Euro’s fate ahead of Greek Election

The EURUSD has been dropping in recent days and appears to have found some support at the 2.5 year low of 1.2165 ahead of the Greek Presidential election. The elections of one of the Eurozone’s most weak and fragile economy is said to trigger fresh anxiety over the country’s future as part of the single currency. The voting is due to start at 10:00 GMT, with the results likely to take up to an hour to surface. The last round of voting which was on the 23rd of December saw Antonis Samaras, Greece’s Prime Minister, with a dozen seats short (168 out of 300) of the number he will need to elect a new president.

The Greek elections are scheduled in 3 ballots which are held on the 17th, 23rd and 29th of December (2014). All eyes are fixed on today’s election which will see the final chance to elect a new president and avert a snap election – something which, alarmingly for the Euro, could see the leftwing Syriza party come to power; a party which is strongly opposed to the country’s international bailout and austerity being demanded by the EU member states.

The country’s Prime Minister is set to appoint his nominee, Stavors Dimas, as President. If Mr. Samaras fails to get adequate votes, then this would lead to a general election which is likely to take place towards the end of January (some couple of weeks short of the country’s 240 Billion Euro bailout expiration). Should this occur, opinion polls have shown that the opposition group, Syriza, would win power.

Should a scenario which sees the Syriza party elected to power occur, investors expect to see a sharp drop in the single currency and see the EURUSD pair head towards its 3.5 year low of 1.2041 or lower. Movement in the markets is generally limited, with many investors opting to either hedge or close positions ahead of the New Year holidays – a move which is aimed at protecting investments against the expected sharp and volatile markets that are often experienced throughout the December holidays.

GBP continues decline trading at 16 month low

From the Daily Chart we see the GBPUSD has been in a continues downtrend since mid-July, trading at 9%+ lower than the 6 year high of 1.7190 which was reached earlier this year. The current downward movement of the Sterling marks a strong downward trend and 16 month low for the pair, which has seen little resistance as the bears look set to brek beyond a critical psychological support level of 1.5500 – a level which has shown to be a critical support point and which has been tested several times in the past week.

With the recent negative economic news from Greece – one of the Eurozones heavily indebted countries – the GBP has been sluggish at trying to bounce back from the 1.5500 level as investors are increasingly skeptical on the future of Greece’s bailout package.

Scenarios

Currently the daily GBPUSD is in a strong downtrend, with the bears sighting the 1.5500 as the next critical support for the pair. Should the Sterling convincingly break this level then the next support is seen at 1.5428 – the August 25[SUP]th[/SUP] low.

Alternately we may see the bulls take a stand and hold the current level and head for the current 50 MA which sits at R1 – 1.5690 – a level that if reached may likely see a boost from the buyers and an attempt to convincingly break above 1.5787 which would mark a halt to the current downtrend and possible trend reversal

Greek woes weigh on Asian shares and Euro

Today’s first session saw a rise in the selloff of Asian shares as recent uncertainty over Greece’s future in the Eurozone, coupled with a higher demand for the safe haven USD has seen risk appetite drop globally. The drop in share prices is also expected to hit the European zone with some predicting the FTSE100 opening up at 0.4% lower than its close.

The full scale of the effect of the postponed Greek election for a President may still not be truly realized in Asia as volumes are very thin around the New Year holidays with Japanese markets closing between Wednesday and Friday. The Japanese NIKKEI stock average was trimmed some 1.6% on its last trading day of 2014, however this still marks a yearly gain of 7.1%. In spite of its drastic last day drop in value, many investors have a hawkish outlook over the Japanese economy further to the imposed inflationary policies from the Bank of Japan and the country’s Prime Minister Shinzo Abe, which are to continue into 2015.

Greece assisted in the Euro’s drop to new 2.5 year lows yesterday (at 1.2123) against the USD, as Prime Minister Antonis Samaras was unable to obtain enough seats (short by a dozen at 168 of 300) to support his presidential nominee, forcing a national election on January 25[SUP]th[/SUP]. Many in the Eurozone fear this will open way for the Syriza party to be placed in power – a party which is strongly opposed to the recent austerity measures and who have openly made it clear that they wish to renegotiate the country’s bailout which it received from the European Union and International Monetary Fund.

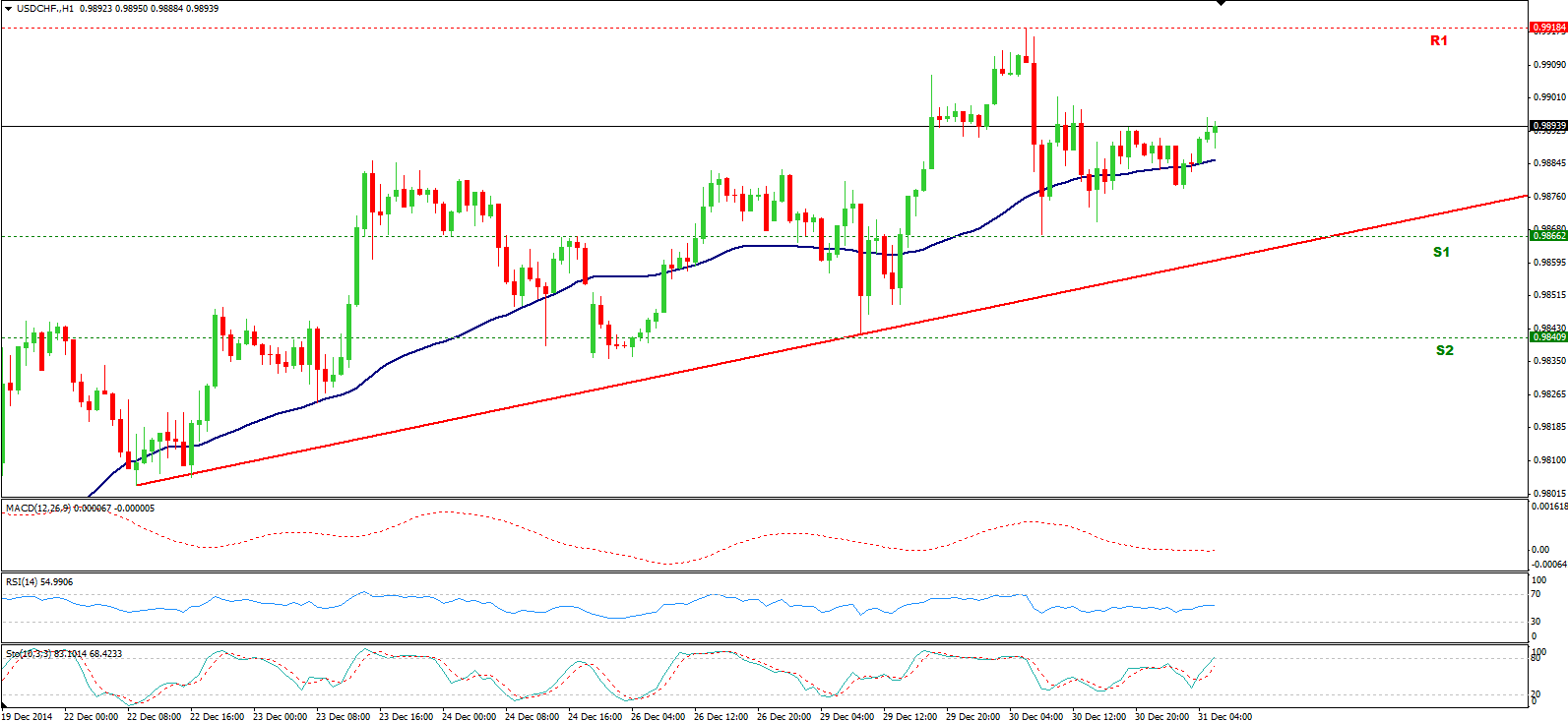

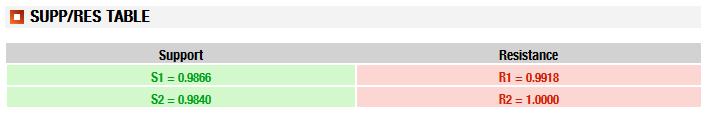

USDCHF heads for parity

The USDCHF has been on a continuous rise the past few days as the USD gains momentum and leads the pair towards parity. The pair peaked yesterday at a 2 year high of 0.9918, before consolidating back to trade around the 0.9890 level for this year’s final Asian session. In spite of this dovish correction the main trend is still upwards in favor of the Dollar and investors expect a re-test of yesterday’s high.

The recent gains mark a six month continuous upward movement for the pair, in which it has gained over 13% from a summer low of 0.8702. Currently all 3 indicators in the graph below show the pair to be in a neutral zone.

Scenarios:

There is a clear intraday uptrend as Investors expect the USDCHF to rally towards yesterday’s high of 0.9918 and if reached to continue on to head for parity – a psychological level – before seeing some more significant consolidations.

Alternately, and as the pair is showing intraday signs of slowing down its upward trend, we may see some momentum from the bears. A significant sign would be if they manage to drop the price down to S1 – yesterday’s low – a convincing break of which will likely see an attempt by the Bears for a rally to S2.

USD set to gain 12% in 2014

The USD has had a very good year in 2014 in terms of appreciation of its currency. It is currently set to make the biggest gain against a basket of currencies, which sits at around 12%, since 2005. The Greenback is expected by investors to continue its rise well into 2015, a great sign for the US economy and a restoration of the USD as a major safe haven currency. The last time the USD saw such a yearly gain was back in 2005 when it gained almost 13% - the only year in 30 in which it had made yearly gains of over 10%.

Although some currencies such as the Euro and Yen have had some retracement from record lows they were reached over the Christmas period, it has been in this trade. Some investors expect the EURUSD to continue its downfall until the critically psychological level of 1.2000 – a level last seen in June 2010. The Dollar Index, a measure between the USD and a basket of 6 Major currencies, was last seen at 89.97 level.

They USD has been greatly boosted by the recent simulative monetary policies in the Eurozone as well as turbulence between member states and the continuation of the bailout of Greece said to be back on the table. The Japanese yen also assisted in the Dollars gain as it drove the USDJPY to an 8.5 year high – a point which was reached in yesterday’s trading. The Federal Reserve has also hinted towards an earlier than expected interest rate rise, a move which boosted confidence and demand for the US currency.

There are also some concerned investors, seeing the recent gain of the USD as a possible drawback for the future of the safe haven currency. The fact that a large part of the gains was accumulated towards the end of 2014 and in a short timeframe, has led some to speculate that the Fed may regard this as a suffice boost to the USD and hence delay the increase of country’s interest rates.

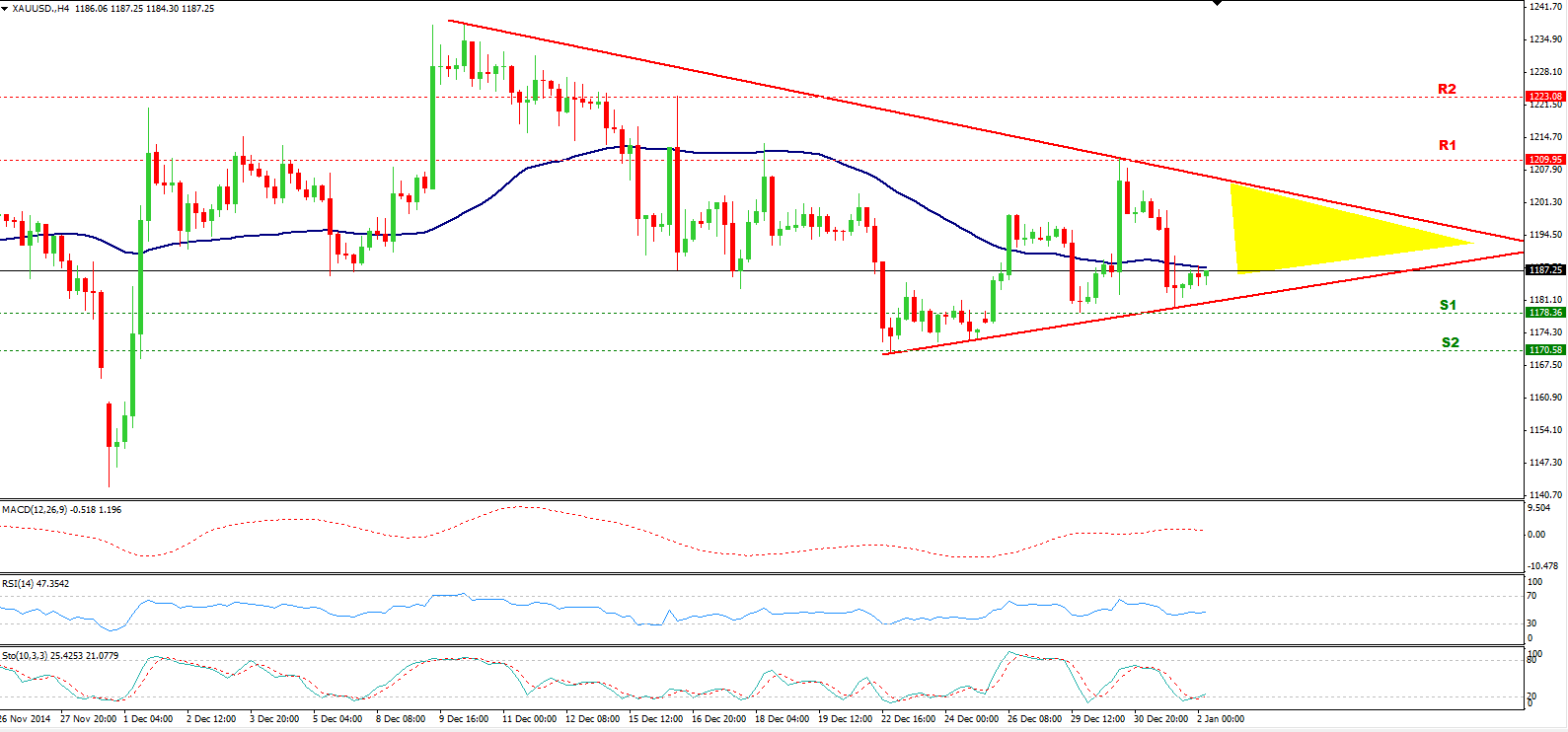

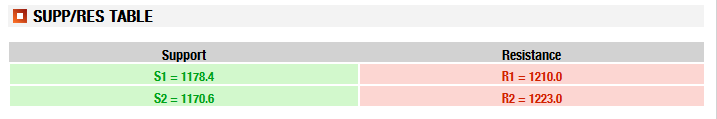

Gold in bullish pennant formation

4 Hour Intraday Trading

Looking at the 4 hour chart below, Gold is set to complete a pennant formation as it squeezes into the yellow shaded area below. A break above or below of the trending lines, could see the precious metal soar either way.

Last year’s final days saw some see-saw action in the XAUSUD as Bulls and Bears took turns in correcting each other. The final days of 2014 saw a modest gain for the safe haven commodity as it received support further to China’s Purchasing Managers Index slipped 0.2 points from its month to month value which indicated a slowing down of economic growth in the second largest economy.

Currently the commodity is trading around the 50 MA with MACD and RSI in neutral positions, as Stochastic has just pulled up from an overbought position.

Scenarios:

Currently the XAUUSD is not favorable either way. If we see the price drop below the red support line, we should expect a sharp drop with some resistance around the S1 level (1178.4) and ultimately to retest the 1170.5 level which proved a strong hold over the holiday period.

Alternatively, should we see the commodity break above the upper resistance line we expect to see it head towards and test the R1 level (1210).

Euro hits 4.5 year low following Draghi speech

The Euro continued on its recent downward spiral today as it dropped to a 4.5 year low against the Dollar as ECB President Mario Draughi strongly indicated that quantitative Easing is on the cards and likely earlier than planned. The EURUSD pair dropped to a low of 1.2033 in late Asian session, marking a drop of over 100 pips since the end of last year. Currently the pair is trading around the 1.2045 level.

Many of the Eurozones heavily indebted countries saw a drastic drop in their yields following the speech as the mention of the print of money by the central bank left clear expectations that such money would be used to purchase government bonds of such countries. Stocks in Europe also dropped following President Draughi’s speech and revision of the purchasing manager surveys for Freance and the Eurozone. There was a drop of 0.5% in the pan-European FTSEurofirst 300 index and markets in Germany and France were down 1%.

Many investors are anticipating the EURUSD to Drop below the 1.2000 level – a highly psychological and influential point. The ECB will next meet in January 22nd, where the inflationary policies will be discussed – the ECB is currently targeting inflation at just below 2%. While policy makers agree in the steps to be taken, the debate over whether fresh stimulus is needed at this point has resurfaced a rift on the ECB’s Governing Council. With expectations of inflation going into the negative figures in 2015, some analysts warn of a deflationary spiral and urge caution in the pace that next steps may be taken, as we may have yet to see the effect of the previously agreed measures.

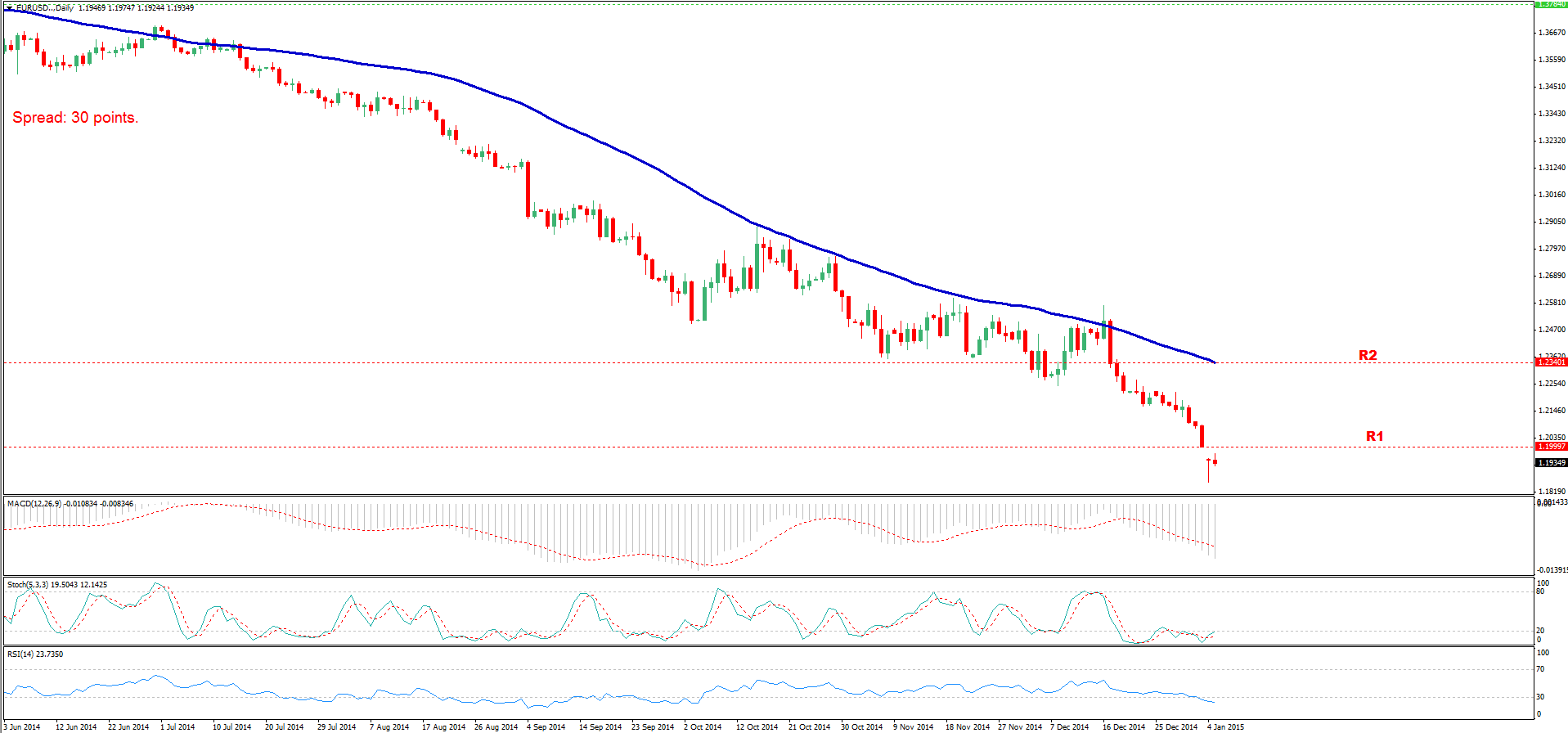

EURUSD at fresh 9 year low

Looking at the Daily chart of the EURUSD we see a clear and very rhythmic downtrend, which has used the 50 MA as a constant resistance level throughout this past 6 months. Today’s Asian session saw the pair open some 50+ pips below last week’s close and sharply dip a further 90 pips to reach a fresh 9 year low of 1.1856, well below the previously psychologically strong level of 1.2000. The pair has made some retracement and is currently trading around the 1.1935 levels.

The pair is expected to remain under pressure further to changing monetary policies outlooks between the US and the 19-nation bloc of the EU. Currently the general consensus is that the European Central Bank may well begin full-blown Quantitative Easing as early as their next upcoming meeting on January 22[SUP]nd[/SUP], whereas the Fed will be likely considering a rate hike stance throughout the mid of 2015.

Scenarios:

On the daily chart; In spite of the clear oversold indications of the Stochastic and RSI Indicators, the Euro is expected to remain pressured and drop further, with the next support level seen at 1.1801, - the 2006 low – with further support at the 1.1638; which if broken would see the Euro at an 11 year low.

On the other hand, should the Bulls muster some momentum and push back up and above the critical resistance point of 1.2000, then the next Resistance point which would prove to be a ceiling top for them, as it has not been convincingly broken in over 6 months, would be the 50 MA, which currently sits at 1.2340.

Euro continues downward spiral to 9 year low

The EURUSD continued its recent one way decline this week, with the EURUSD dropping over 100 pips in the opening hours of the Asian session from last Friday’s close. The pair dropped to a low of 1.1856 before consolidating to come back up and trade around the 1.1930 mark.

The recent decline of the single currency comes on the back of the uncertainty of Greece, as its current Prime minister, Samaras, failed last week to secure enough seats for his presidency candidate and as such a general election will be held, with the Greek Siriza party as favorite in opinion polls. Furthermore the ECB is expected to begin a new round of full blown quantitative easing, a measure which involves the printing of new money, in an effort to stabilize the EU economy.

The QE measures were further affirmed to investors following an interview between ECB President Mario Draghi and German financial daily Handelsblatt, in which he said that the risk of the central bank not fulfilling its mandate of ensuring the price stability in the EU was higher than 6 months ago.

European shares were quite volatile today as they began with a sharp decline from last week’s close before bouncing back up into positive territory. OIL continued its decline dropping to a new 5.5 year low.

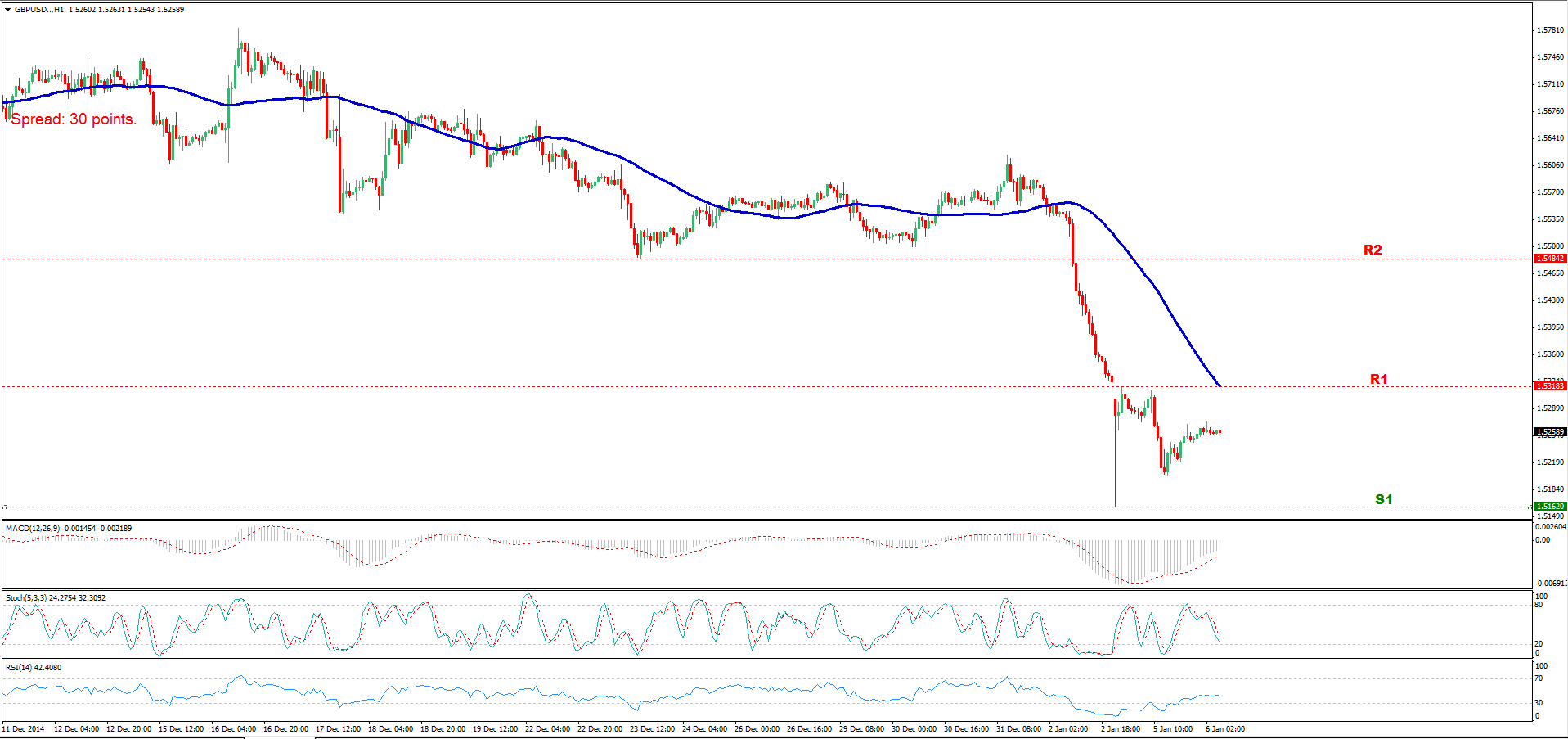

GBP continues decline towards 1.50

1 Hour Intraday Trading

Weaker than expected UK Construction data helped the high flying Dollar push the Sterling lower on the intraday chart, reaching a low of 1.5160 against the Dollar on the wake of the New Year. The 1 hour chart below shows us that the current price is well below the 50 MA as indicators recovered from an oversold position from Friday of last week.

Currently we have a downward intraday trend, which has taken a sharp downward dip over the New Year, on low volumes and has since retraced back to trade around the 1.5290’s. The daily timeframe, and longer term trend, also shows a clear dovish view with largely oversold conditions.

Scenarios:

There is a clear downward momentum, with the next support seen at 1.5162. The risk of a break below this level is high with the pair then exposed to free fall towards the 1.5000 level – a very critical and psychological level for the Sterling.

Alternately, should the Bulls manage to accumulate some momentum, something which we have not seen in recent days, the next important resistance point for them is see as the 50 MA, which currently sits at 1.5318; a break of which may see the price rise and test the previous base line of 1.5484.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Vistabrokers CIF Ltd is an International Investment and Brokerage Company. Being a full-profile Broker, Vistabrokers CIF Ltd provides its Clients the right and ability of online trading in different Stock Exchanges through a modern and advanced Trading Platform, using practically all well-known and also special trading tools such as currency pairs, stocks and shares, futures and commodities.

Here you can find our daily technical and market analysis.