to the Bank of England (BoE) survey released on Friday, 38% of the public not expect rate hikes within the next 12 months, as opposed to the 35% from the previous survey.

Also on Friday, the British Chamber of Commerce cut growth forecasts for the U.K. economy for the next two years, blaming the global economy and defining the country’s performance as “mediocre” with regard to historical trends.

In U.K. data released on Friday, the trade deficit with the EU hit a record high as Britain imported more from its’ European neighbors.

5. Global stocks advance across the board

The Nikkei 225 closed with gains of 0.51%, while Dow Jones Shanghai edged up 0.08% and S&P/ASX All Australian 200 rose 0.32%.

At 10:56AM GMT or 5:56AM ET, European stocks markets moved higher with the European benchmark Euro Stoxx 50 trading up 2.80%, the DAX gaining 2.79%, the CAC 40 advancing 2.92% and London's FTSE 100 adding 1.61%.

source

5 Things to Watch on the Economic Calendar This Week

1. Fed rate decision

The Federal Reserve is not expected to take action on interest rates at the conclusion of its two day policy meeting at 18:00GMT, or 2:00PM ET, on Wednesday. The central bank will also release its latest forecasts for economic growth and interest rates.

Fed Chair Janet Yellen is to hold what will be a closely-watched press conference 30 minutes after the release of the Fed's statement, as investors look for any change in tone about the economy or future rate hikes.

Many in the market anticipate the pace of increases to be gradual amid concerns over tepid growth overseas and divergent monetary policies between the U.S. and other nations.

2. BOJ policy announcement

The Bank of Japan's latest monetary policy announcement is due during Asian morning hours on Tuesday. Central bank Governor Haruhiko Kuroda will hold a press conference afterward.

The BOJ is widely expected to stand pat on monetary policy after January’s shock decision to adopt negative rates, but some speculate it could still cut rates deeper into negative territory as part of its ongoing effort to reflate a stagnant economy.

3. Bank of England "Super Thursday"

The Bank of England will release its rate decision and minutes of its Monetary Policy Committee meeting at 12:00GMT, or 8:00AM ET, on Thursday. Last month, the Monetary Policy Committee voted 9-0 to keep rates on hold at a record low 0.5%.

Expectations for a rate hike by the BOE have been recently pushed back to early-2017 due uncertainty over a June referendum on whether or not Britain should stay in the European Union.

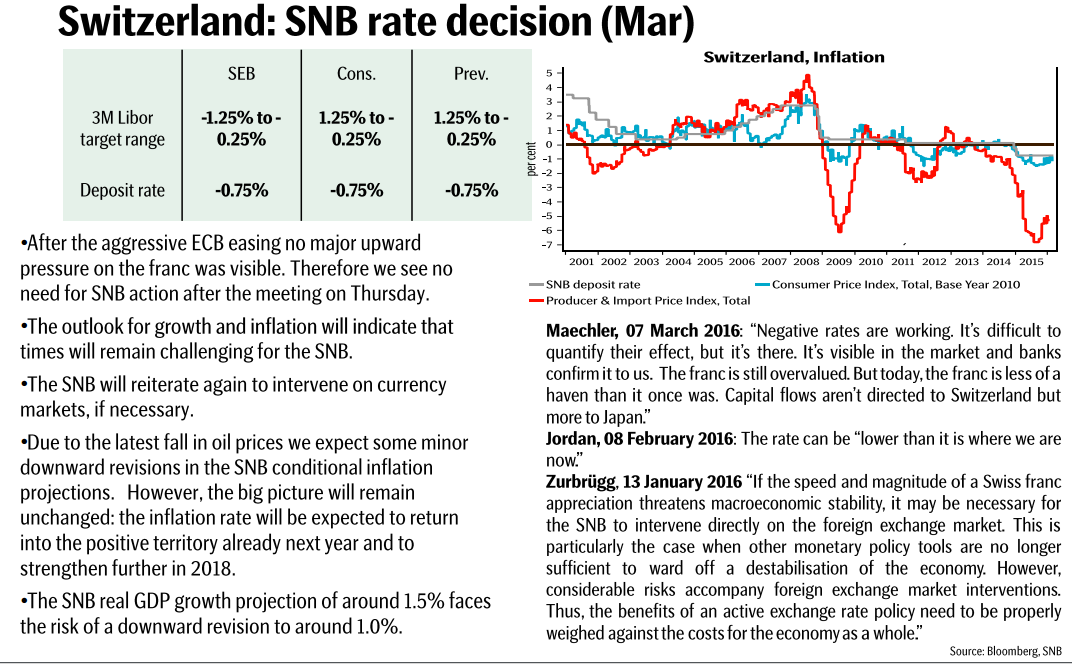

4. SNB policy assessment

The Swiss National Bank's quarterly policy assessment is due on Thursday at 8:30GMT, or 4:30AM ET. Most economists expect the central bank’s benchmark interest rate to remain unchanged at -0.75%, despite speculation it may move further into negative territory following the European Central Bank’s aggressive easing last week.

The SNB will also issue updated growth and inflation forecasts.

5. U.S. retail sales, CPI data

The Commerce Department will publish data on retail sales for February at 12:30GMT, or 8:30AM ET, Tuesday. The consensus forecast is that the report will show retail sales fell 0.1% last month, after gaining 0.2% in January. Core sales are forecast to decline 0.2%, after rising 0.1% a month earlier.

On Wednesday, the U.S. will publish February inflation figures at 12:30GMT, or 8:30AM ET. Market analysts expect consumer prices to post a decline of 0.2%, while core inflation is forecast to increase 0.2% .

source

Top 5 Things to Know In the Market on Monday 1. Global stock market rally continues ahead of central bank meetings

European equities were higher in morning trade on Monday, following a positive lead set in Asia, as investors looked ahead to a raft of central bank meetings and rate decisions this week. However, Wall Street pointed to a muted open after the S&P 500 closed at its highest level of the year on Friday.

Market players braced for the Bank of Japan's policy decision due on Tuesday, followed by the Federal Reserve’s rate announcement on Wednesday and the Bank of England meeting on Thursday.

2. Oil prices pull back from 3-month highs

Oil prices pulled back from three-month highs on Monday, after Iranian Oil Minister Bijan Zanganeh said his country won't join a group production freeze until it doubles its post-sanctions output. A meeting was planned for March 20 in which producers were meant to discuss the details of a proposed action to freeze output at January levels.

U.S. crude was down 84 cents, or 2.18%, at $37.67 a barrel, by 10:00GMT, or 6:00AM ET, while Brent slumped 63 cents, or 1.61%, to $39.74.

3. U.S. dollar inches up ahead of BOJ, Fed meetings

The U.S. dollar edged higher against its major counterparts in cautious trade on Monday, with investors reluctant to make major moves before the Bank of Japan wraps up its two-day policy meeting Tuesday, followed by the Federal Reserve’s policy decision Wednesday.

4. Markets shrug off weak Chinese data

Official data released over the weekend showed that China's factory output in the first two months of the year slowed to the weakest level since November 2008, adding to the view that the economy remains in the midst of an ongoing slowdown which will require Beijing to roll out more support in coming months.

Industrial production rose by an annualized rate of 5.4% in January, below expectations for a 5.6% increase and slowing from a gain of 5.9% in the preceding month, the General Administration of Customs said on Saturday.

5. Germany’s Merkel takes a hit in regional elections

German Chancellor Angela Merkel's conservative Christian Democrat's lost in two out of three state elections on Sunday as Germans punished her accommodative refugee policy with a big vote for the anti-immigration Alternative for Germany (AfD), exit polls showed.

source

Preview: UK wages and jobs data unlikely to help the under-pressure pound UK January unemployment and earnings report out at 09.30 GMT

It's not been the best 24 hours for the pound, and the upcoming data is unlikely to change that sentiment much.

Granted the data may come in better than expected and we see a knee-jerk rally but the overall sentiment remains bearish with Brexit still hogging the headlines.

It's the jobs reading that will steal the headline but as always look for the wages data. That's of more interest to the BOE in it's rate setting deliberations. Not that we're getting a hike anytime soon regardless but traders/algo boxes will feed off that more than jobs.

GBPUSD has nearby support at 1.4080-85 which it held earlier then more at 1.4065 and 1.4050. Topside we have 1.4150 resistance/supply then 1.4185-1.4200. Not expecting much more than that of a range when we have the FOMC later.

source

Preview: SNB & BoE March Meetings - SEB

Japan markets will be closed today Vernal equinox day The Japan markets will be closed in observance of Vernal equinox day.

BOJ's Nakaso: Technically possible to go further into negative rates More from Nakaso:

BOJ is in a jawboning phase. They want markets to think they could do more any moment but they want time to see how the latest measures perform.

Rebalancing Asia-Pacific Exposure; What Is The Trade In FX? The expectations of China’s growth rebalancing away from industrial and real-estate investment toward consumption (of both goods and services) has defined several medium-term trends in relative asset prices within Asia. We highlight three examples.

Equities: Industrial stocks have broadly underperformed consumer stocks in Asia since 2008 and more recently since mid-2015. There has been some variation between consumer staples and discretionary stocks, reflecting cyclical expectations of the Asian consumer (with discretionary underperforming staples during downturns), but the structural trend of optimism for consumer stocks over industrials is clear.

FX: There has been a broad trend of currency underperformance of industrial commodity and capital exporters within the region. This has been most evident for AUD/NZD, which has captured the theme of China rebalancing away from investment toward consumption, with New Zealand benefiting from its dairy exposure to China. But more generally as well, commodity-exposed currencies such as IDR have underperformed the consumer goods/services exporters such as SGD over the long term.

Commodities: While commodity prices have broadly fallen, this masks considerable divergences. In particular, metals such as zinc and aluminum that are widely used in consumer products such as cars have materially outperformed those more directly tied to capex, for instance iron ore and coal.

Market implications: Sell NZD vs Asia-Pacific peers.

While the longer-term trend of rebalancing is inexorable, especially given this is a priority for China, the recent “risk-on” sentiment driven by a dovish Fed and stable China FX suggests some of the risk premium priced into “investment assets” vs “consumption assets” could unwind, at least temporarily.

This has already transpired to some extent, with AUD/NZD trading close to year-to-date highs. But with the RBNZ willing to ease further, dairy export prices remaining wea and some cyclical releveraging in China likely in the near term, we believe the NZD will broadly underperform its Asia-Pacific peers over the coming months.

read more